Sam loves her outdoorsy life in Salt Lake City, Utah and is an avid rock climber, hiker, trail runner, ultimate frisbee player and skier. On the professional side, she manages content creation for Petzl, a French company that manufactures work-at-height equipment for careers in vertical spaces. She enjoys her job and the stability it provides, but craves a more independent lifestyle. She wants to explore the possibility of becoming a freelance video producer in order to be her own boss and control her hours. She’d like our advice on how to make this dream a reality!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 82 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing your brief story to me at mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Sam, today’s Case Study subject, take it from here!

Sam’s Story

Hello! I’m Sam and I’m beyond grateful for my life. I’m 30-years-old, single and only have student loan debt. I have an office job that’s flexible and pays enough for me to do the things I love and, living in Salt Lake City, there are plenty of outdoor activities I love! My favorite is rock climbing and I dedicate a majority of my time, thoughts and money toward the silly sport.

During the summer I trail run, play ultimate frisbee, backpack and climb. In the winters I ski or travel south for warmth. I spend most evenings with friends or alone baking, cooking and Netflixing. I work at Petzl, a French company that manufactures work-at-height equipment for careers in vertical spaces (tree care, tower, window washing, rope access) as well as gear for ice and rock climbing. I oversee content creation for the professional side, which means I travel often for photo and video shoots, averaging about one trip per month.

What feels most pressing right now? What brings you to submit a Case Study?

What feels most pressing right now is the immediacy and brevity of life… and the awful reliance on money. My job offers fairly generous paid time off (18 days), but it’s absurd to me that you’re allotted this tiny amount of time to live. With that being said, I’ve been considering the transition to a freelance career as a producer. Producers are the backbone of any photo and video shoot. They’re the individuals who create the schedule, coordinate the logistics, ensure everyone is fed, secure necessary insurance, etc. A single parent on steroids, essentially. What draws me to this work is the freedom of working when I want, meeting new people, traveling and being an entrepreneur.

I have the freedom, time and dedication for this transition. However, I’m nervous about the financial aspect of it. Thankfully I don’t have to worry about dependents, pets or a mortgage. But, I do have school debt and am worried about saving for retirement, paying for insurance and school loans; all the while saving to buy a house. Although I love being single, it does make launching into a freelance life all the more intimidating!

What’s the best part of your current lifestyle/routine?

The best part of my current lifestyle is that I don’t have to worry about income. Since I’m salaried, I get the same amount distributed into my accounts each month no matter how much or how little I work. Plus, I don’t have to worry about paying an obscene amount for insurance. I also love the travel and social aspect of my routine.

What’s the worst part of your current lifestyle/routine?

The worst part of my current lifestyle is not having autonomy over my life and having someone (my employer) telling me where to go and what to do. Also, it often feels like my job is meaningless. I recently didn’t get a promotion I was surprised to not get. I want to be in a leadership position and be my own boss. The world needs more women in leadership! Also, I would enjoy a life with a partner who supports my career ambitions and who wants to raise healthy, happy kiddos.

And! I don’t have enough time to do all the things I want to do – I have big ideas and want to do so many things. Often, my day is scheduled from 6am – 8pm and I feel like there’s still so much to do. Don’t we all though? I’m hoping that a more flexible schedule will open up time to do things like start a decentralized garden program and volunteer at the state prison.

Where Sam Wants to be in Ten Years:

Finances:

- In 10 years I want to have half a million in my 401k and 6 months of expenses saved.

- I would also like to have a diverse portfolio of investments.

Lifestyle:

- I want to have a family ~ partner and kids ~ and a house.

- I’d also like to be able to travel internationally and be grateful for my life.

- I want to spend time with friends and family who reside in Washington State.

Career:

- I would like to have an impact on the world, somehow. Not entirely sure what that looks like, but I know I want to work with people through visual media and storytelling, which is why I’m leaning toward producing.

