The other day, I saw a great post on Twitter, and it stuck with me. Unfortunately, I can’t recall who wrote it, but I saw it while scanning, and it basically said this…

Market commentary should be categorized into one of three buckets:

- Interesting

- Actionable

- Both

Love that. You should too. And here are the reasons why…

I’ll call it “My five realities about the market everyone needs to know.”

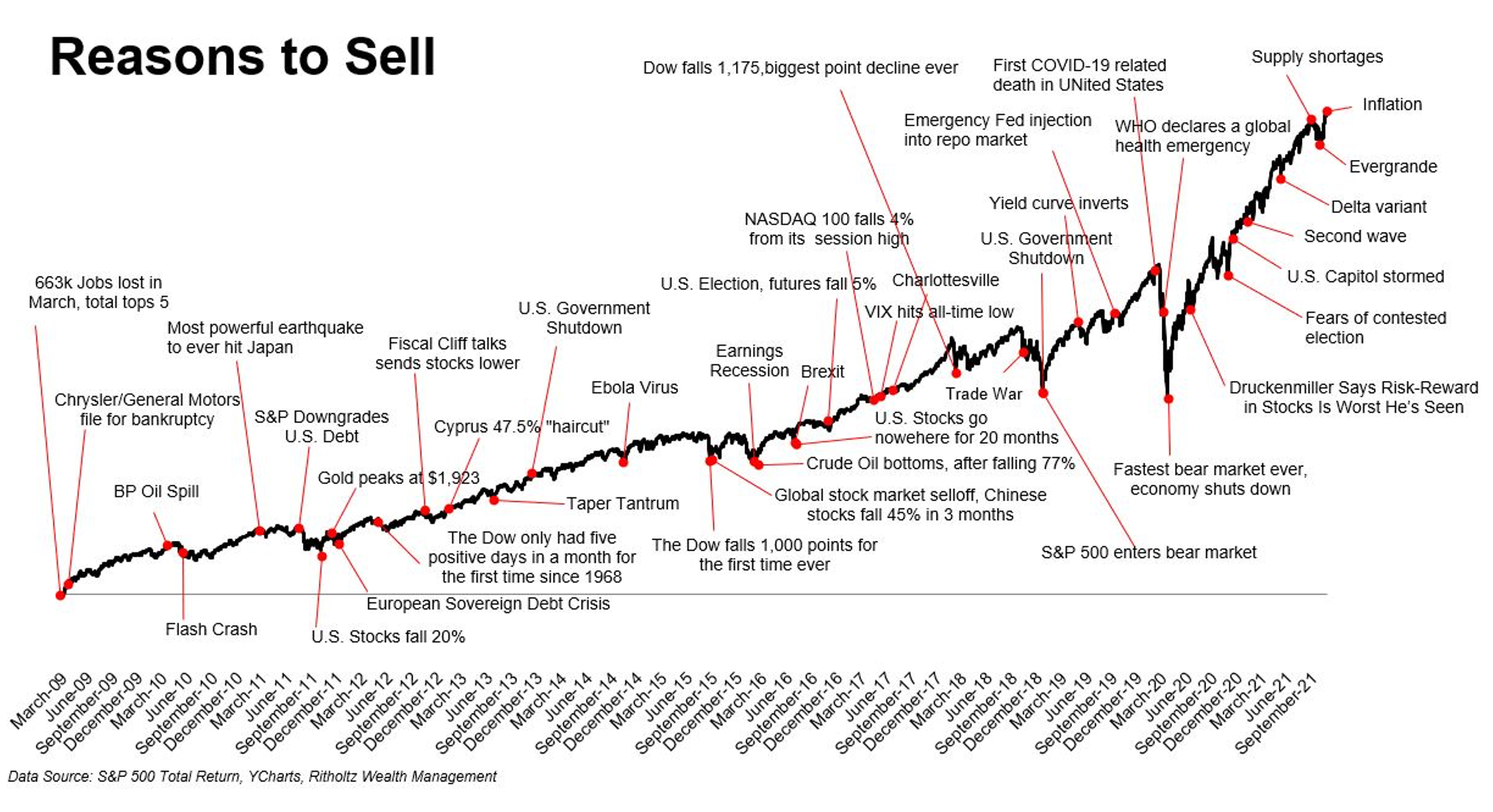

- Over the long-term, the stock market is batting 1000, and there is no historical event it has not overcome. I like to think in terms of probability and possibility, so this one is important. I’ve had this chart for years…there is no date on it, but I suspect it still makes the point.

