Are you tired of paying a monthly fee for a mediocre business checking account? Or maybe it’s time to separate your business and personal accounts to make tax time easier.

The best business accounts offer some of the best banking privileges.

It’s possible to open a free feature-packed account. Whether you need a local account or can do everything online, one of these banks is for you.

You should consider opening one of these accounts if you own rental property, have side hustle income or run a small business.

Best Business Checking Accounts

These banks all offer business checking accounts with different perks and features. Some banks are only available online, while others may have physical branches near you.

Most accounts don’t charge a monthly maintenance fee. However, you must pay attention to how many items (debits, credits and withdrawals) you get for free each month.

You may still need to pay a small per-transaction fee for frequent activity.

1. Axos Bank

There are currently two different Axos Bank business checking accounts. Neither one charges a monthly maintenance fee.

Both accounts offer free unlimited domestic ATM withdrawals, and your first 50 paper checks are free. You can also make up to 60 remote deposits each month.

The basic business checking is probably a better account option for most businesses. You don’t need to maintain a minimum balance and you get more free items.

Axos Bank is an online-only bank and can be a good fit for your home-based business.

| Account Type | Basic Business Checking |

| Monthly account fee | $0 |

| Minimum initial deposit | $0 |

| Minimum average daily balance | $0 |

| Number of free monthly items | Unlimited debits, credits and deposits |

| Key features | Free bill pay and unlimited debits, credits and deposits |

Although the Basic Business Checking account doesn’t earn interest on deposits, there are fewer restrictions. You never have to worry about maintaining a daily balance.

You also get unlimited ATM fee reimbursements with this account.

Business Interest Checking

- Monthly account fee: $0 with a $5,000 minimum average daily balance

- Minimum initial deposit: $100

- Minimum average daily balance: $5,000 for earning interest

- Number of free monthly items: 100 (then $0.50 per item)

- Key features: Balance earns interest, unlimited domestic ATM fee reimbursement

Axos Bank Business Interest Checking can be worth it if you want an interest-bearing checking account.

Your entire balance of up to $5 million earns the current interest rate as offered by Axos.

You must keep a minimum $5,000 average daily balance to avoid the $10 monthly fee. One drawback is that you only get 100 free transaction items each month.

Any extra transaction items over the 100 free will cost you $0.50 per extra item.

This account can make business banking easy. You can earn interest and pay your bills from the same account.

Pros

- Basic Business Checking has no monthly fee or minimum balance requirement

- Business Interest Checking earns a competitive interest rate

- Free nationwide ATM withdrawals

- Up to 60 remote deposits monthly

Cons

- Business Interest Checking requires a minimum $5,000 average daily balance

- No physical branches

2. LendingClub

The LendingClub Tailored Checking earns interest and can be fee-free. You will need to maintain a $5,000 minimum balance to avoid the $10 monthly fee.

All balances of $5,000 or more will earn interest.

Unlike most business checking accounts, you can make unlimited transactions (items) for free. You also have free ATM access worldwide, and bill pay is free.

- Monthly account fee: $0 with a $5,000 minimum average daily balance

- Minimum initial deposit: $25

- Minimum average daily balance: $5,000

- Number of free monthly items: Unlimited

- Key features: Unlimited transactions, unlimited domestic ATM fee reimbursement

In addition to the business Tailored Checking, LendingClub offers personal checking accounts. Their Rewards Checking account offers debit card rewards, and your deposits earn interest.

Pros

- Unlimited fee-free transactions (deposits, debits and withdrawals)

- Worldwide ATM surcharge fee rebates

- Balances above $5,000 earn interest

Cons

- Minimum $5,000 balance requirement to waive $10 monthly fee

- Standard paper checks are available to order

- Online-only bank

3. NorthOne

A NorthOne Business Banking Account has a flat $10 monthly fee and includes these complimentary features:

- ACH payments

- Deposits

- Transfers

- Purchases

- Envelopes

- App integrations

There is an additional $15 fee for incoming and outgoing domestic wires. ATM withdrawals at MoneyPass locations can be surcharge-free.

