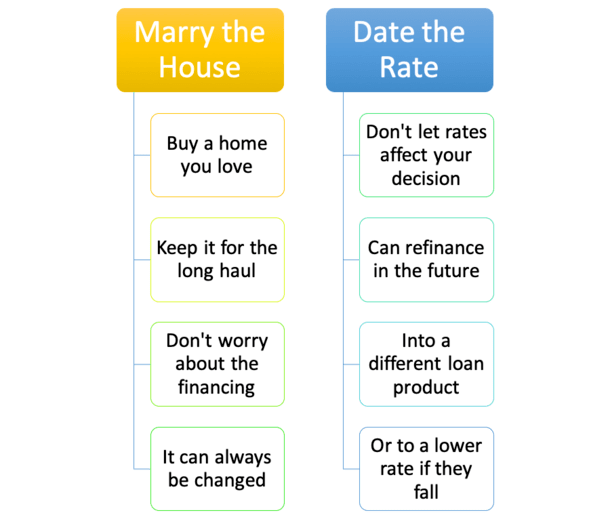

Lately, I’ve been seeing the old “marry the house, date the rate” adage thrown around a lot.

The idea is relatively straightforward. You buy a home you really want, regardless of available financing terms.

And the mortgage rate you receive, even if high today, isn’t your forever rate because you can always refinance down the road.

But is it truly that simple? And does the whole thing hinge on interest rates being more favorable in the future?

What if you want to divorce the house? But you’re too afraid to leave that low rate behind?

Marry the House. Like for Forever?

Let’s dissect the term by breaking it down into its two sections. First, we’ll discuss the “marry the house” piece.

A lot of folks buy a particular piece of property because they fall in love with it. It’s typically emotional.

There’s also a presumption that many people buy a forever home that they plan to keep, well, forever.

Simply put, they plan to stay in the property for the long haul, and as such are essentially marrying the thing.

After all, a marriage is expected to persist, not just last a year or two.

In reality, we know this isn’t the case, but the intention is there, despite what may transpire after the wedding day.

At last glance, the average tenure for an American homeowner was 13.2 years, per the National Association of Realtors (NAR).

This was for the year 2021, a slight dip from 13.5 in 2020, but well above “historical standards.”

Back in 2012, it was just 10.1 years, and before that it was even lower, often just six years.

So are Americans really marrying their homes, or long-term dating them?

Date the Rate (But Keep Looking for Better)

Now let’s incorporate that second piece, “date the rate.” As the saying suggests, your financing can be temporary, similar to your last date.

You don’t have to keep the same home loan, even if you keep the house.

Assuming there isn’t a prepayment penalty, you are openly able to refinance your mortgage at pretty much any time.

For example, if you bought a home in 2008 when 30-year fixed mortgage rates averaged around 6%, you might have refinanced into a new 30-year loan at 3-4% a few years later.

And you may have refinanced again a few years after that when mortgage rates hit record lows, dropping into the mid-2% range.

In other words, not staying faithful to your original home loan or your mortgage lender/servicer.

And why would you if interest rates drop by 50%?

This Idiom Typically Surfaces When Mortgage Rates Are High…

The saying “marry the house, date the rate” makes a lot of sense in hindsight, after mortgage rates have fallen significantly.

But it often doesn’t surface until mortgage rates are “high,” at least relative to what they had been recently.

The phrase essentially exists to lessen the blow of a high(er) mortgage rate. To take attention away from it and focus on the emotional piece of buying a home.

You really love that home, you want that home, so who cares what mortgage rates are?

There will always be a time to refinance in the future once mortgage rates go down again.

And that’s kind of the kicker. What if interest rates don’t go down? What if you’re not able to refinance because you don’t qualify for a mortgage in the future?

There are a lot of what ifs to consider. There’s also the fact that your purchase price drives both the down payment requirement and the property tax basis.

So while you might be able to date your mortgage rate, then dump it in the future, it won’t change how much you needed to put down based on the purchase price.

Or what you pay in annual property taxes, barring a favorable assessment in the future if prices come down.

So really, we’re talking about dating with the expectation that you’ll find a better date in the future.

This isn’t always the case and it’s surely not a guarantee.

If You’re Dating Your Rate, Why Not Take Out an ARM?

Now if you’re truly buying into the marry the house, date the rate argument, shouldn’t you take out an adjustable-rate mortgage (ARM).

After all, it will offer a significantly lower interest rate than a 30-year fixed (the one).

ARMs are mostly hybrids these days with long periods of fixed-rate goodness (5/1 ARM or 7/1 ARM), meaning you can date your rate for a good amount of time before looking for a new date.

Dating for five or seven years seems like an adequate period of time, doesn’t it?

After that, or even during that period, you can move on so to speak, assuming interest rates improve.

You might be able to move into something more permanent, like a 30-year or 15-year fixed mortgage.

Why go with the forever mortgage if you’re not that serious to begin with? Might as well have some fun with the ARM while you’re still testing the waters.

If you’re not looking for a serious commitment, why get involved with a 30-year fixed? Especially one you have to pay a premium for?

To sum things up, the phrase does provide a good opportunity to take a harder look at the intersection of mortgage and homeownership, despite the saying’s obvious flaws.

If you are a prospective home buyer, it is important to consider both the purchase price and the financing available now and in the future.

But you shouldn’t necessarily put more weight into one or the other, as things don’t always turn out as they seem.

The irony today is many homeowners probably want to stay married to their ultra-low mortgage rate, but ditch the house.