Executive Summary

Good marketing based on using impactful messages for consumers is a foundational element for many types of businesses that allows companies to define and convey their unique value. For financial advisors, effective messaging often tells the story of how their advisory practice serves clients, with the intent to resonate with the audience and inspire them to engage with the firm. But while the messaging on many advisory firm websites speaks to a firm’s capabilities, a better approach to drive engagement is to frame communication around the prospect’s needs.

Employing a few key principles to shift the perspective and focus on what clients and prospects need can instantly create a more compelling message that will improve engagement. First, it’s important to make the consumer (rather than the firm) the main character in the firm’s communications. Flipping “we” statements into “you” statements puts the consumer front and center in the story – not the firm. The firm can then consider the unique needs of its target client (and the firm’s ability to deliver solutions to these unique needs) to create more relevant messages. These needs can be determined by interviewing current clients who the firm considers to be ‘ideal’ target clients in order to learn about their priorities. Finally, the firm can use this information to craft messages that speak specifically to the prospects they want to reach, touching on the issues that are most unique – and most relevant – to them.

After the firm has developed its messaging with the target client and their needs in mind, it can consider how to best deploy them effectively on the firm’s website. The goal is to show prospects how they will benefit by helping them understand what they will experience from working with the firm without simply describing the firm’s services. This can be done in several ways, such as describing a ‘path’ (of three or fewer steps) the prospect will be guided to follow to achieve their goals, or creating a ‘call to action’ for what the client will need to do to get their plan in motion (e.g., scheduling a complimentary consultation or downloading a free sample financial plan).

As with any marketing investment, it is important for firms to track the results of these changes; for example, monitoring the number of website visitors during a certain period and the number of prospects who scheduled a consultation. One specific way to measure the effectiveness of messaging – and to identify where adjustments should be made – is through A/B testing, a marketing tool that is used to compare different content assets against one another. For instance, a firm could test an ‘A’ version with its current messaging that uses “we” statements against a ‘B’ version that includes “you” statements to see which generates more engagement.

Ultimately, the key point is that successful financial advisory practices value the power of words and understand the importance of having a solid messaging framework. Yet firms of all sizes and maturity often struggle with optimizing their messaging to get it just right. But by making a simple – yet crucial – shift in their messaging strategy by flipping “we” statements into “you” statements, firms can earn more credibility and (hopefully) attract more clients!

It’s human nature for business owners to describe their business based on how they, as the operators, see it. “We do this… We do that… We help with this… We’re experts in that… We’re the best in this… Here’s how we do this…”. You get the idea.

But really good marketing that actually speaks to the consumers flips the emphasis on “we” and instead focuses on “you” – the person reading or hearing the message, the audience.

My wife is a former journalist with Bloomberg News, and her editor always used to tell her, “Write like you are explaining something to your grandma – but a smart grandma; make it sophisticated enough so that she’s not feeling like she’s being talked down to, but easy enough to digest that she gets what you are talking about.”

She also learned from day 1 of journalism school how to think like a storyteller. What do most stories have in common? A main character (someone the audience can relate to or empathize with) who is looking to achieve some kind of goal but is presented with challenges or obstacles along the way.

What journalists and authors have figured out (that many others find hard to grasp) is that audiences only consume information that is interesting and relevant to them, and that doesn’t require much brain power to interpret.

So when it comes to creating good content to connect with the targeted audience, what easier way is there to do that than to put the audience at the heart of the message, acting as the main character in a story?

Compelling Advisor Marketing: Flipping The Message From “We” To “You”

We have access to more information today than ever before. We are inundated with information, especially in the form of advertising via social media, email, web searches, phone calls, texts, mailers, and other print materials.

Ready to feel overwhelmed?

And that’s just email!

So, for the relatively few things we do click on, the videos we do watch, the messages we do pay attention to, amidst an onslaught of information… what is it about these that is so compelling? What is it that drives us to make the subconscious decision to say, “I’m going to click on this, but not that.”?

Relevancy.

The Consumer As The Main Character

Relevancy is that certain something that makes us take action… that makes us look and think, “Wow, this is speaking to me, this (Google result/ newsletter/ post) is relatable. It’s exactly like what I’m experiencing because I am (this kind of person at this point in time)”.

We’ve all seen it – when we suddenly get into fitness, a bunch of ads for exercise ideas and personal trainers pop up. When we have babies, we suddenly get a spew of information on diapers and sleep training. When content is relevant to something we’re currently experiencing already, our brain tends to notice it.

But to inspire action (and to get people to click on a link or dig in more), the content must speak to the consumer and resonate with them. Rather than just saying, “We make contraptions to help babies sleep better,” they instead say, “Do you want more sleep? Frustrated that your baby keeps waking up? Do this, and you’ll be able to enjoy the sweetest lasting memories with your loved little one without all the torture.”

See what they did there? They flipped the story, so the consumer is the main character. The hero. They also gave the consumer a call to action, a path to save the day. And finally, they gave them a taste of what success would look like.

Long story short – what companies do or how they do it doesn’t matter. What matters most is the main character. And for financial advisors using marketing messaging, the main character is their prospect.

A Good Story Is Relatable

People love stories where a character is relatable – the character feels, does, or says something that is easy to relate to or empathize with. This 180-degree shift in messaging, from describing what the company or product can do, to putting the prospect as the main character of the story, shifts the focus to the prospect’s unique needs.

A good story speaks directly to the reader, so they can see themselves in the story. That’s why the most effective marketing focuses on a niche, or a target market. In marketing, there’s a popular saying, “If you’re talking to everyone, you’re talking to no one.”

Messaging is a way to focus on the audience’s unique needs and is most powerful when it narrows its focus down to the ideal clients that an advisor is best at serving.

The fact that the baby product advertiser understood that I recently had a baby who was right in the middle of a four-month sleep regression is exactly what made it so compelling to me. I was at my wits’ end, trying not to lose my marbles, operating on four hours of sleep with multiple interruptions… while also questioning, “Why did I have another kid? I thought this was supposed to be amazing and rewarding – what am I doing wrong?”

The messaging was 100% geared towards my situation – I did feel frustrated. I did want more sleep. But I also wanted to enjoy time with my newborn. Instead of leading with product features, the messaging in the ads appealed to my feelings. Far more powerful!

Enough about baby products (you can see where my head is at these days)… Let’s talk about how to put this to work for financial advisory firms.

How To Flip Your Advisor Messaging

You may have heard the phrase, “The riches are in the niches“. When a prospect can see themselves in the story – and can relate to the story at that moment in time – you don’t have to keep pushing messages at them. On their own accord, they’ll want to read or consume the information to find out what happens (or how it may turn out for them)!

The Mental Shift: Switching To “You” Statements

The first step in adjusting your own messaging is having the awareness or recognition of what poor messaging looks like. From there, you can implement changes to your messaging – the 180-degree flip that goes from describing the services a firm offers, to pointing out the success that clients will ultimately enjoy.

Let’s dive into real-world examples. We talked earlier about how good marketing tells the story with the prospect as the main character, but how most financial advisory firms tend to tell the story is with the firm as the main character. Put this to the test: open a few financial advisory websites, and what do you see?

