The year 2020 has been an year of ups and downs for Indian equity markets, much like a roller coaster. After a catastrophic drop in March 2020 (due to the covid-19 pandemic), the Indian markets have recovered swiftly and are now trading at their life-time highs.

The last calendar year has been a real-test of character for the so-called long-term and aggressive investors. Many of you might have actually redeemed your equity mutual fund units during Mar to Apr 2020 after a jaw-dropping fall loses (or) atleast would have given it a serious thought to redeem some of your MF units. Am I right??

If you have been investing for a long-term, these kind of market falls can actually be a great chance to make additional investments. You need to have conviction in your investment strategy.

A mere of selection of Best Equity Mutual funds is not enough, you got to stay invested and continue investing in them as per your investment objective. Hence, it is prudent to follow a goal-based approach rather than timing the market and with a proper Asset Allocation.

In this post, let us discuss – What are the Top 15 Best Mutual Funds 2021-22? How to select top & consistent Equity Mutual Fund performers? What are the best large-cap, flexi-cap, mid-cap, tax saving ELSS and Equity Hybrid funds to invest now?…

Top 15 Best Mutual Funds 2021 & beyond

As per my analysis, below is the list of best Equity Mutual Funds to invest in India (now in 2021);

- UTI Nifty Index Fund (Large-cap)

- Axis Bluechip Fund (Large-cap)

- ICICI Prudential Bluechip Fund (Large-cap)

- Parag Parikh Flexi-cap Fund (Diversified)

- UTI Flexi Cup Fund (Diversified)

- Axis Mid-cap Fund (Mid-cap)

- DSP Mid-cap Fund (Mid-cap)

- SBI Small-Cap Fund (Small-cap)

- Axis Long Term Equity Fund (ELSS – Tax Saving)

- Invesco India Tax Plan (ELSS – Tax Saving)

- Canara Robeco Equity Tax Saver (ELSS – Tax Saving)

- HDFC Hybrid Equity Fund

- ICICI Pru Equity & Debt Fund

- Canara Robeco Equity Hybrid Fund

- SBI Equity Hybrid Fund

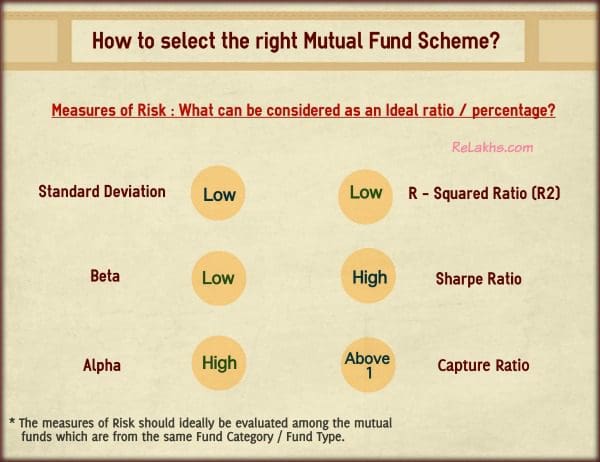

I have considered both, the past performance and risk ratios of mutual funds to shortlist top rated Equity mutual fund schemes.

Below image gives you an idea on the parameters (to know, how consistent the funds have been..?) that one can consider while shortlisting right mutual fund schemes.

Let’s now analyse category-wise best equity funds;

Best Large Cap Mutual Funds 2021-22

Below are the consistent and top performing large cap funds that can be considered to invest now;

- UTI Nifty Index Fund

- Axis Bluechip Fund

- ICICI Pru Bluechip Fund

- The above funds were listed even in my last year review as well.

- Most of the large-cap funds have not out-performed their benchmark indices in the few years (after the implementation of SEBI’s re-categorization rules).

- If you are planning to invest afresh, it is prudent to go for large-cap based index funds than actively managed large-cap Funds.

- Considering the past performance, risk-return trade off and cost, advisable to stick / switch to any large-cap based index fund.

Best Flexi-Cap Mutual Funds 2021-22

As per the old guidelines, a Multi-cap Mutual fund scheme or Diversified Equity Scheme can invest a minimum of 65% of total assets across large, mid and small cap stocks. At present, fund managers of multi cap funds can invest across market capitalization as per their choice.

However, SEBI, in a recent circular, has tweaked the Asset allocation rules for multi cap mutual funds. The fund managers have to mandatorily allocate at least 25% each in large-, mid-, small-cap stocks. These new norms have taken away the flexibility.

Hence, I believe, flexi-cap (new category) can be a better alternative to multi-cap oriented funds. Flexi Cap funds can invest minimum 65% of its assets in equity and equity related instruments with dynamic allocation across large cap, mid cap, and small cap stocks.

You may consider below Flexi-cap funds for your long term financial goals. In case, you have a large-cap fund and also a mid-cap based fund in your portfolio, can give this category a miss.

- Parag Parikh Long Term Equity Fund is renamed as Parag Parikh Flexi Cap Fund.

- It has 65.74% investment in Indian stocks of which 29.05% is in large cap stocks, 11.69% is in mid cap stocks, 21.92% in small cap stocks. Foreign Equity Holdings are around 28%.