- I also want to build a reputation as a hard worker who is honest and determined.

Sam’s Finances

Income

| Item | Amount | Notes |

| Sam’s net income | $3,100 | 8% is going into 401k (2% into before tax; 6% into Roth) |

| Dogsitting Average Income | $185 | |

| Monthly subtotal: | $3,285 | |

| Annual total: | $39,420 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/Your monthly required payment |

| School Loan AB | $18,997 | 6.80% | All currently on hold until October 2022 |

| School Loan AE | $7,956 | 3.40% | |

| School Loan AA | $1,623 | 4.50% | |

| Total: | $28,576 |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Investment Account | $27,081 | Dad gave me $20,000 for school loans, but I put it in an investment account and deposit $800/month | Betterment | 0.11% | |

| 401k | $16,073 | 8% of income / work matches 4% | RFTTX | Empower Retirement | 0.28% |

| Liquid Savings | $10,002 | Liquid HYS account | Marcus Goldman Sachs | ||

| Savings | $2,752 | everyday savings | Columbia | ||

| 401k | $2,458 | Random 401k account that I don’t do anything with and need to transfer | Charles Schwab | ||

| 2nd Checking | $2,163 | second checking account for rent, gas, etc | America First Credit Union | ||

| Random savings account | $1,914 | I don’t have a card for this account; initially was for my truck payments, but I put in $800 a month now just for extra savings | Utah Community Credit Union | ||

| HSA | $1,690 | health savings account | America First Credit Union | ||

| Checking | $1,522 | everyday checking & mostly to pay for credit card | Columbia | ||

| Total: | $65,654 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Toyota Tacoma, 2016 | $30,000 | 80,000 | Yes |

Expenses

| Item | Amount | Notes |

| Rent | $550 | Very grateful! |

| Groceries | $250 | I get CSA’s every summer & eat mostly whole foods & LOTS of meat |

| Personal Care (Waxing & Massage & Chiro) & random health Items | $234 | I look forward to these massages every month; would be hard to give up. I see a chiropractor for my scoliosis and waxing is well… maybe TMI |

| Eating out | $210 | |

| Gas/Rideshare | $195 | #trucklife |

| Sports/Outdoor Gear | $166 | Didn’t get a ski pass this year, which will (hopefully) lower this amount. But, this includes gear and training programs |

| Clothes & Shoes & Accessories | $138 | Eeek! Didn’t realize it was this high |

| Home goods & Hobbies (candles, film, art hobbies, cleaning supplies, etc) | $128 | I just lumped together, but I since my place is so small, and live alone, I don’t spend much on cleaning supplies |

| Gifts (Holidays & Birthdays) | $100 | Gift giving is my love language! |

| Trips & Vacation | $100 | This will increase this summer with three int’l trips planned… |

| Concerts/Entertainment | $100 | Love going to shows! This also includes books, online courses and movies |

| Car & Rent Insurance | $93 | State Farm |

| Internet | $65 | Comcast |

| Phone Bill | $56 | Unlimited data on Verizon family plan |

| Climbing gym membership | $52 | Might cancel this since I also get a free gym membership through work at a different gym |

| Car tabs & oil changes | $35 | |

| Google/iTunes fees for extra storage | $12 | Maybe not necessary? |

| Vitamins | $10 | |

| Haircuts | $10 | |

| Monthly subtotal: | $2,504 | |

| Annual total: | $30,048 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Travel Rewards American Express | Earn 3 points per dollar spent on eligible net airfare purchases. Earn 2 points per dollar spent on eligible net hotel and restaurant purchases. Earn 1 point per dollar on all other eligible net purchases.No foreign transaction fee $95 annual fee |

Columbia Bank |

Sam’s Questions for You:

- Any insights into freelance work?

- Financial recommendations for starting a freelance career?

- Is it too late, financially, to make this career change?

- Any insights into health insurance for a single person?

- Advice for someone with a renaissance soul? How do I pick just one career?

