Sponsored by

Context is important for vision. Managing risk at the household level – known as householding – can provide greater transparency across holdings to create a more complete picture of risk. Seeing how everything works together enables a bigger picture understanding of what’s going on.

Advisors who can do this well, not only for the accounts they manage but also for investments outside their relationship, can better support their clients’ full financial goals.

Capturing the context of client portfolios

Different accounts make it easier for firms or advisors to manage client assets and distinguish them among types, such as a retirement account or an advisory account.

But that is not how clients see themselves.

Clients’ wealth – and portfolio risk – are the sum of their accounts together. Clients often have accounts with multiple relationships, such as a 401(k) plan with their employer or a 529 college savings plan in a different system. Such accounts are also part of their total wealth.

Looking at a list of accounts could confuse clients as to what they are supposed to understand about their investments.

Let’s consider for a moment the ancient parable about blind men and an elephant. Each man, who could not see, felt a different part of the elephant to make sense of it. But because they each only touched one part of the animal, it skewed their experiences, and ultimately, led to contrasting descriptions about what kind of animal they had encountered.

Putting the puzzle pieces together

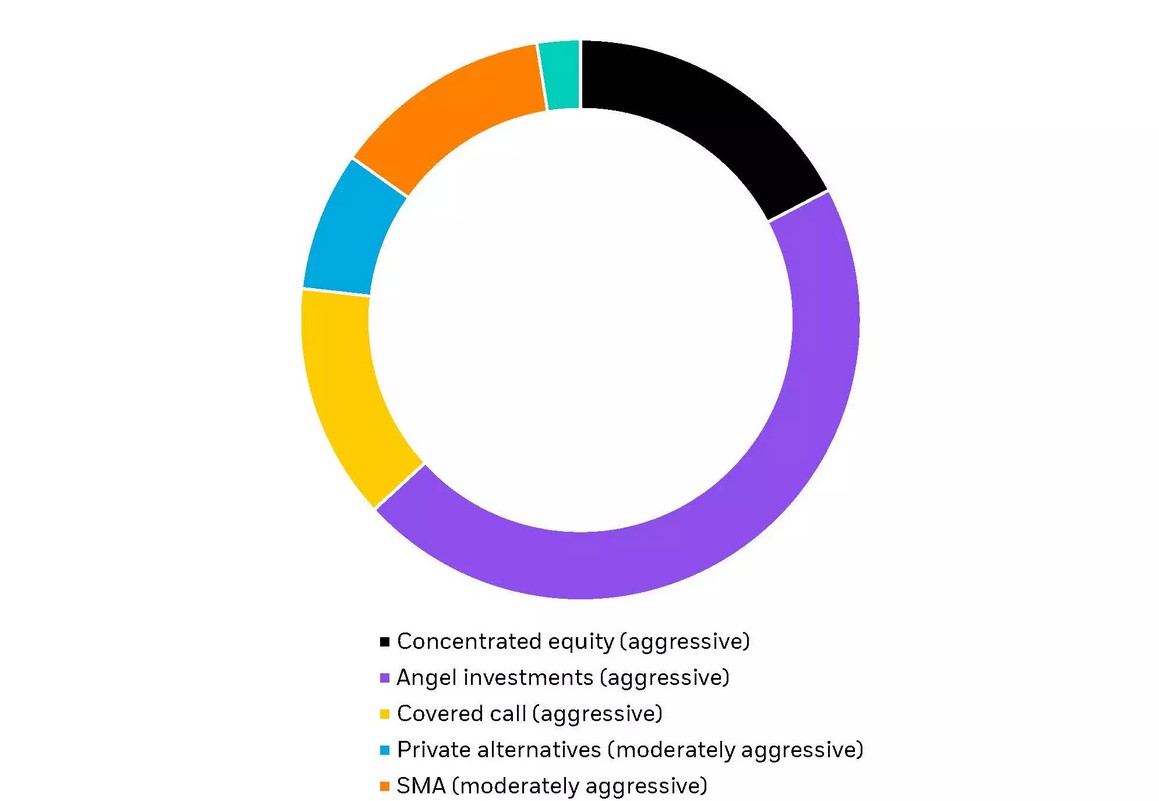

How can you minimize such assumptions when it comes to managing portfolios? Here’s an example to explore householding further. We selected the portfolio of a hypothetical Barbara Smith. In her household, she has six accounts including a concentrated equity account, municipal bond account, covered call strategy, private alternatives, SMA account and angel investments account. The respective portfolio risk of each account varies significantly at 23.01, 3.31, 18.08, 10.67, 16.82 and 60.83. Below is the representation of all of Barbara’s accounts.

