Are you looking for an easy way to invest a small amount of money?

Your only investing option isn’t using a broker that requires you to invest hundreds or thousands of dollars at a time.

Stash helps new and experienced investors invest in stocks and ETFs with as little as $5. This Stash review will help you decide if this is the best investing app for your money.

Summary

Stash Invest makes it easy to start investing with only $5. You can invest in individual stocks, index ETFs and thematic ETFs. This isn’t a good option if you don’t want to pay a monthly account fee or need a “hands-off” managed account.

Pros

- Low start-up costs

- Fractional shares option

Cons

- Monthly fee

- No robo-advisors

How Does Stash Work?

Stash is a micro-investing app offering taxable and retirement investment accounts. It’s possible to invest as little as $5 into fractional shares of well-known company stocks and ETFs.

For example, if a stock costs $100 but you only have $5 to invest, you can invest in a partial share. Other brokers may require you to buy whole shares meaning you need $100 to invest in this instance.

Besides stocks and ETFs, Stash offers thematic ETFs that focus on certain market sectors and social values like cybersecurity and clean energy.

While the monthly Stash subscription fee costs $1, $3 or $9 per month, there are no other hidden fees that Stash charges.

There are no trade commissions to buy or sell investments.

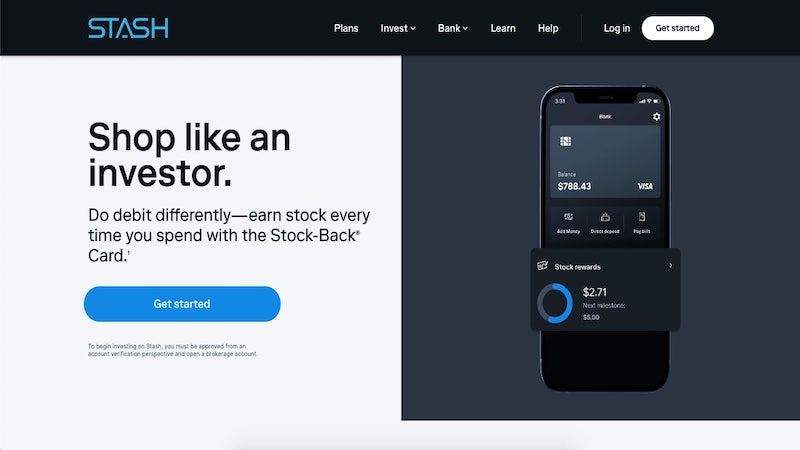

Stash also offers an online banking account with a debit card that offers Stock-Back® rewards.1 This checking account is available with all three monthly plan options.

How to Fund a Stash Account

There are three different ways to fund your Stash account:

- One-time or recurring contributions

- Rounding up your Stash debit card purchases to the next dollar2

- Stock-Back® rewards from purchases1

Investment Strategy

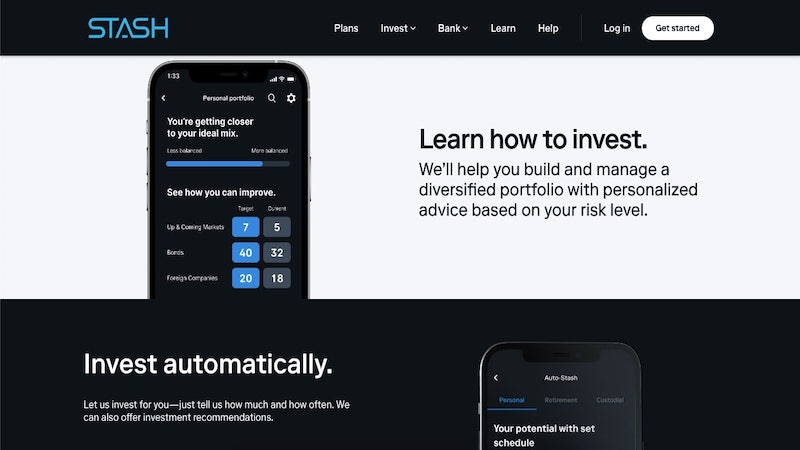

Unlike robo-advisors that automatically choose your investments, Stash offers a Personal Portfolio, their traditional individual brokerage account, that you can pick which ETFs and stocks to invest in.

