This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

My penchant for plain, white, unisex sneakers is paying off in unexpected ways. My son is now at an age where we wear the same-sized shoes. He came to me recently with his tattered kicks, asking if he could have a new pair. I dug out and handed him my old — but still perfectly wearable — running shoes.

Hand-me-downs are just one of several money-saving manoeuvres adopted by American families as inflation soars. Bulk-buying and trading down to economy brands are others. It is all very painful for retailers such as Walmart, which had a profits warning this week.

For me, the sneaker gambit is a no-brainer. The progeny is growing and his rough-and-tumble lifestyle means he goes through footwear like Homer Simpson goes through doughnuts. Why spend money on new shoes when he can wear mine? I can wait until he outgrows his current size before stumping up for new ones.

My son didn’t protest. I would like to think it’s because my shoes are cool and I am down with the kids. More likely, I have drilled into him that resistance is futile. Since the start of the year, I have been giving him and his sister my “need vs want” speech on a regular basis. It goes something like this: “Inflation is at a 40-year high. The cost of everything from groceries to gas is rising. So if you don’t need it, leave it. I thank you for your co-operation!”

To be sure, we (and plenty of other American families) are still spending. For all the talk of an impending recession, the US labour market remains on a solid footing. An unemployment rate of 3.6 per cent hovers near historic lows. Personal income and consumer spending have continued to march higher. Credit card spending soared during the second quarter at the likes of American Express, Citigroup, Wells Fargo and JPMorgan Chase. In particular, consumers — after more than two years of living with the pandemic — are splashing out on travel and entertainment.

But the sticker shock is real. While we may not have slammed shut our wallets, our spending habits have changed. We will still go away for our summer holiday. However, inflation means we are spending more on basic necessities such as food and fuel and cutting back on things such as clothing and home furnishings.

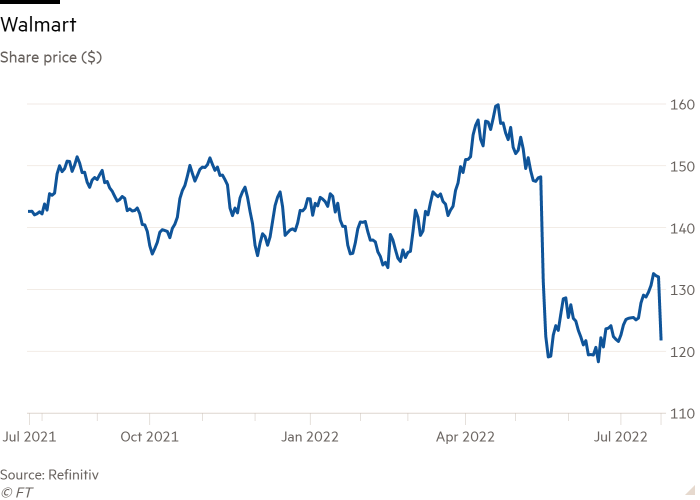

This abrupt shift has caught many retailers off guard, even the undisputed king of bricks-and-mortar retail: Walmart. The company this week issued its second profit warning in 10 weeks. It’s a big one. Operating profit is now expected to fall 13 to 14 per cent for the second quarter and 11 to 13 per cent over the full year. In May, Walmart said operating income would be “flat to up slightly” in the second quarter and down only 1 per cent for the full year.

Walmart’s problem is not a lack of customers. Inflation is actually prompting people to trade down and shop at its 5,335 stores in the US. In fact, like-for-like sales, excluding fuel, are expected to increase by 6 per cent in the second quarter, ahead of its previous forecast of a 4 to 5 per cent rise.

Instead, the issue is inventory. Walmart has too many items that customers no longer want. Casual apparel, kitchen appliances and outdoor furniture flew off the shelves during the pandemic. That prompted retailers to order even more, in hopes of getting ahead of supply chain disruption. The stockpiling strategy backfired when consumers such as me started to divert spending to essentials such as groceries.

Walmart held $61bn of inventory at the end of April, compared with $46bn at the same point the year before. Pre-pandemic, the figure was about $44bn at the start of 2020.

To clear the surge in surplus stock, Walmart will need to ratchet up markdowns. But that is not all. The stuff that people are buying more of these days — groceries — is far less profitable. All this will take a toll on margins and explains the sharp downward revision to Walmart’s earnings forecast.

More profit warnings could be on the way. Target issued one in June. Bed Bath & Beyond and Gap have recently replaced their chief executives after a collapse in quarterly sales. Second-quarter earnings for US retailers will be ugly.

That said, inventory distortion will not last forever. For the likes of Walmart, one could argue it is better to rip off the Band-Aid and clear out excess merchandise now. That would put it on a better footing to grab market share during the all-important holiday shopping season.

For parents on a budget, now is a good time to get ahead on your children’s growth spurts. I have already ordered three pairs of sneakers for my son at 50 per cent off.

May your own bargain-hunting be equally fruitful.

Pan Kwan Yuk

Lex writer

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage