You can start investing with only $100 and build considerable wealth.

Your investments have the potential to grow to six or even seven figures.

Are you feeling like it’s useless to start saving and investing because you have very little money to begin with?

If so, don’t give up just yet. No matter how much money you have to start with, you can build an investment nest egg.

And you can build one that’s big enough to fund your financial dreams. You just have to start by choosing some of the investments we’ll talk about below.

How to Invest $100

Ally Invest

Online discount brokerage firm with no minimums for investors.

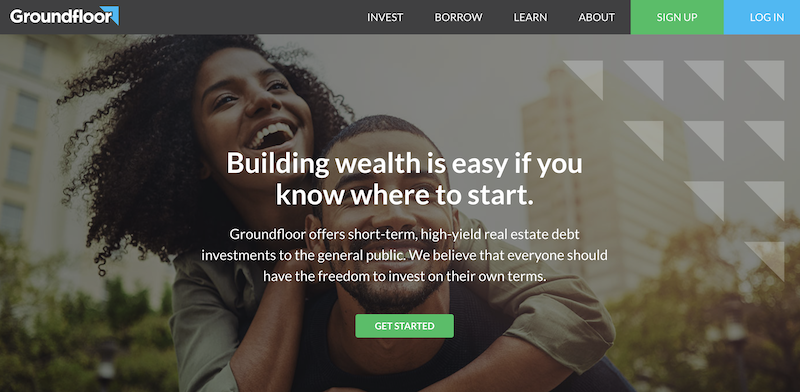

Groundfloor

Offers loans to real estate investors to turn a quick profit on properties.

CIT bank

Offers a higher rate for savings accounts than any local bank.

Before you get started with investing, you need to know a bit about the different types of investing. You need to know what you’re getting into before you put your money down on the table.

So check out different types of investments. Work to determine which types of investments are most suited to your risk tolerance and your knowledge base.

Some investments do better over the long term even though they may seem volatile during the short term.

Diversifying your investment choices will help protect you from market downturns. It will also help protect your money from economic ups and downs, whether personal or global.

Now we’ll talk a little bit about a few different types of investments.

1. Investing in the Stock Market

It’s smart to check out the fine print when investing with small dollar amounts. Brokers who charge high fees can eat up the profits of beginner investors real fast.

However, when done right, beginner investors who start investing with smaller dollar amounts can grow some serious wealth.

You can build wealth through the stock market by purchasing individual stocks, index funds, etc. during the open trading times.

Education is key before you start socking money into the market. Luckily, the Internet is filled with great articles explaining the ins and outs of stock market investing.

You should be cautious though and only do your research using credible investment websites.

Also, there are great books on investing by experts such as John C. Bogle and Warren Buffett. Read books and articles by investing experts.

This way you can begin to understand how to make money through the stock market.

Beware of get-rich-quick schemes and other promoted methods that promise big profits overnight. Investing in individual stocks involves a “slow and steady wins the race” mentality.

And it also involves sticking with your investment through the ups and downs of the market. In addition, beginner investors will want to choose a brokerage account that they can manage themselves online.

This is especially true if you’re starting with a smaller amount of cash. These types of brokerages charge little or no fees.

So this way you can be sure that as much of your money as possible is used for growing wealth.

Here are some options for stock investment accounts for beginner investors.