This bank is online-only and can make it easy to connect your your various business apps to track transactions and pay vendors. Freelancers and LLC formations can apply for an account.

Your balance also has $250,000 in FDIC insurance through The Bancorp Bank.

- Monthly account fee: $10

- Minimum initial deposit: $0

- Minimum average daily balance: $0

- Number of free monthly items: Unlimited

- Key features: Free app integrations and unlimited deposits

Pros

- Surcharge-free MoneyPass ATMs

- No minimum balance requirement

- Unlimited free monthly transactions

Cons

- Online-only bank

- $10 monthly account fee

- $15 per domestic wire

4. NBKC

NBKC Bank (National Bank of Kansas City) may not be a household name. But they make it easy to avoid annoying fees.

The NBKC business checking account doesn’t charge any of these fees:

- Monthly fee

- Transaction item fees

- Mobile deposit

- Overdraft fees

- Non-sufficient funds

- Incoming domestic wires

- ATM fees (within the 32,000+ locations MoneyPass network)

You will also only pay $5 for outgoing domestic wire transfers. Other banks charge as much as $30 for domestic wire transfers.

NBKC accepts accounts from business owners across the United States. Although they only have three branches all located near Kansas City.

- Monthly account fee: $0

- Minimum initial deposit: $0

- Minimum average daily balance: $0

- Number of free monthly items: Unlimited

- Key features: Over 32,000 fee-free ATMs and no per-item fees

Pros

- No monthly fees

- No transaction fees

- Over 32,000 fee-free ATMs

Cons

- Online-only bank

- Deposits don’t earn interest

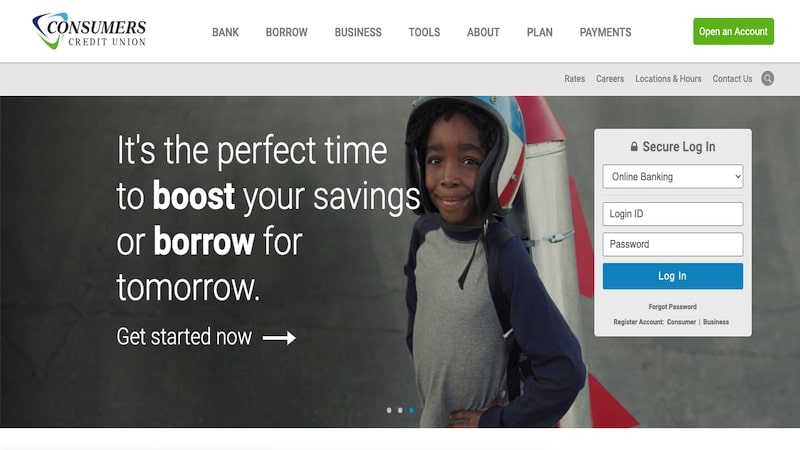

5. Consumers Credit Union

Consumers Credit Union offers several different options for businesses and nonprofits. They also have an exciting reward checking account. Being a loyal member means you can earn up to 5.09% APY on your personal account balance.

Freedom Business Checking

- Monthly account fee: $0

- Minimum initial deposit: $0

- Minimum average daily balance: $0

- Number of free monthly items: 100 (then $0.25 each)

- Key features: No monthly account fees or minimum balance requirement

Forprofit businesses can qualify for the Freedom Business Checking account. There isn’t a monthly account fee or minimum required balance. Your first 100 monthly transactions are free, then $0.25 each.

*Upgrading to the Power Business Checking account gives you 500 free transactions. However, you need to maintain a $5,000 account balance to avoid a $20 monthly fee.

- Monthly account fee: $0

- Minimum initial deposit: $0

- Minimum average daily balance: $0

- Number of free monthly items: 300 (then $0.25 each)

- Key features: Exclusively for not for profits and nonprofits

Not for profits and nonprofits may like Community Checking. This special account can offer more perks than standard business checking accounts.

You get 300 free monthly transactions. Account balances above $500 will earn interest dividends.