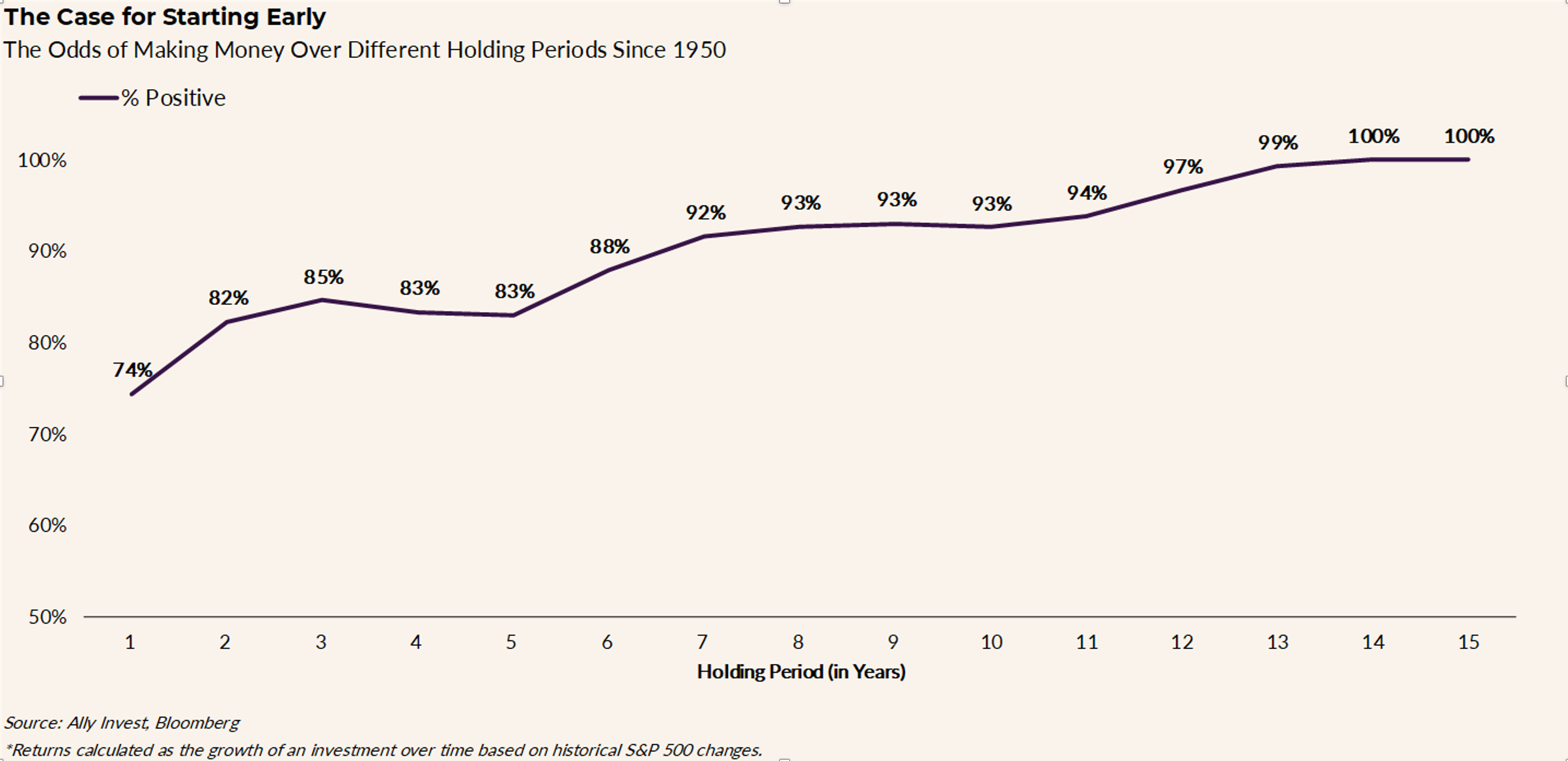

- Things get tough to guess/time/trade/maneuver/anticipate/react/position/etc in the short-term. See my recent blog on why you don’t remember many of the pullbacks we have seen since the 2000s. Here’s a graph to punctuate it. It’s showing the average drop in each separate calendar year is -14%, while returns end up positive in 32 of the 42 years shown…or 76% of the years. Again, probabilities and possibilities – put the odds in your favor just like you would in Vegas. It’s just that the investing odds are way better.

- Bear markets suck. They can happen in the blink of an eye. Most of you remember how fast we saw a drop between February 2020 and the end of March 2020. Most of you will also remember how long they can last…like the ~50% decline we saw between October 2007 and March 2009. We remember because we were starting Monument. We had a plan, stuck to it, and turned out like a diamond. The reality was that we started out as a piece of coal and then just stuck with the job. You can too.

