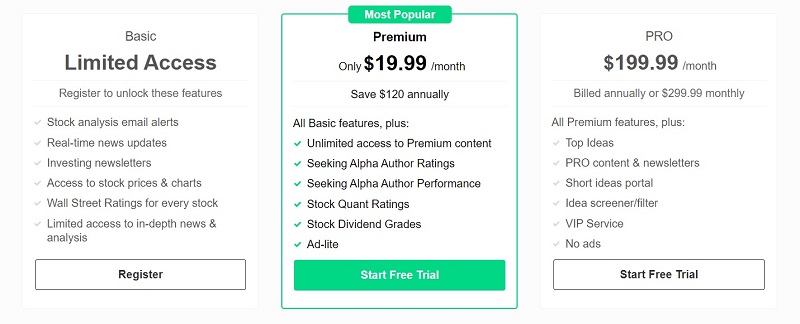

Seeking Alpha is one of the most well-respected investment research platforms. It’s possible to receive coverage for stocks and ETFs plus discover different investing ideas.

If you regularly swing trade stocks or invest in individual stocks, high-quality research is essential to be a successful investor.

While this online community offers a Basic free plan, you can upgrade to Seeking Alpha Premium, but is it worth it? Find out in this review.

Summary

Seeking Alpha Premium gives investors unlimited access to its investment research articles and the Quant Rating system. Investors can quickly find reasons for other investors to buy or avoid a stock. Due to the high cost ($29.99/month), infrequent investors may not benefit from upgrading.

Pros

- Unlimited access to Investing Ideas articles

- Reviews most stocks and ETFs

- Can track your investment portfolio

Cons

- High monthly cost

- Too much information for casual investors

- Not for technical traders

What is Seeking Alpha?

Seeking Alpha is an online community of investors that’s like Bogleheads but for investing in individual stocks.

You can get investing newsletters about different topics, including the daily market headlines and analysis of individual tickers and market sectors.

When researching investing ideas or doing a portfolio checkup, you can read analysis articles that professional investors write covering specific stocks, funds and asset classes.

Over 7,000 contributors write approximately 10,000 articles every month, according to Seeking Alpha.

You can also access the latest market news, read earnings call transcripts and monitor your portfolio performance.

What Does Seeking Alpha Cost?

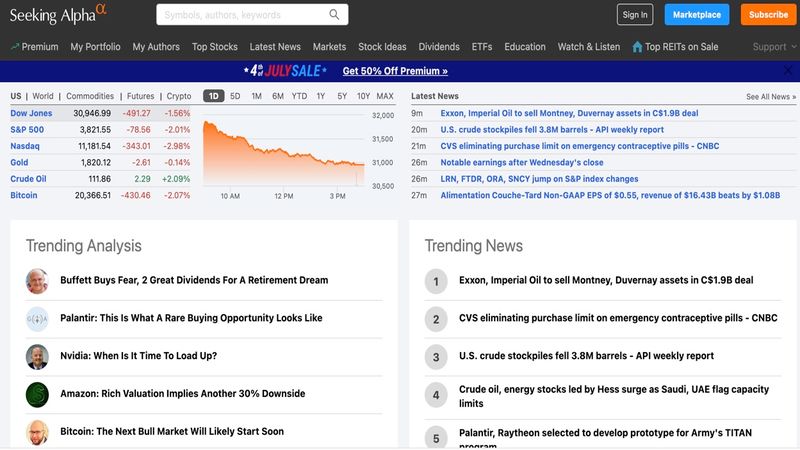

There are three subscription plans to choose from when using Seeking Alpha:

- Basic: Free

- Premium: $29.99/month ($19.99/month when billed annually)

- Pro: $299.99/month ($199.99/month when billed annually)

Most investors will only need the Basic or Premium membership plan. You can try Seeking Alpha Premium with a 14-day free trial.

The most expensive membership plan, Seeking Alpha Pro, provides exclusive newsletters and more robust screening tools.

For instance, you can screen stocks by investing ideas or by shorting stocks. Plus, you will also have your own VIP Editorial Concierge.

Seeking Alpha Premium: In-Depth Review

You might already use the free version of Seeking Alpha but tire of hitting the paywall to access exclusive content.

Upgrading to Seeking Alpha Premium gives you access to more advanced information, including ratings tools and a stock screener.

This extended access can make researching and following investing ideas easier.

Find Investing Ideas

One of the best reasons to use Seeking Alpha is for its numerous investing ideas articles. Seeking Alpha has more of them than many of the best investment sites.

Most investing ideas articles are available for free for the first ten days. However, Premium members get unlimited access to all investing ideas articles.

Contributors share their predictions in article format, and the Seeking Alpha editorial team screens the article for statistical accuracy.