- “Fee-only fiduciary offering comprehensive wealth management and investment management”

- “We offer a range of wealth management and financial advisory services, including portfolio management, tax planning, risk management, and estate planning”

- “We use our 50+ years of combined experience to service our clients at the highest level”

- “We offer not only investment management but also wealth management, to ensure you’re on the right path to securing your future”

- “Providing wealth management to busy professionals and business owners”

- “We put you first to help you achieve your financial goals”

These phrases are statements, not stories in which a prospective client can imagine themselves as the main character. Think of how many similar messages you’ve seen over the years! They’re not centered on the audience at all.

Statements like this don’t draw the prospect in, which makes prospective clients work harder to figure out how they fit into the story. Prospects need to make a few mental leaps in order to draw the connection between what “range of wealth management and financial advisory services” actually means and how it will solve their unique problems in the present moment. And the harder prospects have to think in order to connect to the messaging, the less receptive they will be to the messages.

We want to avoid these mental leaps as much as possible. Instead of leaping, we want to hold the prospect’s hand and walk with them down a well-defined path.

That’s why your first step is flipping the mindset around messaging. Your firm’s services, features, or benefits don’t matter… at least not yet when appealing to new prospects; what matters most, especially when presenting a story to a client or prospect for the first time, is the main character (the hero), and what success looks like to them. You want to start with the outcomes you can help them achieve, versus the services they will be paying for to achieve those outcomes.

It’s easy to get sidetracked with secondary or tertiary messaging points – like how many years you’ve been in business, your set of services, or how many awards and certifications your team has – but it’s also key to understand that while those things are important, they will be more meaningful to clients if they’re introduced later in the story, when the client understands how they fit into the story first.

Embrace this mental shift: your financial practice is not the hero of this story. Your wealth advisors and client service associates are not the heroes of the story. The real, true heroes of the story are your clients – prospective and current!

Diving Deep Into Your Hero

To tell a good story, understanding your main character is key – who they are, what they do, what they desire, and what they struggle with. For a financial practice, the best way to do this is to figure out answers to the following questions:

- What do our clients want?

- What do they care about?

- What do they like to do?

- How do they spend their time?

- What motivates them?

- What frustrates them?

- What keeps them up at night?

- What are their thoughts, attitudes, and desires related to our industry?

- What do they want to get out of working with someone like us? What are the problems that we are helping them solve?

- Are there specific things that are complex/confusing/challenging about their current situation?

The best way to get answers to these questions is by actually interviewing clients and asking questions, rather than by guessing what the answers are based on what you think you know. You’ll probably get a lot of content from the answers; your task will be to extract recurring themes of common challenges that your clients face.

For example, is our ideal client seeking peace of mind for their family? Or are they more concerned about growing their wealth quickly? Treating your client as the main character in a story about a hero’s journey will help you better understand where they are coming from. This gives you the ability to cater your messaging directly to them in a compelling way.

Once the clients’ main challenges are identified, the next step is to understand how recurring themes rank in order to determine what to prioritize first in your messaging. By synthesizing and prioritizing your client interview takeaways, you can rank these themes by importance and exclusivity. How important is each theme to your target audience? How exclusive is each one to your firm’s ability to deliver and solve that challenge?

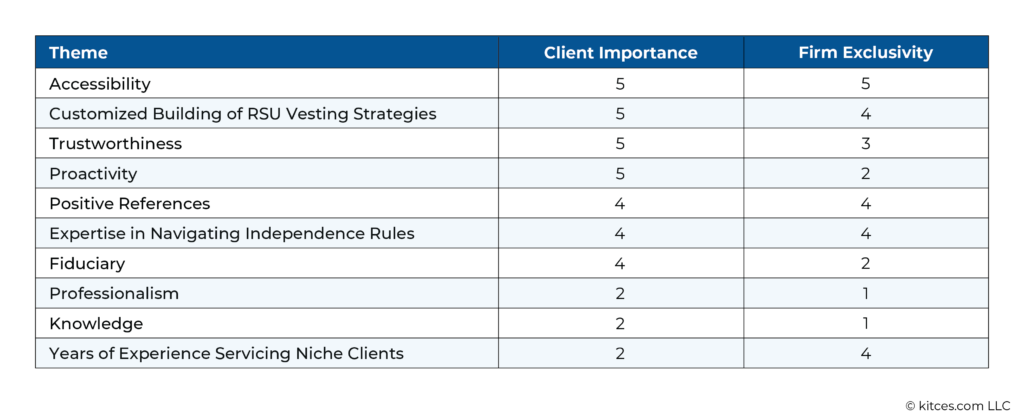

To prioritize these messaging themes, consider each circumstance and rank each theme on a 1–5 scale for importance to your target audience and a 1–5 scale for exclusivity to your firm’s ability to deliver and solve the challenge. Prioritize the highest cumulative scores for each one of your themes.

Example 1: In an assessment of their marketing strategy, Firm XYZ sought to determine whether they could adjust their messaging efforts to better connect with ideal prospective clients.

They interviewed several clients who were good representations of their target niche to identify recurring themes that were important to them and then ranked each theme on a scale of 1 to 5, where 5 reflected the themes that were mentioned most often.

Next, the firm assessed each of the themes and ranked their own ability to exclusively address the issues that were important to their clients.

Their list of themes and associated importance and exclusivity scores were as follows:

They realized that while being a fiduciary was important to their clients, it didn’t necessarily set them apart from the competition. They also found out that their model for customer service (being available and accessible to clients when and how they wanted) was something that they had a particularly unique ability to deliver.

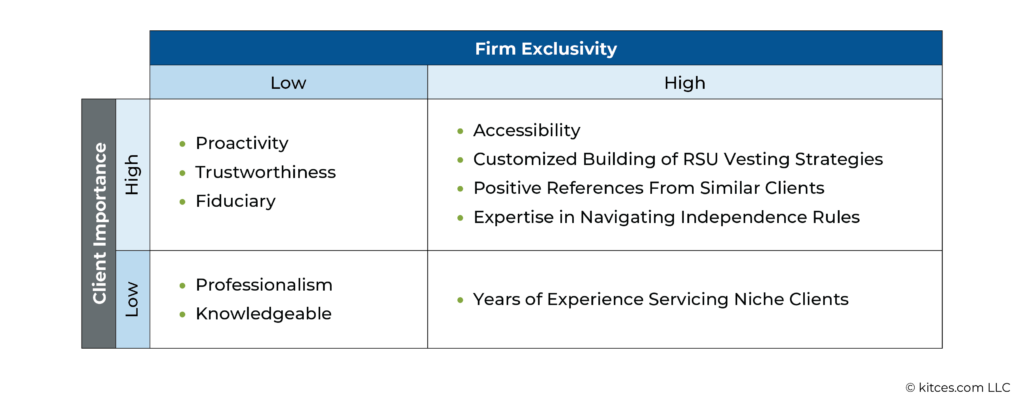

Plotting these themes on a matrix, the firm was able to identify the highest scoring items in both exclusivity and importance:

Based on this information, Firm XYZ decided to target their messaging on these themes, which they identified as most important to the client and most exclusively performed by their firm in particular:

- Accessibility

- Customized building of RSU vesting strategies

- Positive references from similar clients

- Expertise in navigating independence rules

Before advisors can gather the most useful and relevant information from their clients, though, they first need to understand how to choose which clients to talk to.

Targeting The Message

The best clients to interview when identifying good messaging themes are those that fit your ideal client profile. Remember, “the riches are in the niches“.

You may be thinking, “But how do I find the right niche?”

If you’re not sure who you should target, it’s helpful to do a deep dive on what kind of person makes your ideal client, and to consider if there are any recurring themes among your existing client base that you’ve found you are good at addressing.

Who do you enjoy working with the most? Which types of people would be most beneficial for you to market your business toward?

The idea is to find a group of people with a common set of challenges where you are uniquely positioned to add the most value – value that is recognized and appreciated.

In your messaging, you don’t want to capture the feelings of people in general; instead, you want your content to embody how specific prospects that represent your target client – whether they are professionals in a certain field or people from a certain generation, background, or demographic – and how they see the world and experience challenges. The more you can focus on a particular niche, the easier it is to create relevant messaging.

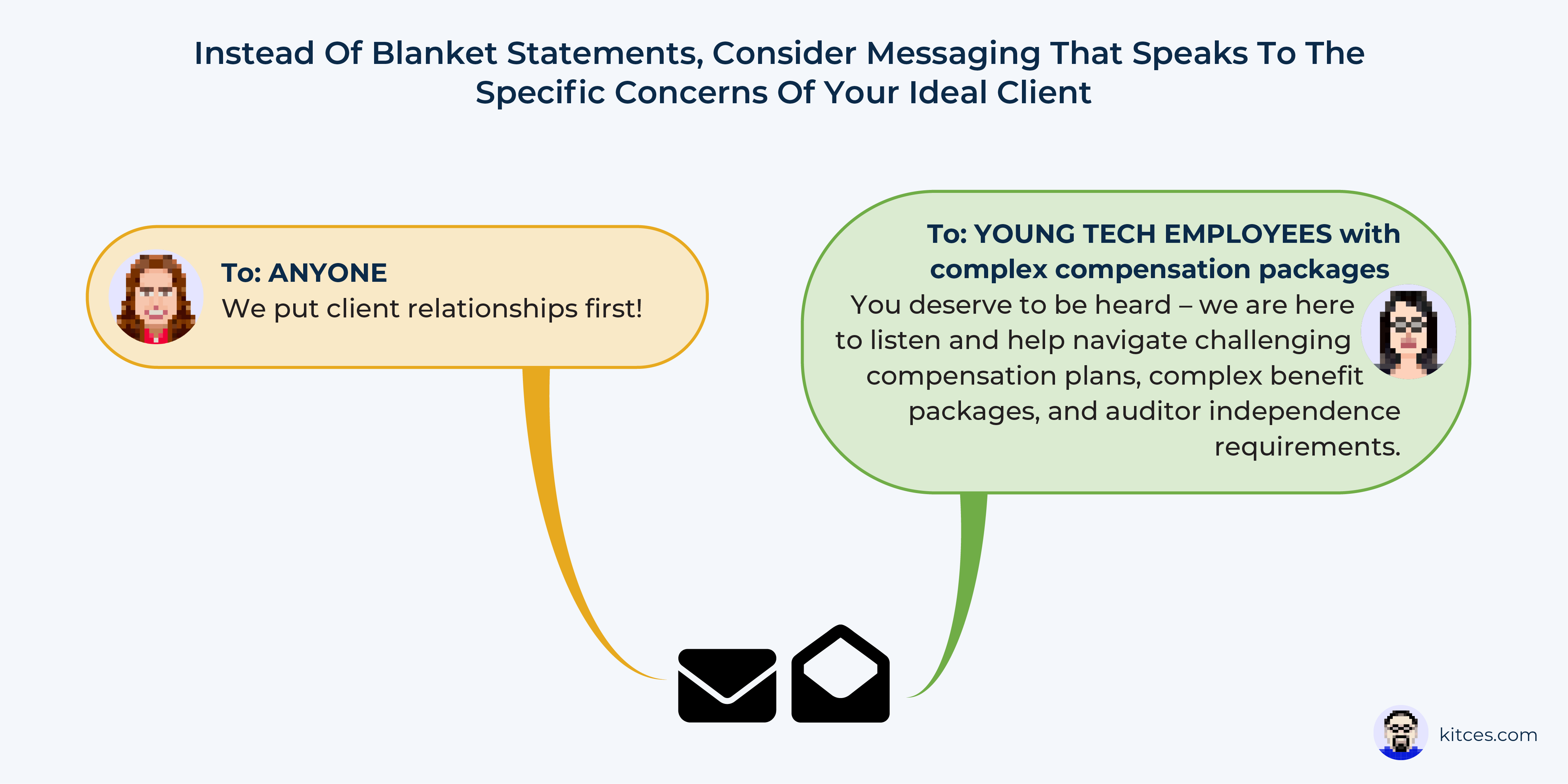

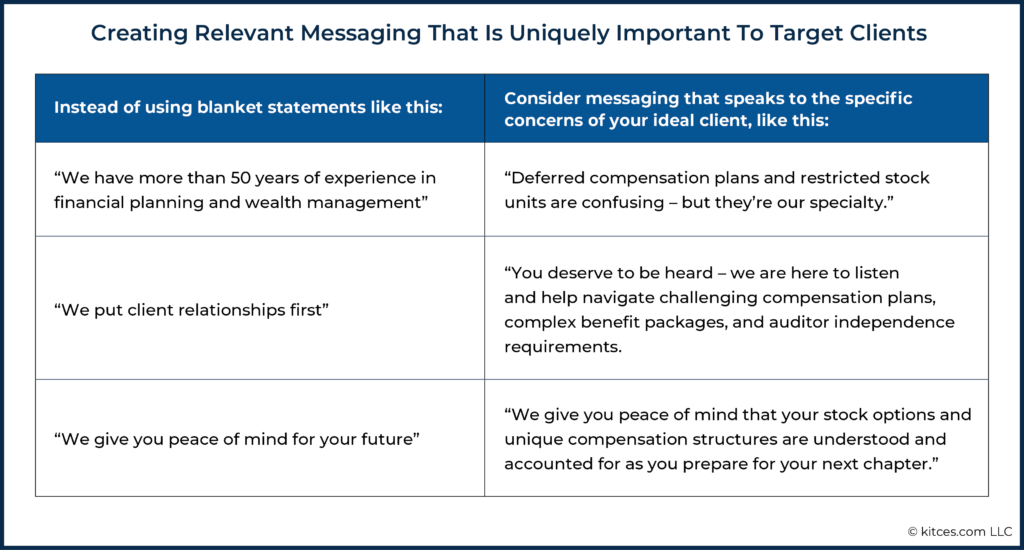

So instead of using generic blanket statements (commonly found on many advisor websites), consider sharing something more specific that you offer to your ideal client. Speak to the customers you want to earn, touch on what is unique to them, what they are really looking for, or why they come to you in the first place.