- It has a very good downside protection ratio.

- The Financial Services, Technology & Consumer cyclical related stocks have been its favorite picks.

- UTI Equity Fund is one of the oldest funds in Indian Mutual Fund industry. I have been keenly following UTI Equity fund from a long time. In fact, this fund was in my best multi-cap fund list earlier.

- It has now been moved from muti-cap category to flexi-cap category.

- The fund has given returns of around 14% pa in the last 15 years.

- The Financial Services, Consumer cyclical & Technology related stocks have been its favorite picks.

Best Equity Mid-cap Mutual Funds to invest in 2021

Below are the top performing equity mid-cap & small-cap oriented funds;

- Axis Mid-cap Fund

- DSP Mid-cap Fund

- SBI Small-cap Fund

- The average category returns from mid-cap oriented funds have been around 14% in the last 10 years. We currently have around 27 mid-cap funds.

- The key parameter to look in mid-cap funds is their standard deviation (volatility). The above funds have given good performance with lower risk.

- In this year’s list, I have replaced Franklin Prima Fund with DSP Mid-cap fund. In case, you are investing in Franklin fund, can continue with your investments.

- Axis Mid-cap fund has a current allocation of 12.18% in large cap stocks, 66.29% in mid cap stocks & 8.11% in small cap stocks.

- DSP Mid-cap fund has good upside and downside capture ratios.

- You may keep an eye on Invesco Mid-cap fund as well.

Best ELSS Tax Saving mutual Funds 2021

We currently have around 38 funds under the ELSS Fund category. The average returns from ELSS fund category are around 13.5% and 12% in the last 5 and 10 years respectively.

In my opinion, below are the consistent and best ELSS Mutual Funds to invest for tax saving and long term wealth creation;

- Axis Long Term Equity Fund

- Invesco India Tax Plan

- Canara Robeco Equity Tax Saver

Related comprehensive article : Top 5 Best Tax Saving ELSS Mutual Funds 2021-22

Best Equity Hybrid Funds 2021-22

Below are the best aggressive Equity Hybrid (Balanced) Funds ;

- HDFC Hybrid Equity Fund

- ICICI Prudential Equity & Debt Fund

- Canara Robeco Equity Hybrid Fund

- SBI Equity Hybrid Fund

- There are currently around 45 equity hybrid funds. The average returns generated under this category have been around 14% in the last 7 years.

- The risk grade has improved for funds of Canara and SBI, whereas, it has slightly deteriorated for HDFC Hybrid Equity and ICICI Pru funds.

- HDFC Hybrid Equity Fund has 75.08% investment in Indian stocks of which 54.02% is in large cap stocks, 4.26% is in mid cap stocks, 8.8% in small cap stocks. It has 22.12% investment in Debt of which 6.33% in Government securities, 15.25% in funds invested in very low risk securities.

- The ICICI Pru fund has 76.55% investment in Indian stocks of which 61.48% is in large cap stocks, 7.52% is in mid cap stocks, 6.3% in small cap stocks. It also has 17.93% investment in Debt of which 0.15% in Government securities, 17.03% in funds invested in very low risk securities.

- The Canara Robeco Fund has 73.71% investment in stocks of which 49.4% is in large cap stocks, 12.42% is in mid cap stocks, 2.82% in small cap stocks. It has 15.26% investment in Debt of which 3.56% in Government securities, 11.7% in funds invested in very low risk securities.

- SBI Equity Hybrid Fund has 73.66% investment in Indian stocks of which 49.38% is in large cap stocks, 10.89% is in mid cap stocks, 3.56% in small cap stocks. The Fund has 18.77% investment in Debt of which 9.97% in Government securities, 8.13% in funds invested in very low risk securities.

- You may track Mirae Asset Hybrid Equity Fund as well.

My Latest Equity Mutual Fund Portfolio details

Below are the changes made to my Equity Mutual Fund Portfolio;

- We (my spouse & myself) have decided to opt for ‘new tax regime‘, hence ready to forgo Section 80c tax deductions. So, I have decided to discontinue my future investments in Axis LTE ELSS Tax Saving Fund (will hold on to the existing units though).

- I have recently redeemed my investments in Franklin Smaller Companies fund.

- I have added one more Equity Hybrid Fund to my MF portfolio – SBI Equity Hybrid Fund.

- So, I have been actively making investments in three Equity Mutual fund schemes for now;

- HDFC Hybrid Equity Fund

- UTI Nifty Next 50 Index Fund &

- SBI Hybrid Equity Fund

Mutual Fund Capital Gain Tax Rates for FY 2020-21 / AY 2021-22

One of the important amendments of the Financial Bill 2020-21 is ‘abolition of Dividend Distribution Tax’ in companies hands. As DDT will not be paid by the companies, dividend income (from April 2020) is taxed and paid by investor, at applicable individual tax slab rates.

Capital Gains Tax Rates on Mutual Fund Investments of a Resident Indian for FY 2020-21 are as below;

- The STCG (Short Term Capital Gains) tax rate on equity funds is 15%.

- The STCG tax rate on Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate.