Liz Frugalwoods’ Recommendations

I’m thrilled to have Sam as our Case Study today and want to congratulate her for all of her wise financial choices! She’s done a great job on a not-super-high income and I want to commend her for her values-based, prioritized spending. Sam’s at an interesting juncture and I’m excited to explore her options for next steps. So let’s dive in!

Sam’s Question #1: Any insights into freelance work?

At the outset, I want to establish that freelancing isn’t going to be less work. It’s going to be more work–at least at the beginning. However, it might give you more flexibility to choose WHEN you work. I love working for myself and prefer my freelancing lifestyle, but over the years, it’s been A LOT more work than a traditional 9-5. That’s because in addition to doing the actual work (in Sam’s case, video production), you also have to run your own small business:

- You have to pay quarterly taxes

- You have to set up your own liability insurance

- You have to set up (and contribute to) your own retirement plan (I use a Solo 401k)

- You have to research and sign-up for your own health insurance (my family and I are on a plan through the ACA).

- This is my quick answer to Sam’s question #2 on health insurance: you sign-up through your state’s ACA portal. Insurance varies by state, so you’ll just have to see what Utah offers.

- You have to manage all of your own tech: website, social media accounts, email provider, video calls, etc

- You’re your own front and back office: you have to invoice clients, reconcile invoices, keep a database, etc

- You are your own marketing firm: you have to build a name for yourself and solicit clients.

This is not to scare Sam off; rather, it’s a reality check. I’ve been working for myself since 2014 and a lot of this stuff has gotten easier over the years, but I still always feel behind on the “back office” stuff. Yes, I could hire someone, but then I’d have to find them, interview them, hire them, train them, set up payroll, manage them, do performance reviews, etc… It hasn’t been worth that hassle to me (at least, not yet).

Also, I worked WAY harder building up my business than I ever did at a 9-5 office job because my business is my third child and I love what I do and I want it to succeed! I joke that my initial hourly rate was probably $0.05. It has increased over the years, but my point is that it’s taken time to build it to this point.

One Idea: Build Your Freelance Business Alongside Your 9-5

This is what I did and, I have to say, it’s the most financially responsible approach. I used to get up at 6am every day and work for 2 hours on Frugalwoods before going to my office job. In the evenings, I’d go to yoga, come home and eat dinner and then work for another 2-3 hours on Frugalwoods. Every single day. That was the only way I could build it into a real business while working full-time.

This was before I had kids and my husband helped me every step of the way. The advantage to doing this–for me–is that I continued to receive my stable office job income (and benefits) while building up my passion project. Since we didn’t have kids yet, I was able to devote all this extra time to Frugalwoods and I’m so glad I did. I’ll never forget the euphoria I felt on my first “full-time” day working on Frugalwoods after I left my office job. I was euphoric because:

- I was already earning an income from it

- I had clear, precise goals and next steps to execute

- I knew exactly why I was working on it

- I was grateful to have so much time to devote to it

Consequently, because I became so accustomed to cramming Frugalwoods work into the odd hours of the day, I’m able to not work full-time on it to this day. My priorities have shifted to spending more time with my kids and out on the homestead. But, I’m able to get a lot done in my part-time schedule because I’m so used to working fast and furious when I’m “on the clock.”

Sam’s experience will obviously be different from mine and she’s in a totally different industry, but, I strongly encourage her to start building up her freelancing work while working at her stable 9-5. This’ll give her ample financial buffer and will inform her choice of whether or not this is actually what she wants to do.

Since flexibility and control over her schedule seems like her top goal, I could envision Sam doing something like 9 months of hard work per year and then taking 3 months off to go rock climbing! Again, it’s not going to be less work, but you can choose when and where you do the work.

Sam’s Question #2: Is it too late, financially, to make this career change?