Using Messaging To Transform The Prospect Experience

Simply following these principles – flipping “we” statements to “you” statements, diving deep into the hero, and targeting the message to your ideal clients – can instantly make a more compelling message that will better engage prospects.

Let’s share some examples to demonstrate how much of an impact these guidelines can have. First, consider an example of a “we” statement describing a firm’s services:

I’m a financial advisor who cares deeply about my clients, and I can help you with your long-term financial planning needs.

Now compare that to this revised message using a “you” statement:

You deserve to be listened to – not pitched to. At XYZ firm, you will be treated like a human, get a clear and personalized financial plan based on your unique story, and know your wealth is in caring and competent hands.

As another example, consider this “we” statement:

Experienced leadership team with a combined 50 years in providing financial planning and wealth management for business owners.

To convert the message above into a “you” statement, think about the emotions of the reader and approach it from their point of view:

Ambition has driven your success. You set the destination when you tap into our entrepreneur experts, who will help you create the map and find the resources to achieve your financial aspirations (in and out of the office).

We also talked about identifying who the hero is to make the messaging more relatable to them and to use the words and phrases that will speak to your ideal customer. By addressing the particular pain points and challenges of the story’s hero (and your ideal client!), you can help to demonstrate empathy in your “you” statements – you understand their pain points; you get it! – while engaging the exact target audience you want to work with.

Examples of empathetic statements:

- “We understand how frustrating it can be to be sold to.”

- “As a busy professional with a lot of demands on your time, we understand it can be stressful to manage multiple investment accounts in your ‘spare’ time.”

- “Stop feeling stuck in a never-ending cycle of pitches that don’t fit your needs.”

The goal is to evoke more emotion. People take action based on emotion and then validate their decisions with logic.

Now let’s talk about how to do this on your website.

Making The Change: Your Website

Your website is one of your greatest assets in communicating who you are and what you do. The challenging part is to position this in such a way that shows your prospects how they will benefit from your services. This can be done by helping them understand what they will experience from working with you, without simply telling them about the services you offer.

Example: Financial Advisory Firm Marketing To Big 4 Consulting Professionals

Imagine that your ideal client is a Big 4 consulting professional. In your client interviews, you learn that these professionals are often confronted with the following circumstances that they find frustrating, challenging, or annoying:

- Finding the right financial advisor partner that is familiar with auditor independence rules;

- Developing a strategy for stock options, deferred compensation, RSU vesting, and ESPP;

- Consolidating old 401(k) plans and other investment accounts;

- Evaluating benefit packages;

- Creating a plan for financial stability amid M&A activity and other uncertainties;

- Aligning portfolio risk level;

- Preventing unnecessary tax liabilities by tax-loss harvesting;

- Financial modeling and projections specific to a consultant’s career trajectory and forms of compensation;

- Navigating an employer’s mergers and acquisitions or severance packages; and

- Investing bonuses or other extra cash.

Prioritizing these challenges by their importance to the target audience and the firm’s exclusive ability to solve those challenges (as explained above), you determine that the following three themes are not only most important to your clients, but also something that your firm has a unique ability to address:

- Finding the right financial advisor partner that is familiar with auditor independence rules;

- Developing a strategy for stock options, deferred compensation, RSU vesting, and ESPP; and

- Modeling financial scenarios and projections specific to a consultant’s career trajectory and forms of compensation.

It can be tempting to chase all of the themes that you extract from the conversations, but it is more powerful to focus your messaging on only the top 3-5. You’ll make a bigger impact and see better results if you focus on these top points rather than spreading your message too thinly in an effort to address everything. Trying to cover all points will only result in confusion or loss of attention.

Just like a brand can be recognizable because of consistent imaging, so too can a company be recognizable with consistent messaging.

With the previous example in mind, let’s consider how you, as an advisor whose ideal clients are Big 4 consulting professionals, would put this to work on your website, starting with your home page.

Updating Your Home Page

To start – think of who the main character in your story is. Who are they, what is important to them, and what are their challenges? Creating a specific client persona is an excellent way for advisors to attract their ideal clients.

Max is a Big 4 consulting professional. He is 40 years old, has been married for 12 years, and has an 8-year-old daughter. He is incredibly busy with managing work and travel but also prioritizes balancing his time with family and friends.

He is looking to continue moving up the corporate ladder so that he can provide for his family and live a comfortable retirement.

Max’s vision of retirement consists of spending his time hitting the links or relaxing at the beach – this is his end goal.

But there are obstacles that Max faces before he can ultimately achieve that end goal:

- He’s smart and knows he should be actively investing his money, but as a Big 4 consultant, Max is faced with tricky and complex auditor independence rules. It’s a lot for him to manage staying up to date with those rules.

- Max doesn’t have a lot of spare time or expertise to figure out how best to invest his bonuses, big raises, extra cash, and other complex benefit offerings.

- He doesn’t have the time (or the tools) to craft a detailed financial model or income projections – he already has a lot on his plate.

Remember that the goal is to keep the character of your messaging story front and center. Stay focused on the challenges you’ve prioritized from the client interviews and let the content develop from there. This is what you want to capture on your home page.

Here are some messaging examples of how Max’s story, from the example above, can be captured at the very top of your homepage:

- “Reclaim mind space from navigating complexities of auditor independence rules by trusting us with your wealth management.”

- “Wealth and investment management can be time-consuming and confusing. Let us help you take care of it so you can spend more time doing the things you enjoy.”

- “Your assets should grow – not sit idle. Your busy lifestyle doesn’t need to prevent you from keeping up to date with your stock options and deferred compensation plan benefits.”

You can even specifically call out your target niche. For example:

- “You’ve achieved the highest degree of professional success at PwC. Now let us help you capitalize on your financial success”

- “As a Big 4 consultant, you face special circumstances that require knowledge of complex compensation, auditor independence rules, and attention to detail.”

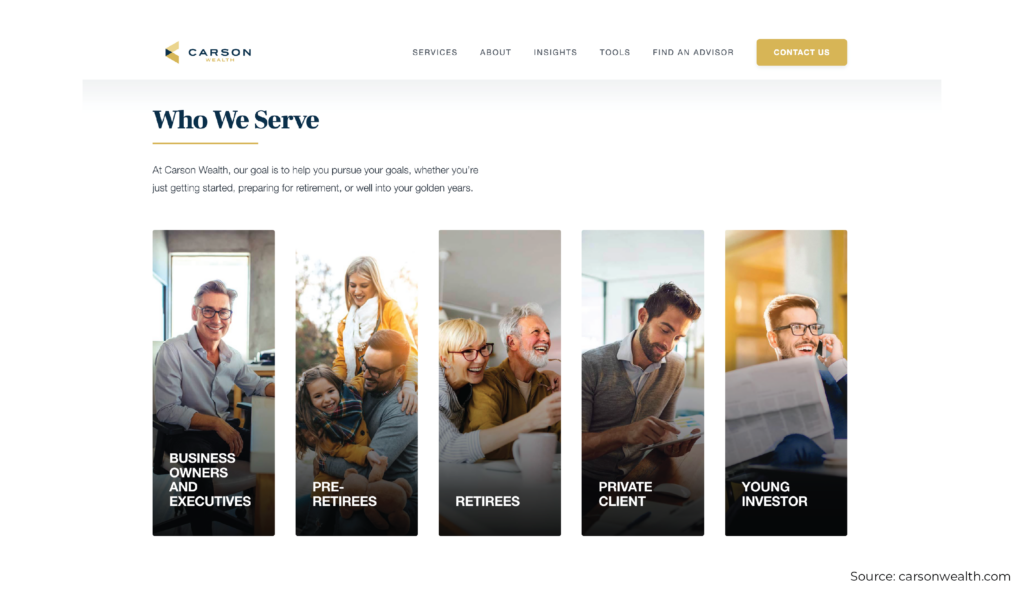

For example, Carson Wealth points out its target audiences on its homepage, and when you scroll over the text, you see the prospects’ top challenges:

Plan ABZ also uses targeted messaging on their homepage, centered on families caring for an individual with special needs:

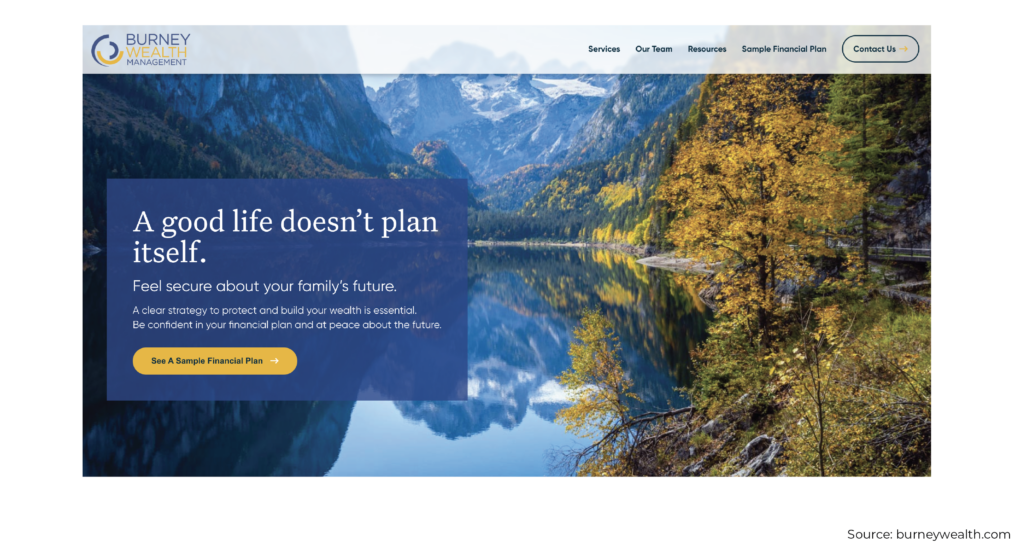

As an example of flipping firm-centric messaging to customer-centric messaging in a homepage header, Burney Wealth Management focuses on the individual and their desires:

Once you’ve identified the story and have come up with some targeted messaging, the next thing to capture on your homepage is a clear path for your Big 4 consulting website visitors to understand how they will successfully achieve their goals by engaging your services, making it simple, in three steps or less.

Step 1: You talk, and we listen.

Step 2: We craft a plan together.

Step 3: We help you stay focused on your career, because you’ll be able to trust that your wealth and investments are in good hands.

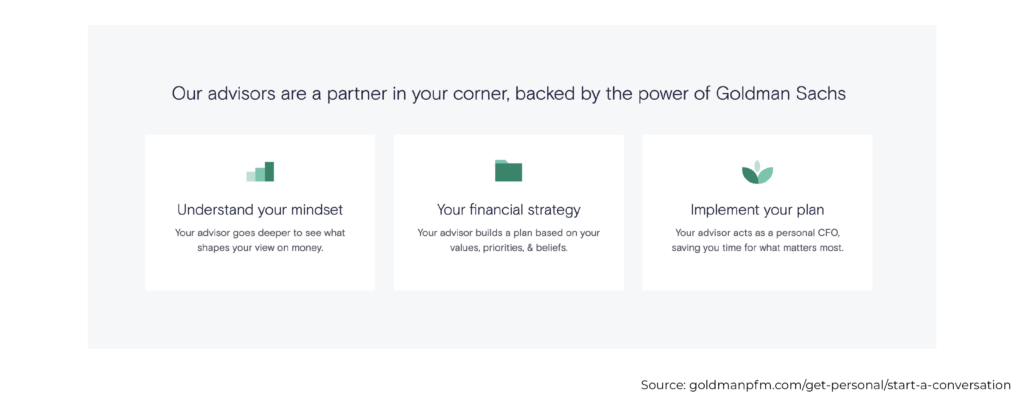

Here’s an example of a 3-step plan from Goldman Sachs Personal Financial Management:

And finally, a call to action for what the client will need to do to get that plan in motion.

- Schedule a complimentary consultation

- Give us a call at _____

- Register for our upcoming webinar, “Developing a Strategy for Stock Options, Deferred Compensation, RSU vesting, and ESPP”

- Download a free sample financial plan (30 pages)

- Take our assessment for Big 4 consultants with $250,000+ investments

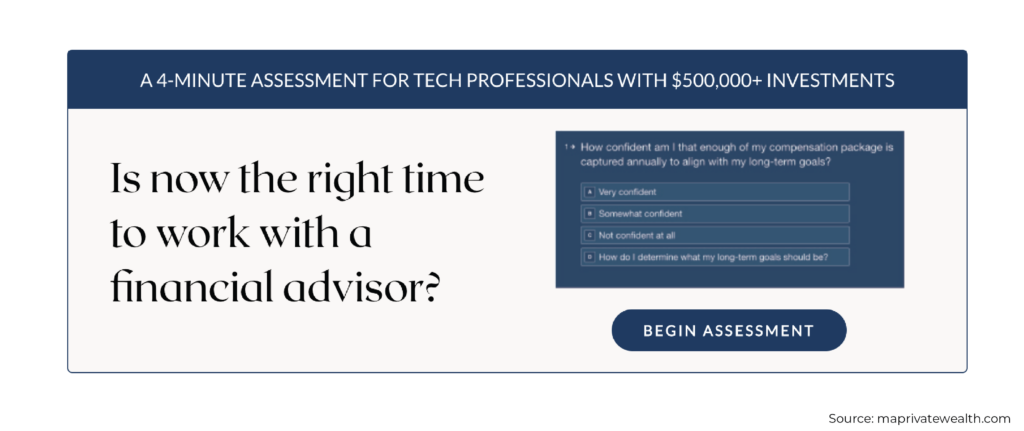

Here’s an effective, targeted call to action that our client MA Private Wealth used on the company’s homepage:

Here are some examples of downloadable guides used as calls to action from Fischer Investments:

Updating Your Services Page

For the Services page on your website, you will want to do the same thing. Think about the outcomes rather than the deliverables or services that you provide.