Stash offers a library of learning resources that help teach investors investing basics.

To be clear, you may need to invest more than your spare change to save for retirement, which may require you to eventually invest hundreds of dollars each month into a 401k to achieve your long-term financial goals.

Micro-investing apps like Stash are a good way to either start investing as these small amounts can help increase your net worth.

Trading Windows

Stash doesn’t offer trading on demand at the exact time you place an order.

There are four daily trading windows. Two are in the morning and two are in the afternoon.

When you’re ready to place a trade, Stash executes the order at the next window.

Fractional Investing

Possibly the most notable difference between micro-investing apps like Stash and traditional brokerages like Vanguard is fractional investing.

Most online brokerages require you to buy full shares of individual stocks and ETFs. If you can’t buy a full share, your money sits uninvested until you can.

Stash lets you buy a partial share when you can’t invest the full amount and there are no investing minimums3 for their Personal Portfolio account.

Fractional investing makes it easier to maintain a diversified portfolio when you only invest a few dollars at a time.

For transparency, brokerages like Vanguard offer fractional investing with index mutual funds. But you may need to meet the relatively high investment minimums to buy shares.

For example: Vanguard may require a $3000 minimum initial investment. Recurring investments can then be made in increments after you open a position.

Fidelity offers fractional share investing when buying stock with using its mobile app. But investors must purchase whole shares when using the Fidelity web platform.

Account Types

Stash offers these investment accounts:

Each Stash monthly plan comes with an online banking account. Using this account is optional but it’s possible to earn pieces of stock back after every purchase with their , Stock-Back® debit card1.

The retirement accounts are available in the Stash Growth and Stash+ plans. The custodial investing accounts are only available with the premium Stash+ monthly plan.

Smart Portfolio

Recently, Stash added a new feature called Smart Portfolio. It allows users to build long-term, diversified portfolios which Stash fully manages. With Smart Portfolio, you do not have to worry about which stocks to invest in.

Those using Smart Portfolio will receive a “smart mix” based on trusted financial research, ultimately crafting a diversified personalized portfolio.

This portfolio will be based on your financial risk level you provided during onboarding. As you add or remove cash, Stash will move you closer to your ideal “smart mix”.

Stash will automatically rebalance your portfolio if it drifts too far out of the balance (greater than 5%).

The Smart Portfolio is available for those that use the Stash Growth and Stash+ subscription plan which starts at $3/month or $9/month.

How Much Does Stash Cost?

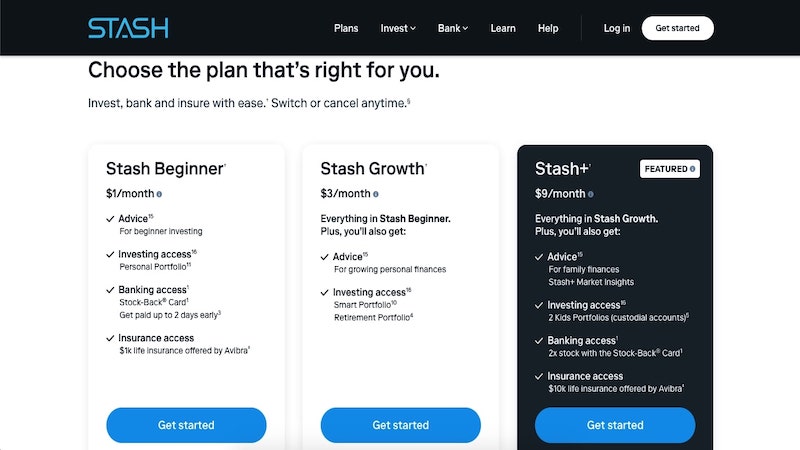

You pay a flat monthly account fee:

- Growth: $3 per month

- Stash+: $9 per month

Stash offers unlimited monthly trades with each plan. What’s different between each plan is the type of investment account access.

ETF fund fees apply. However, you pay this expense ratio no matter which stock brokerage you invest with.

