Ever feel like getting customers to pay is like pulling teeth? If you’re in business and invoice customers, the answer is likely a resounding yes. Many customers wait until the due date to pay (who hasn’t?). Other customers still don’t pay even after the deadline has passed. And if your business needs cash, you may consider offering an early payment discount.

So, what is an early payment discount? Will offering it help or hurt your business? Find out below.

What is an early payment discount?

An early payment discount is a (typically small) price cut that customers enjoy when they pay their bills before the due date. This type of discount is also called a cash discount, prompt payment discount, or sales discount.

If you offer credit to your customers, you likely send an invoice that details when payments are due, how to pay them, and more. Because invoices give customers time to pay their bills (e.g., 30-60 days), many businesses offer an early payment discount to speed up payments.

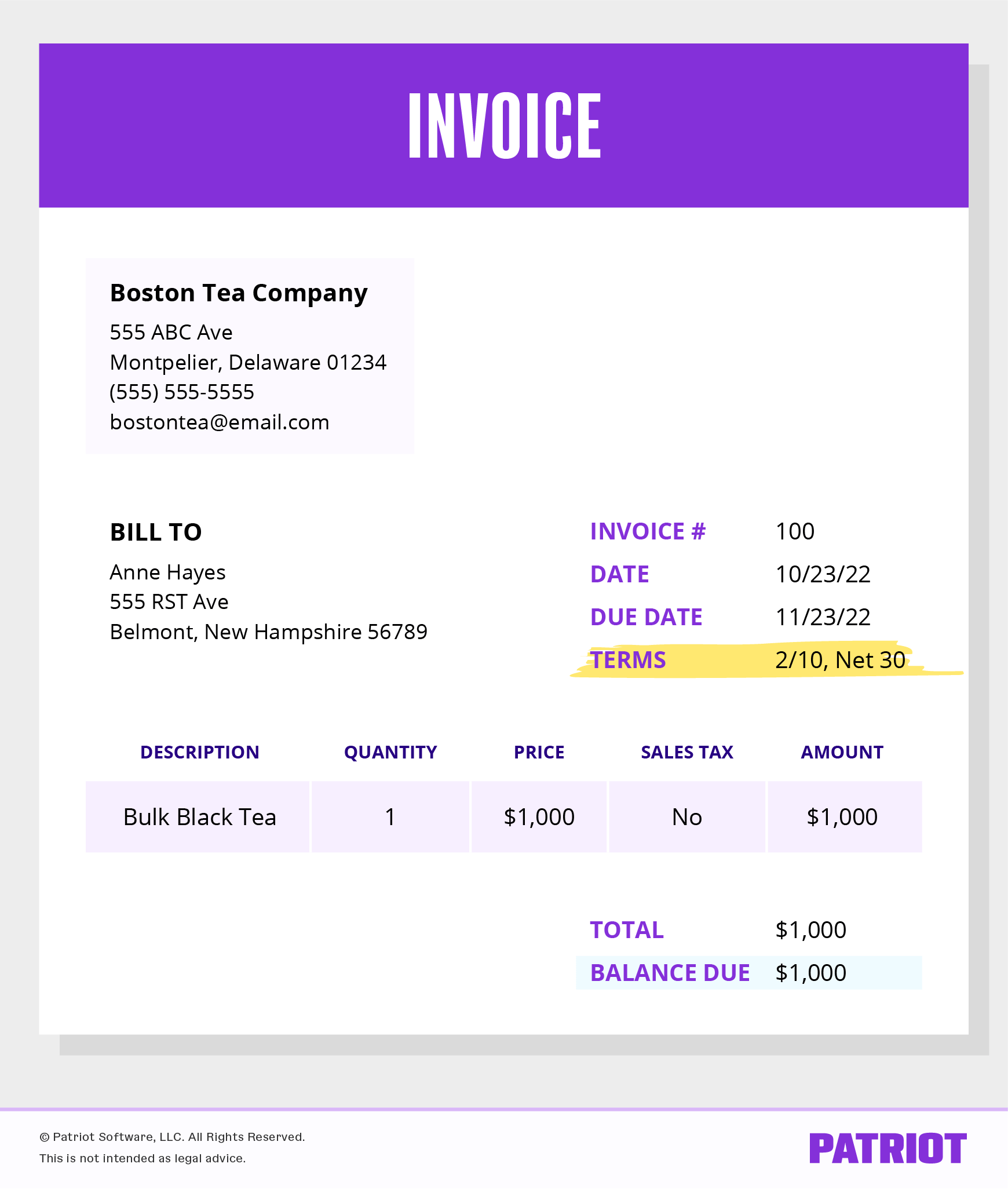

You can include your early payment discount terms directly on the invoice. You might also tell customers about the offer at the point of sale. That way, they can start budgeting for the payment before they receive their invoice.

Advantages of early payment discount

So, why should you consider applying discount for prompt payment to customer bills? Offering customers an early payment discount can help:

- Boost cash flow

- Discourage late or non-existent payments

- Strengthen relationships

- Increase customer loyalty

Caution ahead! A discount for prompt payment has its flaws, too. Before offering customers an early payment discount, consider your profit margin. After all, you don’t want to wind up with a low or nonexistent profit.

How to write an early payment discount on your invoice

When you create your invoice, you should write the early payment discount in a certain way. But before getting to that, you need to know the parts of an invoice.

Invoices generally have a standard structure. Your invoice should include the following information:

- Invoice date

- Customer information

- Seller information

- Purchased goods or services

- Total amount due

- Payment terms (when payment is due, early payment discount, how to pay, etc.)

