Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back much of October’s gains fairly quickly.

I have been turning this over slowly in my mind, trying to assess their thinking here. I am not sure what models they use, what data they think is most important, what impact their actions will have, and perhaps most importantly, exactly what they are hoping to accomplish.

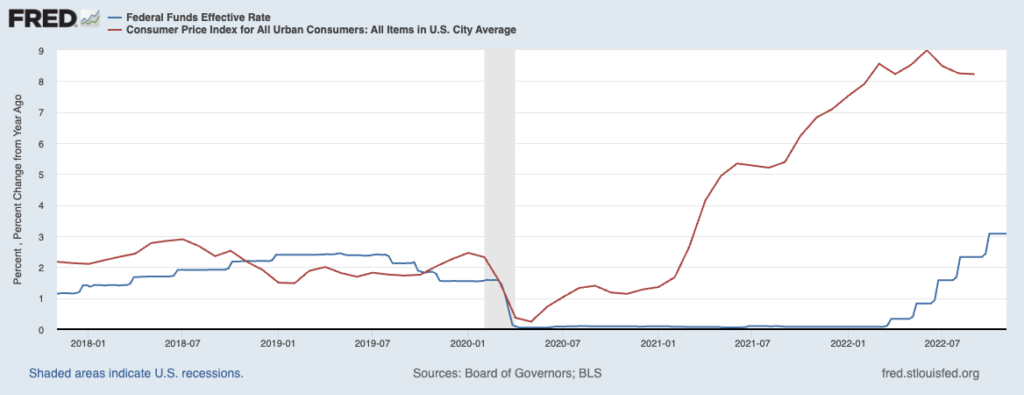

I direct your attention to the chart of CPI and Fed Funds Rate above.

I don’t care what your personal theories on monetary policy might be, your thoughts on Milton Friedman, or who you plan on voting for next week. Instead, I challenge anyone to look at that chart and tell me this crew has the slightest idea WTF they are doing.

In March 2001, CPI ticked through the Fed’s 2% inflation target, and their reaction was . . . nothing. They remained on the emergency footing of zero. A few months later, CPI was over 4%; by June, it was over 5%, October, higher than 6%, and they finished 2021 with CPI over 7%. And still, crickets.

It wasn’t until March 2022, 2 years after the pandemic panic, that the FOMC deemed it ok to start raising rates.

The post Behind the Curve, Part V appeared first on The Big Picture.