Like many small business owners, you send customers bills after providing a product or service. An effective invoicing system gives customers more flexible payment options. You need to know which types of invoices to send customers for different situations.

Types of invoices

There are many different types of invoices you can send to customers. Each type of invoice has a specific purpose.

The following are six types of invoices in accounting that you might send to customers.

1. Pro forma invoice

A pro forma invoice is not a demand for payment. You can think of this document like a pre-invoice. You send a pro forma invoice before completing work for a customer.

The pro forma invoice shows the customer how much to pay you once you deliver a product or perform a service. You can also use a pro forma invoice to show the value of items you give away, such as a gift.

Usually, a pro forma invoice estimates the work you will do and how much items will cost. The pro forma invoice represents a commitment to provide something. The terms in a pro forma invoice can change as the project proceeds.

2. Interim invoice

An interim invoice breaks down the value of a large project into multiple payments. You send interim invoices as you complete the large project.

The larger the project, the more you spend on labor, materials, and other operating costs. Interim invoices help you manage your small business cash flow for large jobs. You don’t have to wait until the end of the project to receive payments. Instead, you can use money from interim invoices to cover some of the costs.

3. Final invoice

As the name implies, you send a final invoice after you complete a project. The final invoice lets the customer know the work is done. Unlike a pro forma invoice, the final invoice is a demand for payment.

Your final invoice should include an itemized list of the products and services you provided. You should also note the total cost, due date, and payment methods.

Be sure to send final invoices immediately via mail or online after completing work. That way, you can keep cash flowing into your business at a healthy rate and avoid collections problems.

4. Past due invoice

Sometimes, your customers don’t pay you by the due date on the final invoice. When this occurs, you need to send a past due invoice. Send past due invoices immediately after an invoice becomes late.

A past due invoice reminds customers that their payment due dates have passed. Include all the information from the final invoice on the past due invoice. Also, include any late fees or interest penalizing the customer for paying late.

If past due invoices don’t work, you might have to take a different approach for customers who won’t pay. Consider changing your payment terms, setting up a payment plan, or hiring a collections agency.

5. Recurring invoice

Use recurring invoices to bill customers for ongoing services. You charge the same amount periodically, similar to some utility bills.

Using a recurring invoicing system works well for subscription-based businesses. And, you could use recurring invoices if your customers have memberships to your company. For example, if you own a gym and members pay a monthly fee, recurring invoices might be the best billing option.

Entrepreneur Renzo Costarella explained recurring invoices in a Due.com article:

When you have on-going projects with the same client, it’s often best to use a recurring invoice. With these you and the client will agree upon a billing interval (usually weekly or monthly) and the invoices will automatically bill at the set interval. The client will eventually make this part of their routine, which gets you paid quicker.”

6. Credit memo

Instead of charging a customer, you use a credit memo to acknowledge that you owe them money. The credit memo will be equal to or less than the amount of the customer’s original invoice.

You might send a credit memo because your customer returned goods, products you sent were damaged, or you sent the wrong item. With a credit memo, you can refund the amount the customer originally paid or offer credit to your customer on a future purchase.

Creating an invoice

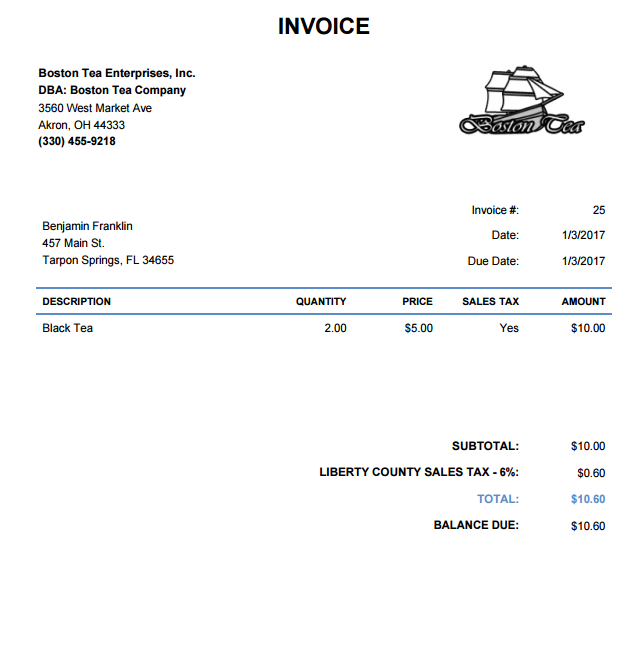

Each type of invoice has its own unique purpose. But, usually, invoices contain the same key information. Make sure your invoices include the following items:

Date of the invoice: Let customers know which day you created the invoice.

Customer contact information: Customers want to be sure the invoice is intended for them. State the customer’s name, business, address, and phone number.

Your business’s information: Customers need to be able to reach you. Include your name, business, address, email address, and phone number on the invoice.

Items purchased: Create an itemized list of each product and service you provided. Next to each item, write the individual cost.

Total amount due: State the total payment amount you expect to receive from the customer.

Payment terms: Note the date you expect to be paid by. Also, detail how you want the customer to pay you. For example, do you accept checks, credit cards, or cash? Is there a specific address where customers should send payments? Clear invoice payment terms make it easy for customers to pay.

Invoice number: Number each invoice for your records. Make a note of the invoice number so that you can match it to payments in the future.

Use Patriot’s online accounting software to easily create invoices and record payments. We offer free, USA-based support. Try it for free today.

This article has been updated from its original publication date of September 14, 2017.

This is not intended as legal advice; for more information, please click here.