Georgina Green

The take-up of mortgage payment holidays in the UK during the Covid-19 pandemic was extraordinary: according to UK Finance, holidays granted reached a peak of 1.9 million during the pandemic, or roughly one in six mortgages. But which households benefited from the scheme? In this post I use rich UK household survey data to conduct an in-depth analysis of the distribution of the debt-relief scheme at an individual level. I find that borrowers struggling to keep up with payments during Covid applied for a holiday, suggesting the scheme played an important role in preventing a sharp rise in defaults. There is also evidence that some households may have taken them as insurance against future shocks, possibly dampening precautionary spending cuts.

What are payment holidays?

The spread of Covid and the actions to contain it had a significant impact on UK household incomes and had the potential to cause a significant rise in household debt distress. However, from March 2020 payment deferral schemes, known as ‘payment holidays’, were quickly rolled-out across the UK. They provided a form of forbearance to borrowers struggling because of Covid, by allowing a temporary freeze on mortgage repayments.

The schemes were offered by lenders for up to six months following guidance from the UK conduct regulator, the Financial Conduct Authority. Mortgagors were eligible as long as they were not already behind on payments and borrowers were told that holidays would not be reported as missed payments on their credit file, impacting their credit scores.

As most mortgagors were eligible for a holiday, understanding which households applied for the schemes is of key importance for policy. Of particular interest, is whether deferrals went to households whose finances had come under strain as a result of the pandemic, such as: those whose health was affected and were temporarily unable to work because of this; those shielding because of underlying health vulnerabilities; and those who lost income as a result of lockdowns, such as those who were furloughed or unemployed. The consequences of payment deferrals going to households in need are highly material. By ensuring households stayed current on their mortgages, the schemes may have prevented a sharp rise in defaults and spending cuts, which could have had negative spillovers to the rest of the economy. Indeed, throughout the pandemic mortgage arrears remained near to historically low levels. And though household spending fell significantly, largely driven by curbs on social activity, it may have declined even further had payment deferrals not been introduced to support households.

Use of household survey data to examine who accessed mortgage payment holidays in the UK

I use granular data covering around 3,000 UK mortgagors collected from the Understanding Society Covid-19 Study. Understanding Society is the UK’s main longitudinal household survey. The Covid study was introduced to capture experiences of a subset of these households during the pandemic.

The first time a household was interviewed they were asked if they had applied for a mortgage payment holiday. I pool together all the responses to this question across three waves (in April, May and July 2020) to create my sample. In my sample, 12% of mortgagors responded that they had applied for a payment holiday. Of these applications, around 1% were still under review with only 0.1% having been declined. That very few applications were declined confirms that payment holidays were largely driven by borrower demand rather than lender supply. The applications under review at the time of the survey were likely delayed by capacity constraints among lenders. I therefore focus on all applications rather than only those granted to maximise my sample size.

To explore predictors of responses to the payment deferral question I link information from the Covid surveys (age; ethnicity; income; health; employment; and financial concerns) to important pre-crisis household characteristics from the main survey, such as mortgage debt, net savings and previous housing payment difficulties.

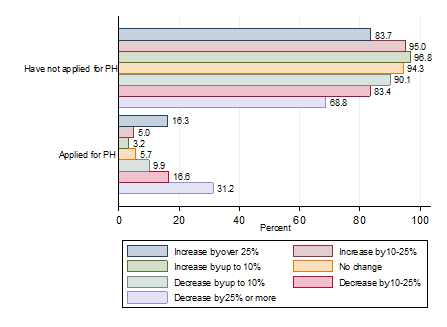

I find that variables which indicate that an individual’s finances had come under strain during the pandemic are correlated with decisions to apply. When nothing else is controlled for, households which had experienced a fall in earnings were more likely to apply for a holiday than others, particularly if the fall exceeded 25% (Chart 1). While it is surprising that a relatively large share of households which experienced rises in earnings of over 25% still applied for deferrals, these households tended to be much worse-off prior to the pandemic. On average, pre-Covid household earnings for this group were 45% lower than other households that applied for deferrals. As a result, even despite the rise in income, they may have been struggling financially. Individuals who expected to be worse off in the following month were also considerably more likely to apply for a deferral, suggesting precautionary reasons may have been important (Chart 2).