- Invoice number

The payment terms information includes your early payment discount. To write the terms of your early payment discount, write the percentage discount the customer will receive, followed by the number of days they must pay by to receive this discount. Then, write the normal due date.

Let’s say you want to give customers a 2% discount if they pay their invoice within 10 days instead of the normal due date of 30 days. You would write 2/10, Net 30 on the invoice.

Here are a few more examples of common early payment discount options:

- 1/10, Net 30 (1% discount for payments made within 10 days; 30-day due date)

- 2/15, Net 45 (2% discount for payments made within 15 days; 45-day due date)

- 4/10, Net 60 (4% discount for payments made within 10 days; 60-day due date)

Early payment discount formula

Calculating an invoice early payment discount is easy, but it does require a little bit of math (unless you use accounting software).

You can use the following early payment discount formula to calculate the customer’s discount amount:

Early Payment Discount = Discount Percentage X Invoice Total

Early payment discount example

Let’s look at an example. Say you offer a 3% early payment discount to a customer with a total invoice of $500. To find out the discount dollar amount, plug your numbers into the formula:

Early Payment Discount = 3% X $500

Early Payment Discount = $15

Want to see how much the customer owes you with the discount? Use the following formula to see their total invoice liability with the discount:

Discounted Invoice = Invoice Total – (Discount Percentage X Invoice Total)

Using the same numbers from above (3% discount and $500 invoice), plug your numbers into the formula to get the discounted invoice total:

Discounted Invoice = $500 – (3% X $500)

Discounted Invoice = $485

With a discount of 3%, the customer would owe $485 rather than the original invoice amount of $500.

How much should your discount be?

You don’t want to offer too big of a discount, or your profit margins will be razor thin. At the same time, you want the discount to be enough of an incentive that customers want to pay early. How much should you offer?

To help you determine your discount amount, find your product’s or service’s profit margin. To do that, use the following formula:

Profit Margin = [(Product Price – Cost of Goods Sold) / Product Price] X 100

To find your cost of goods sold (COGS), add up your expenses for creating the product or offering the service. Then, subtract those costs from the price of your product to get the difference. Finally, divide that total (the product price minus cost of goods sold) by the product price and multiply by 100. This shows you what percentage of your profits you retain.

Find your profit margin without the early payment discount. Then, you can try out different discount options to determine if you will earn a high enough profit margin.

When deciding your cash discount, consider your industry standards and competitors. Find out how much other businesses charge for similar services or products. You may choose to offer a low enough early payment discount to stay competitive.

Make sure to leave yourself enough room to cover costs and give yourself a healthy profit. You don’t want your business to struggle financially because of the discount.

Determining your discount amount: Example

Let’s say you set a product price at $300. It costs you $210 to make. First, find your profit margin:

$300 – $210 = $90

$90 / $300 = 30%

You want to give a 4% early payment discount to your customer, which would be a savings of $12 ($300 X 0.04). So, the customer would owe $288 ($300 – $12). Determine your profit margin for the early payment discount:

$288 – $210 = $78

$78 / $300 = 26%

With an early payment discount of 4%, you would still earn a profit margin of 26%.

Accounting for prompt payment discounts

Like any transaction, you must create journal entries reflecting early payment discounts.

Using double-entry accounting, create an initial journal entry when the customer purchases something before they pay. Then, create a second journal entry when the customer pays.

In your first journal entry, debit your Accounts Receivable account and credit your Inventory account. Because the customer owes you, you must increase the Accounts Receivable while also decreasing your Inventory accounts.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Accounts Receivable | X | |

| Inventory | X |

When the customer pays, it’s time to reverse the entry by creating a second journal entry. Debit your Cash account to increase it and credit your Accounts Receivable account to decrease it.

This is how a normal journal entry would look without the early payment discount:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cash | X | |

| Accounts Receivable | X |

However, early payment discount accounting requires you to add another account to record the money your business is “losing” for the sale discount. To do this, use the Sales Discounts account.

Sales Discounts account is a contra revenue account. That means that its purpose is to help you match your unequal accounts (Cash and Accounts Receivable, in this case). As a result, you must debit your Sales Discount account. Together, your Cash and Sales Discounts accounts will equal your Accounts Receivable account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cash | X | |

| Sales Discounts | X | ||

| Accounts Receivable | X |

Because the Sales Discounts account is decreasing the revenue your business earns, you need to deduct the total from your business’s gross revenue at the end of the period.

Early payment discount accounting example

Let’s say you make a $5,000 sale to a customer. First, record your sale to the customer by debiting Accounts Receivable and crediting Inventory.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Accounts Receivable | 5,000 | |

| Inventory | 5,000 |

You offer an early payment discount of 4% if the customer can pay within 15 days (4/15, Net 30). The customer does pay within 15 days. So, you must record the transaction in your books.

To record the customer’s payment, debit your Cash account and credit your Accounts Receivable account. Because the customer receives a discount, you must also debit your contra revenue account, which is Sales Discounts.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cash | 4,800 | |

| Sales Discounts | 200 | ||

| Accounts Receivable | 5,000 |

Quick tips for offering an early payment discount

Again, offering a discount for prompt payment can encourage customers to pay their bills early, boost cash flow, and strengthen relationships.

But before doing so, you should:

- Check your profit margin before applying an arbitrary discount amount

- Record the correct amount in your books

- Use accounting software to streamline the process

- Make sure customers are aware you offer a prompt payment discount

Do you send invoices regularly? With Patriot’s online accounting, you can create invoices, apply an early payment discount, and track unpaid invoices with ease. Get your free trial today!

This article has been updated from its original publication date of August 2, 2018.

This is not intended as legal advice; for more information, please click here.