One of the best aspects of getting the midterm elections behind us is that we no longer have to hear an endless firehose of drivel coming out of television, radio, and print media. It’s not merely that the main pundit narratives were wrong, but rather the entire framework for discussing elections has been deeply misguided for many election cycles.

I’m a 30,000-foot guy,1 so I want to consider some of the big-picture misses, misunderstandings, and fundamental failures that we heard about during this election cycle.

These 10 items reflect where the conventional wisdom was wrong and often 180 degrees from reality:

1. Markets Love Gridlock: Markets prefer2 an environment where future revenue and earnings streams are relatively easy to project, taxes are relatively low, and the rule of law provides certainty over contract and private property rights. At the same time, moderate fiscal stimulus and accommodative rates, both of which support the overall economy, are not disliked either.

Mid-terms tend to follow the first 2 years of a president’s term, which can be replete with fiscal stimulus. This often leads to higher economic activity and stock prices in presidential year 3. Some conflate this with post-mid-term gridlock; the data does not always support that view.

2. Sentiment Readings Are Junk: I have been ragging on sentiment and surveys for decades as worthless garbage. My prime reason is that they primarily inform you what has happened in the recent past. Negative sentiment tells you things were bad the past 3-6 months; positive sentiment informs us of the opposite. Hence, sentiment is a lagging, not a leading indicator.

But it’s even worse than that: Does it make sense that current sentiment readings are worse than the 1987 Crash, the 9/11 Terrorist Attacks, the Dotcom implosion, or the Great Financial Crisis? No, and therefore something else must be at work.

The post-GFC era gave us a new reason to distrust sentiment, as a motley assortment of Fed haters, anti-institutionalists, hard-core partisans, and autocracy supporters had no place to express their unfocused fury at the world. Their anger manifests itself in trolling pollsters and other readers of sentiment.

Hence, the causation is backward – negative sentiment does not reflect future behavior, but rather tells you that for some ~20% of the population, tribalism has become their dominant self-image. Hence, they answer surveys as a reflection of their partisan beliefs, not how they actually feel.

3. Roe v Wade Hurt Democrats: This is not to say that abortion rights are not a huge issue and were not motivators to many women and young voters. Rather, it’s more nuanced than it appears at first blush.

How did the Supreme Court’s decision to legalize abortion in 1973 hurt Democrats? I have argued over the years a very counterintuitive thesis: Roe v. Wade has worked to the advantage of conservative Republicans in purple states and counties. Those candidates’ argument has been “Hey, my personal views on abortion do not matter because Roe is the law of the land.” Since 1973, pro-life candidates were able to get elected without having to defend their anti-choice positions.

That argument is no longer operative and those candidates who are Pro-life/Anti-choice can no longer hide behind SCOTUS. Hence, the Dodd case overturning Roe mattered a great deal to a large swath of women and young voters, especially those in influential swing states and suburbs.

4. Inflation? Less Important: The perfect manifestation of the sentiment issue has been the rise of inflation as issue #1 in surveys. The election results strongly suggest that this was incorrect. Inflation matters but so too does the overall economy — the unemployment rate, wage gains, and fiscal stimulus during the pandemic. In other words, it’s complicated and nuanced, something surveys manage poorly.

