When Tesla and SpaceX founder Elon Musk launches a new venture, investors pay attention. Investors have been wondering how to buy Boring Company stock since the Company’s launch in Dec. 2016.

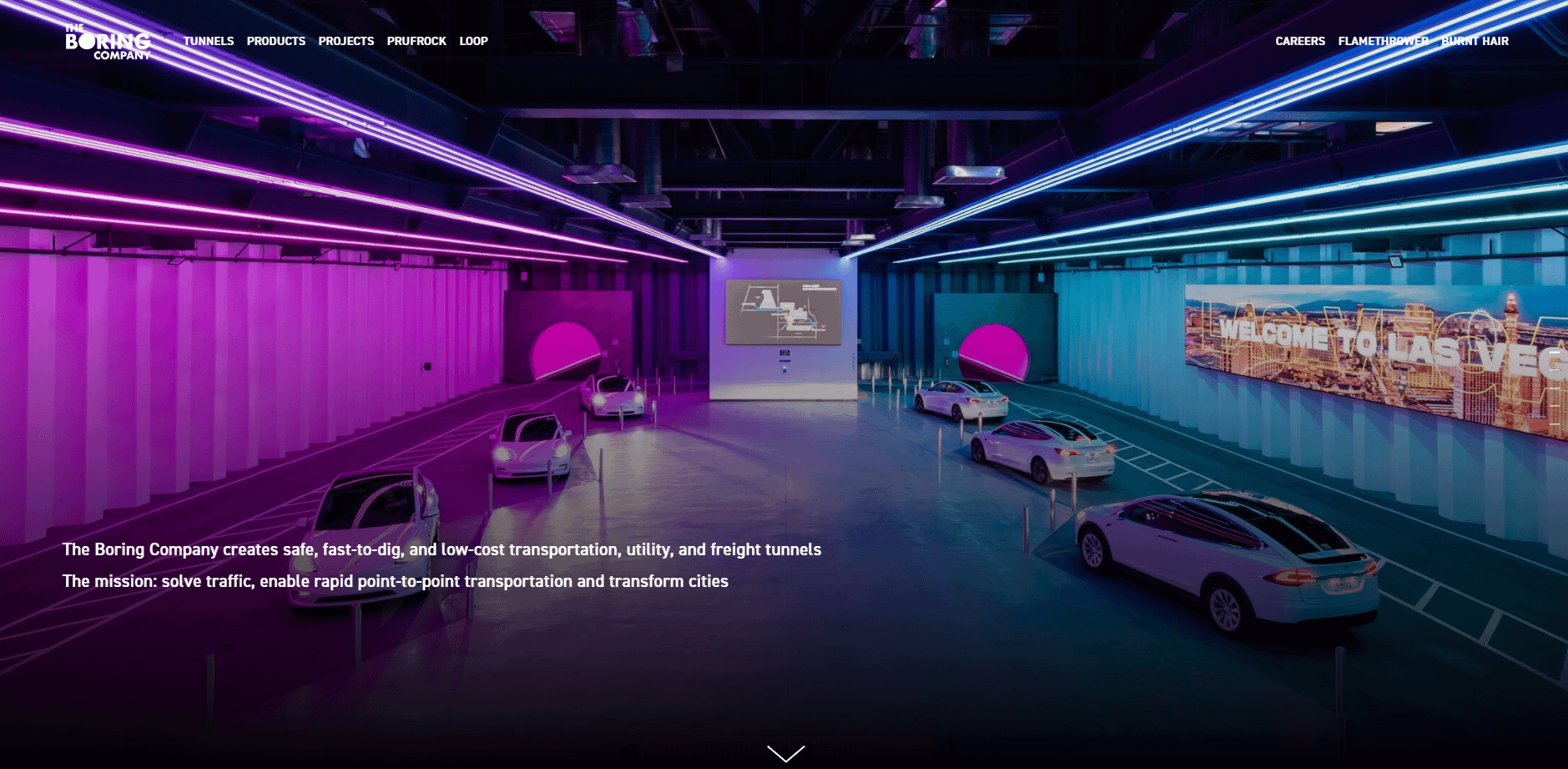

The Boring Company intends to shake up urban transportation by moving it underground, making the construction and deployment of underground transport systems faster, cheaper, safer, and more efficient.

