Three random thoughts on the current state of the stock market:

(1) The top 10 stocks are getting smoked. One of the prevailing theories during this past bull market is the biggest stocks were carrying the S&P 500.

The top 10 stocks now make up more than 30% of the index by market cap so it would make sense for this group to have an outsized impact on the performance of the market.

To take this a step further, it would make sense that once those stocks crashed, look out below for the stock market. If the biggest stocks were propping up the stock market the logical conclusion would be their downfall would spell doom for the S&P 500 if and when they crashed.

The current market is putting this theory to the test.

These were the top 10 stocks in the S&P 500 as of September 2021 as well as their current peak-to-trough drawdown from the highs:

(1) Apple -15.3%

(2) Microsoft -24.1%

(3) Google -28.1%

(4) Amazon -34.4%

(5) Facebook -55.7%

(6) Tesla -33.6%

(7) Berkshire -20.6%

(8) Nvidia -48.1%

(9) Visa -14.8%

(10) JP Morgan -33.2%

The average drawdown of the top 10 stocks from last fall is a decline of 30.1%. This compares rather unfavorably with the drawdown in the S&P 500 of -17.4%.

In fact, there are only two stocks with a drawdown that beats the S&P 500 — Apple and Visa. Eight out of the top 10 are down more than the market itself. Many of these stocks are down in a big way.

I have to be honest — this outcome is fairly surprising to me. I would have assumed the stock market would be down much more than it actually is if you would have told me the top 10 stocks in the index from last year were down this much.

How is it possible that the biggest, sexiest tech names are all getting smushed, yet the S&P 500 is outperforming the majority of them by a wide margin?

This year’s performance shows it’s not always just the biggest or the sexiest stocks that matter when it comes to performance.

Sometimes it’s the boring stocks that save the day.

The sectors that are outperforming this year so far are utilities (-1.5%), consumer staples (-3.9%), energy (+30.9%), industrials (-13.8%), financials (-15.4%), materials (-16.3%) and healthcare (-7.2%).

Yes, the tech sector is having a rough go at it this year but tech stocks do not make up the entire stock market.

It’s hard to believe the stock market is not down more than it is at the moment.

(2) The speed of the moves in the stock market is a giant distraction. I love watching the stock market but the short-term movements we’ve seen can play head games with you if you’re not careful.