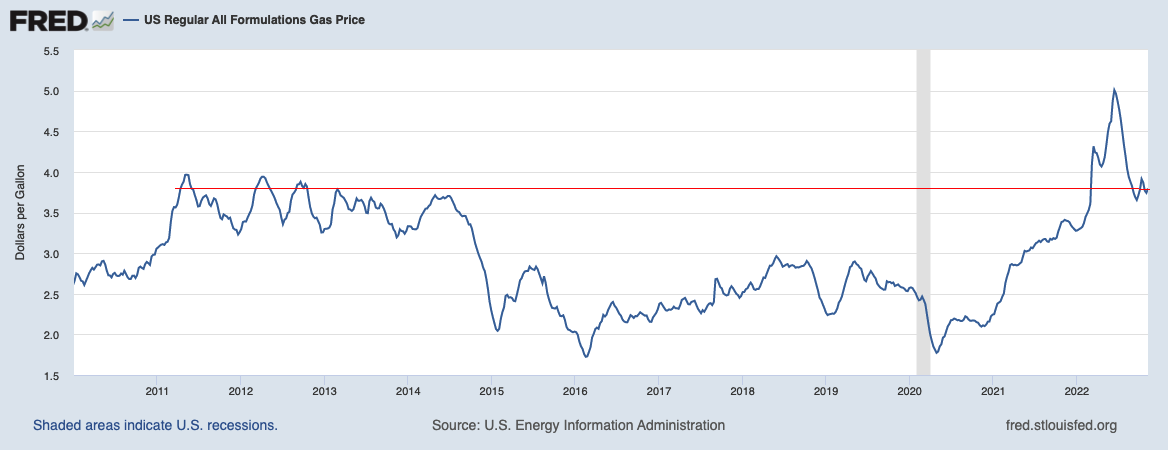

This is a big shocker but perhaps it shouldn’t have been. We have had 15 years of low inflation and modest wage gains; perhaps some simply accepted that we were overdue. Also, energy prices are 3% of a family’s budget today; it was triple that in the 1970s. (Gasoline costs the same as it did in 2011-12). I am not suggesting that inflation is not a problem but it also is not the catastrophe it has been portrayed in the media. Inflation in goods has been falling, and the idea that companies have been abusive is getting more traction.

Give the public $5 trillion in spending cash along with higher inflation for 18 to 24 months – that is a trade most median-income earners (or less) would gladly make.

5. Polling Is Fundamentally Unsound: Ask people what their future behavior is going to be, and under the best of conditions the answers you get range are false. Humans just are not good at forecasting their own future state of mind and what actions they might take at some distant point in time. political polling suffers from this perhaps more than other forms of polling.

Polling in the past two elections undercounted GOP voters; polls this election undercounted Democratic voters. The consistent theme is that the polls are unreliable.

6. All Models Are Wrong: The models that project voting activity are deeply problematic, relying on weather, local turnout, and other variables. But it also is dependent upon who answers their landlines(!), in an era where the under 40 set no longer has landlines and fraud/spam calls have led people to not answer numbers they don’t recognize.

As I noted the day before elections:

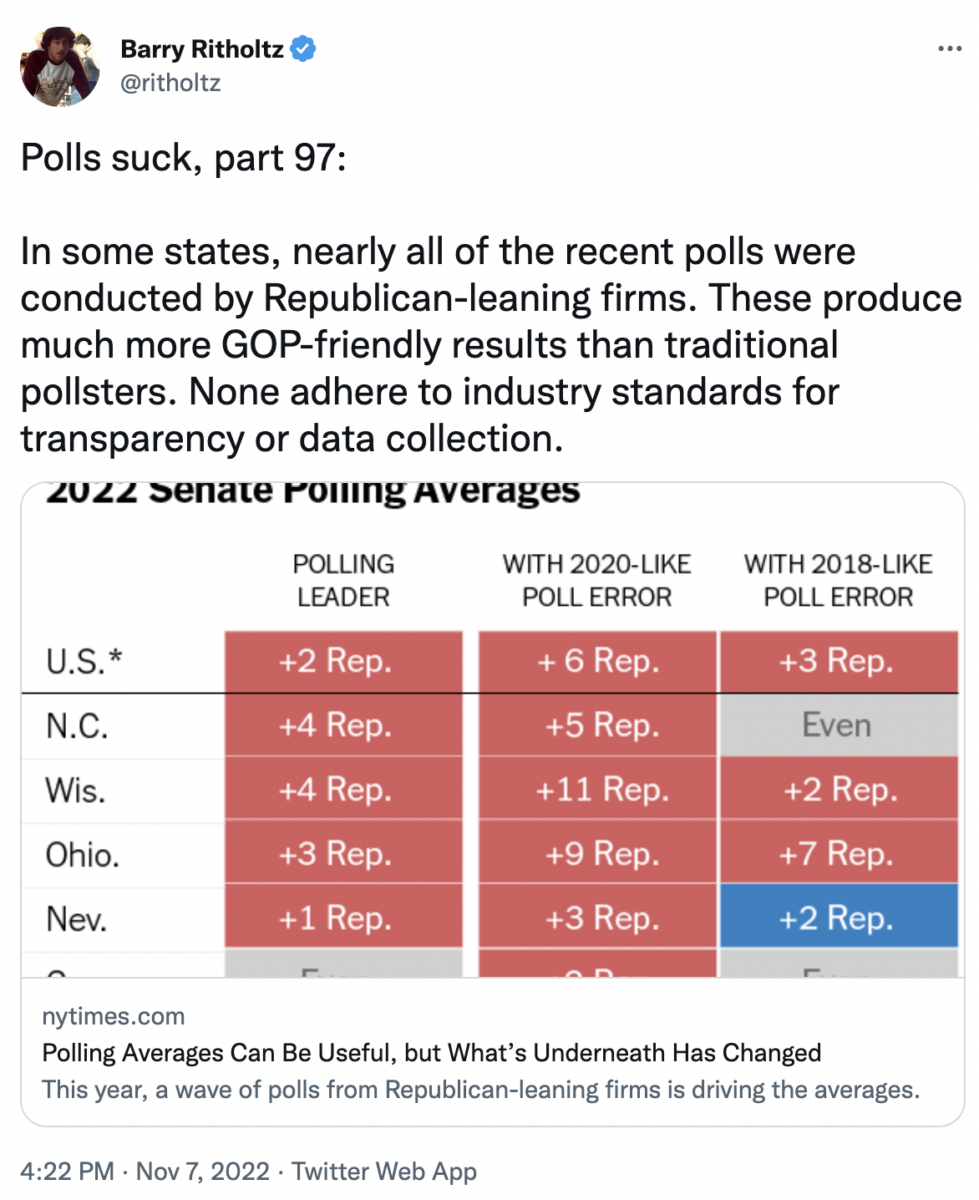

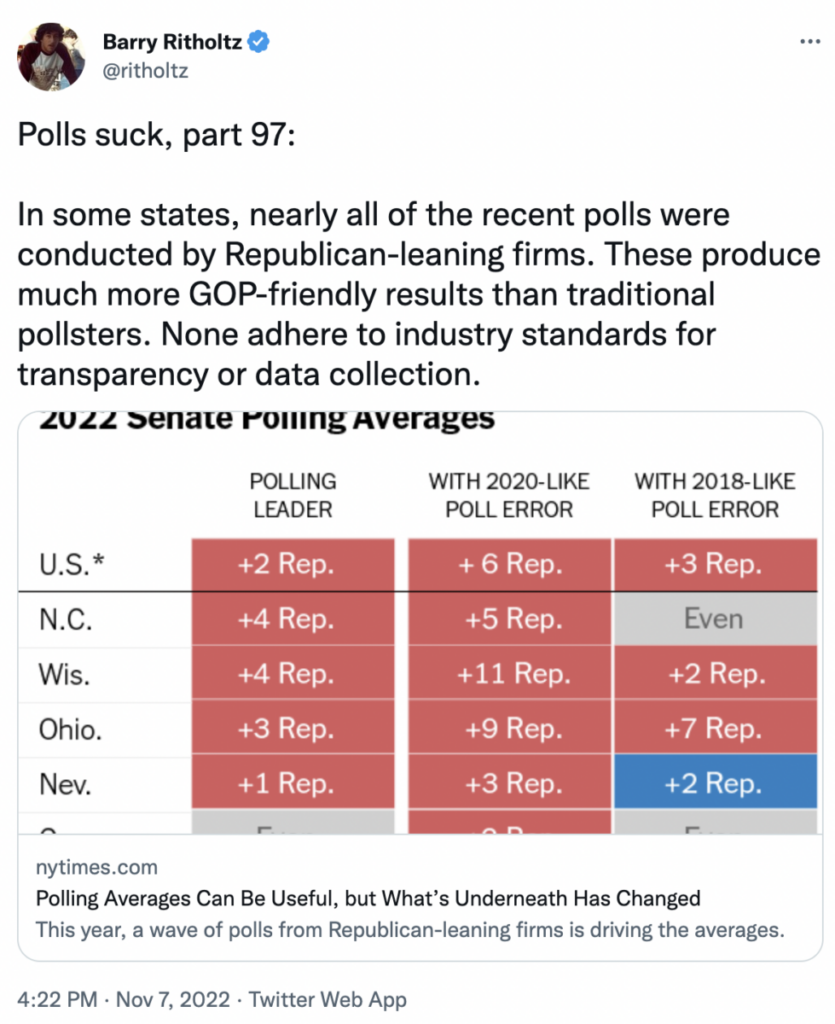

Polls suck, part 97:

In some states, nearly all of the recent polls were conducted by Republican-leaning firms. These produce much more GOP-friendly results than traditional pollsters. None adhere to industry standards for transparency or data collection.https://t.co/TCScc0ou6w

— Barry Ritholtz (@ritholtz) November 7, 2022

Working the refs remains in vogue, and one way to do that is to influence the “Poll of Polls” – the average of ALL polling data. The assumption was that it encourages your base and discourages the other side. This may be more conventional wisdom that is now called into question.

7. The January 6th Hearings Were Very Influential: Conventional wisdom was that the January 6th hearings did not influence voters. while it did not move the needle for partisans on either end of the political spectrum, it clearly had an impact on independent voters and others concerned with the sanctity of elections.

8. Candidates Matter: As much as the national news likes to focus on the big issues – inflation, abortion, and war in Ukraine – it’s the local issues that drive local voters. We see that in the over and underperformance of people from the same party performing very differently. The difference in votes for Governors and Senators in the same state – see Nevada, Arizona, Georgia, and Pennsylvania – suggest that party affiliation is not a monolith.

One piece of conventional wisdom has held up well: Politics remains local and personality-driven.