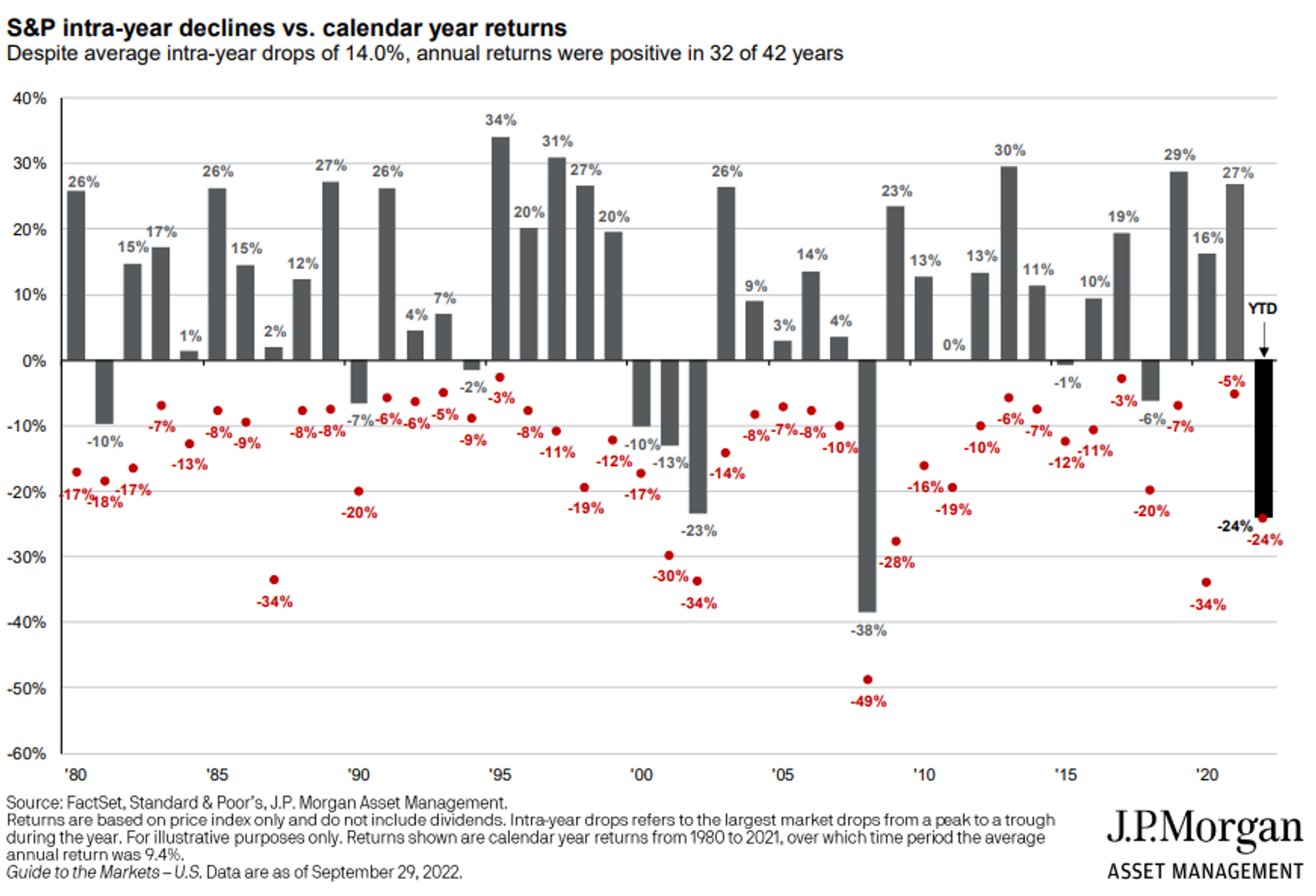

- There will always be something to agonize over. Chart credit @michaelbatnick (because I’ve always intended to build one of these myself but never have. Future intern project. Stay tuned.)

- And the bombshell you’ve all been waiting for…Number Five…No one knows jack shit. I’m not even going to write commentary…I’m simply going to publish some of the 2022 S&P 500 year-end predictions and the dates that came out of the big investment firms (roughly alphabetical).

- Barclays – 4,800 (12/2/2021)

- Bank of America, Savita Subramanian – 4,600 (11/23/2021)

- BMO, Brian Belski – 5,300 (11/18/2021)

- BNP Paribas, Greg Boutle – 5,100 (11/22/2021)

- Credit Suisse, Jonathan Golub – 5,000 (08/09/2021)

- DWS, David Bianco – 5,000 (12/1/2021)

- Goldman Sachs, David Kostin – 5,100 (11/16/2021)

- Jefferies, Sean Darby – 5,000 (11/23/2021)

- JPMorgan, Dubravko Lakos-Bujas – 5,050 (11/30/2021)

- Morgan Stanley, Michael Wilson – 4,400 (11/15/2021)

- RBC, Lori Calvasina – 5,050 (11/11/2021)

- UBS, Keith Parker – 4,850 (09/07/2021)

- Wells Fargo – 5,100-5,300 (11/16/2021)

- Yardeni Research, Ed Yardeni – 5,200 (11/28/2021)

As of today, the S&P 500 is trading at about 3780 (about noon on 10-4-2022).