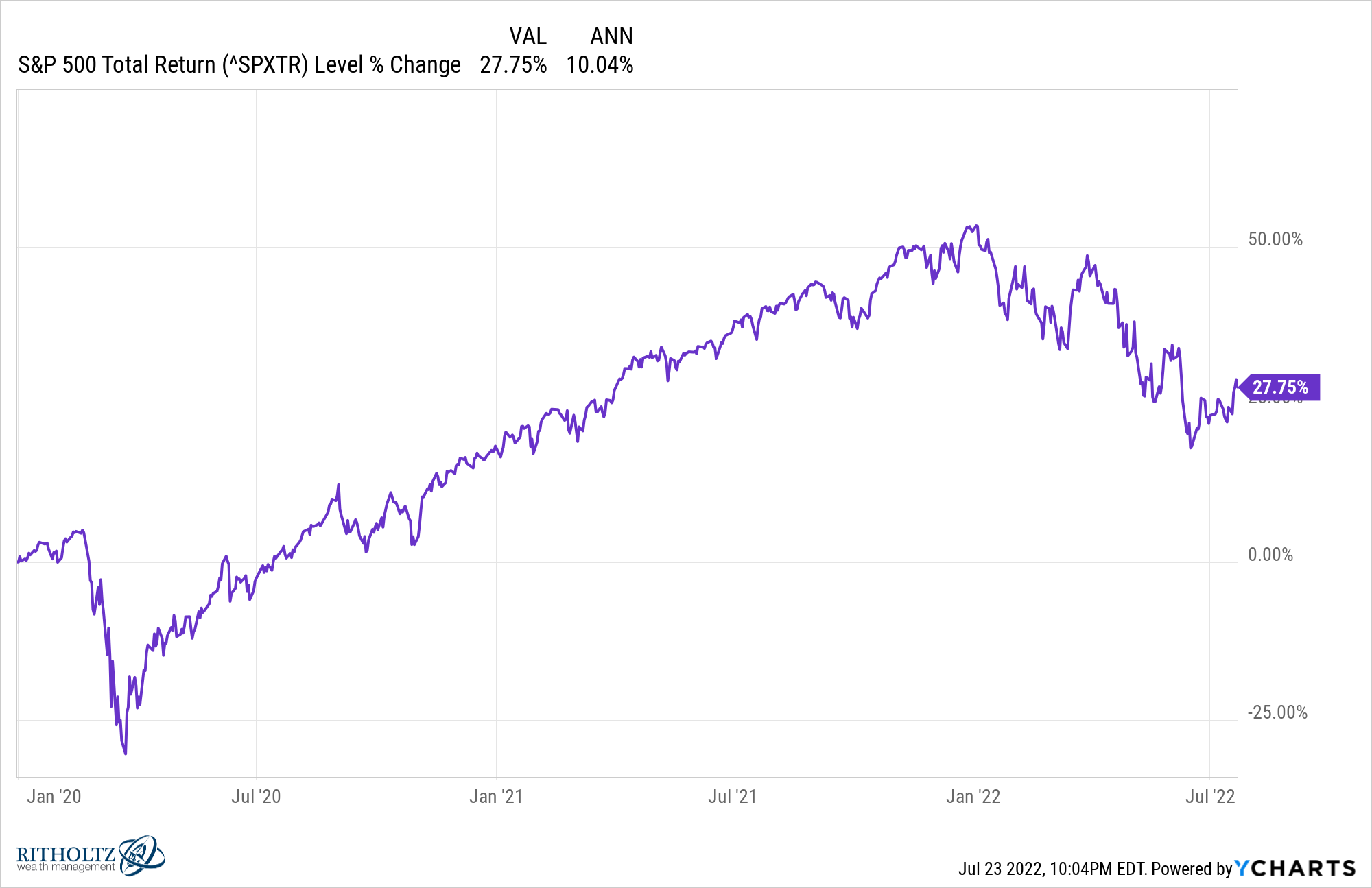

Since just before the onset of the pandemic (January 2020) the S&P 500 is up just shy of 28% in total with dividends included.

On an annualized basis that’s a return of 10% per year. So the last 19 months have given investors in U.S. stocks the long-term average annual return you see in the history books.

Not bad, right?

Just think about all that we’ve gone through in that time — the pandemic, lockdowns, negative oil prices, supply chain disruptions, 40 year high inflation and dozens of other crazy macro, geopolitical and market-related stuff.

That 28% total return includes the following moves:

- A 34% drawdown from February to March 2020 that was the fastest bear market in excess of 30% from an all-time high in history.

- A gain of 120% from those March 2020 lows through the first trading day of this year in one of the wilder blow-off tops we’ve seen in recent history.

- And now a drawdown that reached nearly 24% at its worst point.

That’s two bear markets and a massive bull market in the span of less than 3 years!

That 10% annualized return in nearly 3 years seems just fine if you lived in a cave and were able to ignore the stock market.

I’m not suggesting you should actually live in a cave. That seems a tad drastic as a form of behavioral alpha.

But I am reminded of the wonderful quote from the late-John Bogle when he said, “The stock market is a giant distraction to the business of investing.”

Headlines are also a giant distraction to the business of investing.

If you could avoid paying attention to your own long-term investments that’s probably a win for most investors.

(3) Sometimes you simply have to eat your losses. I had a conversation with an investor this week who asked the following:

So I have a reasonable asset allocation I’m comfortable with over the long-term. I don’t take any crazy risks or speculate with a large part of my portfolio. I save enough money to feel like I can achieve my financial goals. What else can I do to deal with losses in the stock market?

My reply was something like this:

Unfortunately, not much. As long as you have a reasonable investment plan as a long-term investor sometimes you have to just eat your losses. Long-term returns are the only ones that matter but sometimes that means living through poor returns in the short-term.

I suppose you could try to hedge or time the market or completely shift your asset allocation to guess what happens next before the onset of a bear market.

I’ve just never come across any investors who can pull that off consistently without making a massive mistake at the worst possible time.

Losses are an annoying feature of successful long-term investing but there’s not much you can do to avoid them if you wish to earn decent returns over time.

Further Reading:

To Win You Have to Be Willing to Lose