Over the past 10 years, environmental, social, and governance (ESG) investing has evolved from a niche style to a mainstream investment option. Demand from investors is widespread, particularly among women and millennials. These cohorts tend to view ESG investing as a way of expressing their values and making a positive impact on the world. As a result of the interest, the investment space has seen a proliferation of sustainable investment products, particularly from historically traditional managers. In 2020, sustainable fund flows reached an all-time high of $51.1 billion, according to Morningstar.*

Despite garnering record-breaking flows, only 21 percent of financial advisors are proactive in initiating ESG discussions with clients, and only 32 percent of advisors use ESG to attract new clients, according to InvestmentNews. Don’t miss this valuable opportunity to differentiate your services from those of other advisors and continue exceeding your clients’ expectations by introducing ESG. If you’re not talking to clients about ESG investing, you may be missing out on an effective way to meet their needs and retain their business. Below, my colleague Sarah Hargreaves and I look at the performance of sustainable investing products and lay out a plan for broaching this topic with your clients.

The Case for Competitive Performance

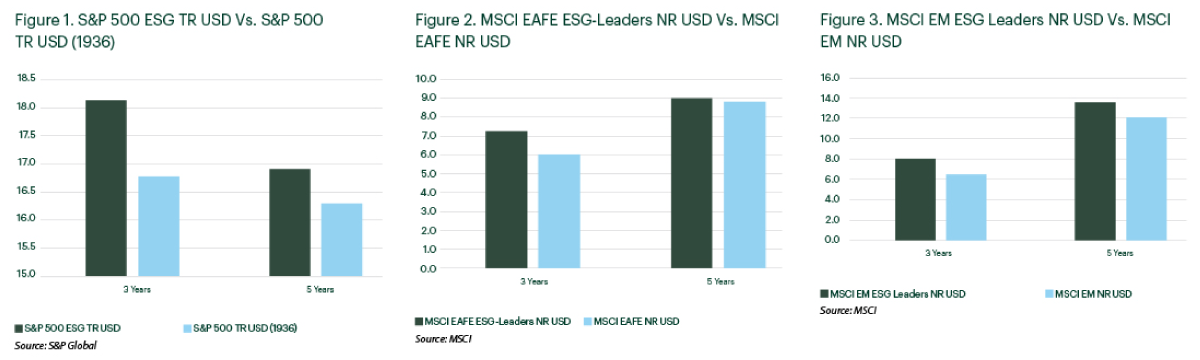

Some skeptics might dismiss ESG investing, believing that incorporating its standards and principles would lead to underperformance compared with traditional investment strategies. But, recent data suggests otherwise. As shown in Figures 1, 2, and 3, ESG indices outperformed their traditional counterparts across various regions and time frames—regardless of the country of domicile. Based on these wide-ranging performance comparisons, it’s clear that ESG investing offers a competitive performance opportunity.

Data as of 3/31/2021.

A Plan for Talking to Clients About ESG Investing

How can you get comfortable steering a client discussion toward sustainable investing? The best practices outlined below provide a good way to get started.

Get educated. Enhance your understanding of sustainable investing and the available approaches before introducing this concept to your clients. Check out the educational resources offered by the Center for Sustainable Investment Education or Principles for Responsible Investment to get started. Once you ascertain the fundamentals of the space, you’ll be better prepared to discuss ESG investing with your clients.

Initiate a conversation. Be proactive and ask your clients if they have heard of ESG investing or if they have an interest in learning more about this investing approach. Not only is this a great way to gauge your client’s interest, but it also allows you to engage with your clients on their financial goals and priorities.

Stick to the basics. When framing the advantages of sustainable investing, it’s best to keep it simple. By using an ESG framework, investors can gain a more holistic understanding of how a company operates. You can also mention how leveraging ESG factors can help mitigate risks by identifying high-quality companies with sustainable business models—key drivers of long-term outperformance.

Keep it personal. Go the extra mile and tailor the conversation to the issues your clients care about most. You can even provide relevant examples or data to further set the stage. Either way, personalizing the message will help you effectively reach your clients.

Be prepared for questions. Some clients may have little exposure to this space, and others may know bits and pieces, so be ready to answer their questions. Some may wonder how to incorporate ESG into an existing financial plan, and others may be concerned with performance.

A Commitment to Your Clients’ Evolving Needs

As evidenced by the recent proliferation in client interest and asset flows, there’s no time like the present to commit to talking to clients about ESG investing. While there is no uniform approach to incorporating ESG strategies into client portfolios, proactively initiating a conversation will help you address your clients’ investment needs, while gauging their interest in the sustainable investing space. As investor preferences continue to evolve, being prepared to present all available investment offerings will help you demonstrate your ongoing expertise and dedicated financial stewardship.

*Source: Morningstar, “Sustainable Equity Funds Outperform Traditional Peers in 2020,”

January 2021.