- The LTCG (Long Term Capital Gains) tax rate on equity funds is 10% on LTCG exceeding Rs 1 Lakh.

- The LTCG tax rate on non-equity funds is 20% (with Indexation benefit)

Capital Gains Tax Rates on NRI Mutual Fund Investments for the Financial Year 2020-21 (Assessment Year 2021-22) are as below;

Related comprehensive article on MF Taxation Rules : Mutual Funds Taxation Rules FY 2020-21 (AY 2021-22) | Capital Gains Tax Rates Chart

Some Important Points to ponder about Mutual Fund Investments :

- Identify your Goals : Majority of us identify the products first and then try to shortlist best investment avenues. An investor has to first identify his/her financial goals and then try to short-list best available options. This is applicable for mutual fund investments also.

- Set you Asset Allocation : Asset allocation is an exercise to invest across various avenues such as time-deposits, bonds, equities, gold etc., Set your allocation based on your investment objective, time-horizon and risk tolerance. For example : If your investment horizon is say 10+ years, objective is to wealth accumulation, you can consider an asset allocation of Equity to Debt as 60:40. Besides investing in Equity oriented products, it is equally important to invest in debt-oriented products (like PPF, EPF, VPF, Debt Funds etc.,) as well.

- Is it good to invest in multiple Schemes from same Fund category? – Kindly do not invest in too many funds especially within the same fund category. Over-diversification is not beneficial and may lead to high portfolio overlap.

- Consistency is the key parameter : A ‘good mutual fund scheme’ is the one that consistently manages to outperform its category returns and also it’s Benchmark’s. It is prudent to be with the consistent performers for long-term goals instead of churning your portfolio based on Star ratings or recent performances of the funds.

- If you observe, the recent stellar performances have come from equity funds managed by the fund houses like Axis, Canara, DSP, UTI…The funds managed by HDFC, Franklin & Birla have taken a back seat. But, do not churn your portfolio based on recent performances alone. Look for consistency of returns and then take decision!

- I am 60 years old, can I invest in Equity Funds? – Invest in Equity funds based on your future goals & financial resources and not based on your current age. For example – If you are a retiree (say 65 years) and have regular income which is more than your monthly living expenses, you can surely invest a portion of your surplus income in hybrid or equity oriented mutual funds.

- Importance of Portfolio Performance – If one of the schemes in your MF portfolio is not performing well, do not immediately churn your portfolio. Also, do not churn your portfolio very often based on fund star ratings. The negative consequences of regularly churning the portfolio are undeniable. Do track that scheme’s performance for sometime (say 1 or 2 years) before deciding to drop it from your portfolio. Sometimes, it is prudent to analyze the overall portfolio performance than to get too worried about individual fund’s performance. Also, have realistic return expectation from your investments.

- Shall I invest in Focused/Value oriented MF Schemes? – If you have created a core portfolio with say a Large cap fund / Index Fund, mid-cap fund (or index based funds) & Hybrid fund, you may invest a portion of your investible surplus in focused, value oriented, Funds of funds or Theme based funds. Ex : Parag Parikh Long Term Value Fund, Axis Focused 25 Fund etc.,

- Shall I pick Index Funds? – If you are not comfortable investing in actively managed Funds, you can consider investing in Index based Funds. Ex : UTI Nifty 50 Fund (Large-cap), UTI Next Nifty 50 Index Fund (Large + Midcap) etc., It makes sense, to add one Hybrid Equity Fund to your Index based portfolio, to manage the volatility.

- SIP or Lump sum? – Systematic Investment Plan (SIP) inculcates financial discipline. However, it is not a fair comparison to equate SIPs with investing in a lump sum. Both have their own pros and cons. It is better to have SIPs in place and at the same time, you can make additional investments (lump sum) when you believe that markets are down.

- Suggest you not to remain invested in equity oriented funds till the goal target year. You may consider redeeming MF units by starting SWP (Systematic Withdrawal Plan)may be 2 to 3 years before the goal year. You can re-invest this amount in safe investment avenues. You may also re-balance your portfolio based on your Asset-allocation strategy (Equity : Debt allocation).

- DIY / Advisor – If you are a DIY investor, pick Growth and Direct plans. In case, you are not comfortable investing in Mutual funds on your own or do not have the required time, do engage with a fee-only Financial planner.

Continue reading :

- What are Mutual Fund Upside / Downside Capture Ratios? | How to use them in MF Performance Analysis?

- What is Indexation of Mutual Funds and why is it important for you?

- List of all Popular Investment Options in India – Features & Snapshot

- When should you sell your Mutual Fund Schemes? | When to exit a Mutual Fund?

- Mutual Fund Units Transmission procedure | How to get Mutual Fund units transferred upon death of a Unitholder?

Kindly note that the above list of top & best mutual funds 2021 is not an exhaustive one. Mutual funds’ returns are not guaranteed, their values/returns change frequently and past performance may not be repeated. MFs are subject to various market risks.

(Data Source & references : Valueresearchonline, Moneycontrol, Morningstar, Freefincal & The Economictimes) (Post first published on : 21-January-2021)