The answer is that it really depends. If Sam wants to quit her job tomorrow and live off her savings while building up her freelance business, I’d say she’s going to put herself in a more financially precarious position. On the other hand, if Sam wants to build up her freelance business while continuing to work her regular job, she’ll only be spending her time to do so.

Let’s run through all of Sam’s numbers:

1) Cash: $18,352

This is a phenomenal emergency fund! Sam spends just $2,504 per month, so this amount would cover seven months worth of her spending–fantastic! An emergency fund is easily-accessible cash (held in a checking or savings account) that covers anywhere from three to six months worth of your spending. It’s your safeguard from debt and a #1 financial priority.

My suggestion: consolidate this to one account.

- Sam has this money spread across five different checking/savings accounts, which seems like a lot to keep track of.

- If it were me, I’d consolidate to one high-yield savings account, such as the American Express Personal Savings account, which–as of this writing–earns 1.50% in interest (affiliate link).

- Sam would earn $275 on her money in a year, just by having it in this high-interest account.

The Freelancing Challenge:

If Sam were to quit her job to focus on building up her freelancing career, she could spend down this $18k on living expenses, which as noted, would last her about 7 months. I don’t recommend that approach because it puts Sam in a dangerous position of having no buffer from debt and uncertain income.

2) Retirement: $18,531

I agree with Sam that she should go ahead and roll over her old 401k. It’s great that she’s been contributing to her retirement and fantastic that her employer offers a match! The major red flag I see is the expense ratio on this account: 0.28% is way too high. Sam should contact her employer’s benefits coordinator to explore what other funds might be available at lower expense ratios (I’ll talk more about this below).

The Freelancing Challenge:

Once freelancing, she’ll no longer have an employer match in this same sense, although she can match her own contributions to a Solo 401k. She stated that one of her goals is to have $500k in her 401k in ten years, so let’s see how she can get there.

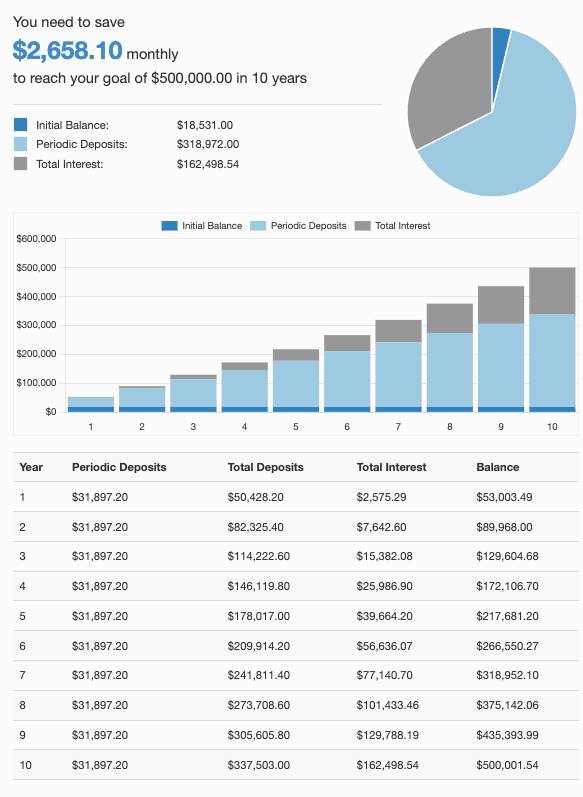

I used this online calculator to determine how much Sam will need to save every month in order to reach her goal of $500k in ten years:

What this shows is that starting with Sam’s current retirement savings of $18,531, and her goal of growing that to $500k in ten years, she’d need to save $2,658.10 per month. The caveat is that this calculator assumes a flat 7% annual return, which is the historical stock market average. But, the stock market doesn’t return that amount every single year and certainly isn’t guaranteed to do so every year for the next ten years. That caveat aside, this does give Sam a general idea of how much she’ll need to save every month in order to hit that goal.

