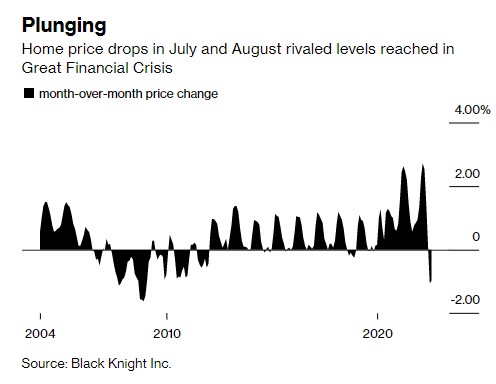

The Case-Shiller Home Price index is up 43% since the end of 2019. This unsustainable increase is reversing, and the headlines will read as if another 2008 is upon us.

Exhibit A:

Home prices fell 1.05% in July and 0.98% in August. With prices up >12% y/o/y, “plunging” is not how I would describe this. Normalizing seems more appropriate.

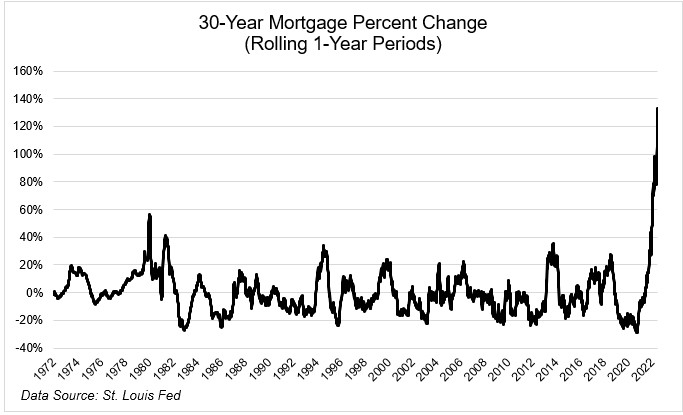

While the language might get hysterical, there’s no denying that this is in fact a wild period we’re living through. We’ve never seen mortgage rates double in a twelve-month period.

During normal times, home purchases are as qualitative as they are quantitative. But with the rapid increase in interest rates, math dominates emotions. It’s no longer about which home you want to live in, but which house you can afford.

Michael McDonough showed that a buyer could afford a $758,572 home assuming they put down 20% and paid $2,500 a month. Those same numbers now get you a $476,425 house. The math is the math.

Home prices need to come down to reflect the new reality. The downgrades are rolling in as Fitch Ratings, Moody’s Analytics, Goldman Sachs, and Morgan Stanley all call for prices to fall between 5 and 15%.

Tonight at 5:30 we’ll talk with Skylar Olsen, Zillow’s Chief Economist, who knows a thing or two about the housing market.

“If we assume a 7% mortgage rate, affordability looks materially worse than today. And the pace of its deceleration has already more than doubled compared to almost any time in history,” writes Morgan Stanley researchers. “The positive takeaway—which we think puts the magnitude of this [7% forecasted home price] drop into perspective—is that this decrease would only bring home prices back to where they were in January 2022. That is still 32% above where home prices were in March 2020.”