Portfolio risk of individual accounts in Barbara Smith’s household

For illustrative purposes only.

When you look across her accounts, notice their variations in investment style. If you view Barbara’s accounts as part of a household, you’ll see that she is an overall aggressive style investor. She doesn’t mind taking on additional risk if there’s potential for additional return, and she is open to taking positions in angel investments that might relate to causes she believes in.

Her angel investments account comprises most of the portfolio risk. Is this an issue to flag?

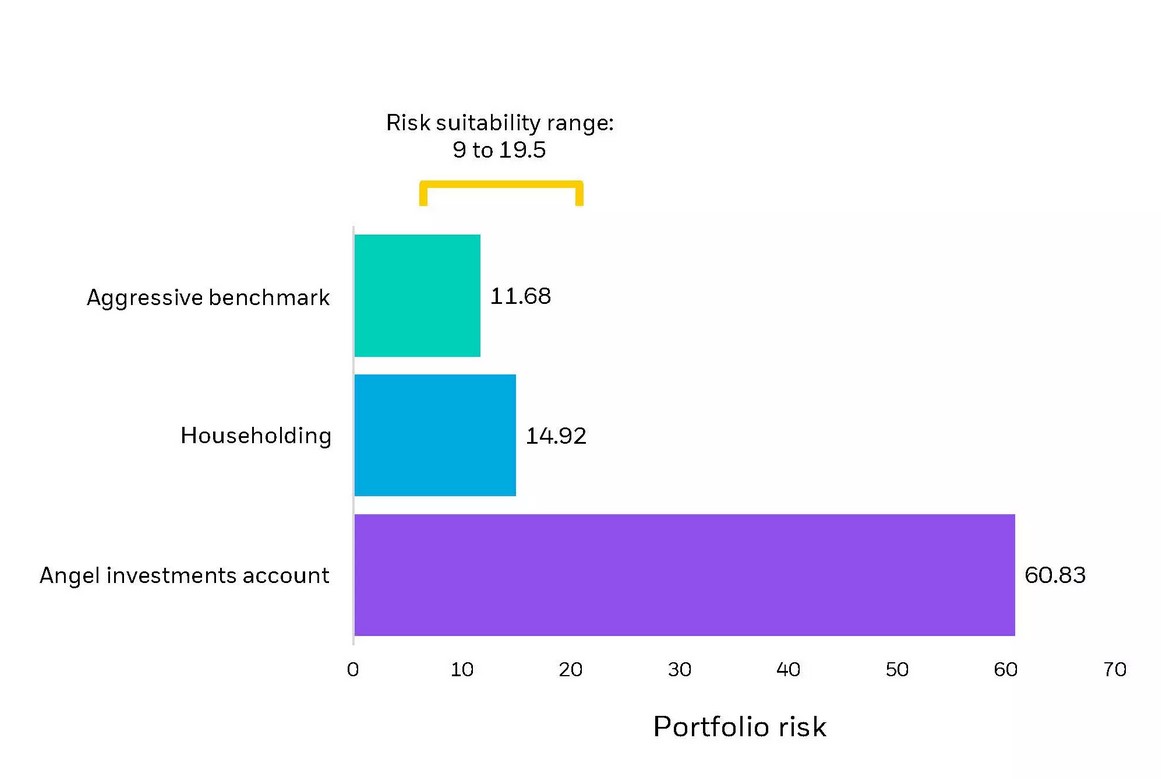

When we look at the risk of that account in isolation, it seems like it could be.

You’ll see that at a portfolio risk of 60.83, the angel investments account seems far outside her risk suitability range. As defined by her advisor’s firm, it’s between 9 to 19.5. But what about at the household level?

What does householding look like?