While these fees are reasonable, they can be expensive if you don’t invest a lot of cash each month.

Choosing the right plan can include your investing needs and how much you plan on investing each month.

Below is a brief overview of each plan and its unique features.

Stash Growth

The mid-level Stash Growth plan costs $3 per month and includes access to retirement accounts.

It’s possible to invest using a taxable and retirement account at the same time.

This plan is better if you want to save for retirement. Stash also provides basic personalized retirement advice similar to a retirement calculator.

Speaking with a financial planner can be a better option if you want hands-on retirement planning advice or want to retire early.

Stash+

The highest-level Stash+ plan costs $9 per month.

This plan includes these deluxe features:

- Custodial investment accounts

- Exclusive Stock-Back® Card offers for higher rewards

- 2x Stock-Back® on certain eligible card purchases5

- Monthly stock market insights report (i.e., premium research)

Parents can open two taxable custodial accounts for each child under age 18. Each extra account is $1 per month.

The child takes possession of the account at either age 18 or 21 years, depending on the state.

Investment Options

The Stash investment options may be the deciding factor for most people. The investment options are similar to most micro-investing apps.

Stash is a self-directed investing app where you choose what to invest in.

If you want a fully automated investing app that picks your investments for you, Stash may not be a good option.

You have three different investment options:

- Individual stocks: Directly invest in specific companies like Amazon,Nike, Apple and more

- Index ETF: Holds multiple companies in an index like the S&P 500

- Thematic ETFs: Invests in a specific market sector like healthcare or banking

You may like Stash because you also have the option to invest in stocks and ETFs.

At first, you may start with index ETFs to build a diversified portfolio. In the future, you can invest in stocks and thematic ETFs to get more exposure to certain industry sectors.

Having all your investments in one place can make it easier to maintain a diversified portfolio. As you invest, remember to keep your risk tolerance and investing goals in mind.

Regardless of which ETFs or stocks you invest in, Stash fills all buy and sell orders in their daily morning and afternoon trading windows.

Index ETFs

Stash offers several stock and bond index ETFs from iShares and Vanguard that track the broad market like the S&P 500, emerging markets and developed global markets.

You may choose to invest in index ETFs first to help attain a diversified portfolio.

Individual Stocks

It’s possible to invest in approximately 3,400+ widely-known companies like Amazon, Walmart and ExxonMobil.

You can also invest in newer companies including Spotify and Pinterest.

Thematic ETFs

The third investment option is thematic ETFs. These ETFs either focus on a certain market sector or companies that might have certain environment, social and governance (ESG) standards.

Similar ETFs may be available on other brokerages although they may require you to buy full shares.

A few quick examples of thematic ETFs Stash offers include:

- Do The Right Thing (ETF Symbol: SUSA) Invests in 250 companies with high environmental, social and governance scores

- Gamers FTW (ETF Symbol: GAMR) Holds stocks of companies that create or use video games from around the world

- Women Who Lead (ETF Symbol: SHE) Invests in companies with women in high-level leadership roles

- Young Money (ETF Symbol: MILN) Focuses on companies that Millennials use

Of the approximate 110 ETFs that Stash offers, many of them are thematic ETFs.

It’s important to understand the investment strategy and risks as these portfolios are not guaranteed to earn passive income each year.

Research Tools

Stash has minimal research tools beyond a basic stock price chart and company profile. Investors can use a stock screener to perform in-depth research to buy stocks.

If you only plan on buying index funds, the lack of research tools is not a big drawback.

Banking

Stash also offers a FDIC-insured online checking account and debit card at any subscription plan level. Green Dot powers the Stash banking account.6

This can be a good option if you want to keep your cash and investments in one place.

There are no overdraft fees or a required minimum balance.7

Here are some of the reasons why you might use the Stash online checking account.

Fee-Free ATM Access

You also have access to 19,000 fee-free ATMs in the Allpoint network.8

Some of the national stores with in-network ATMs include:

- Costco

- CVS Pharmacy

- Kroger

- Walgreens

- Walmart

Non-network ATMs have a $2.50 withdrawal fee. Balance inquiries cost $0.50 each.