Both Basic and Premium members can leave comments sharing their thoughts on whether they believe the author’s prediction is correct.

The investing ideas articles present the bullish, bearish and neutral case for a stock. Of course, each piece is a matter of opinion. You should read both the bull and bear case to perform thorough investment research.

Also, having unlimited access lets you read previous articles from the same author covering a stock that interests you.

If you’re looking into buying a new stock, the company’s investor relations page and Seeking Alpha can be two essential research sources. Of course, no Seeking Alpha content is personal investment advice but helps you complete your due diligence.

You might also use Seeking Alpha as a companion to Motley Fool Stock Advisor, which recommends two monthly stock picks.

Stock Ratings

Seeking Alpha Premium lets authors assign one of five ratings to a stock or ETF:

- Very Bullish

- Bullish

- Neutral

- Bearish

- Very Bearish

Both authors and the Seeking Alpha scoring tools follow this rating system. Basic members cannot see the author or Seeking Alpha ratings.

In addition to a general rating for a stock ticker, you can read a brief “Bulls and Bears say” synopsis. This quick read lets you see why a stock is worth buying and why you might avoid or sell shares.

Article Sidebar

Next to each article, Premium members can see an article sidebar.

This sidebar contains extra details:

- Author’s stock rating (i.e., bullish, neutral or bearish)

- Stock price chart

- Ratings from proprietary Seeking Alpha scoring models

With Seeking Alpha, the sidebar can help you quickly understand and compare the author’s sentiment of a specific stock. This tool can also help reduce your research time per article.

Author Ratings

Premium subscribers can see the long-term track record of the contributors submitting investing ideas. This data can help you find contributors that make better long-term predictions.

In addition to the author’s rating history, you can see each contributor’s favorite stocks. Some contributors work for well-known investment firms.

As a result, you can get an inside look at their investment strategy while avoiding high advisor fees.

Stock Screening Tools

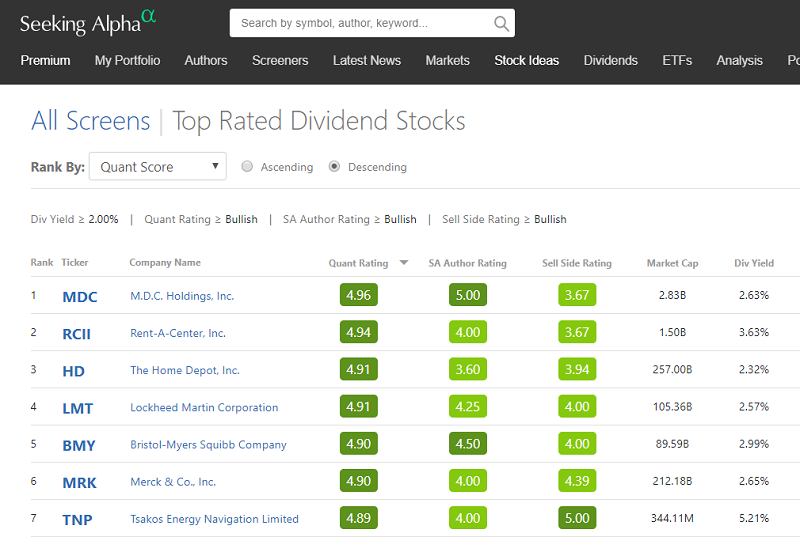

Premium members have access to in-depth stock screening tools.

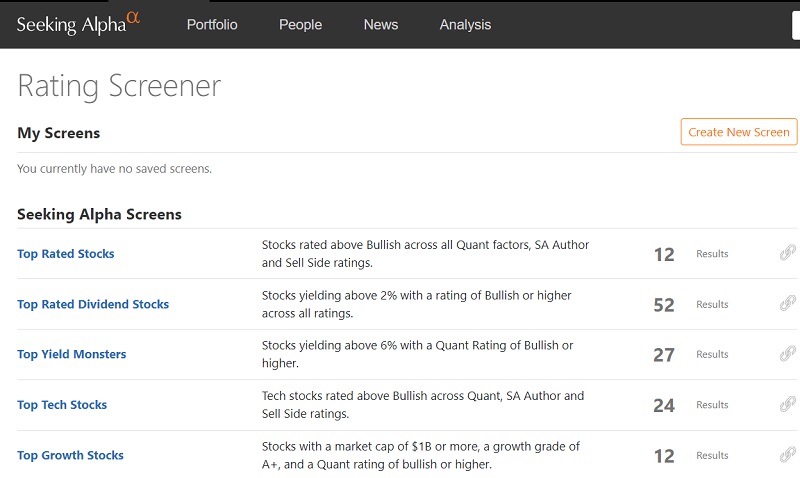

Stock Screener

Like most online brokerages, Seeking Alpha has a stock screener to run your custom filter, including author rating, market cap, or a fundamental rating like growth or momentum.