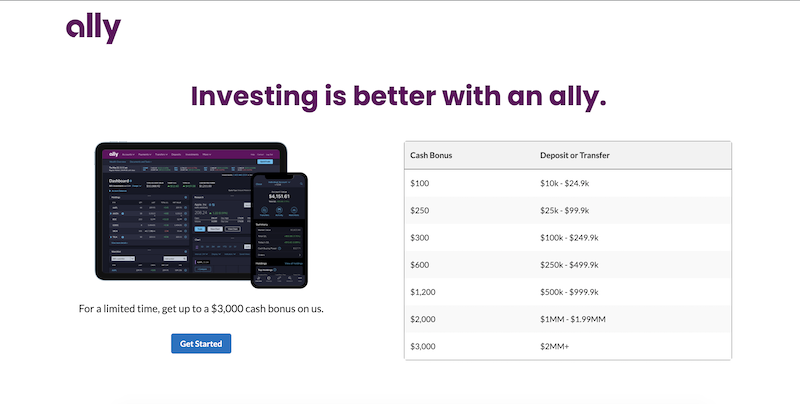

Ally Invest

One of my favorite investment companies is Ally Invest. I like them because they allow you to opening an investing account with no account minimum.

Also, stock and EFT trades are $0 each and you can open an account with as little as $100.

Ally Invest is considered a “self-directed” investment firm, which means they don’t provide investment advice.

Instead, they provide custom charts and other investing tools to help you analyze trades and performance. This way you can learn to make your own educated choices about what to invest in.

With Ally Invest, you can access your investment account via multiple types of devices. This allows for easy and convenient investing.

In addition, they also keep you aware of the latest investing information. They do this with live news streaming information.

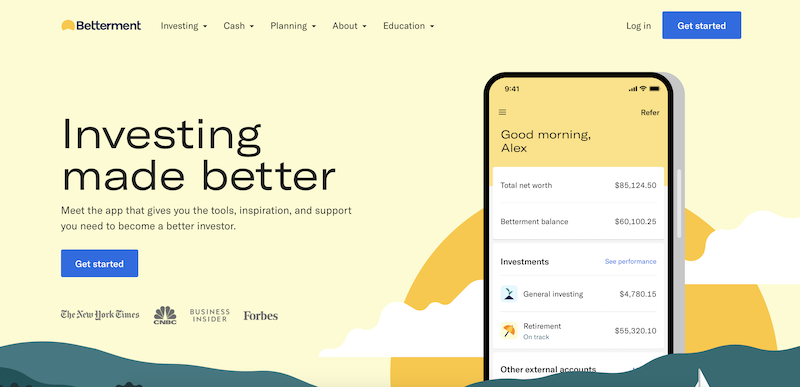

Betterment

Betterment is another company that offers stock investment accounts. One of the cool things about Betterment is that they charge you zero for transaction fees and trade fees.

Since they will actually give you investment advice, they’re a little different than Ally Invest. They base their advice on your risk tolerance and how long you have to invest.

Betterment charges an annual fee, but it’s super affordable (0.25% on accounts with balances below $10,000).

This is a benefit for clients who make a recurring account deposit each month of at least $100.

Each of these companies offer affordable fees and commissions for those just getting started in investing.

Note: If you invest in mutual funds, make sure to check the expense ratios of those funds so that you don’t pay too much in fees over time.

2. Invest in Real Estate

Investing in real estate has long been touted as a smart move, and the wealthiest people frequently use real estate as an investment tool.

You might think investing in real estate isn’t an option when you only have $100 to invest. After all, you can’t buy a rental property or flip a house on a $100 budget.

However, there are companies that cater to those wanting to invest smaller dollar amounts.

Groundfloor offers fractional shares of short-term, high yield investment properties to both accredited and non-accredited investors.

The company offers venture loans to real estate investors, who then use that money to turn a quick profit on real estate properties.

To-date, Groundfloor has achieved average returns of over 10% on their investments, which are typically held for 6 to 12 months.

The minimum to invest with Groundfloor is just $10.

3. Buy Collectibles

Investing in collectibles is also something that was at one time reserved for the wealthiest people.

Celebrities and other wealthy people invest in art, in cars, in sports memorabilia and more.

Today, the world of fractional share investing has changed all of that, and now virtually anyone can invest in collectibles. This opportunity is much better than pursuing penny stocks.

While penny stocks may seem appropriate if you have a small amount of money to invest, fractional shares investing in collectibles is a much safer investment opportunity. Penny stocks are more volatile.