3) Taxable Investments: $27,081

Taxable investments are investments in the stock market that aren’t retirement accounts. Having a taxable investment account is wonderful, but it’s a higher level goal. Before opening an account like this, you generally want to do all of the following first:

- Pay off all debts (excluding a low, fixed-rate mortgage)

- Save an emergency fund (of 3 to 6 months’ worth of your expenses)

- Have fully funded retirement accounts (and the ability to continue contributing to them)

- Not have a major capital expense in your near future (such as buying a house or car)

While I commend Sam for being forward-thinking in opening this account, my concern is that she still has $28,576 in student loan debt. In general, you don’t want to tie your money up in a taxable investment account when you could instead be using it to pay off debt. This is particularly true in Sam’s case because her largest loan has a 6.8% interest rate and–as we noted above–the stock market’s average annual return is only 7%. That means she’s losing money on that interest rate anytime the market doesn’t deliver a return above 6.8%.

What to do?

All that being said, the US is currently in a period of federal student loan limbo. Payments on federal student loans were paused during the pandemic and continue to be in deferment until August 31, 2022. Sam noted that hers are deferred until October 2022, but the US Department of Education site on student aid states that all loan re-payments will re-start on August 31, 2022. Sam should check her paperwork to ensure she has the correct re-start date in mind.

This period of student loan deferment has been a wonderful gift to anyone with a federal loan because it enabled them to stop making payments but not incur penalties. Additionally, there is speculation that President Biden might further extend student loan deferment or potentially even cancel some portion of student loans. In light of that, I think it makes total sense for anyone with federal student loans to not make payments while in deferment and to wait and see what the administration decides.

Scenario #1: If student loan deferment (or cancelation) continues:

- Sam should continue not making payments.

Scenario #2: If student loan payments re-start:

- Sam needs to be on top of when these payments resume to avoid incurring penalties.

- In this scenario, the big question is whether or not Sam should liquidate her taxable investment account in order to pay off her student loans.

Liquidating A Taxable Investment Account (AKA pulling money out of the stock market)

I typically do not advise doing this because:

- The whole point of having a taxable investment account is to keep it open for many decades in order to benefit from the stock market’s longterm growth.

- You have to pay capital gains taxes on the profits (not the total amount)–in other words, any money your stocks have earned over the years.

- If you liquidate during a market downturn, you’re locking in your losses and ensuring that you lose money. See this Case Study for a detailed explanation of this unfortunate scenario.

Sam, however, presents an interesting case because:

- Her investment account almost equals her student loan debt and the interest rate on her debt is fairly high.

- She’s young and can open another taxable investment account once her loans are paid off.

- Perhaps most importantly, her salary is low. See below for why this matters:

Since Sam files her taxes singly and makes under $41,675, her long-term capital gains tax rate should be 0%, assuming she’s owned the stocks in question for more than a year (that’s the threshold for “long-term capital gains”). Short-term capital gains taxes are higher than long-term, which is yet another reason to keep taxable investment accounts open for the long-term.

Capital gains are determined by any profits you’ve made from your stocks as well as your taxable income. However, you only pay higher tax rates on amounts above each tax bracket threshold. Given Sam’s income and the size of her taxable investment account and, assuming she’s held the stocks for more than one year, it looks like her tax rate will be nominal or non-existent. This fact makes liquidation-to-pay-off-student-loans more attractive. Check out this Motley Fool article, which outlines the process and from which I drew much of this information. Since Sam’s account is with Betterment, here’s their overview on how to withdraw funds from an investment account.

Opening A Future Taxable Investment Account

If Sam decides to liquidate her Betterment account in order to pay off her student loans, I suggest she consider a different brokerage in the future. Betterment is nice because it offers assistance with investing, but it’s not so nice because it charges pretty high fees for their services. The expense ratio on Sam’s Betterment account is 0.11%. For comparison, I have an expense ratio of 0.015% on my FSKAX account (Fidelity’s total market index fund). These numbers might sound similar, and that’s what companies like Betterment are hoping you’ll think.

