Well that was rough. The first half of the year saw the worst performance for risk assets in a long, long time.

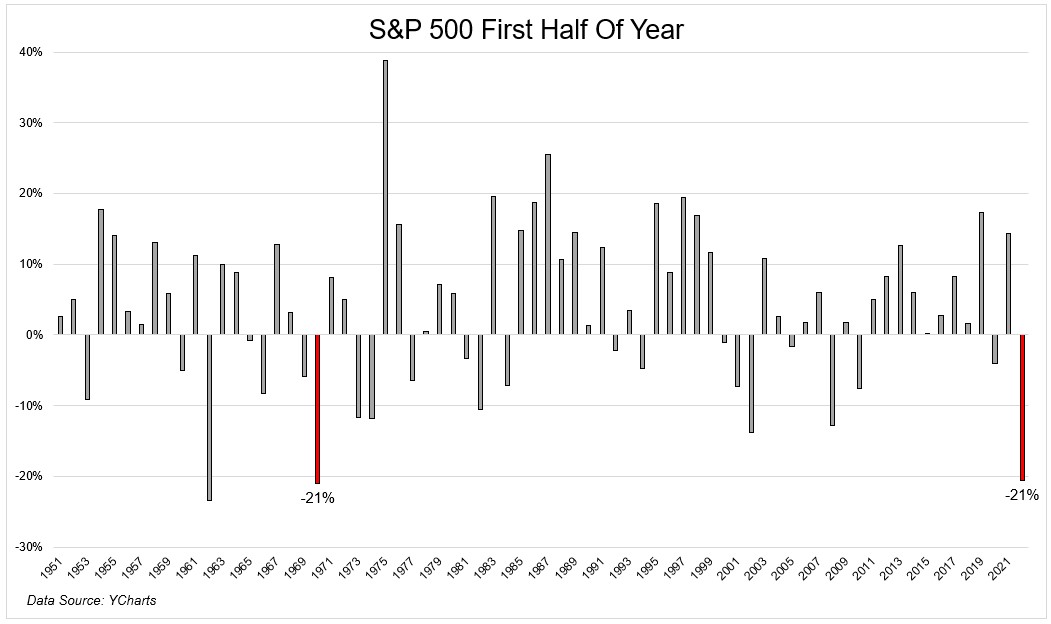

The S&P 500 hasn’t had a January through June like the one we just had since 1970.

