There are so many online banking options to choose from that have few fees and more perks than local banks.

In addition to low fees and a high interest rate, you may want a bank that promotes social and environmental causes.

Aspiration is one financial institution makes saving money exciting while promoting a good cause.

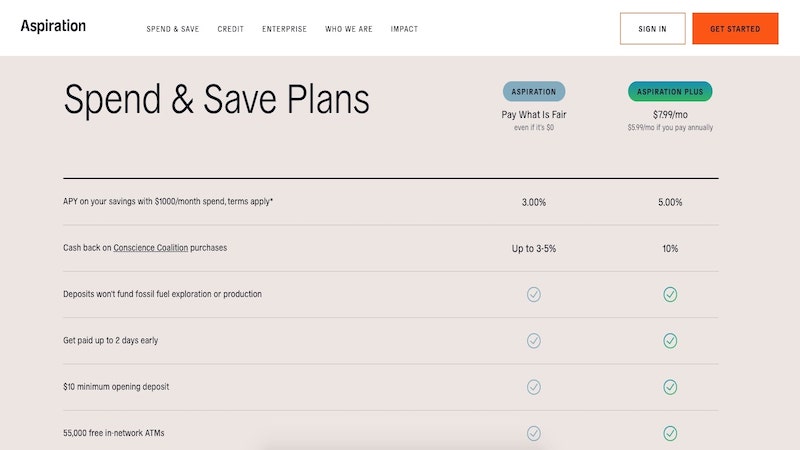

It’s possible to earn up to 5% interest on your savings (3% interest for Aspiration, up to 5% for Aspiration Plus), get free ATM access and offset carbon emissions.

Should you join this mission-minded online bank?

Summary

Aspiration is a solid option for anyone looking to get a competitive interest rate on their savings. It also offers cash back on debit purchases and refunds on all ATM fees. But perhaps more importantly, Aspiration is a good option for those who are conscious about supporting certain causes, and who wish to see the impact of their spending.

Pros

- Competitive rates

- Refunds ATM fees

Cons

- Limited investment products

- No physical branches

What is Aspiration?

Aspiration is a registered brokerage firm (not technically a bank) that offers online checking, savings and investing accounts.

Despite not being a full-fledged online bank, Aspiration offers an FDIC-insured Spend & Save account.

The free Aspiration Spend & Save* account is an online-only checking account offering fee-free ATM access and online shopping rewards.

You can also open an Aspiration Plus Spend & Save account for $7.99 per month (or $71.88 per year, which averages to $5.99 per month).

Extra features include earning up to 5% interest on deposits, one monthly out-of-network ATM reimbursement and a carbon offset program.

In addition to the online bank accounts, Aspiration offers sustainable investing accounts with a $10 initial deposit.

Who is Aspiration For?

Aspiration can be good for people looking for competitive rates and low fees.

Those wanting to bank in a socially conscious way will also like Aspiration. This bank doesn’t back fossil fuel exploration or production, for instance.

Also, customers can also earn cash back by shopping at select socially conscious brands like Warby Parker and TOMS.

Political and social leanings aside, Aspiration can be a good fit for anyone who wants a basic checking account without ATM fees.

However, monthly bank fees can be as high as $7.99 to unlock the premium Aspiration Plus features like earning bank account interest.

There isn’t a minimum opening deposit to start saving money.

Whether you have a little cash or a well-stocked emergency fund, you enjoy the Aspiration banking perks easily.

Banking Products

The best reason to consider Aspiration is for its saving and spending account options.

Either account option is FDIC-insured up to $2.46 million as Aspiration partners with multiple banking partners.

Aspiration Save & Spend

Yes, it’s possible to open an online Save & Spend cash management account with up to $2.46 million in FDIC insurance.

Most online banks only offer up to $250,000 in FDIC insurance as they don’t sweep excess cash into partner banks.

To prevent accidentally spending your savings, the Spend & Save account is two different accounts.