Instead of simply listing out the firm’s services, such as the following:

Services:

-

- Wealth Management

- Financial Planning

- Retirement Planning

- Investment Management

- Trust and Estate Planning

Update it to focus on the client’s desired outcome by saying:

Big 4 consultants have enough on their plates – enjoy the additional freedom and peace of mind, knowing that you have a trusted partner who will help you:

-

- Navigate your investments, taking into consideration auditor independence rules

- Develop a strategy for stock options, deferred compensation, RSUs, and ESPPs

- Plan tax-efficient investment strategies

- Evaluate compensation and benefit packages

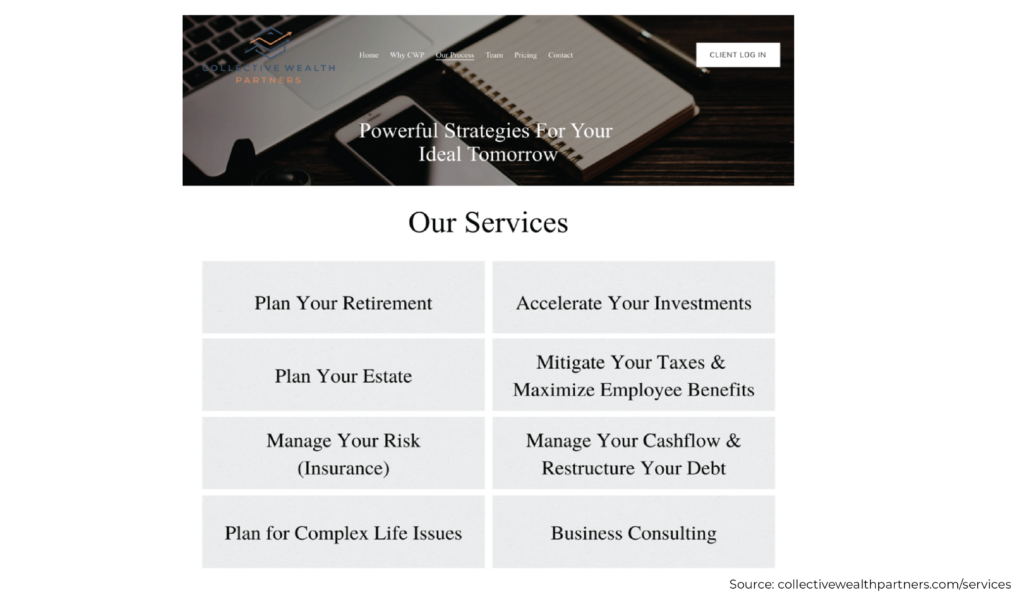

For example, we love the Services page messaging our clients at MA Private Wealth developed to capture this outcome-centric focus for their audience of tech professionals:

MA Private Wealth speaks directly to tech professionals, saying at a high level, “You have a career in tech”. This validates that the audience has come to the right place with a team that can address their unique needs. The firm conveys that they’ve worked with others in the field by using familiar terms or challenges that will resonate with a tech professional – using phrases like “stock options” and “equity compensation” that relate to their personal financial worth.

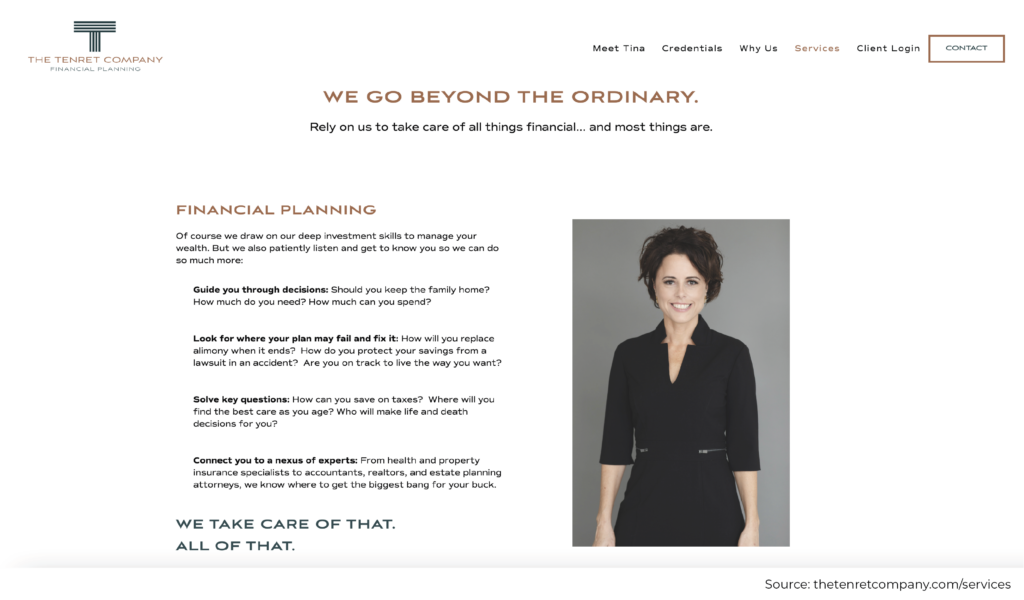

The Tenret Company also does a nice job of describing outcome-based services aimed at their target clients, individuals who have recently experienced divorce or a death in the family:

Here, the Tenret Company leverages a number of impactful “you” questions that focus on their ideal clients’ challenges: “How will you replace alimony?” and “Where will you find the best care as you age?” By listing questions specific to the audience, the reader gets a sense right away that the company understands their unique situation.

Collective Wealth Partners names their target customers on their homepage (Black, Indigenous, and People Of Color [BIPOC], as well as underserved communities), making it clear who they serve and how.

The company also does a good job of using “you”-based statements to describe their services:

On this services page, there’s not one mention of “we”; there are only “you”-based items – “your estate”, “your taxes”, etc.

Creating Additional Content For Your Site

An easy way to create marketing materials on your site that will directly speak to prospects and clients is to use the top themes gathered from your client interviews and to turn them into questions that you answer in written blog articles, with your ideal prospect as the audience.

