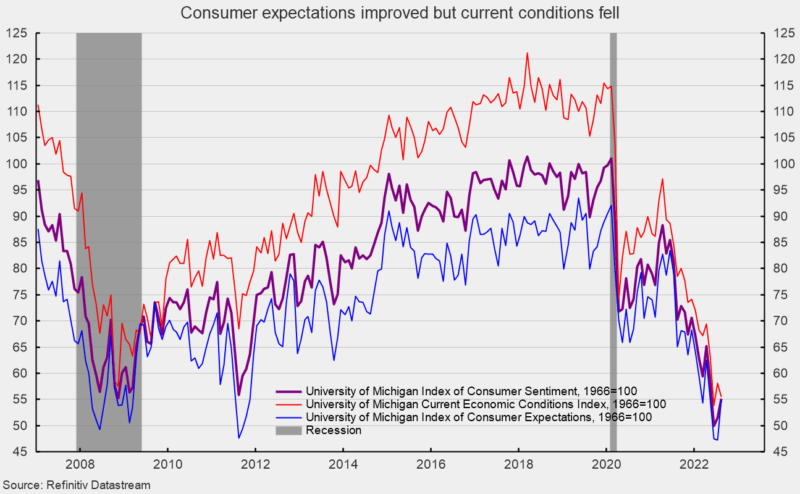

The preliminary August results from the University of Michigan Surveys of Consumers show overall consumer sentiment ticked up in early August but remains near record lows (see first chart). The composite consumer sentiment increased to 55.1 in early August, up from 51.5 in July and the record low of 50.0 in June. The increase in early August totaled 3.6 points or 7.0 percent. The index remains consistent with prior recession levels.

The current-economic-conditions index fell to 55.5 versus 58.1 in July (see first chart). That is a 2.6-point or 4.5 percent decrease for the month. This component is slightly above the record low and remains consistent with prior recessions.

The second component — consumer expectations, one of the AIER leading indicators — gained 7.6 points or 16.1 percent for the month, rising to 54.9 (see first chart). Despite the gain, this component index is also consistent with prior recession levels.

According to the report, “Consumer sentiment moved up very slightly this month to about 5 index points above the all-time low reached in June.” The report goes on to add, “All components of the expectations index improved this month, particularly among low and middle income consumers for whom inflation is particularly salient.” However, the report also notes, “At the same time, high income consumers, who generate a disproportionate share of spending, registered large declines in both their current personal finances as well as buying conditions for durables.”

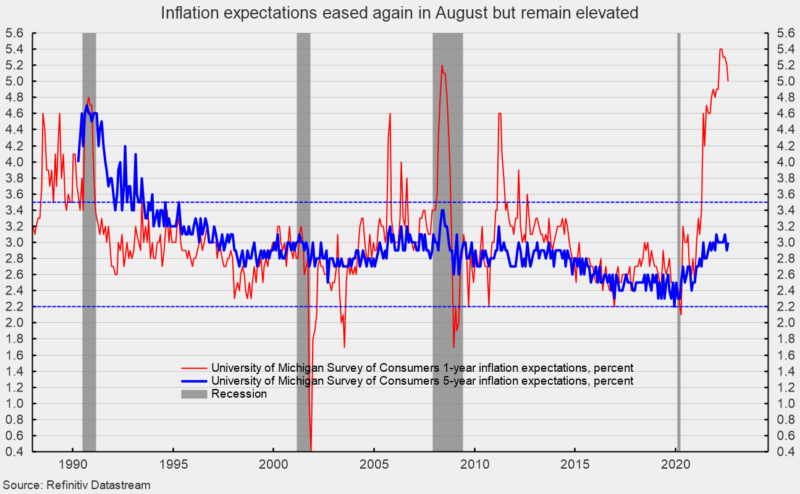

The one-year inflation expectations fell again in early August, dropping to 5.0 percent. That is the third decline in the last four months since hitting back-to-back readings of 5.4 percent in March and April (see second chart).

The five-year inflation expectations ticked up to 3.0 percent in early August. That result is well within the 25-year range of 2.2 percent to 3.5 percent (see second chart).

The report states, “With continued declines in energy prices, the median expected year-ahead inflation rate fell to 5.0%, its lowest reading since February but still well above the 4.6% reading from a year ago.”

The report adds, “At 3.0%, median long run inflation expectations remained within the 2.9-3.1% range seen over the past year. Uncertainty over long run inflation receded a bit, with the interquartile range in expectations falling from 4.7 last month to 3.8 this month, remaining above the 3.3 range seen last August. Still, the share of consumers blaming inflation for eroding their living standards remained near 48%.”

The plunge in consumer attitudes over the past year reflects a confluence of events with inflation leading the pack. Persistently elevated rates of price increases affect consumer and business decision-making and distort economic activity. Overall, economic risks remain elevated due to the impact of inflation, an intensifying Fed tightening cycle, and continued fallout from the Russian invasion of Ukraine. As the midterm elections approach, the ramping up of negative political ads may also weigh on consumer sentiment in the coming months. The overall economic outlook remains highly uncertain. Caution is warranted.