That goal has obvious appeal, and if the Company can pull it off it could have a remarkable future.

What Is the Boring Company?

| The Boring Company: Fast Facts | |

|---|---|

| Industry | Underground Transportation |

| Key Products/Services | Loop, Prufrock |

| Key Competitors | Virgin Hyperloop, TransPod |

| Founder and CEO | Elon Musk |

| Founded In | 2016 |

| Website | https://www.boringcompany.com/ |

| Current Valuation | 5.675 billion |

| Projected IPO Date | None |

The Boring Company builds tunnels. If that sounds, well, boring, think again. Think of it as a new take on an old approach to urban transportation.

The Boring Company is inextricably linked to its founder, Elon Musk, and fittingly for a Musk company, it appears to have been conceived on Twitter, while Musk was stuck in traffic.

Musk officially founded The Boring Company on that same day – Dec 17, 2016 – so he probably didn’t come up with the idea while writing those tweets. It’s not the first time he’s complained about traffic, though, and it is plausible that his frustration with traffic gave birth to The Boring Company.

The Boring Company is focused on building tunnels. Tunnels have been around for centuries, but Musk’s vision was to bring tunneling – or boring – into the 21st Century, deploying new technology to build faster, safer tunnels for transporting people and freight.

The mission is to “solve traffic, enable rapid point-to-point transportation, and transform cities.

The Boring Company puts it this way:

To solve the problem of soul-destroying traffic, roads must go 3D, which means either flying cars or tunnels are needed. Unlike flying cars, tunnels are weatherproof, out of sight, and won’t fall on your head.

Tunnels minimize usage of valuable surface land and do not conflict with existing transportation systems. A large network of tunnels can alleviate congestion in any city; no matter how large a city grows, more levels of tunnels can be added.

The Boring Company pursues these goals with two products.

Loop

Loop is “all-electric, high-speed underground public transportation”. It is not a rail system, but more a highway in a tunnel. Passengers board individual vehicles (provided by Tesla, of course) and are brought to their destination station with no intermediate stops.

A loop system is already operating at the Las Vegas Convention Center (LVCC), with three large stations. The system has transported up to 26,000 passengers per day, with an average ride time of under two minutes and an average wait time of 15 seconds. It is designed to handle up to 4,400 passengers per hour.

The larger Vegas Loop project was approved in October 2021, and will expand the LVCC loop to a 29-mile network with 51 stations, capable of handling 57.000 passengers per hour.

The Boring Company plans to use autonomously driven Teslas operating at up to 150 miles per hour, but the current operation in las Vegas involves human drivers and speeds closer to 35 mph. The limits are imposed by Nevada regulators.

Prufrock

Prufrock is The Boring Company’s purpose-built tunnel borer. It can dig a 12-foot diameter tunnel at 1 mile a week and is designed to “porpoise”, meaning it can enter and leave the ground itself, without having to be placed in or extracted from a pit.

Prufrock enables continuous tunneling, with precast segments placed as the machine bores.

The system allows the Boring Company to offer tunnels specifically optimized for utility, freight, pedestrian, and other uses, with a range of surfaces, lighting, ventilation, fire safety systems, and CCTV coverage.

Product offerings include project engineering, environmental review, and permit acquisition.

Hyperloop

Hyperloop is a proposed high-speed transportation system that would have passengers traveling in electric pods at speeds that could exceed 600 miles per hour. The system would use Boring Company tunnels.

A test track has been built and test pods have reached speeds up to 288 mph, but there is no indication of when the system will be deployable and no assurance that it ever will be.

The Boring Company has a number of test projects in progress, but the Las Vegas Loop project is its only revenue-generating enterprise as of October 2022.

When Will the Boring Company Hold Its IPO?

The Boring Company has not filed for an IPO and has given no indication that it is planning an IPO. The Company has adequate funding and has no immediate need to go public.

If you want to buy Boring Company stock you’ll have to look for private shares on the pre-IPO market If you find shares you’ll have to accept that you may have to wait for a fairly long time before those shares are publicly tradeable.