Pros

- No monthly fees

- No minimum balance requirement

- Special account for not for profits and nonprofits

Cons

- Other banks offer more free transactions

6. PNC Bank

You may appreciate having local branch access if you live near a PNC Bank location.

For example, you may need to make cash deposits. Also, they offer a free account option if you only make a handful of monthly transactions.

Tip: PNC Bank offers a money market account to help your personal assets earn more interest.

Business Checking

The free account option is PNC Bank’s Business Checking. There is a $10 monthly fee for this account, but you have ways you can avoid that fee.

You get up to 150 transactions per month for free when you have this account. You can avoid the monthly fee if you:

- Keep a minimum of $500 in the account

- Use your PNC credit card to make at least $500 in purchases each month

- Use PNC Merchant services with the account

It’s also possible to process up to $5,000 in cash per month.

- Monthly account fee: $10 (with ways to avoid)

- Minimum initial deposit: $100

- Minimum average daily balance: $0

- Number of free monthly items: Up to seven in-person and unlimited online

- Key features: Free local branch access and free online transactions

Business Checking Plus

If you can maintain a $5,000 average daily balance, you may consider their Business Checking Plus account.

There is a $20 monthly fee if you can’t keep the minimum balance. This account offers more perks than the free basic Business Checking option.

The advantages of this mid-tier account include 500 free monthly transactions and $10,000 in monthly cash processing.

PNC Bank also has other ways you can waive the monthly fee. You can make at least $5,000 in credit card purchases with your PNC Business credit card.

Or you can use PNC Merchant Services for at least $5,000 in deposits each month.

Another option for waiving the fee is to maintain a $20,000 balance between your business checking account and your PNC business Money Market account.

- Monthly account fee: $20 if average balance is below $5,000

- Minimum initial deposit: $100

- Minimum average daily balance: $5,000

- Number of free monthly items: 500 (then $0.50 each)

Note that PNC Bank has a number of other business checking account options as well. See the bank’s website for more information on those accounts.

Pros

- Free local branch access

- No monthly account fees

- Unlimited debit card and ATM withdrawals

Cons

- Monthly maintenance fees apply if you don’t meet minimum requirements

- Only available in select U.S. states

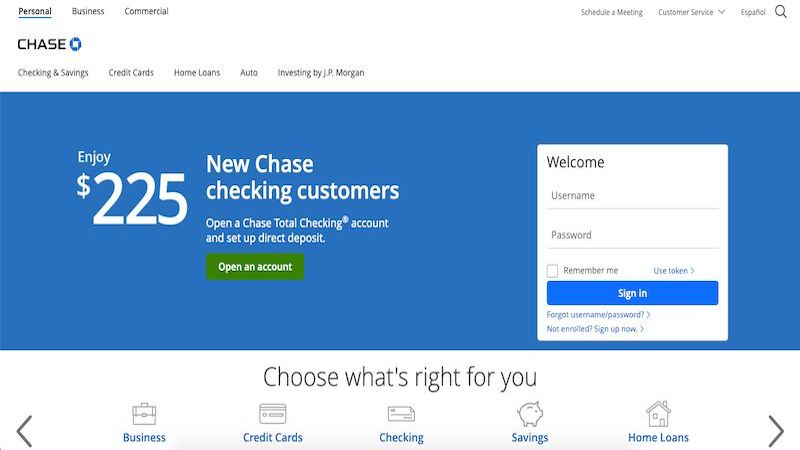

7. Chase

Chase Bank needs little introduction, thanks to its national presence. However, you still need to live near a local branch to qualify.

Their best overall account option is the Chase Business Complete account (formerly called Total Business Checking) option.

You only need to maintain an average $2,000 daily balance to waive the $15 monthly fee. It can still be a hassle, but it’s better than the $5,000 balance most banks require.

There are other ways to waive the monthly fee as well, including charging at least $2,000 on your Chase Business credit card or linking to a Chase Private Client Personal checking account.

Each month, you get 100 free transactions and unlimited electronic deposits. Plus, you can deposit up to $5,000 in cash each month fee-free.

Chase also gives you free ATM access to over 16,000 ATMs and 5,000 branches.