To calculate what Sam is losing in fees, I used this calculator from BankRate.com:

If Sam were to remain invested in this fund for the next 20 years, and the stock market delivered its annual average 7% return, her investments would stand at $102,513 and she will have lost a total of $2,282 to Betterment, broken down as follows:

$992 in opportunity costs (in other words, what the money she paid in fees could’ve earned her if instead invested in the market)

+ $1,290 in fees (in other words, payments to Betterment)

$2,282 lost

Now, this is not a ridiculously large amount of money, but it’s money Sam doesn’t have to pay. Let’s run the calculation again, but this time with Fidelity’s 0.015% expense ratio. In this scenario, we find that Sam would lose only $237 in fees and $181 in opportunity costs, for a total of $418 lost.

In other words, if Sam were to switch to a low-fee brokerage, she’d stand to save $1,864 in fees.

For reference, the following three brokerages offer DIY low-fee investment options:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

Wondering how to find a fund’s expense ratio? Check out the tutorial in this Case Study.

Sam’s Expenses

Sam’s expenses are totally reasonable for her current salary level. She makes $3,285 a month (after 401k contributions) and spends $2,504. The challenge will be if she wants to reach her 401k goal of $500k in ten years and if her freelance salary is lower than her current income. But no worries, all of this is solvable!

As always, we have two levers to pull here:

If Sam were to start building her freelance business while working her full-time job, she’d potentially increase her income and be able to maintain her current spending level, pay off her debt, and increase her retirement contributions. On the other hand, if Sam quits her job to build up her freelance business full-time, she might reach profitability faster, but would need to use her emergency fund for her expenses and should consider reducing her expenses during this time period.

Sam can look at reducing discretionary spending, as outlined below:

| Item | Amount | Notes |

| Personal Care (Waxing & Massage & Chiro) & random health Items |

$234 | I look forward to these massages every month; would be hard to give up. I see a chiropractor for my scoliosis and waxing is well…maybe TMI |

| Eating out | $210 | |

| Sports/Outdoor Gear | $166 | Didn’t get a ski pass this year, which will (hopefully) lower this amount. But, this includes gear and training programs |

| Clothes & Shoes & Accessories | $138 | Eeek! Didn’t realize it was this high |

| Home goods & Hobbies (candles, film, art hobbies, cleaning supplies, etc) | $128 | I just lumped together, but I since my place is so small, and Iive alone, I don’t spend much on cleaning supplies |

| Gifts (Holidays & Birthdays) | $100 | Gift giving is my love language! |

| Trips & Vacation | $100 | This will increase this summer with three int’l trips planned… |

| Concerts/Entertainment | $100 | Love going to shows! This also includes books, online courses and movies |

| Climbing gym membership | $52 | Might cancel this since I also get a free gym membership through work at a different gym |

| Haircuts | $10 | |

| TOTAL discretionary spending per month: | $1,238 |

There’s no pressing need for Sam to eliminate all of these expenses. But, if she wants to pursue freelancing full-time, she may need to cut these out while she builds up her business so as not to deplete her entire emergency fund. If she were to temporarily pause all of these expenses–and switch to an MVNO for her cell phone service–she’d rocket her monthly spending down to a very low $1,225:

| Item | Amount | Notes |

| Rent | $550 | Very grateful! |

| Groceries | $250 | I get CSA’s every summer & eat mostly whole foods & LOTS of meat |

| Gas/Rideshare | $195 | #trucklife |

| Car & Rent Insurance | $93 | State Farm |

| Internet | $65 | Comcast |

| Phone Bill | $15 | Unlimited data on Verizon family plan |

| Car tabs & oil changes | $35 | |

| Google/iTunes fees for extra storage | $12 | Maybe not necessary? |

| Vitamins | $10 | |

| TOTAL required monthly spending: | $1,225 |

At this super-low rate, her fabulous emergency fund of $18,352 would last her 14 months, which should be plenty of time to make her freelancing business profitable! Of course the trade-off is that she wouldn’t be contributing to her retirement during this time period. Sam has two options here on how to proceed and she can determine which she prefers–or perhaps she’ll choose a blend of both.