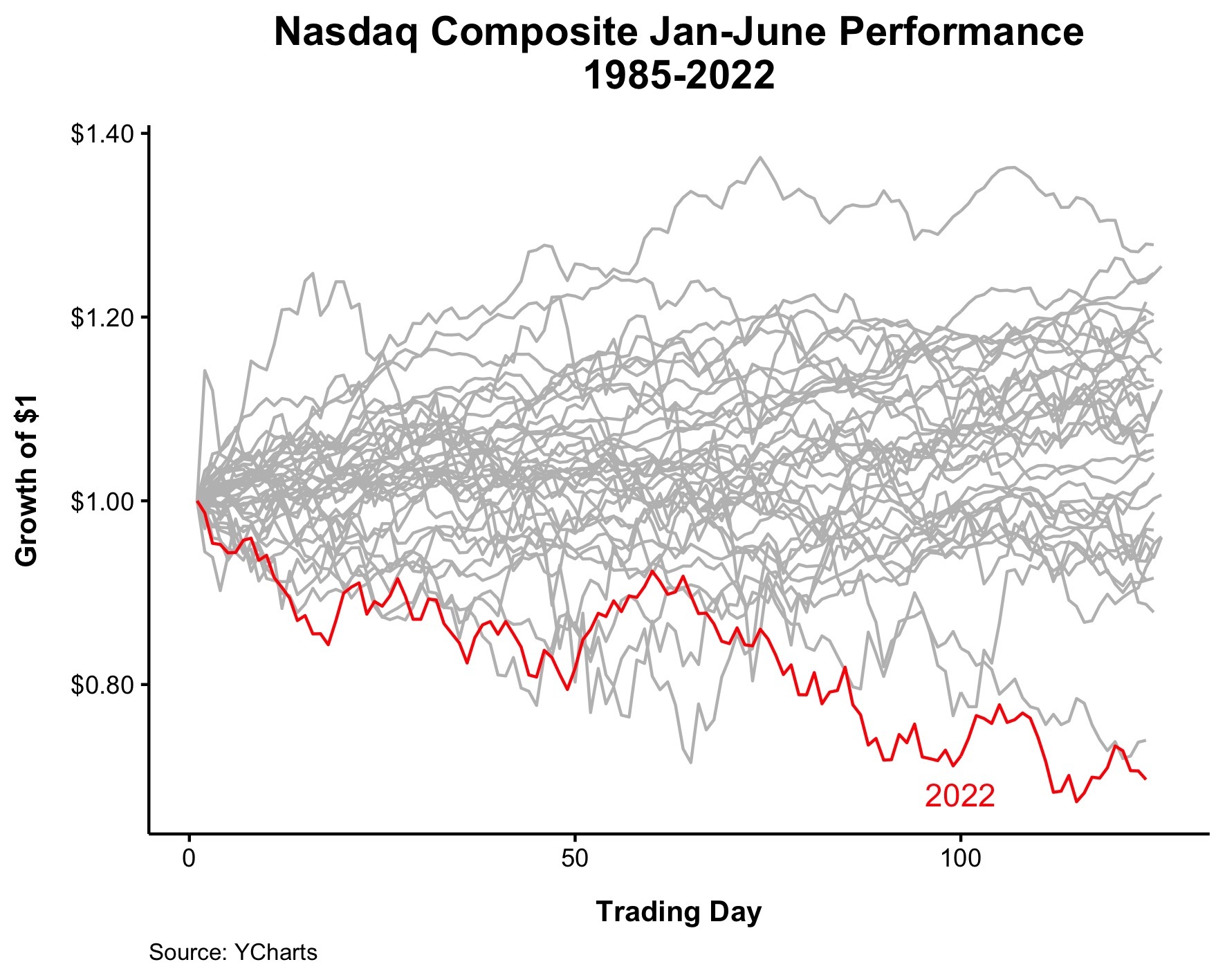

It was the worst start ever for the Nasdaq, which fell more than 30%.

