Turmoil in UK government debt has sent shockwaves through global markets, sparking big swings in US and European bonds.

“Bond markets are always highly correlated, but we’ve definitely seen the tail wagging the dog this week,” said Dickie Hodges, head of unconstrained fixed income at Nomura Asset Management. “The moves in gilts were so big that they filtered through to European and US bond markets.”

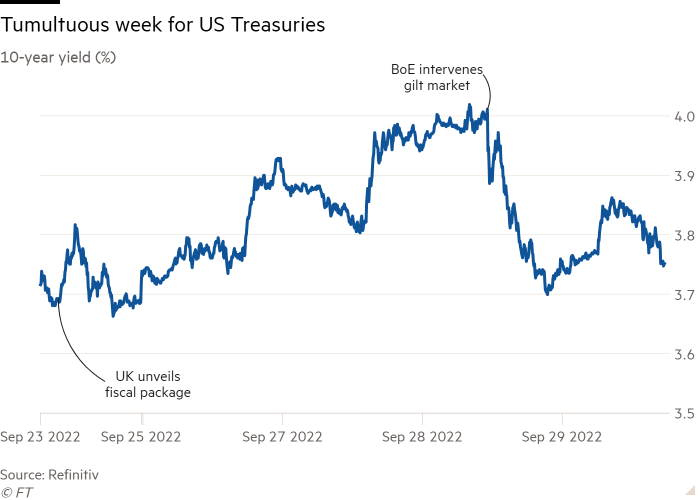

The 10-year US Treasury, the benchmark in the world’s biggest and most important debt market, on Wednesday posted its biggest one-day rally since March 2020 after the Bank of England announced emergency bond purchases to halt the freefall in UK government debt. Those gains followed heavy losses for global bond markets since last Friday as the heavy sell-off in gilts spread around the world.

Analysts and investors say some of the moves in Treasuries or German Bunds have been caused by leveraged investors — who use debt to amp up their gains and losses — dumping easily tradeable assets elsewhere in order to cover their losses in the UK. But the similar — albeit much more muted — moves in the US and Europe are also down to the shared challenges facing most big economies of how to tame runaway inflation without choking off economic growth.

“Even though the UK is a basket case of its own making, the fact is the same pressures are being acutely felt elsewhere,” said Richard McGuire, a rates strategist at Rabobank. “Investors see the government’s ill-conceived experiment, and wonder if it’s a sign of things to come in other countries.”

Following chancellor Kwasi Kwarteng’s £45bn package of tax cuts and energy subsidies last Friday, traders swiftly priced in a steeper rise in UK interest rates, betting that the BoE would need to tighten monetary policy faster in order to offset the inflationary effects of the fiscal stimulus. Eurozone markets also added expectations for an extra European Central Bank rate increase over the coming year “in sympathy,” said McGuire. He added that his clients, who invest in eurozone sovereign debt, currently have the UK at the top of their list of questions.

The global alignment of monetary policy has also meant that when one central bank changes direction, like when the BoE this week decided to delay its quantitative tightening process, it raises questions about whether other central banks will follow suit.

“In the US market we’re a bunch of single-celled monkeys. You see the Bank of England ending quantitative tightening suddenly and you think that maybe the US will end quantitative tightening too,” said Edward Al-Hussainy, a senior interest rate strategist at Columbia Threadneedle.

The aftershocks of the UK crisis have been particularly evident in the US because of the volatile state of markets more broadly, said analysts and investors. The US and UK, among central banks globally, are raising interest rates at a rapid rate, which has created unusual price swings, even in markets that are typically ultra-stable, like Treasury bonds. Two- and 10-year Treasury notes are both on track to record their biggest sell-off on record this year.

A significant reaction in markets is to be expected, given the historic shift in monetary policy this year. But those moves have also been exacerbated as the uncertainty about the future direction of monetary policy have pushed more cautious investors on to the sidelines. With fewer investors in the market, price swings become even more dramatic, a phenomenon some investors have described as a “volatility vortex.”

“In higher volatility moments, everything becomes correlated,” said John Briggs, head of US rates strategy at NatWest Markets.

“Even though what is going on in the UK, objectively, shouldn’t have any impact on the Fed outlook or inflation, the fact is that when markets move to that degree, no one is going to be immune. Volatility begets volatility,” said Briggs.

Two Fed officials this week have indicated that the crisis in the UK could potentially create problems for the US. Raphael Bostic, president of the Atlanta Fed said that the UK’s tax plan and the ensuing market volatility could increase the chances of tipping the world economy into a recession. New Boston Fed president Susan Collins also said that “a significant economic or geopolitical event could push our economy into a recession as policy tightens further.”

“There is money moving back and forth that keeps various national markets in line with one another,” said Gregory Whiteley, portfolio manager at DoubleLine. “It is natural spillover as money moves between markets to take advantage of changing prices.”