When viewed as part of the household, the risk taken is well within the risk suitability range established by the advisor. The householding analysis is more representative of the overall risk she’s taken on across all six accounts.

If the household risk had been out of range, the advisor could have looked at the underlying accounts to figure out a solution to align Barbara’s full portfolio with her financial goals.

Don’t lose sight of client assets with narrow vision

That’s why householding matters in getting to know a client. An incomplete picture could lead to less favorable positions. Imagine the weather’s getting chilly outside, and you need a coat. Is one already hanging in your closet? Folded in a box somewhere? Plopped on a stack of clothes on a chair?

Your wardrobe is all your clothing combined, not just one coat, and it can be in various places. A household is the totality of accounts, the investments inside them and wherever they may be held.

With householding, clients’ risk exposure can be better aligned across advisory, brokerage and assets currently held away from advisor relationships.

A more complete view with Aladdin Wealth™

The Aladdin Wealth™ platform can help wealth managers perform analyses and proposals at any level – by an account, a group of accounts or total householding including external assets. It provides transparency into risks taken across a client’s total wealth. When financial advisors have a deeper understanding of the full risk picture, it enables them to better align those risks with clients’ portfolio goals.

© 2022 BlackRock, Inc. All rights reserved.

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Performance and risk calculations, including those incorporated into Aladdin Wealth technology, are based on assumptions, historical correlations, and other factors (such as inputs provided by the Aladdin Wealth users) and are not assured to predict future results. All graphs and screenshots are for illustrative purposes only. BlackRock’s Aladdin Wealth platform is a financial technology platform designed for institutional, wholesale, qualified, and professional investor/client use only and is not intended for end investor use. Aladdin Wealth users undertake sole responsibility and liability for investment or other decisions related to the technology’s calculations and for compliance with applicable laws and regulations. The technology should not be viewed or construed by any Aladdin Wealth users, or their customers or clients, as providing investment advice or investment recommendations to any parties. This material should not be construed as a representation or guarantee that use of Aladdin Wealth technology will satisfy your legal or regulatory obligations. BlackRock, as provider of the technology, does not assume any responsibility or liability for your compliance with applicable regulations or laws. For additional information on any of the descriptions contained herein, please contact your Aladdin Wealth Relationship Management representative. BlackRock may modify or discontinue any functionality or service component described herein at any time without prior advance notice to you.

In the U.S. and Canada, this material is intended for public distribution. In the UK, this material is for professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the EEA, this material is for professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. In Singapore, this advertisement or publication is intended for public distribution and has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is intended for public distribution. The technology and the material have not been reviewed by the Securities and Futures Commission of Hong Kong. In Japan, this is for Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In Brunei, Indonesia, Philippines and Malaysia, this material is issued for Institutional Investors only. In Latin America, for institutional investors and financial intermediaries only (not for public distribution). No securities regulator within Latin America has confirmed the accuracy of any information contained herein. Please note that IN MEXICO, the provision of investment management and investment advisory services (“Investment Services”) is a regulated activity, subject to strict rules, and performed under the supervision of the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, the “CNBV”). BlackRock does not provide, and it shall not be deemed that it provides through Aladdin Wealth technology, any personalized investment advice to the recipient of this document, by reason of its use or otherwise. These materials are shared for information purposes only, do not constitute investment advice, and are being shared in the understanding that the addressee is an Institutional or Qualified investor as defined under Mexican Securities (Ley del Mercado de Valores). Each potential investor shall make its own investment decision based on their own analysis of the available information. Please note that by receiving these materials, it shall be construed as a representation by the receiver that it is an Institutional or Qualified investor as defined under Mexican law. BlackRock México Operadora, S.A. de C.V., Sociedad Operadora de Fondos de Inversión (“BlackRock México Operadora”) is a Mexican subsidiary of BlackRock, Inc., authorized by the CNBV as a Mutual Fund Manager (Operadora de Fondos), and as such, authorized to manage Mexican mutual funds, ETFs and provide Investment Services. For more information on the Investment Services offered by BlackRock Mexico, please review our Investment Services Guide available in www.blackrock.com/mx.

©2022 BlackRock, Inc. All rights reserved. BLACKROCK and ALADDIN WEALTH are trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owner.