You can use a premade screen to find top-rated stocks and ETFs.

Here are some of the premade Seeking Alpha screens:

- Stocks with an above bullish rating across all rating factors

- Dividend stocks yielding at least 2% and with an above bullish rating

- Best growth stocks with a minimum $1 billion market cap

- Best value stocks with a minimum $1 billion market cap

You can also browse the best stocks by market sector, such as technology and consumer staples. These premade screens can be a quick way to find potential trades and fine-tune an investing idea.

Quant Ratings

Technology is transforming investing from an art into science as computers can analyze lots of data in minimal time. Most professional investors use quantitative analysis to research stocks and manage their portfolios.

Seeking Alpha has a proprietary “Quant Ratings” system to help ordinary investors understand the complex numbers.

The quant score derives from these factors:

- Value

- Growth

- Profitability

- EPS revisions

- Stock price momentum

Each stock undergoes a backtest to calculate its final quant rating.

Factor Scorecard

In addition to screening stocks by quant score, you can analyze the underlying stock fundamentals. Seeking Alpha compiles a factor scorecard compiling the stock’s value, growth, profitability, momentum and EPS revisions.

When grading real estate investment trusts (REITs), Seeking Alpha scores the Funds from Operations (FFO) and Adjusted Funds from Operation (AFFO) as well.

The scorecard ratings for these five factors range from “A+” to “F.” Like your school grades, an A+ is the best score a stock can receive for each item.

You can see why a stock receives the rating it does by clicking the letter grade. They also show you the underlying data to determine the score.

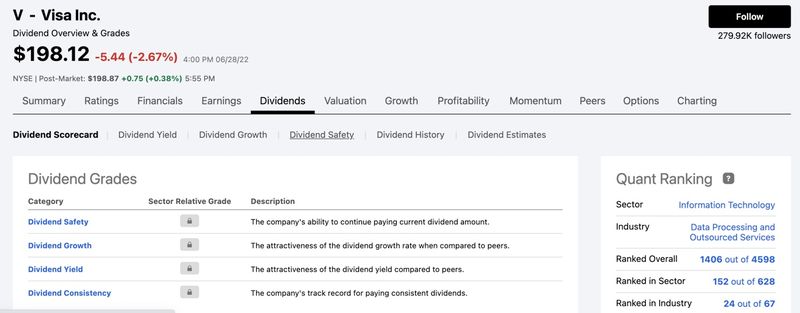

Dividend Stock Scorecard

Do you want to earn dividend income? For your long-term investing ideas, the dividend stock scorecard can help you avoid stocks with unsustainable yields.

Stock Comparison Tool

You can compare multiple stocks by quant rating and factor with a single search screen. Many full-service online brokers offer this tool, but free investing apps most likely don’t.

Earnings and Conference Call Transcripts

A premium subscription lets you listen to audio recordings of earnings and conference calls. You can also print and download the presentation slides and transcripts.

As a Basic member, Seeking Alpha only lets you read the transcripts online.

Premium members can also read up to 10 years of financial statements. However, Basic members can only access up to five years.

Earnings Forecasts

All Seeking Alpha members can see a stock ticker’s dividend payment schedule and company earnings. Premium membership lets you see extra factors, including earnings estimates and surprises.

Notable Calls

In addition to the Seeking Alpha scoring systems and the investing ideas articles, you can access “notable calls” that Wall Street professionals and fund managers make.

This feature is another source of finding investment ideas. You can also get a glimpse into how the “smart money” is investing the cash of their wealthy clients.

Portfolio Monitoring

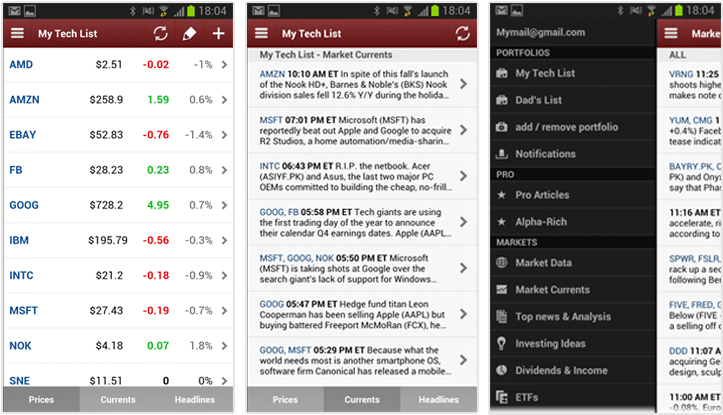

You can monitor your portfolio performance in Seeking Alpha. Basic members can track their portfolio holdings and receive some alerts.