Rally Rd is an app that offers fractional shares of collectibles to accredited and non-accredited investors alike.

The leadership team chooses collectibles they believe are priced correctly and will increase in value.

You can buy fractional shares of collectibles including toys, cars, comics, books and more.

When I checked Rally Rd for this article, collectible offerings included a vintage copy of MacWorld signed by Steve Jobs and Steve Wozniak, a 1780 letter penned by George Washington and more.

And you can buy fractional shares for as little as $3.50 per share (with a $50 minimum investment), depending on the collectible item.

With Rally Rd, collectibles are purchased and turned into “companies” with equity shares. As an investor, you have the option to sell your shares after 90 days or to hold them.

If you’ve always wanted to invest in collectibles, Rally Rd might be a great way for you to invest $100 using fractional shares.

4. Open a High Yield Savings Account

A high yield savings account is an option to make money if you are nervous about investing in the stock market. Most banks pay next to nothing for their savings accounts or a money market account.

However, CIT Bank typically offers a higher rate for their savings account that you will not find at any local bank.

You won’t get rich if you invest $100 or more only in high-yield savings accounts. But you will get paid much more than you would at most traditional banks.

Plus, if you are keeping your emergency fund in this type of account, you’ll easily be able to access your funds. It’s preferable to keep an emergency fund in an account you can access without early penalty fees.

5. Peer-to-Peer Lending

Another less traditional investing option is peer-to-peer lending (often called P2P lending).

Companies such as Lending Club and others like it work differently than banks.

With P2P companies, investors choose to lend money to those seeking personal loans.

Loan applications get analyzed and approved by the lending company staff.

Then those loans are offered to investors who can contribute all or a portion of the loan amount to the applicant.

Detailed information about the loan applicant (such as credit score and payment history) gets shared with potential investors.

When investors open a Lending Club account, money is withdrawn for loans as the investor chooses. They lend money to borrowers after reviewing the borrower’s credit and other facts.

When a borrower makes a loan payment, you (the investor) get paid back with interest. This can be a fixed interest rate or a variable one.

It’s important to be aware of the fact that you can lose your cash in this type of investment. If a customer you choose to loan money to decides to stop making payments, you’ll lose your investment.

However, many people choose to invest in this lending format and are happy with the results. Proceed with caution if you choose this route.

No matter which of these investing routes you choose, you can start earning money on your cash. But only if you’re willing to take the plunge and open an account.

Luckily, many of these businesses will let you invest even if your account only has $100 in it.

6. Invest $100 in Index Funds

An Index Fund is a fund designed to mirror financial markets such as the S&P 500.

When you invest in individual stock shares, each basket of shares is at risk if the company you’ve invested in goes under.

When you invest in an index fund you’re spreading out the risk of investment loss through several companies as opposed to just one.

Index fund investing was made popular by legendary investor Jack Bogle. Learn more about becoming a Boglehead by reading this article.

You can buy these funds as an exchange traded fund or a mutual fund. Just make sure to check the expense ratio and compare exchange traded funds or mutual funds before investing.

7. Investing in a Business

Many people choose to grow their money by investing in a business of some sort. Some people choose to invest in an existing business, while others choose to start their own.

Personally, I have found success with owning my own business.

Investing in a business can be costly, but even those with only $100 to invest can make money with their investment.

In the case of my company, it cost very little up front to start.

This is because the business involved using my skills. I could share my knowledge with people and help them get better rankings with their websites.

And I only needed my knowledge and my laptop.

Fortunately, there are many business startups you can do with only $100.

Consider Chris Guillebeau, author of The $100 Startup: Reinvent the Way You Make a Living, Do What You Love and Create a New Future.

He wrote a book sharing what he learned from interviewing over 1500 business owners. And each business owner started their businesses with a smaller amount of capital.