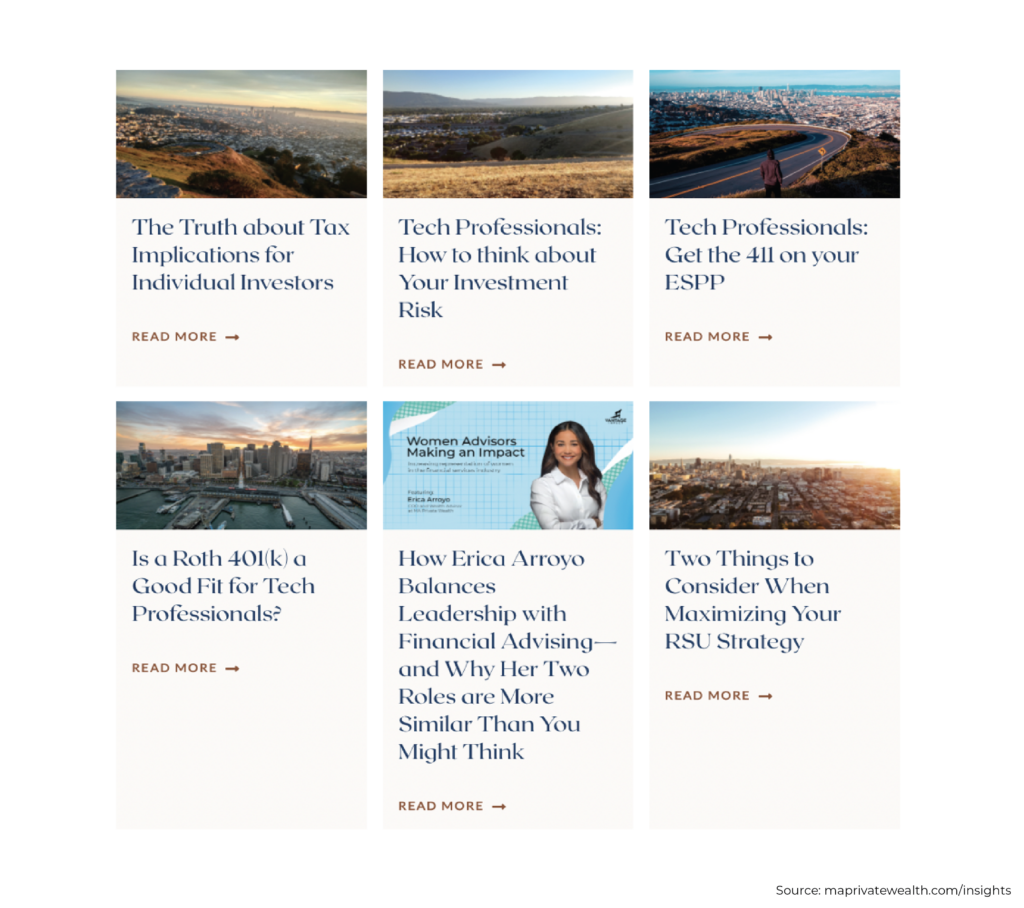

You can see how MA Private Wealth does this in their “Insights” section, focused on tech professionals:

For example, by including “Tech Professionals” in several of their article titles (e.g., “Is a Roth 401(k) a Good Fit For Tech Professionals?” and “Tech Professionals: Get the 411 on your ESPP”), they demonstrate that their content is geared toward a specific population – and that the focus is on specific topics that the audience will find relevant in their daily life.

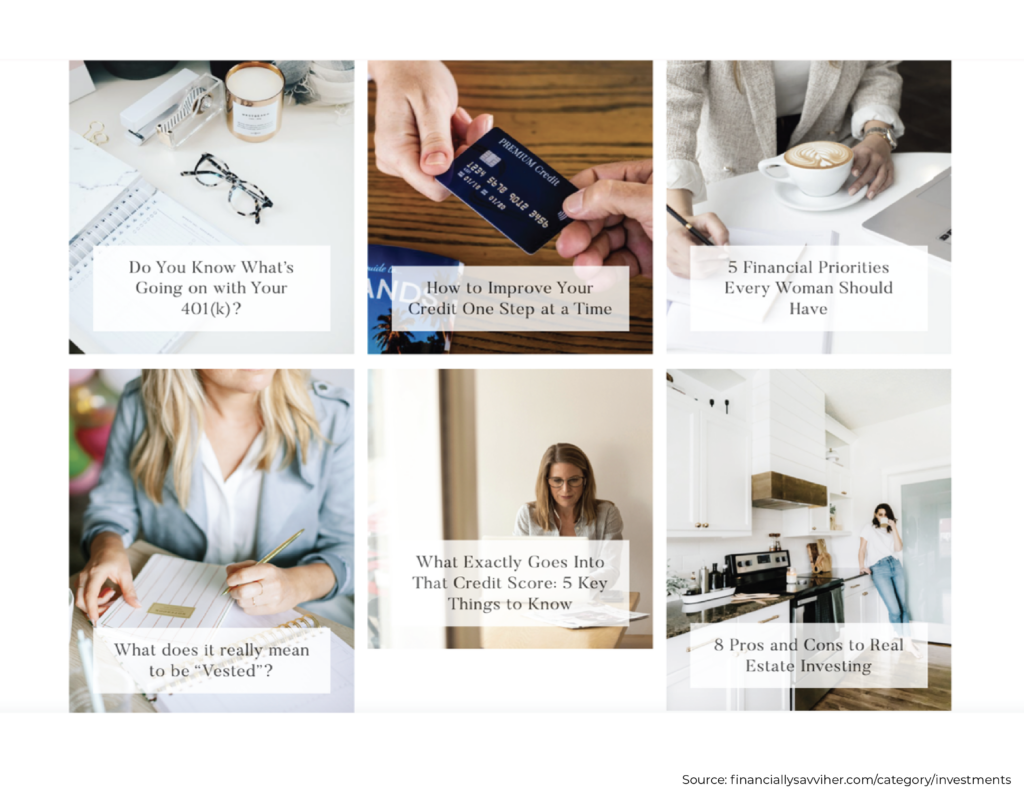

SavviHer also does a good job with this on their website, with blog posts focused on young women seeking financial empowerment. Here’s a snapshot from the company’s blog:

“5 Financial Priorities Every Woman Should Have” names the audience, while “How to Improve Your Credit One Step at a Time” and “Do You Know What’s Going on with Your 401(k)?” are likely questions the firm has heard from multiple women, and why they determined it to be relevant to share more broadly.

These articles can serve as foundational marketing and sales content, providing your advisory team with evergreen resources in the sales process, which can be referenced and shared in cold outreach as well as follow-up materials to target prospects.

Whether your clients are challenged by RSU vesting schedules, auditor independence rules, consolidating accounts, or something else, make sure the content speaks directly to the particular client’s pain point, provides an unbiased educational account of how to best think through these pain points, and, finally, includes specific solutions that a financial advisor would offer to the reader.

Pulling It All Together

Tying together all of the considerations noted above, our financial advisory firm servicing Big 4 consulting professionals agreed on the following messaging choices to upgrade their marketing efforts:

Website Homepage:

- Header text included with website banner image uses “you” statements to identify with Big 4 consultants:

Your assets should grow – not sit idle. Your busy lifestyle doesn’t need to prevent you from keeping up to date with your stock options and deferred compensation plan benefits.

- Content block 2 specifically identifies with “Big 4 consultant” clients:

As a Big 4 consultant, you face special circumstances that require knowledge of complex compensation, auditor independence rules, and attention to detail.

- The firm’s 3-step process is clearly laid out and uses “you” statements throughout:

- Finally, a call to action is included on the home page to encourage clients to get their plans in motion:

Take our assessment for Big 4 consultants with $250,000+ investments.