Look, these people are smart; I’m not hating on them. In fact, they and their teams are so smart I could offer to work for them for no pay, and they’d say, “No thanks!”…that’s how smart they all are.

I’ve said it a lot: guessing is fun. It provides a platform for opinion sharing, debate, discussion, and some appropriate discourse, but being smart doesn’t make them good guessers.

And here’s a NEWS FLASH – you are not a good guesser either.

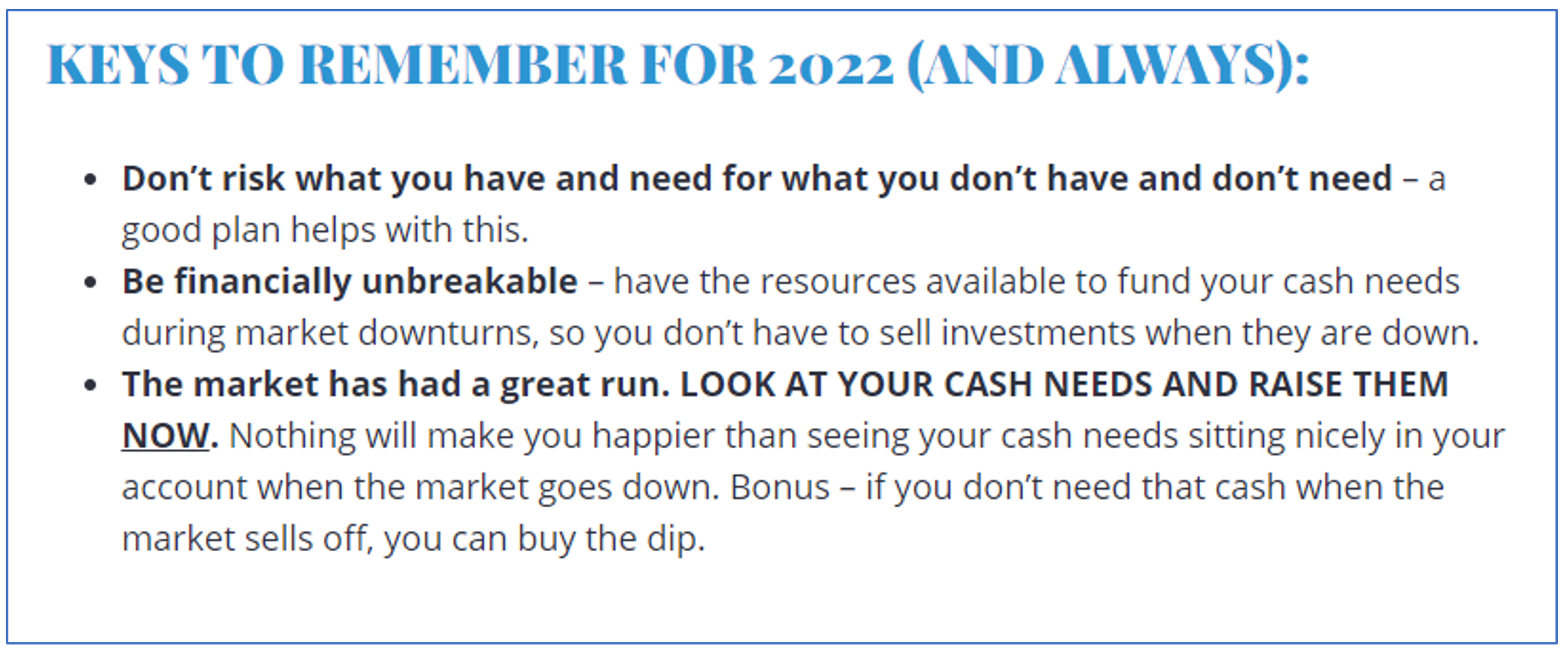

Put the odds in your favor, have a good plan, and make good decisions.

See my blog from December 2021, where I review my thoughts on a few published 2022 predictions.

Also, here’s my concluding “thought blurb” from that post:

I’m not trying to rub it in. I’m just highlighting that sometimes the best advice is just good fundamental decision-making and getting the big things right.

If you are feeling like shit right now, PLEASE remember this feeling so that when the market gets back to the levels we saw in January (and we will…someday), you can tune up your plan, reallocate your portfolio, and raise the cash you wish you were living out of right now.

Check out our most recent episode of the Off the Wall Podcast, where we free form discuss the current market volatility and put some things into perspective that can be helpful for keeping a clear head.

Keep looking forward.