“Did you like it?”

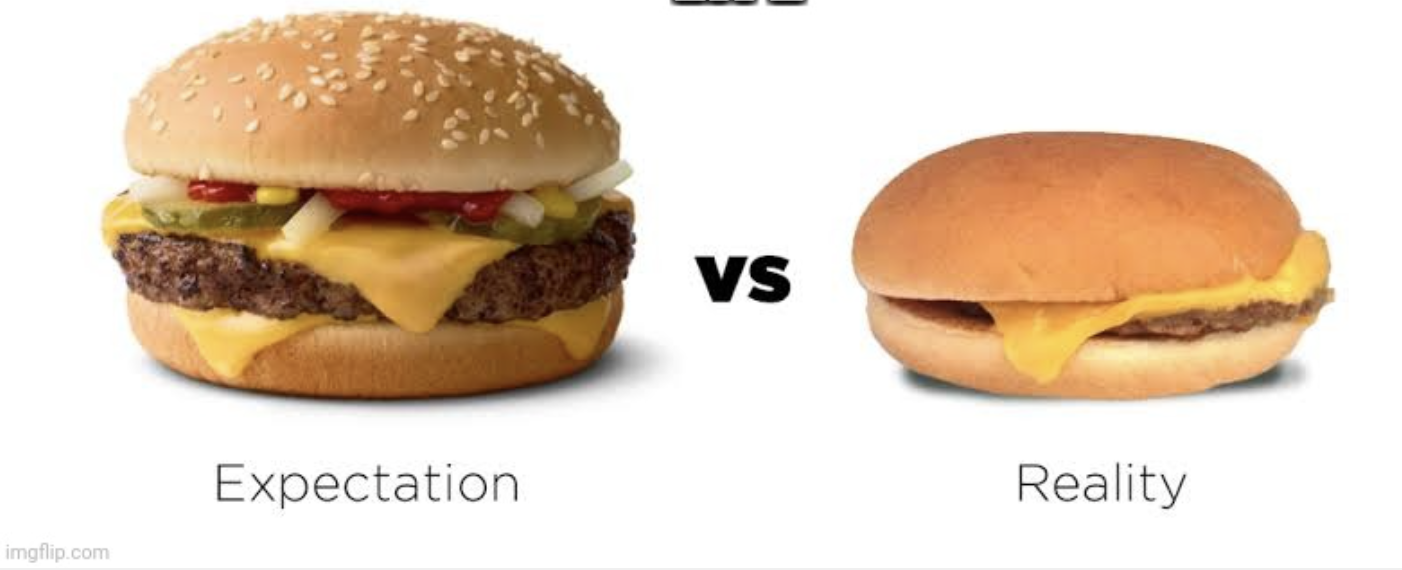

The answer to one of the most common questions in the world is not just about whether you liked the thing in question. Your response will depend on reality exceeding or falling short of expectations. How did you like it relative to how you thought you would like it?

One of my colleagues told me he enjoyed the new Jurassic Park movie and I absolutely could not believe it. He didn’t love it, more like a “hey it wasn’t so bad.”

I almost refused to believe him. Like literally I could not believe it. And then another colleague of mine had the exact same response. Like exactly the same. “I mean it wasn’t good, but it wasn’t that bad.”

This had me shaken.

Two things going on here. First, movies on airplanes are 30% better than movies on your couch. There’s nothing to distract you, and there’s not much else you could be doing. It’s not like you wasted two hours watching a piece of crap when you could have done literally anything else. In an airplane, there are three choices- sleep, read, or watch something.

The second and main determinant of them not hating a very bad movie was their expectations. The movie got lambasted by everyone, myself included. Jurassic Park is one of my favorite franchises. It would be difficult for there to be a dinosaur movie that I didn’t like. And I really, really didn’t like the new Jurassic Park. So my colleagues were expecting horrible, and I guess through that lens, terrible is actually pretty good.

I’m big into expectations versus reality, but I think even I underestimate how foundational this is to everything whether it’s books or movies or trips or food or anything really.

So I tried something on the flight home. I had no interest in watching Morbius. I’m a fan of superhero movies, but I was not wasting my time with this one. 15% from critics on Rotten Tomatoes, 5.2 on IMDB, and 35% on Metacritic. No thanks.

But after being shocked that my two colleagues liked an objectively awful movie, I decided to put the expectation game to the test. I watched Morbius and I was surprisingly entertained. The reality is this movie was terrible, but it wasn’t horrible, and the small gap between the two made me like it.

And this is what makes investing so hard. Markets don’t move on good or bad, they move on better or worse, specifically better or worse than expected. The tricky, nay impossible thing is you don’t know what’s expected until you see the market’s reaction.

The other day I saw this tweet from Sean Fennessey

See this. Don’t read anything about it. Just go see it in a crowded movie theater. pic.twitter.com/xQzKD0RNEm

— Sean Fennessey (@SeanFennessey) August 23, 2022

Mindful of the no-expectations thing, I did it. At least the first part. I don’t know how to find a crowded theater. I saw it with a total of two other people. Obviously for Sean to tweet something like this, I suspected I was in for a treat, but in order to not taint the experience, I took his advice and saw it blind without knowing a single thing about it.

Holy shit. This movie was absolutely wild. If you’re a fan of demented horror, I cannot recommend it enough. And Sean’s right. The less you know about this movie the better.

It’s going to be a week in the markets. We’ve got the Fed on Wednesday and the market is pricing in an 82% chance of 75 bps. With respect to the fed funds rate, we do know what the market is expecting, but we don’t know if it will like it.