Stock-Back® Round-Ups

One way Stash makes investing easy is with their “Stock-Back®” spending roundups.2 You will need a Stash Stock-Back® card if you want to invest using spending round-ups.

For instance, Stash deducts $5 from your account when you make a $4.60 purchase and invests the extra 40 cents in the company stock you made the purchase at.

Amazon purchases mean you get Amazon stock, Apple purchases yield Apple stock.

But a purchase at a local restaurant will invest your roundup into a default investment2.

A reason to consider the Acorns spending roundups is that the entire amount is invested in index ETFs and not individual stocks that may not match your investing goals.

Education

Their “Stash Learn” resources include these tools:

These learning tools can help inexperienced investors learn how to invest.

Learning investing basics is a good idea before starting to invest but not necessary.

Stash doesn’t provide any hands-on human advisor access.

Here is a closer look at the Stash Learn educational tools.

Stash Learn

Most articles take five minutes or less to read and cover basic investing and money management topics.

All of the educational content focuses on these three investing principles:

- Invest for the long-term

- Invest regularly

- Diversify

During the onboarding process, Stash will ask you a variety of questions to help determine your investing goals.

Stash then provides curated articles and investment suggestions that can help you become a better investor.

Is Stash Worth It?

Stash can be a good investing app for new investors that only want to invest small amounts of money at a time. The no investing minimum is better than many investing apps.

Being able to have an investing and banking account at the same place is nice. The Stock-Back® Card can be a fun incentive to invest more cash each month.

However, the monthly fee can still be expensive if you only invest a few dollars each month. It’s possible that your investment gains may not be higher than your account fees.

If you can meet the investment minimums for commission-free ETFs and mutual funds, it’s possible to invest in the same funds at another broker and avoid the monthly account fee.

The educational tools that Stash offers are good too for learning investing basics. But the research tools may be insufficient for experienced investors wanting to have more complex investments in company stocks.

You may avoid Stash if you want to avoid the monthly fee.

Pros and Cons of Stash

Pros

- Can buy fractional shares of stocks and ETFs

- Unlimited monthly trades for one flat fee

- No investment minimum

- Individual, retirement and custodial accounts available

- Spending round-ups and banking accounts

Stash can be a good option when you are comfortable picking your own investments.

The fractional investing makes investing affordable when you might only be able to invest $100 or less at a time.

Cons

- Monthly fee

- Can only trade stocks during trading windows

Most people will avoid Stash because of its monthly fee.

You may also consider using Stash as a secondary investing account. Your employer-sponsored 401k or a similar retirement plan might be your primary investment account.

Stash can be an affordable way to use your spare change to earn passive income. Perhaps you may use this cash to invest in riskier stocks and thematic ETFs that you don’t want to hold large positions in.

Alternatives to Stash

Stash is a legit investing app but it’s not the best option for every investor. You might prefer these options instead.

Acorns

Acorns is the most identical alternative. You can make investments in $5 increments.

They offer taxable and retirement accounts, fee-free checking and spending roundups with a flat $1, $3 or $5 monthly fee.

The two main differences are Acorns only offers index ETFs and they automatically manage your portfolio.

Betterment

Investors wanting a fully-automated investing experience may like Betterment. You only need $1 to start investing in a basket of stock and bond index ETFs.

Betterment handles the entire investing process and automatically rebalances your portfolio. The entry-level Digital plan costs 0.25% annually.

You can customize your investment portfolio allocation to a small degree. Also, Betterment offers add-on financial planning sessions at an extra costs.

Plus, Betterment offers some banking options including a spending account and a high-yield cash account. Both accounts are free.

M1 Finance

Are you ready for a 100% free investing app? M1 Finance doesn’t charge trade fees or account management fees. You only pay fund fees for any ETFs you invest in.

It’s possible to invest in almost every individual stock and ETF that trades on the U.S. stock exchanges.

M1 also offers premade portfolios that copy robo-advisor strategies and other investing themes.

Like Stash Invest, M1 Finance lets you trade fractional shares.

One downside compared to Stash Invest is that you need at least $100 to open a taxable account and a $500 initial deposit for retirement accounts.