The “Spend” account is an online checking account and the “Save” account is an online savings account.

Spend & Save account perks include:

- Debit card made from 100% recycled plastic

- 55,000 free in-network ATMs

- Purchase roundups to plant a tree

- Get up to 3.00% APY Interest on Save balance every month you spend $1,000 plus

While the 55,000+ Allpoint ATM network is fee-free, out-of-network ATM fees incur a surcharge. The fee can vary by network provider.

Also, this entry-level account option doesn’t earn interest on your savings account deposits. This account option can be good if you want a free checking account.

Debit card purchases at participating retailers earn between 3% and 5% cash back. These retailers must be part of Aspiration’s “Conscience Coalition.”

Other card purchases can earn 0.5% back if the store has a high social impact score.

“Pay What You Think is Fair” Pricing

The Save & Spend account fees are transparent but can the monthly service fee can be initially confusing.

This account is free but Aspiration offers a “pay what is fair” pricing structure. This means that members can choose a custom monthly fee.

You may decide to pay $1 per month or $10 per month, for instance. If you choose to pay a fee, Aspiration donates ten cents of each dollar to charity.

When you need to pay for extra services, Aspiration only charges the true cost. One fee you may encounter is incoming or outgoing wire transfers.

Aspiration Plus

The other bank account is Aspiration Plus. This premium subscription costs $7.99 per month.

Paying the $71.88 annual fee upfront reduces the monthly rate to $5.99.

Enhanced Aspiration Plus features include:

- One out-of-network ATM fee reimbursement per month

- 10% cash back on Conscience Coalition shopping purchases

- Carbon offsets on gas purchases

- Get up to 5.00% APY Interest on Save balance every month you spend $1,000 plus

Interest earned is on the first $10,000 in savings account deposits. Any excess balance earns only 0.10% interest.

While the full savings account balance doesn’t earn interest, the 5.00% APY is higher than most high-yield savings accounts.

In addition to the one monthly non-network ATM fee reimbursement, there are over 55,000 free in-network ATMs.

It can also be worth choosing Aspiration Plus for the carbon offset program.

The Aspiration Planet Protection program buys carbon offsets each time you buy gas with your Spend & Save debit card.

Upgrading to Aspiration Plus can be worth it if you can maximize the savings account interest, online shopping perks and ATM fee reimbursement.

However, the monthly fee is higher than most brick-and-mortar banks.

About Cash Back

Aspiration offers up to 3% cash back on select debit purchases. Aspiration Plus members get up to 10% back on qualifying debit purchases.

In order to earn cash back on more purchases, consider shopping with a cash back site.

Cash back deposits on the first day of each month and there are no limits to the amount of cash back you can earn.

How much cash back you can earn depends on which retailer you shop at.

Coalition Partners

The Conscience Coalition partner earns between 3% and 5% back for basic Spend & Save accounts.

Aspiration Plus members earn 10% back on each purchase.

There are approximately 15 Conscience Coalition partners. These companies may make a donation for each purchase to help the needy.

Some of the current Conscience Coalition partners include:

- Arcadia Power

- Blue Apron

- Soapbox

- TOMS

- Warby Parker

Aspiration Impact Measurement Score (0.5% Back)

Other qualifying debit card purchases earn 0.5% back for all Aspiration members.

To earn cash back, the merchant must have a high Aspiration Impact Measurement (AIM) score.

Brands with a high AIM score emphasize sustainable “people and planet” business practices for people and the planet.

Over 20 local and online merchants in multiple industries qualify for 0.5% back.

Some of the brands that earn 0.5% back include:

- Allstate

- Apple

- AT&T

- CVS

- Target

- Verizon

- Walmart

- Xbox

It’s possible to earn cash back on most common purchases when buying household essentials, insurance, tech or paying the monthly cell phone bill.

Checking the Aspiration app for the most current cash back partners lets you earn shopping rewards.

You can view the AIM People and Planet score for businesses when you view your list of transactions on the Aspiration mobile app.