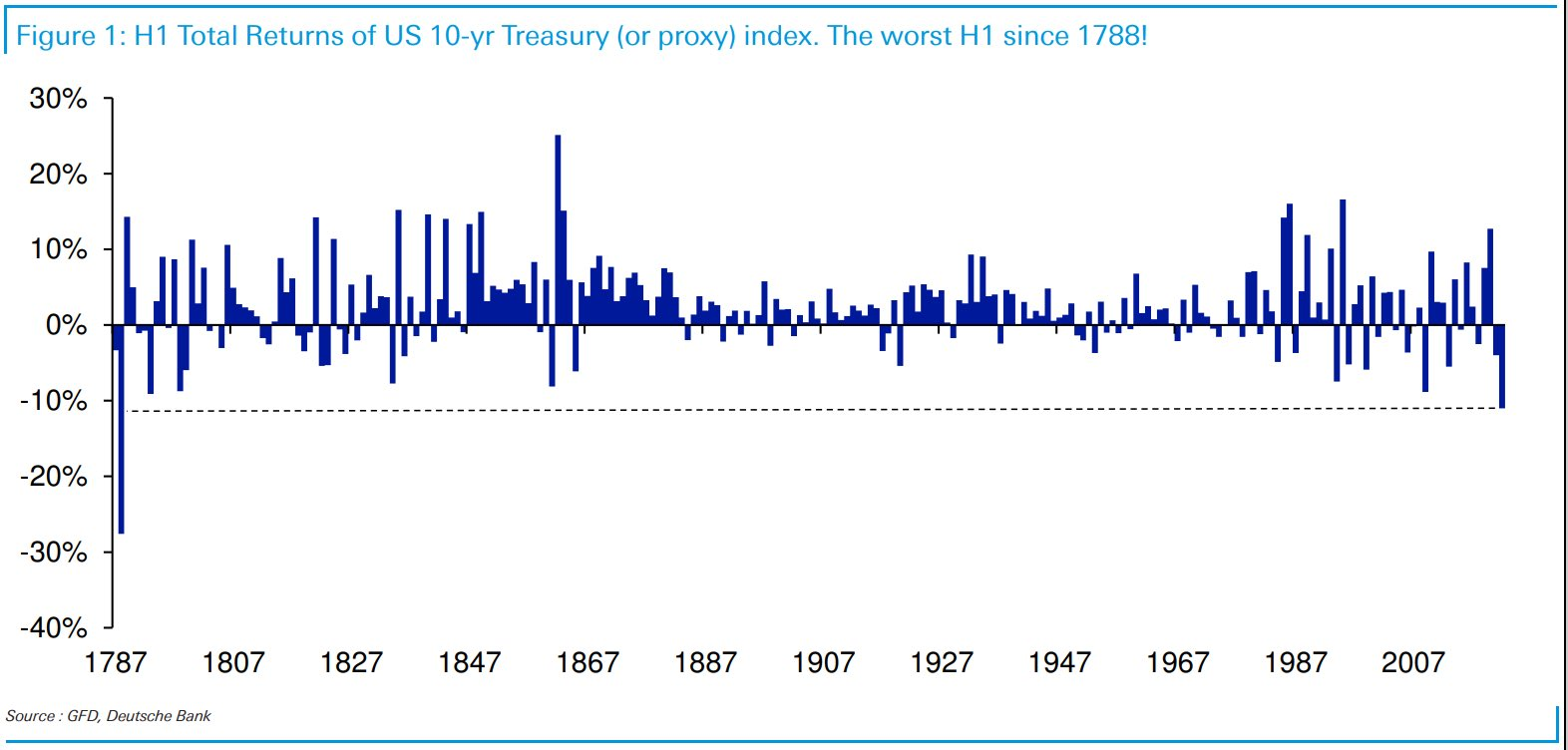

Making matters worse, it was also the worst start to a year for risk-off assets. The 10-year treasury note hasn’t seen a first half like this since George Washington was in office.

It’s funny that once we’ve experienced a painful decline, people seem to think that the worst is ahead of us. That may be the case, but it’s more likely that the worst is behind us. But even though the worst may be behind us percentage-wise, max pain may be around the corner. Going from down 20% to down 30% may only be a 12.5% move lower, but it will feel a lot worse than that. The numbers may tell you that it’s not as bad, but numbers don’t drive decision-making, feelings do.

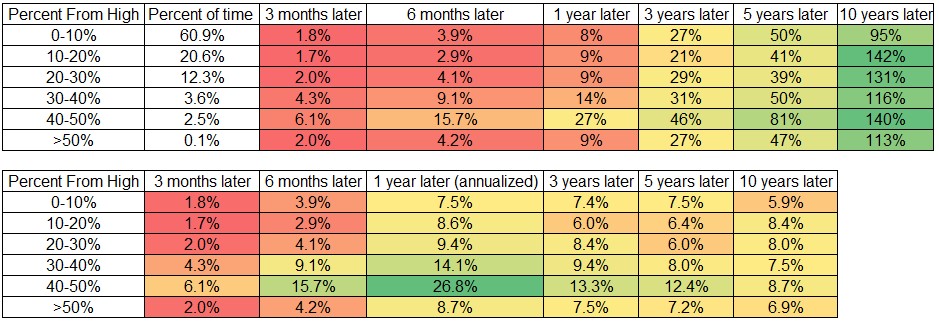

The good news in all the bad news is that forward returns get better with every leg lower, as you can see in the table below.

One year later, when the S&P 500 is within 10% of its all-time high, the average return is 7.5%. Once it’s 10-20% from its highs, the average return jumps to 8.6%. Going down to 20-30% off its highs like we are today, that number goes to 9.4%. And the more time you give it, generally speaking, the more attractive the returns become.

We’re in a bear market. We just experienced a massive amount of pain. Could things get worse? Yes. Will they eventually get better? Absolutely.

Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?