9. The Control of the GOP is Complicated: Who controls the Republican Party? Is it the base? Is it Donald Trump? What about traditional non-MAGA moderate Republicans? Is it future stars such as Ron DeSantis or Greg Abbott? the answer seems to be an amalgam of all the above.

Conventional wisdom has completely marginalized traditional moderate Republicans and overemphasized the influence of Donald Trump.

10. Conventional Media Does Not Understand the National Zeitgeist: The conclusion of all of the above is that the national media base focuses on the wrong issues and oversimplifies complexity in the service of creating a better narrative with the resulting poorer understanding of the circumstances.

The complaints that the media is politically biased miss the point; they are instead focused on storytelling and clickbait and other forms of poor reportage that simply fail to depict reality as it is. What some people see as partisanship I read as lazy.

~~~

I love doing these exercises to see if I can identify where the crowd or an institution reflecting that group is wrong.

If the conventional wisdom is so wrong about elections, just imagine how wrong it can be about stocks, bonds, markets, valuation, the Fed, inflation, and earnings…

Previously:

What’s Driving Inflation: Labor or Capital? (November 7, 2022)

Is Partisanship Driving Consumer Sentiment? (August 9, 2022)

Are Markets Wise — or Probabilistic? (March 26, 2020)

_____________

1. This blog ain’t called the Big Picture for no reason

2. Sorry to anthropomorphize markets, but…