The European Central Bank’s rate-setters have expressed concerns over the potential for “self-reinforcing” inflation, with governments’ fiscal packages and the weakness of the euro threatening to push up prices for years to come.

Monetary policymakers, now battling record high inflation of 10 per cent, warned that the nature of the price-setting process was changing, with price growth becoming “self-reinforcing, to the point that even a projected weakening of growth was not sufficient to bring inflation back to target”.

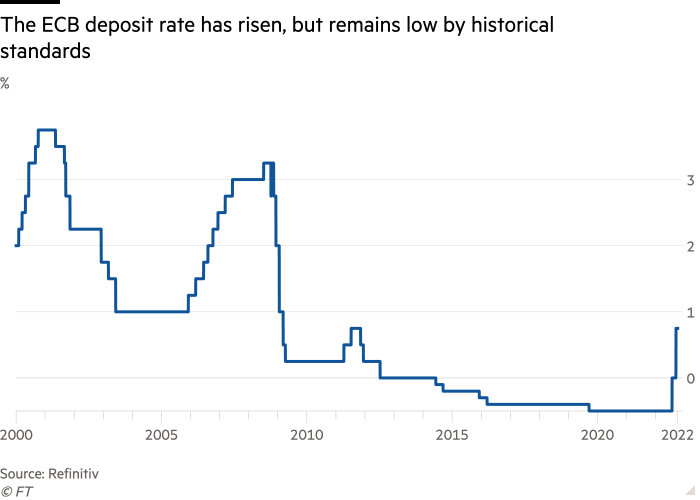

The comments came in the minutes from the ECB’s September monetary policy meeting, when the benchmark deposit rate was increased by 75 basis points, a record margin for the central bank, to 0.75 per cent.

The statements, which were published on Thursday, will reinforce expectations of large interest rate increases in the months ahead, despite concerns the region’s economy is edging towards a recession.

The eurozone’s growth prospects have been hit hard by Russia’s invasion of Ukraine, with the region’s energy crisis also triggering the surge in inflation.

Rate-setters highlighted the priority placed on bringing price pressures closer to their 2 per cent target, stating that “growth concerns should . . . not prevent a needed forceful increase in interest rates.” They also argued that acting “forcefully” now could avoid the need to increase interest rates more sharply later in the economic cycle when the economy was slowing down.

“[The account] gives green light for further large hikes,” said Ken Wattret, head of European analysis and insights at S&P Global Market Intelligence.

Markets are pricing in a 66 per cent probability of a 75 basis points increase at the next meeting on October 27. There is a 34 probability of a full percentage point rise.

The minutes warned that a number of indicators pointed to an increased risk of inflation staying high over the long term.

“The longer high inflation persisted, the higher the risk that inflation expectations could become unanchored and the costlier it would be to bring them back to target,” said the minutes.

Since the policy announcement on September 8, eurozone inflation has come in higher than expected.

Despite the large rate increases over the summer, the ECB members said that the key policy rates remain “significantly below the neutral rate,” at which they neither stimulate nor limit activity.

Andrew Kenningham, chief Europe economist at Capital Economics now saw the deposit rate rising to 2.5 per cent by the end of this year and a peak of 3 per cent early next year.

The weakness of the euro, which has fallen to multi-decade lows against the dollar in recent weeks, was also a concern for the central bank. “Without a timely reduction in monetary policy accommodation, inflationary pressures resulting from a depreciation of the euro might increase further,” the minutes said.

Governments’ response to the energy crisis constituted “an upside risk to inflation,” according to the ECB. Members agreed that measures to tackle energy prices should not be too broad, and instead should be “temporary and targeted at the most vulnerable households and firms in order to limit the risk of fuelling inflationary pressures.”

Overall, inflation risks remained “tilted to the upside over the entire projection horizon,” the minutes said.