Subsequent investments only require a $25 balance.

Summary

One of the best investing habits you can practice is investing small amounts of money on a routine basis.

Both beginner and experienced investors can appreciate Stashs low monthly fees.

Investors who can afford to buy whole shares of stocks and ETFs may prefer to use another broker that provides more flexibility.

Stash Disclosure

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

Stash Subscription fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

“Retirement Portfolio” is an IRA (Traditional or Roth) and is a non-discretionary managed account. Stash does not monitor whether a customer is eligible for a particular type of IRA, or a tax deduction, or if a reduced contribution limit applies to a customer. These are based on a customer’s individual circumstances. You should consult with a tax advisor.

“Kids Portfolio” is a custodial UGMA / UTMA account. Money in a custodial account is the property of the minor. This type of account is a Non-Discretionary Managed account.

A “Smart Portfolio” is a Discretionary Managed account whereby Stash has full authority to manage. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account. “Balance” is defined by investing recurring and future deposits into underweight assets, and for withdrawals, trimming overweight positions. As you deposit or withdraw funds, your portfolio can slowly be aligned to the target allocation appropriate for your risk profile by additional money movements throughout the year. The Investment team built these portfolios with the goal of optimizing risk-adjusted returns achieving this through utilizing the diversification benefits highlighted by modern portfolio theory. Portfolios aim to optimize returns given client’s risk profile. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account.

A “Personal Portfolio:” You can choose your own investments only in a “Personal Portfolio” which is a Non-Discretionary Managed account.

1 Stash Stock-Back® Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program. What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payment. If stock of the merchant is not available for a qualifying purchase, the security will be in shares of a predetermined ETF or from a list of predetermined publicly-traded companies available on the Stash Platform. See full terms and conditions. All rewards earned through use of the Stash Visa Debit card (Stock-Back® Card) will be fulfilled by Stash Investments LLC. Rewards will go to your Stash personal investment account, which is not FDIC insured. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. Stash Stock-Back® Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates. If publicly-traded stock of the merchant (or a subsidiary thereof, if applicable) is not available or otherwise capable of being fulfilled for any reason, the stock reward arising from a qualifying transaction will be in an ETF or a publicly traded company available on the Stash Platform. A user will receive shares of the ETF or publicly traded company that is designated as their Default Investment at the time the qualifying purchase posts to the user’s Stash Banking account.

2 This Program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account. This Program is not sponsored or endorsed by Green Dot Bank.

3 Fractional shares start at $0.05 for investments that cost $1,000+ per share.

4 Group life insurance coverage provided through Avibra, Inc. Stash is a paid partner of Avibra. Only individuals who opened Stash accounts after 11/6/20, aged 18-54 and who are residents of one of the 50 U.S. states or DC are eligible for group life insurance coverage, subject to availability. Individuals with certain pre-existing medical conditions may not be eligible for the full coverage above, but may instead receive less coverage. All insurance products are subject to state availability, issue limitations and contractual terms and conditions, any of which may change at any time and without notice. Please see Terms and Conditions for full details. Stash may receive compensation from business partners in connection with certain promotions in which Stash refers clients to such partners for the purchase of non-investment consumer products or services. This type of marketing partnership gives Stash an incentive to refer clients to business partners instead of to businesses that are not partners of Stash. This conflict of interest affects the ability of Stash to provide clients with unbiased, objective promotions concerning the products and services of its business partners. This could mean that the products and/or services of other businesses, that do not compensate Stash, may be more appropriate for a client than the products and/or services of Stash’s business partners. Clients are, however, not required to purchase the products and services Stash promotes.

5 Double Stock-Back® Rewards is subject to terms and conditions.

6 Stash banking account opening is subject to identity verification by Green Dot Bank. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

7 Transaction is declined and no fee is charged. Other fees apply to the bank account. Please see the Deposit Account Agreement for details. If applicable, your Stash banking account is a funding account for purposes of the Advisory Agreement. Your Stash subscription fee may be deducted from your Stash banking account balance.8 Fee-free ATM access applied to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the ATM owner or bank may charge.