Why is sequence returns risk so much important pointer to consider for retirees? When we plan for retirement, we arbitrarily assume fixed returns from our investments, and on the basis of that, we determine that we are SAFE if our withdrawal rate is significantly lower than the product returns. The truth, however, is completely different and especially if you plan to fund your retirement using market-linked securities.

What is sequence returns risk?

When we assume 10% returns on equity for our long-term goals, the market will not provide us with 10% returns every year. Instead, it could be 2%, -10%, 15%, or even ZERO on a yearly basis. However, if you rely on such a volatile asset for your systematic withdrawal, you end up withdrawing from the principal itself, and the likelihood of evaporating your principal is much higher than you anticipated.

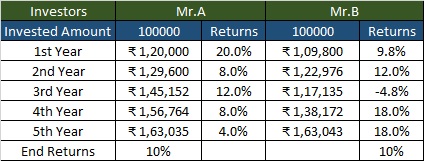

Let me explain to you this sequence returns risk with a simple example. Assume that Mr.A and Mr.B invested Rs.1,00,000 in two different assets and the returns after 5 years is 10%. However, even though the final amounts of Mr.A and Mr.B are the same, their yearly returns are different.

Now assume that both planned to withdraw Rs.10,000 after each year’s end. Then what will be the final value?

You noticed that because of higher volatility for Mr.B, even though with the same withdrawal, after the 5th year, his final value is less than Mr.A’s. This is called sequence returns risk.

Mr.A and Mr.B invested the same amount but in different assets which generated different returns on yearly basis for the next 5 years. Because of this, their end value changed. Here, the defining factor is volatility in returns.

Let us move on to cross-check how this sequence returns risk actually impacts by taking live examples like one ultra short-term debt fund and equity fund.

# Using Ultra Short Term Debt Fund

Assume that you invest Rs.1,00,00,000 in SBI Magnum Ultra Short Duration Fund as a lump sum. The rate of withdrawal is 6%. This means that you will begin withdrawing Rs.50,000 per month from this fund. The annual increase in this withdrawal is assumed to be 5%. As a result, you can assume that the inflation rate under consideration is 5% and the withdrawal rate is 6%.

Why is a withdrawal rate of 6% used? Because the fund has generated a 7.08 percent rate of return since its inception. Just for a safe withdrawal consideration, I have assumed a 6% withdrawal rate and a 5% inflation rate to see how long the invested amount would last. With such a conservative withdrawal rate (than fund returns) and inflation rate (well below withdrawal and fund return rates), Rs.1,000,000 invested will vanish in 20 years.

The red line represents the gradual depletion of invested funds (even if your withdrawal rate is less than the fund’s past returns and the inflation rate is only around 5%).

# Using Equity Funds

If you choose volatile products such as equity funds, the outcome may vary depending on the time period you select. As a result, selecting one time period and arriving at a conclusion may backfire on you (especially if your selection is a volatile asset like equity).

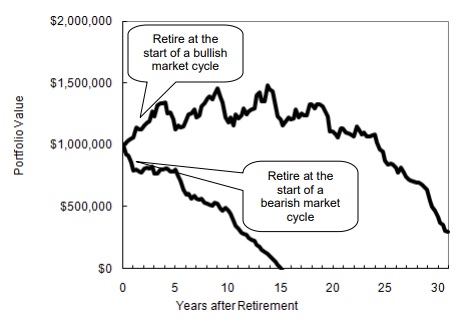

Furthermore, if we assume a higher rate of inflation, the results could be disastrous. To demonstrate my point, let me share a real picture from Jim C Otar’s book “Unveiling The Retirement Myth.”

You’ve noticed that when you first enter the market, the past returns don’t matter as much. This is especially true for those who are experimenting with volatile assets such as equity.

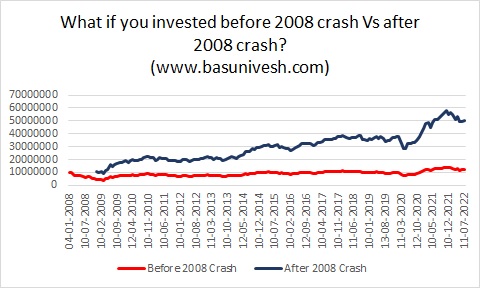

Let us demonstrate this with the 2008 market crash example. I chose the 4th of January 2008 as the date because Nifty was at an all-time high (6,274) at the time, and the crash began shortly after, with the low occurring on the 27th of November 2008. (2,752). As a result, I’ve decided to invest Rs.1,00,00,000 in these two scenarios. I considered a withdrawal rate of 6% or Rs.50,000 per month. Because we are considering 100% equity, I have ignored inflation. If we do, what is the current value? I used Franklin India Bluechip Fund Regular Fund as an example. Mostly because it is an old fund and regular fund data is easily accessible. If we perform this test, the results will astound us.

You note the situation of an investor who invested prior to the 2008 market crash. In fact, the value of the investment of Rs.1,00,00,000 dropped to the lowest point in 2009 (Rs.40,04,233). Approximately 60% of the invested capital vanished.

Consider the situation of a person who invested following the 2008 market crash. In this instance, the lowest value was Rs.92,18,512 (after few months of investment). It afterward picked and never come back to this lower level.

Examine the end corpus available in both scenarios. If the person invested before the market crash, his current value (after a monthly withdrawal of Rs.50,000) is Rs.1,19,61,792. If the person invested after the market crash, his current value (after a monthly withdrawal of Rs.50,000) is Rs.5,02,20,476. In 14 years, the difference is nearly fourfold.

The point I’m trying to make here is that no one can perfectly time the market. At the same time, no one can predict the risk of future sequence returns. If you chose a volatile asset with a high withdrawal rate, your retirement fund may run out sooner than expected.

How to protect from sequence returns risk?

# Invest more than what the retirement calculators will show you.

# Be conservative to moderate in your return expectation.

# Never use volatile assets during your retirement for your immediate cash flow requirements (like 10 years or 15 years of monthly requirements).

# Use equity only for the requirements which are required after 10-15 years and that also not more than 40%.

# Never fall into the trap of fancy calculators which show you comfortable numbers with high return expectations and lower inflation rates.

# Retirement goal is filled with a lot of surprises ranging from your health, early retirement, outliving the expected life expectancy, inflation, returns, and many more…..Hence, the only solution is to be an aggressive investor than an aggressive risk taker.