There is no assurance that the Boring Company will ever hold an IPO or that the shares will be publicly traded.

What Do We Know About the Boring Company’s Fundamentals?

Quick answer: almost nothing.

The Boring Company has not filed an IPO prospectus. It is not a subsidiary of a publicly traded company, so it’s not required to disclose any financial information.

The Boring Company has one active project, the LVCC Loop, and one project in progress (the Vegas Loop). Any revenues would come from these projects. The LVCC Loop project cost roughly $47 million, but it’s not clear how much of this was booked as Boring Company revenue.

Ongoing revenues for the LVCC project are heavily constrained by Nevada regulators, who have limited the speed and the number of vehicles deployed and prohibited the use of autonomous driving technology.

TechCrunch reports that The Boring Company receives $167,000/month to keep the LVCC project working, with additional payments based on the number of passengers carried and the number of events served. The Company pays the drivers, security staff, and other employees from these amounts.

Continued constraints on capacity could limit the revenues drawn from the project.

One source claims that revenues are $2.7 million annually, without citing a source.

Multiple sources state that The Boring Company has around 200 employees.

Given the minimal amount of information available, an investment in The Boring Company has to be regarded as highly speculative. Most people seeking to invest will be drawn mainly by Elon Musk’s reputation.

The Boring Company’s Financing

The Boring Company has raised $908 million in three funding rounds.

| Date | Investors | Amount | Round |

|---|---|---|---|

| April 2018 | Elon Musk | $113 million | Late VC |

| July 2019 | Threshold Ventures, Vy Capital, Valor Capital, 8VC, Craft Ventures | $120 million | Late VC |

| April 2022 | Sequoia Capital, Valor Equity Partners, Founders Fund, Vy Capital, DFJ Growth, 8VC, Craft Ventures | $675 million | Series C |

The most recent funding round, in April 2022, left the company valued at $5.7 billion.

How Can I Buy Boring Company Stock?

Boring Company stock does not trade on any public exchange. It is a privately held company. You will not be able to buy shares in a conventional broker transaction until after the Company holds an IPO, assuming that it does.

It may be possible to acquire Boring Company stock from pre-IPO marketplaces that acquire shares from early investors or from employees who have received stock options as part of their compensation.

Pre-IPO Secondary Markets

These pre-IPO marketplaces make privately held shares available to selected investors. There is no guarantee that Boring Company stock or shares in any other privately held company will be available at any given time. These marketplaces may have investor qualifications and other requirements.

- Forge Global is now the world’s largest private share marketplace, since its merger with Sharespost. There’s a $100,000 minimum investment, and the minimum may be higher for some shares. There may be a qualification process.

- EquityZen acquires pre-IPO shares from early investors and employees who have received stock as part of their compensation. EquityZen states that they cooperate with the companies to assure recognized transactions. There’s a $10,000 minimum investment, with some companies having higher minimums. You will need to meet the revised SEC “accredited investor” criteria.

- Nasdaq Private Market provides access to private-company shares for investors who meet the SEC’s accredited investor criteria.

- EquityBee is a marketplace that allows investors to fund an employee’s stock options in return for a share of the proceeds.

⚠️ Warning: There are serious risks that come with investing in any pre-IPO shares. An IPO may not take place when inspected. It may not take place at all. That would leave you with shares that could be difficult or impossible to sell at any price.

📚 Learn more: about pre-IPO investing before considering a purchase. Review this guide to how to buy pre-IPO stock before you start!

Invest in the IPO

If pre-IPO shares are not available or if the minimum purchase or qualification requirements are prohibitive, you can consider investing in the IPO itself.

Most IPO underwriters allocate set numbers of shares to specific brokers for their clients. You’ll need an account with a broker that has a share allocation. You will tell your broker how many shares you want and they will tell you how many you can get. There is no assurance that you will be able to get a share allocation.

Many brokers have requirements for IPO participation, which you will have to meet.

- Charles Schwab requires a history of at least 36 trades and an account balance of $100,000 or above for IPO participation.