Premium members get more features that can help you be among the first to see news on positions you own.

Sync Brokerage Accounts

Premium subscribers can link most US brokerage accounts to Seeking Alpha. If you have multiple brokerage accounts, you can track all of your investments in one place.

Basic members must manually enter each stock they want to track.

Personalized Alerts

You can receive breaking news, upgrade and downgrade alerts for your portfolio holdings.

Premium members can read the full alert directly from their email inbox instead of visiting the Seeking Alpha website.

This personal service can make Seeking Alpha easier to use than your brokerage.

News Dashboard

Seeking Alpha members can use the platform to read market headlines and ticker-specific news. But Premium members have enhanced in-article capabilities for further reading.

Upgrading also gives you a fully-functional news dashboard. You can have articles for specific sectors, and investment strategies appear first.

The news dashboard can be a good alternative to CNBC or an expensive subscription to The Wall Street Journal or Barron’s.

Earnings Calendar

You can view an earnings calendar that lists upcoming calls and reports from stocks in your portfolio. Premium members can also see EPS revision scores as the market adjusts to the latest company reports.

Monitor Portfolio by Valuation Metrics

In addition to tracking the stock price, you can view your position performance by specific valuation, fundamental and author rating metrics.

Other Seeking Alpha Features

Seeking Alpha Premium may have all the features that you need to research stocks and track your portfolio.

These features are available to all Seeking Alpha members and help you get more out of Seeking Alpha as your primary source for stock market research.

Marketplace

Several Seeking Alpha contributors offer a subscription service similar to an investing newsletter. This content gives you in-depth analysis and model portfolios that you won’t see in the free Investing Ideas articles.

Podcasts

Seeking Alpha hosts eight different investing podcasts. Some podcasts cover the daily market happenings while others focus on specific themes like trading stocks or investing in ETFs.

You’ll receive fifteen free newsletters with different themes, including the morning market headlines and focused sectors. You can quickly find links to relevant articles in each issue.

Stock Ideas

The Stock Ideas feed collects articles by investing themes. The Seeking Alpha homepage shows a list of pieces that people are reading the most. Visiting both places lets you find more articles that might interest you.

Some of the idea themes you can browse include:

- Long ideas

- IPO analysis

- Quick picks

- Fund letters

- Editors picks

- Stock ideas by sector

You might also see company releases in the Stock Ideas section as their news team periodically publishes articles.

Investing Strategy

The Investing Strategy section features articles that can help shape your overall portfolio investment strategy. Other write-ups are for financial advisors, but regular investors may appreciate them as well.

Is Seeking Alpha Premium Worth It?

Yes, Seeking Alpha Premium is worth it if you hold several individual stocks and want to save time monitoring your portfolio.

You might also choose Premium if you make several trades per month and rely on the fundamental analysis from other investors.

It’s difficult to justify the monthly cost if you only invest small amounts of money. Having a brokerage with useful research tools and analyst reports also makes upgrading to Seeking Alpha Premium not worth the extra cost.

You should consider joining Seeking Alpha Premium in these instances:

- Hold at least five individual stocks

- Are a serious investor

- Like to research stocks and ETFs

- Want access to Seeking Alpha content older than ten days

Who Should Avoid Upgrading to Seeking Alpha Premium?

Investors who use a robo-advisor or don’t invest in individual stocks or ETFs should avoid Seeking Alpha Premium.

New investors may decide to stay with the basic version of Seeking Alpha and use the platform to read the investing ideas articles. However, you will need to upgrade to read articles at least ten days old and access the Seeking Alpha stock ratings.

Unlike investing newsletters that recommend one or two monthly stock picks, Seeking Alpha is a research tool that presents the buy and sell reasons for each stock. But you must decide what to invest in.

Also, if you prefer investing in mutual funds, Morningstar Premium can be a better fit.

Frequent traders who rely on technical analysis and charting are less likely to benefit from Stock Advisor Premium. The quant ratings can make it easier to find potential stocks and read about insights from other investors.

The capabilities can be good for casual traders and competitive with most brokerage services.

Positives and Negatives

Pros

- Covers most stocks and ETFs

- Unlimited access to investing ideas articles

- Quant Ratings for most stocks

- Can track personal portfolio performance

- Listen and download company call transcripts and presentations

Cons

- Plan fee can be too high for casual investors

- Few technical analysis tools

- Doesn’t recommend stocks to buy

- Minimal coverage for mutual funds

Seeking Alpha Alternatives

If you are looking for another option other than Seeking Alpha, check out Zacks which is currently offering a free report on 5 Stock Set to Double.

Summary

Seeking Alpha Premium can be worth it for active investors who rely on research. You will see a different perspective than your brokerage research platform or free stock screening tools.

However, casual investors should consider sticking with the free version instead.