- Monthly account fee: $15 ($0 when your daily balance is above $2,000)

- Minimum initial deposit: $0

- Minimum average daily balance: $1,500

- Number of free monthly items: 100 (then $0.40 each)

- Key features: Unlimited free electronic transactions and up to 20 free teller transactions/paper checks

The other Chase business checking products are intended for larger businesses. You may fall into this group if you outsource payroll.

For instance, Chase’s mid-tier business checking account requires a $35,000 daily balance to waive the monthly fee.

Pros

- Local Chase Bank branch access

- Unlimited free electronic deposits

- Below-average minimum daily balance requirement

Cons

- Only 20 free non-electronic monthly transaction items

- Not available in every U.S. state

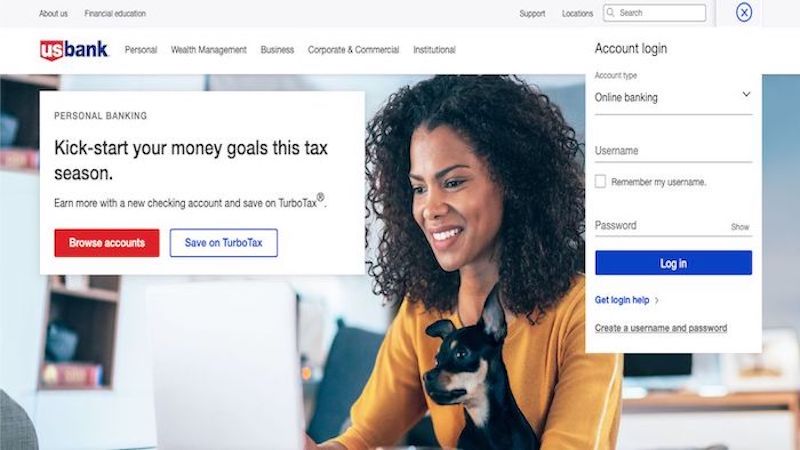

8. U.S. Bank

For a national bank, U.S. Bank also has a competitive business checking account. Their free Silver checking account doesn’t require a minimum balance.

The higher-tier checking accounts can also be useful. However, they have high minimum balance requirements to waive the annual fee.

For example, the mid-tier Gold account requires at least $10,000 in your checking account. Or $25,000 in a linked interest-bearing account like a money market account.

Silver Account

The free U.S. Bank Silver account gives you 125 free monthly transactions (then $0.50 each) and 25 free cash deposits each month.

You won’t pay a monthly maintenance fee. There isn’t a minimum balance requirement, either.

- Monthly account fee: $0

- Minimum initial deposit: $0

- Minimum average daily balance: $0

- Number of free monthly items: 125 (then $0.50 each)

- Key features: No monthly fee or minimum required balance

Pros

- No monthly fee without a minimum average daily balance

- 125 free monthly transactions

- Free cash deposits at local branches

Cons

- $0.50 per excess transaction is higher than some banks

- Fewer local branches than other national banks

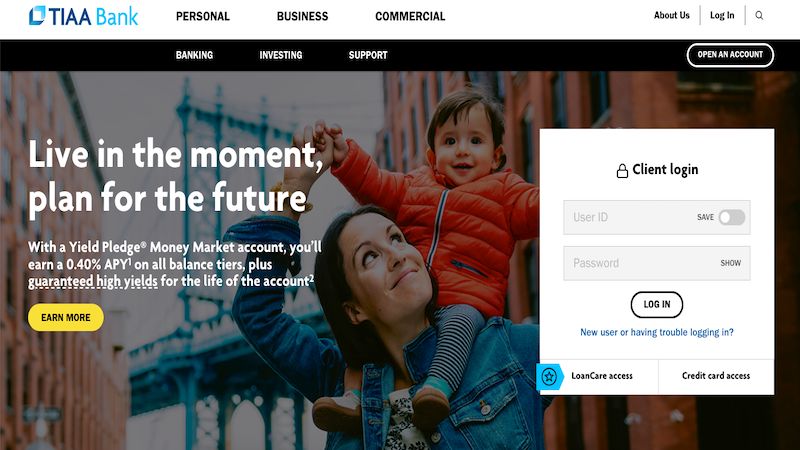

9. TIAA Bank

TIAA Bank offers several business checking options. Your account balance can earn interest, and you may not pay an annual fee.