- E*Trade has no minimum account balance or trading history requirements for IPO participation. An eligibility questionnaire may be required by the underwriters of the IPO.

- Fidelity allows IPO participation for clients who meet a minimum household asset requirement or are in their Private and Premium client groups.

- TD Ameritrade offers participation in IPOs if they are part of the selling group. You will need a minimum account balance of $250,000 or 30 trades in the last calendar year to qualify for an IPO share allocation.

IPO shares may come with a lockup period, often 60 or 90 days. You will not be able to sell your shares until the lockup period expires.

IPO shares will cost more than pre-IPO shares. That cuts your potential gains, but you’ll also have less risk. If you buy at an IPO you know there will be a market for your shares when the lockup period expires, even if there’s no assurance of profit.

Invest After the IPO

The easiest and safest way to buy stock in The Boring Company is to wait until after the IPO. You can use your usual broker and there won’t be any special requirements or lockup period. You’ll be able to sell whenever you want.

If you buy after the IPO you won’t get in as cheaply as you would with an IPO or pre-IPO purchase. On the other hand, you’ll be able to buy as few or as many shares as you want, and you’ll have a chance to observe the stock’s market reception before you pull the trigger. That’s especially important if the company makes its debut during a generally weak market.

Getting in before the IPO is not a guarantee of quick profit. Not all stocks spike in value after an IPO. Some, even shares in quality companies, may sputter or even drop immediately after the IPO.

If you buy after the IPO you won’t get the rock-bottom prices that you would get from a pre-IPO purchase or the somewhat higher price you’d pay for participating in the IPO. On the other hand, you will be able to gauge the market’s reception to the IPO before you buy. Not all IPOs soar out of the blocks. Some of them crash.

For long-term investors, the price difference between a pre-IPO and a post-IPO purchase may not be large enough to justify the greater complexity and risk of buying early. If you’re in that bracket, a post-IPO purchase is probably the best way to go.

Are There Any Concerns About the Boring Company?

Any pre-IPO investment carries significant risks. information on the company is often very limited. There’s no assurance that an IPO will ever occur or that there will be a public market for the shares.

On top of those general risks, there are specific risks that go with an investment in the Boring Company:

- The technology is unproven. The LVCC Loop project is operating but at only a fraction of its intended capacity. The Loop system is intended to use Tesla’s autonomous driving technology to provide high-speed driver-free transport, and regulators are not yet convinced of the system’s safety. Failure to gain approval will limit the system’s marketability.

- Safety concerns. Aside from the concerns over autonomous driving systems, regulators have expressed concerns over the possibility of battery fires in tunnels, which would pose hazards for passengers, rescuers, and firefighters. Failure to gain approval or a serious incident would be a huge blow to the Company.

- The uncertain market for tunneling services. The Boring Company’s Prufrock system does not appear to have been deployed on any commercial project, other than those of the Loop system. Forge Global states that “the company has not yet completed any tunnels for public or commercial use”.

- Elon Musk. The charismatic CEO and founder is a huge source of appeal to investors, but he’s also a risk. The Boring Company is dependent on his continued involvement, and dependence on one individual is always risky. Musk’s behavior has at times been erratic and he is involved in large numbers of projects that could be distractions.

- Limited information. Very little is known about the Company’s financials or deals in progress.

These risks are significant, and The Boring Company has to be considered a highly speculative investment even by the standards of pre-IPO companies.

Conclusion

The Boring Company is a fairly unique entry in the private equity market. It is almost alone in its niche: there are many engineering and construction companies that build tunnels, but the Boring Company is the only one specifically formed to improve tunnel-building technology.

There’s a clear demand proposition – traffic is a massive problem in many places – but there is still no evidence that urban planners are going to turn to the Boring Company for solutions to their traffic problems. The limited stock of actual products and the regulatory issues and potential safety concerns faced by its flagship Loop project place this firmly in the speculative category.

If you’re interested in speculative investments and the Musk connection appeals to you, it might be worth looking for pre-IPO shores, though there’s no guarantee of finding them. Just be sure your fully aware of the risks, both of pre-IPO investing in general and of the Boring Company in particular!