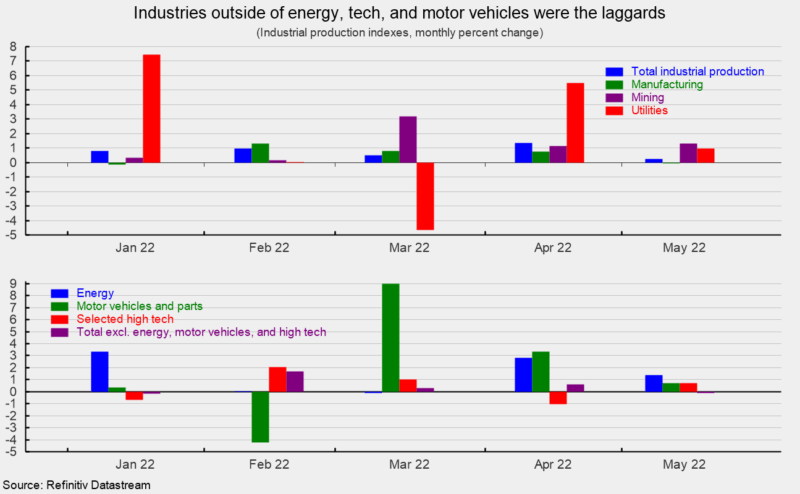

Total industrial production increased a modest 0.2 percent in May following strong gains in the first four months of 2022. The May rise pushes total industrial output to a record high (see first chart). Over the past year, total industrial output is up 5.8 percent.

Total industrial capacity utilization increased 0.1 point to 79.0 percent from 78.9 percent in April, and is the highest since December 2018. However, total capacity utilization remains below the long-term (1972 through 2021) average of 79.5 percent.

Manufacturing output – about 74 percent of total output – posted its second decline in the last five months, falling 0.1 percent for the month (see first chart). From a year ago, manufacturing output is up 4.8 percent.

Manufacturing utilization decreased 0.1 point to 79.1 percent but remains above its long-term average of 78.1 percent. However, it remains well below the 1994-95 high of 84.7 percent.

Mining output accounts for about 14 percent of total industrial output and posted a strong 1.3 percent increase last month (see top of second chart). Over the last 12 months, mining output is up 9.0 percent.

Utility output, which is typically related to weather patterns and is about 12 percent of total industrial output, rose 1.0 percent with natural gas off 4.5 percent but electric up 1.9 percent. From a year ago, utility output is up 8.4 percent.

Among the key segments of industrial output, energy production (about 27 percent of total output) rose 1.4 percent for the month (see bottom of second chart) with gains across all five components. Total energy production is up 8.5 percent from a year ago.

Motor-vehicle and parts production (slightly under 5 percent of total output), one of the hardest-hit industries during the lockdowns and post-lockdown recovery, continues to struggle with a semiconductor chip shortage. Motor-vehicle and parts production increased 0.7 percent in May following gains of 3.3 percent in April and 9.0 percent in March (see bottom of second chart). From a year ago, vehicle and parts production is up 11.6 percent.

Total vehicle assemblies rose to 10.72 million at a seasonally-adjusted annual rate. That consists of 10.40 million light vehicles (see third chart) and 0.32 million heavy trucks. Within light vehicles, light trucks were 8.57 million while cars were 1.83 million. Assemblies have risen sharply recently but remain below pre-pandemic levels.

The selected high-tech industries index gained 0.7 percent in May (see bottom of second chart) and is up 4.1 percent versus a year ago. High-tech industries account for just 1.9 percent of total industrial output.

All other industries combined (total excluding energy, high-tech, and motor vehicles; about 67 percent of total industrial output) fell 0.3 percent in May (see bottom of second chart). This important category is 4.4 percent above May 2021.

Within this category, consumer goods output, about 19.0 percent of total industrial output, fell 0.3 percent (up 4.4 percent from a year ago) while materials output (about 25 percent of output) fell 0.6 percent (and is up a modest 3.8 percent from a year ago). Weakness in these two categories, should it persist, would be a troubling sign. Other segments within the “all other” category include business equipment (7.7 percent of output) up 0.1 percent for the month and 6.3 percent from a year ago, construction supplies (5 percent of output) up 0.2 percent for the month and 7.1 percent from a year ago, and business supplies (7.3 percent of output), unchanged from April but up 4.9 percent from a year ago.

Industrial output posted a modest gain in May, helped by mining and utility output. Manufacturing output however fell for the month and has gains in just three of the last six months. Within total output, energy, high tech, and motor vehicles (about 32 percent of output) had gains for the month while many other areas were down or had small gains. Ongoing labor shortages and turnover, rising costs and shortages of materials, and logistics and transportation bottlenecks continue to be challenges for the industrial sector. Furthermore, turmoil surrounding the Russian invasion of Ukraine, periodic lockdowns in China, and an intensifying Fed tightening cycle remain significant threats to the economic outlook. Caution is warranted.