Which account you qualify for depends on which business you own. For example, are you a sole proprietor, corporation or a nonprofit?

If you live in Jacksonville, Florida, you can visit their few local branches.

Small Business Checking

The TIAA Small Business Checking is only open to sole proprietors and single-owner LLCs.

There isn’t a monthly fee, but you need to make a $1,500 first deposit. Plus, you don’t need to maintain a minimum daily balance.

It is free to make mobile deposits, and your standard online bill payments can be free. However, you may pay extra for an expedited payment.

TIAA reimburses your first $15 in monthly ATM fees. Keeping a $5,000 balance gives you unlimited ATM reimbursements.

Your account balance also earns interest. Balances up to $250,000 earn up to 0.10% APY.

- Monthly account fee: $0

- Minimum initial deposit: $1,500

- Minimum average daily balance: $0

- Number of free monthly items: Varies

- Key features: Account balance earns interest and $15 ATM fee credit

Multi-owner LLCs will need to open a Business Checking account. There are a few differences.

For example, you must have a $5,000 average daily balance or pay a $14.95 monthly fee. You may also be able to get more free transaction items.

Nonprofit Checking

TIAA also offers a nonprofit checking account. Like Small Business Checking, you will need to make a $1,500 opening deposit.

But you will need to maintain a $5,000 balance to waive a $14.95 monthly account fee.

Your deposits earn interest, and your first ten monthly bill payments are free.

Pros

- No monthly account fee

- Entire account balance earns interest

- Monthly $15 ATM fee reimbursement

- Keeping a $5,000 daily balances waives all ATM fees

Cons

- Online-only access

- Low free monthly transaction limit

Navy Federal Credit Union offers a good business checking account if you rarely need local branch access.

Their free account option gives you 30 free non-electronic transactions. Each excess transaction is a reasonable $0.25. Your various online transactions are free.

All of the Navy Federal checking account options earn interest and include free paper checks.

Like all credit unions, the largest drawback is qualifying for membership. Navy Federal is easier to join than many others.

You must be a member of the Armed Forces or a family member of one. Veterans, retirees and the Department of Defense members qualify too.

Business Checking

The entry-level Business Checking option is free. You don’t have to worry about maintaining a minimum balance.

Two signers can be on the account, which is a nice feature. Other free checking accounts may only allow one signer.

Your first 30 non-electronic transactions per month are free. Each additional transaction costs $0.25 each.

The entire account balance earns 0.05% APY. While this rate is lower than similar accounts, it’s better than nothing.

- Monthly account fee: $0

- Minimum initial deposit: $0

- Minimum average daily balance: $0

- Number of free monthly items: 30 non-electronic items (then $0.25 each)

- Key features: Account balance earns interest

Business Premium Checking

When you have multiple owners or frequent non-electronic transactions, consider the Business Premium Checking plan.

Your first 100 non-electronic items are free, then $0.25 each.

Your deposits can earn as much as 0.45% APY. However, this yield is still lower than other online banks.

There is a $20 monthly maintenance fee unless you keep a $5,000 daily balance.

- Monthly account fee: $20 ($0 with a $5,000 daily balance)

- Minimum initial deposit: $0

- Minimum average daily balance: $5,000

- Number of free monthly items: 100 non-electronic items (then $0.25 each)

- Key features: Account balance earns interest and is open to multiple owners

Pros

- No monthly account fees

- Accounts can have multiple signers

- Excess transaction items are only $0.25

Cons

- Limited free non-electronic items

- Must have a military connection to become a member

Summary

Online banks tend to offer the best business checking accounts with the fewest fees. But if you can’t live without a local bank, it’s possible to open a free account.

As your business grows, pay attention to your monthly activity to avoid any potential fees.

Which bank has the best business checking account? What is the most important perk you want from a checking account? Share your opinion by leaving a comment.