Low Rent Is Great While It Lasts!

I also want to highlight that her rent appears to be way under market value. $550 per month is fantastic, but I can’t imagine it’s market rate. Sam should plan for the eventuality of this increasing–possibly by quite a lot. To get a sense of what market rate is in her area, she can scan Craigslist, etc for similarly sized and located apartments. This’ll give her a sense of what she can expect to pay in the future.

Another super easy way to save money is to switch her cell phone provider to a low-cost MVNO.

Here are a two MVNOs to consider:

For more, I have a full chart of providers and their prices here: How to Save Money on Your Cell Phone Bill with an MVNO: I Pay $12 a Month

Sam’s Question #3: Advice for someone with a renaissance soul? How do I pick just one career?

I have no idea. If anyone knows the answer to this, please let me know :)! I’m on my second (third?) career, but that doesn’t bother me. I’m happy to change my mind as I age and as my family circumstances evolve. My priorities change with each year and I’m comfortable with this level of fluidity in my life.

A few things that have worked for me:

-

Scratch the itch for a different career through volunteer work.

- Sam mentioned she has an interest in building out this aspect of her life and I encourage her to do so! I derive a lot of fulfillment from my service on nonprofit boards and it lets me flex my nonprofit fundraising muscles (that was my pre-Fruglwoods career and I enjoy keeping a toe in it).

- Keep your mind and body engaged through hobbies and friends.

- Sam is already doing this perfectly with her climbing and other outdoor pursuits.

- I don’t feel the need to turn every hobby into a revenue-generating thing, which is why I’m so delighted with my pursuits of skiing, paddle boarding, hiking, yoga and terrible farming. I’m clear in my mind that these are hobbies and that I can just enjoy learning for the sake of learning.

- Be very clear about where your income comes from.

- I do some work that I don’t 100% love because it earns me money. I try not to do a TON of this work, but I do have revenue goals in mind and I’m very clear-eyed about how I make money versus what I do because I love it, not because it’ll ever make me any money.

- This also encourages freelancers to set clear goals and rates. Too many freelancers give away too much for free because they’re passionate about their work. I’ve made this mistake 100,000 times over the years and am trying to be better about accurately valuing my time and my worth.

Essentially it’s about building a well-rounded life, which Sam is already doing! I think giving yourself permission to designate which things will earn you money and which things won’t is a great way to allocate your energy and understand how you want to use your two most precious resources: time and money.

Summary:

1. If student loans are not cancelled or deferred:

- Check on the date for student loan re-payment re-start and ensure you’re ready to start making payments at that time.

- Consider liquidating the Betterment account in order to pay off the student loans in one fell swoop:

- If you go this route, pay the loans off in full.

- In the future, consider opening another taxable investment account with a lower expense ratio.

2. Contact your HR department to explore what other funds are available for your employer-sponsored 401k since 0.28% is a very high expense ratio.

3. Decide if you want to start building your freelancing work while maintaining the security and income of your current job. Create a schedule and business plan for making it profitable and identify a “quit date” for leaving your job.

4. If you want to quit your job now in order to build a freelancing business, be prepared for leaner times:

- Eliminate all discretionary spending and create a a schedule and business plan for reaching profitability.

- Have a plan for re-entering the traditional workforce if the freelancing business isn’t profitable by that point.

5. Be aware that you’re paying under market rate for rent and that it’s likely to increase at some point. Do some research to determine what market rate is so you have a sense of what you might need to pay in the future.

Ok Frugalwoods nation, what advice do you have for Sam? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

Never Miss A Story

Sign up to get new Frugalwoods stories in your email inbox.