Services Page:

On the page describing the firm’s services, the firm emphasizes outcomes the client can expect – not the deliverables or services provide – and again uses “you” statements liberally:

Big 4 consultants have enough on their plates – enjoy the additional freedom and peace of mind, knowing that you have a trusted partner who will help you:

- Navigate your investments, taking into consideration auditor independence rules

- Develop a strategy for stock options, deferred compensation, RSUs, and ESPP

- Plan tax-efficient investment strategies

- Evaluate compensation and benefit packages

Additional Website Content:

Finally, the firm includes a blog section with articles and webinars that will be relevant to Big 4 consultant clients:

- “Top 7 Considerations To Navigate The Complexities Of Auditor Independence Rules”

- “Big 4 Consulting: What Am I Allowed To Invest In? What Would Be Off Limits?”

- Webinar Recording: “Developing A Strategy For Stock Options, Deferred Compensation Plans, RSU Vesting, And ESPPs”

Measuring Your Results To Adjust And Improve Your Website

As with any marketing investment, you should keep an eye on your results. The analytics will help you determine where to invest more marketing effort and where to cut back.

There are a few things in particular that you should track closely over time to help assess how your messaging efforts influence the conversions of website visitors into prospects:

- Number of website visitors over a 90-day period, broken down by month;

- Number of people who scheduled a consultation via the website;

- Number of registrants for webinars offered;

- Number of people who downloaded resources offered on the website (e.g., free sample financial plan); and

- Number of people who engaged with online tools offered on the website (e.g., the assessment for Big 4 consultants with $250,000+ investments).

If implemented effectively (with clear, concise, and compelling language), your new and improved website messaging can help to gradually increase these numbers – and the number of people that sign up to be clients! – over time.

Finally, don’t be shy to ask your current clients or ideal target prospects what they think about your revised messaging. See if it speaks to them and if it clarifies what you do. If anything, this additional engagement can help with generating more referrals because your clients will be able to better understand your ideal client profile.

Your simplified messaging with the client as the hero of the story will be much more shareable. You may also get into conversations with current clients who simply didn’t realize all the ways you can help them!

A/B Testing Your Firm’s Message

One concrete way of measuring and tweaking messaging is by using A/B testing.

A/B testing is a marketing tactic that is used to compare different content assets against one another. For example, we could A/B test the title of this blog article to be either:

- “From ‘We’ to ‘You’ – How Effective Messaging Flips the Script”; or

- “Creating Powerful Firm Messaging That Targets Prospects In Your Niche”.

Which title will more people click on when we distribute this blog article through our social media channels or email newsletter? Instead of relying on our gut or personal preference, A/B testing allows audience data to give us that answer.

It’s very common to A/B test call-to-action buttons. Let’s take an example of a downloadable guide – a person could test a button that reads “Download Our Retirement Guide” versus a button that says “Prepare for Retirement with this Ultimate Guide” and see which button gets more clicks and downloads.

We highly recommend A/B testing your website messaging. Try an “A” version with your current messaging and a “B” version that includes “you” statements instead of “we” statements. Start with small tweaks so you can easily decipher the analytics. In other words, don’t change 10 things at once on your home page; start with A/B testing two things. This tactic allows you to compare different versions of your messaging against each other to determine which one people gravitate towards. Over time, you’ll eliminate the poorly performing messages and double down on the messaging that resonates more.

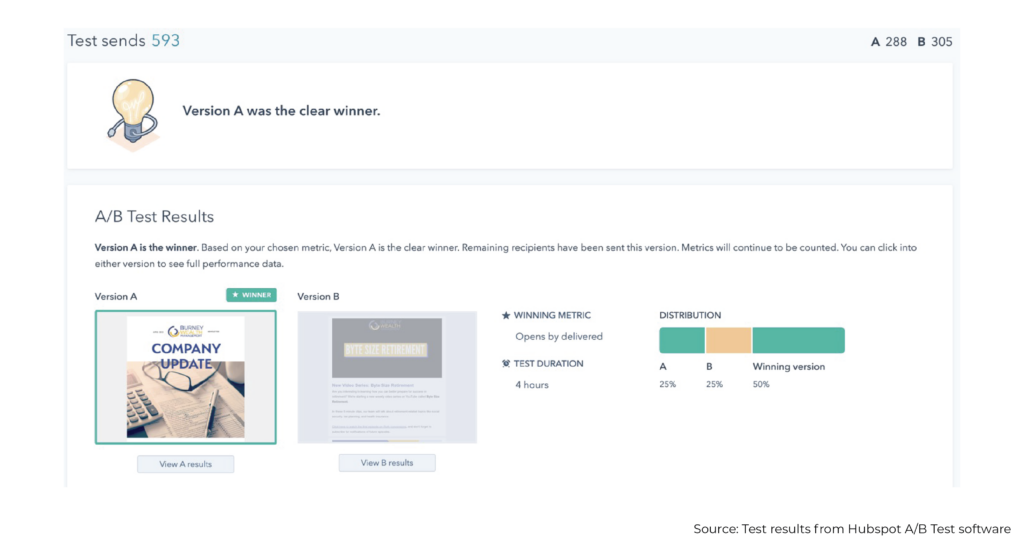

Many content marketing software tools have the ability to set up and measure the results of an A/B test. For example, the snapshot below, taken from HubSpot’s email marketing tool, shows how an A/B test was conducted to determine the most engaging subject line in a monthly email newsletter. The two subject lines being assessed by the A/B test were as follows:

Version A: New Video Series: Byte Size Retirement

Version B: Enjoy Our New Video Series On-Demand

To do this, the primary metric being examined by the A/B test was the “Opens by delivered” rate, which is the percentage of people who successfully received the email in their inbox and who proceeded to open it. The email newsletter was set to be delivered to 1,192 contacts.

HubSpot’s email marketing tool conducted the test by first sending the different versions of the email to only half of the total contacts (593 of the total 1,192). So 288 recipients received an email with Version A, and 305 received emails with Version B (totaling 593).

The open rates of the two versions stacked up as follows:

Version A: 31.3% open rate

Version B: 20% open rate

Once the more successful version was identified, the remaining 50% of the recipients (599 in total) received that version (Version A – the “Winning version”) in order to maximize the open rate of the email newsletter overall.

Some A/B tests can end out providing inconclusive results. In these instances, savvy marketers would choose one of these options:

- Implement additional changes to see if there’s a difference in test results; or

- Determine that their time is better spent tweaking and testing something else.

Thanks to the digital world we live in, prospective clients have more information at their fingertips than ever before. They’re also more diligent in their decision-making processes. Relevancy in both service delivery and promotional content is now the expectation, the ‘new norm’. In other words, people expect to be targeted by marketing content that applies to them and their unique situation.

When someone visits your firm’s website to see the “who we are” and “what we do” sections, they may struggle to see how they fit into the picture. They may feel like they’re simply a number instead of a person with a unique situation. This presents a great opportunity for the financial advisor who chooses to embrace “you” statements over “we” statements. Because when you adopt the mindset of putting your prospect at the center of your firm’s story, you’ll be more aligned with how people like to be sold to. We refer to this as buyer alignment: the primary driver of your business isn’t you, your team, your background, or your experience; rather, it’s the hero of your firm’s story, the client.

Once the prospect can see themselves in the driver’s seat as opposed to watching from the grandstands, now your firm is in a strong position to establish trust, win their business and foster a long-term partnership. And, as we all know, relationships built on trust last a long time, which is good news for both your clients and your firm!