Back in the March 2019, I wrote up the merger between U.K. based Mereo BioPharma (MREO) (~$100MM current market cap) and OncoMed Pharmaceuticals (formerly traded as OMED) as a way to play the contingent value rights that were issued to OMED shareholders. The CVR part of the thesis hasn’t worked out, at least yet, there are still potential milestones on Navicixizumab in play before the CVR expire on 4/23/24. Since closing out that trade (I received MREO shares in the merger but sold immediately at $5.30, shares trade for $0.95 today), I’ve checked in on the company occasionally as the CVRs naturally have Mereo counterparty risk. On the most recent of those check ins, I came across two Seeking Alpha write-ups (here and here) by Dalius Taurus of SSI that piqued my interest.

Mereo BioPharma has six product candidates, four purchased from larger biopharmaceutical companies (Novartis and AstraZenca) that previously received considerable investment in the pre-clinical stage but were no longer strategic priorities and two product candidates inherited from the OncoMed acquisition. MREO’s market cap is approximately $100MM (MREO trades as an ADR, each MREO share equals 5 ordinary shares) and last reported a cash balance of $105MM (current conversion rate, MREO reports in GBP) as of 2021 year end, after some cash burn, it likely has a small positive enterprise value.

Similar to most pre-revenue biotechs these days, Mereo’s investors have lost their patience funding development pipelines, Rubric Capital (~14% owner) has stepped up as an activist to stop the cash burn by attempting to reconstitute the board of directors. Rubric has its eyes on gaining control of the board, then monetizing assets and returning cash to shareholders in what amounts to a liquidation. Rubric is run by David Rosen, who was a portfolio manager at SAC Capital (now Point72) before going on his own in 2016. It just so happens that the second largest MREO shareholder is Point72 with 8.6%, likely friendly to Rubric, further increasing the likelihood that Rubric gains board seats in the proxy campaign as the current board/management owns an insignificant amount.

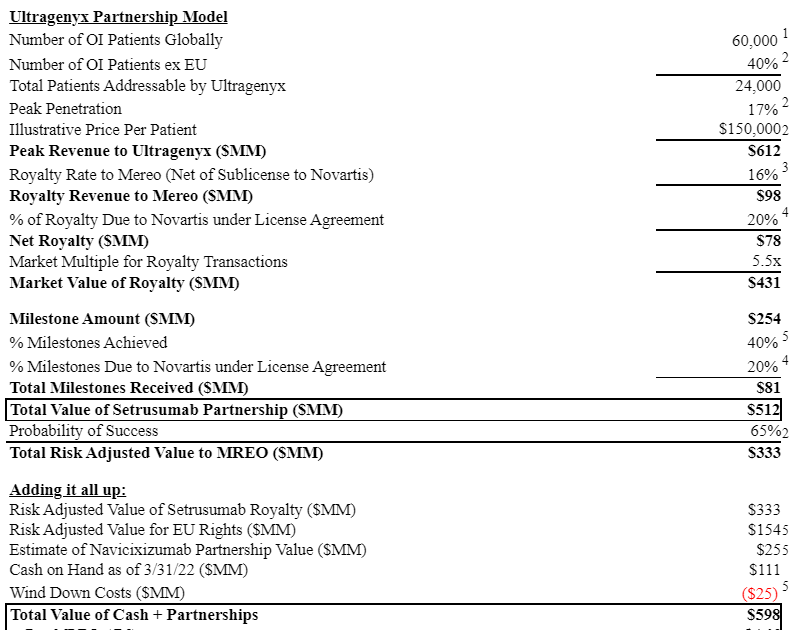

Below is the back of the envelope valuation math provided by Rubric in their 6/9/22 letter:

I have little way of confirming or refuting their valuation, but even if they’re wrong by half the stock is approximately a double from here. Mereo’s most valuable asset according to Rubric is their partnership with Ultragenyx (RARE) on Setrusumab (originally purchased from Novartis) which is a treatment for a rare bone disease, osteogenesis imperfecta (“OI”), that currently has no approved therapies. Mereo retained the commercial rights for Setrusumab in the UK and Europe, otherwise Rubric is ascribing no value to Mereo’s other product candidates, including Alvelestat which is a treatment for a rare lung disease undergoing clinical trials.

Alvelestat is the one product candidate that came from AstraZenenca (AZN). In June, which to be fair is a lifetime ago in this market, The Times of London reported that AZN was considering a bid for MREO:

Word is that it is considering a bid for Mereo Biopharma, a specialist in cancer and rare diseases.

Mereo, which has developed a portfolio of six clinical-stage product candidates, is based in London but listed on the Nasdaq exchange in New York and lists AstraZeneca among its partners alongside Novartis, OncXerna and Ultragenyx. There are suggestions that at least one other suitor, possibly another partner, may also be on the prowl.

Shares in Mereo have been a stinker, shedding almost 80 per cent of their value in the past year, although they jumped by 8.5 per cent to 69 cents on Wednesday, valuing the company at $81 million. Analysts have an average target price of $7 and the talk is that Mereo would accept $5, equating to $500 million including American depositary receipts or ADRs. Evercore and Citigroup are said to be involved as advisers.

This article came out around the same time as the Rubric letter, they might be related, or it might be coincidence. Even if the Setrusumab valuation is overstated, there might be other assets worth something here. Rubric and Mereo’s management have been going back forth on Rubric’s request for a special meeting, Mereo seemingly was citing every technicality why Rubric’s request was ineligible but eventually relented and the special meeting is now set to happen sometime in November. It appears that a new board will be put in place shortly, we’ll see what happens from there. I bought a small position.

Disclosure: I own shares of MREO and some non-tradable OMED CVRs