In many cases, the successful business owners that Chris interviewed spent no more than $100 on their startups. And his interviewees weren’t all people with special skills.

They were ordinary people like you and me. As Chris states in his book, they simply “discovered aspects of their personal passions that could be monetized.”

You never know; maybe you’re one of those people. You might be able to turn doing what you know and love into a business that grows into unimaginable wealth.

I’m not saying that this will happen without a lot of hard work. Growing a business always involves hard work.

However, if you are willing to put in the time, you might be able to grow a successful business even without having to put down a lot of cash up front.

8. Investing in Yourself

Another way to consider growing your $100 into a lot more is to invest in yourself.

By that, I mean invest in yourself to learn more about how to grow your skills, and eventually your net worth.

You can do this in a number of ways:

- Purchasing books to learn about investing or business ownership

- Taking online courses to learn a new skill

- Taking in-person classes to learn a new skill

- Joining an investment club or another networking group

The more you learn about money, whether earning, saving or investing, the more tools you have to grow wealth.

In fact, in Thomas Corley’s book, Rich Habits, he shares that 88% of wealthy people read at least 30 minutes every day. And they’re not reading rag mags.

Instead, they’re reading books that will educate them on improving their skills. So consider investing your $100 in yourself and see where it leads you.

9. Pay Off Debt

This is one investment I can’t overstate enough. When my wife and I were first married, we were sitting with over $52,000 in consumer debt.

It was like a weight hanging over our heads.

Through a lot of hard work, we paid off that $52,000 in debt in just 18 months. That one (albeit tedious) step has led to exponential wealth growth for us.

Putting extra money (or $100 per month) toward credit card debt or another type of debt may not seem like it will do much good.

But I promise you that it will add up because you’ll be paying less interest on the debt over time. And once you’re debt free, you’ll be able to save money and invest.

10. Invest $100 in Cryptocurrencies

Cryptocurrencies are another investment option you can start with $100 or less in. Many crypto exchange sites have minimums between $0 and $10.

And fees, depending on the exchange site, can run from zero to 3% or more.

One thing to note about crypto is that it can be very volatile. Investing in cryptocurrencies is not for the faint of heart.

You’ll want a higher risk tolerance level if you’re going to invest in crypto. Also, be prepared to pay Uncle Sam since any profits you earn are considered taxable income.

See our article on the 10 Best Crypto Exchanges and Platforms to learn more about investing in cryptocurrencies.

The Importance of Contributing Regularly

Contributing regularly to your investment portfolio is definitely one of the keys to successfully building wealth. Whether you are utilizing a traditional IRA or a different type of account, contributing is key.

It doesn’t matter if you’re only contributing a small amount or are putting money into retirement accounts or a savings account. Of course, contributing extra money each month helps.

The more money you put into your investment accounts each month, the more compound interest can work to grow your wealth. This will help you work towards financial freedom.

But the habit of making monthly investments is the most important thing. Consider making a habit of contributing to your investment accounts on a regular basis.

Do this by treating your investment contributions like a bill.

Talk to your bank or investment firm about setting up an automatic transfer. They’ll transfer money each month from your bank account to your investment account.

This will help you to make regular deposits on the same day every month.

Automatic investments will help you eliminate the need to think about investing each month. It just happens magically for you. But if you leave your investment deposits as a non-automated “choice,” you might not make the investments.

Instead, you might find yourself making excuses for why you can’t contribute. Bills will come due, as will the chance to spend the money on other things.

If you are hesitant to begin investing, consider consulting with a financial advisor. This can also help you if you aren’t sure how investing will impact your income taxes.

Summary

As you can see, there are low-risk ways to invest $100. You can put money into a high yield savings account as a contribution to an emergency fund or pursue higher risk options like investing in the stock market.

If you start investing with $100 today, your future self will thank you as the account grows trying to reach the six and seven digit figure range.

In the process, you’ll create a more secure future for you and your loved ones.