Aspiration also provides your personal impact score using your purchase history.

A higher score can indicate you support businesses with social and environmental initiatives.

Investment and Retirement Products

Aspiration offers a taxable and a traditional IRA retirement investment account that emphasize sustainable investing.

Roth IRA accounts are not available.

Each account has a $10 minimum initial investment and no account service fees. Subsequent investments are only $1 per account.

Both investment minimums make it easy to invest small amounts of money.

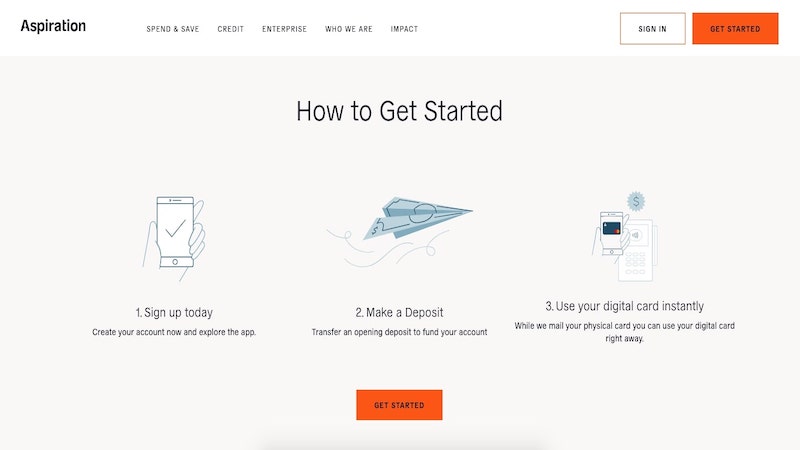

Opening an Account

Joining Aspiration is straightforward. You begin by providing your email address and a password.

Next, you can choose which Spend & Save account or investment account to open. It’s possible to open both if you want to save and invest.

You will also answer some basic identifying information that all banks ask. If you open an investment account, Aspiration asks for your employment details.

They’ll also ask you about your level of investing experience. Once again, each online broker asks the same questions.

To fund an account, you can link to an existing bank account or enroll in direct deposit. The entire process should take about five minutes.

Approval to open an account is not guaranteed. If your application is denied, Aspiration is under no obligation to provide a reason.

However, the outcome may have been the result of something that appeared in your credit report.

If you are denied, Aspiration recommends requesting a free copy of your credit report from Equifax.

Smartphone App

It’s possible to bank with Aspiration entirely from your smartphone. The Aspiration free app is available from the Google Play and Apple App Store.

With the app, you can view balances and transfer funds between accounts.

It’s also possible to pay bills, deposit mobile checks and manage investment accounts. The app offers the option of two-factor authentication for enhanced security.

Charity Donations with Aspiration

There are several ways to make charitable donations through Aspiration. These donations can help social and environmental causes.

Dimes Worth a Difference

Aspiration donates 10% of its revenue to charity through its “Dimes Worth a Difference” program. One-tenth of your monthly service fee goes to this charity program.

Specifically, the company supports microloans provided through Accion U.S. Network.

These microloans offer capital to small business owners looking to get their businesses off the ground.

It emphasizes environmentally friendly businesses, and those operated by women, minorities, and disabled people.

These donations are not tax-deductible.

Plant Your Change

Aspiration lets all members round up their debit card purchases. For example, a $15.23 purchase has a 77-cent round-up. Each round-up helps plant a tree.

As a reward, members can earn a cash rewards by reaching tree planting milestones. The first milestone is a $5 reward after planting 30 trees.

Support Non-Profits

In addition to donating a portion of its revenue, Aspiration also allows you to make direct contributions to support certain causes.

These funds are built by Aspiration and relate to Education, Global Poverty, Water, Human Rights, Environment and Health.

There’s also an “Opportunity” fund offering microloans of $5,000 or less.

These charity donations can qualify as a tax deduction.