Chart 1: Payment deferral by change in household net earnings between January/February 2020 and the interview date (per cent)

Sources: Understanding Society Covid-19 Study and Bank calculations.

Chart 2: Payment deferral by financial expectations one month ahead (per cent)

Sources: Understanding Society Covid-19 Study and Bank calculations.

Did payment deferrals go to people whose finances had come under strain as a result of the pandemic?

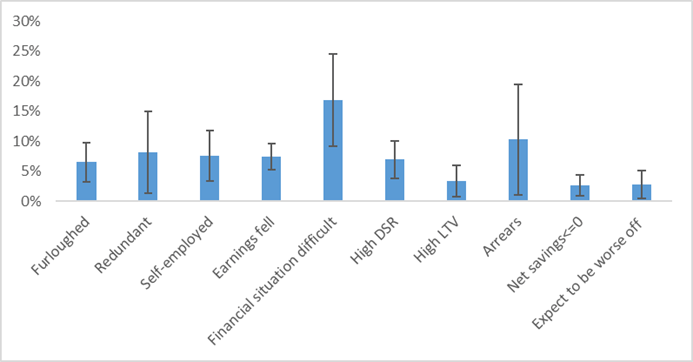

To formally investigate which characteristics are associated with applications for payment holidays I run logit regressions, which model the probability of an event happening. My baseline results are shown in Chart 3. I report the marginal effects, which tell us the impact of a variable on the probability of applying for a payment holiday, holding all other variables at their average level.

I find evidence that many deferrals went to those whose finances had come under strain. Being furloughed, losing household earnings or being made redundant since the start of the pandemic are all economically and statistically significant predictors of deferral applications. Individuals who are self-employed are also significantly more likely to have applied for a deferral than the average. This is in line with evidence that the self-employed were particularly hard hit by the pandemic and restrictions to contain it. The most economically significant predictor is an individual’s subjective current financial situation: those who were finding their existing financial situation difficult, were around 17% more likely to apply for a deferral.

No health variables – such as having had symptoms of Covid in the past or having tested positive for Covid – are significant. It is likely that the pressure on household finances from being sick with Covid and having to self-isolate is already being soaked up by the income and job status variables.

Chart 3: Results logit regression

Notes: Error bars represent 90% confidence intervals around mean marginal effects. ‘Earnings fall’ refers to the change in household net earnings between January/February 2020 and the individual’s first-response to the Covid survey. ‘Net savings’ is calculated as household savings net of total consumer credit. ‘High DSR’ is a binary variable indicating whether a household’s mortgage debt servicing ratio was in the top quintile. ‘High LTV’ indicates whether a household’s mortgage loan to value ratio was in the top quintile. Additional variables controlled for in regression but not shown include: ability to work from home; result of Covid test; had symptoms of Covid; mortgage loan to income ratio; household net income; NHS told to ‘shield’; age; children; gender; marital status; and ethnicity.

Who else took payment holidays?

My results also suggest the policy encouraged financially vulnerable households, who had not suffered any type of Covid-related shock to their finances, to apply.

Mortgagors with a high debt-servicing ratio, high loan to value ratio, negative household net savings or those who had previously been in arrears, were more likely to apply even when changes in income and job status are controlled for. These individuals likely faced borrowing and liquidity constraints and may have used the schemes to build up a buffer of savings to insure against future shocks. Expectations also seem to matter. Individuals who expected to be financially worse off in one months’ time also had a statistically significantly higher predicted probability of applying.

These results are robust to a number of tests, including controlling for the month of interview, region, the removal of weights and changes in the sample.

Conclusions

Overall, my results suggest that many deferrals flowed to those whose finances had come under strain as a result of the pandemic. Indeed, a household’s subjective financial situation being difficult is the strongest predictor of applying for payment deferrals. It is therefore possible that deferrals helped prevent a rise in defaults and dampened household spending cuts. But expectations and pre-Covid balance-sheet variables mattered too, even when employment and income are controlled for. This implies that some applications could have been made for precautionary reasons. Therefore the schemes may have dampened spillovers to the real economy even further by preventing financially vulnerable and pessimistic mortgagors from cutting back on their spending.

Georgina Green works in the Bank’s Macro-financial Risks Division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.