Other Perks

Aspiration offers two free services that other banks may not offer and help you save money.

Identity Theft Expense Reimbursement

If you are the victim of identity fraud, you may incur expenses trying to clear up the situation.

Aspiration can reimburse you for up to $1,000 worth of these costs.

This coverage is available only if you are not already insured or covered by another identity theft service.

Specific details and restrictions are available in your debit cardholder agreement.

Cell Phone Protection Coverage

If you pay for your wireless bill using your Aspiration debit card, you are eligible for free cell phone protection coverage.

The coverage limits are worth up to $600 per claim and $1,000 per 12-month period if your cell phone is damaged or stolen.

Like any insurance policy, there are some restrictions to this (for example, you are not covered if you damaged your phone intentionally).

Full coverage details are available in the debit cardholder agreement.

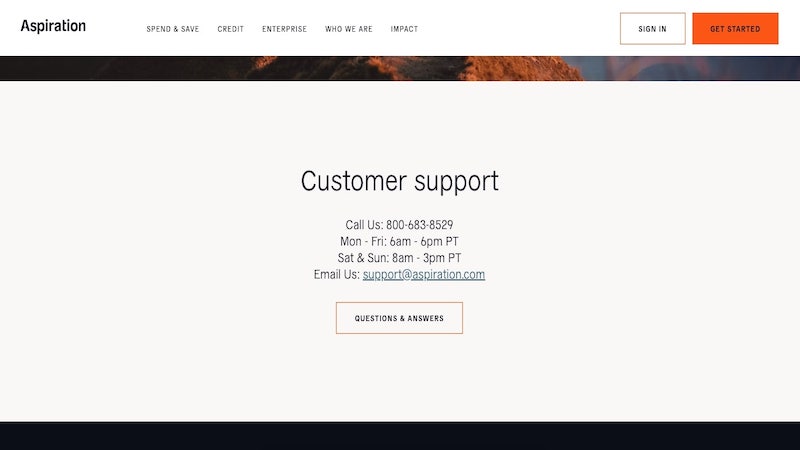

Customer Service

If you need help with your accounts or have questions, Aspiration offers phone and email customer service.

You can call 800-683-8529 on Monday through Friday from 6 am to 6 pm PT, or Saturday and Sunday from 8 am to 4 pm PT.

You can also contact the support team via an online form.

Positives and Negatives

Pros

- Pay what you want in monthly fees, even if it’s nothing

- Socially conscious mission. This may not matter to every potential customer, but for some, it may be just what they are looking for

- Cash back on qualifying debit card purchases

- Clean, simple online interface

- Better interest rates than brick-and-mortar banks (Aspiration Plus only)

- Over 55,000 fee-free ATMs

- Socially responsible investing accounts

- Cell phone protection coverage and identity theft expense reimbursement

Cons

- No physical branches

- May support the different charities than you do

- Only one investment product

- Must pay a monthly fee to earn interest

- No loan products

Is Aspiration Worth It?

Without a doubt, Aspiration offers a different banking and investing experience.

Being able to support social and environmental causes is one reason to consider Aspiration.

Also, not having to pay a monthly fee or maintain a minimum deposit is good.

However, other banks can be better if you don’t want to pay a monthly fee to earn interest or get non-network ATM reimbursements.

Summary

You can think of Aspiration as banking with a soul. The company is unique in the marketplace.

It’s possible to save and invest while supporting causes that are important to you.

Aspiration may not be for everyone; you may not personally support the same causes as the company, or you may prefer to be socially conscious in your own way.

As a financial institution, it’s products are competitive compared to most banks.

You can potentially use Aspiration as your only bank, though some might find the offerings too limited.

*The Aspiration Spend & Save Accounts are cash management accounts offered through Aspiration Financial, LLC, a registered broker-dealer, Member FINRA/SIPC, and a subsidiary of Aspiration Partners, Inc. (“Aspiration”). Appreciation is under separate ownership from any other named entity. Aspiration is not a bank.