Accounting errors are inevitable, especially if you’re rushing to add information into your small business accounting books. To detect accounting errors sooner rather than later, learn which ones to keep an eye out for and how to find them in the first place.

5 Types of accounting errors

Some accounting mistakes are small, while others are big. Either way, one error can cause a ripple effect, easily causing your books to become disorganized and inaccurate. To avoid making accounting errors, you need to know which ones to keep on your radar.

1. Making transposition errors

Ever write down a number or amount only to realize you flip-flopped a number? This is exactly how easily transposition errors can plague your books.

A transposition error is when you reverse the order of two numbers when recording a transaction in your books (e.g., 13 vs. 31). Transposition errors can occur when you’re writing down two numbers or a sequence of numbers (e.g., 2553 vs. 5253).

This type of accounting error can happen anywhere you record numbers, including in:

A transposition error can cause overspending, inaccurate books, and not paying enough in taxes.

2. Reversing entries

Debits and credits can be confusing. Even the most seasoned business owner or accountant may switch up entries every once in a while. To avoid any issues with your books, watch out for reversed entries.

Reversed entries cause issues with your debits and credits balancing. Plus, they can throw off your accounting records and reporting.

While making any type of entry in your books, double-check your work to ensure everything is accurate. If you catch an error along the way, fix it as soon as you can to avoid any other problems.

3. Omitting transactions

Let’s face it: As a busy business owner, you’re going to forget to do something every once in a while. One task that could slip your mind is recording a transaction (big or small) in your books. And when this happens, you deal with the consequences of omitting entries.

Errors of omission can spell doom for your business books. Even one small missed transaction can cause issues.

Record every transaction your business makes, no matter how much it is. And, try to record it as soon as possible so it doesn’t slip through the cracks. Record entries in your books regularly to avoid any issues (e.g., every week).

4. Tossing out receipts

Have a habit of tossing your business receipts in the trash? If so, you could be making a big accounting blunder.

It’s oh-so-important to hold onto certain receipts when you run a company. Why? They can come in handy when you find an accounting discrepancy or have an audit.

As a common rule of thumb, keep receipts that are $75 or more just in case a problem comes up. And, keep business receipts in your records for at least three years in case of an audit.

For safekeeping, you can digitally store receipts on your phone, computer, etc. Or, you may opt to have a paper filing system to organize receipts. Regardless of the method you use, make sure you hold onto receipts just in case you need them down the road.

5. Mixing funds

You know how oil and vinegar don’t mix? Well, neither do business and personal funds. And you probably guessed it—this is one major mistake many businesses make with their books.

Combining company and personal funds can wreak havoc on your business’s books. Tracking income and expenses can be difficult when you mix them together. Not to mention, it can be a disaster come tax time.

Keeping funds separate with a business bank account can help you maintain a better picture of your company’s cash flow and financial standing.

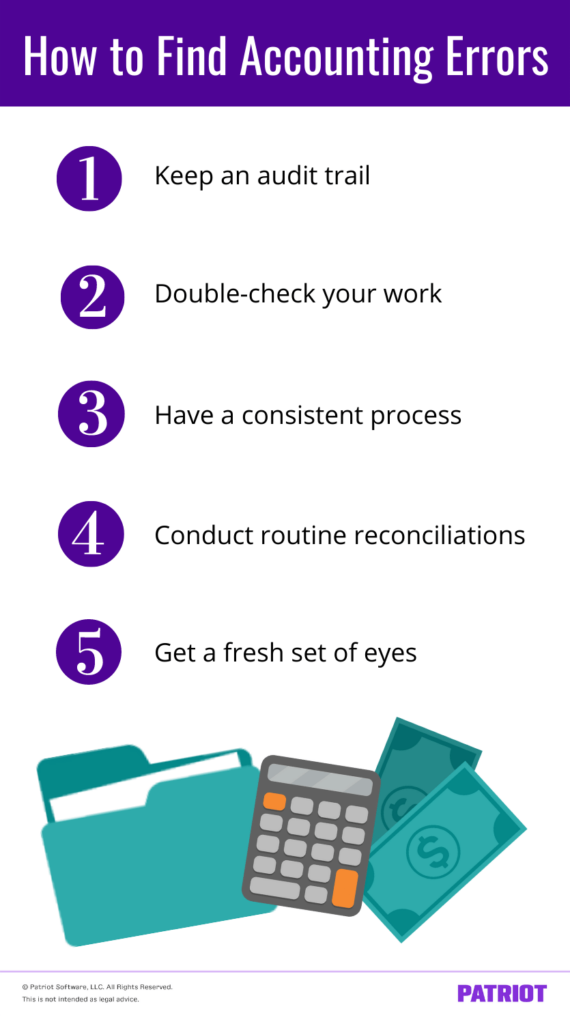

How to find accounting errors: 5 Tips

To stop accounting errors in their tracks, know how to detect them in the first place. Use these five tips to scour your books for accounting mistakes.

1. Keep an audit trail

If you’re looking for an easy way to track down accounting transactions and find errors, a good place to start is an audit trail.

For those of you who don’t know what an audit trail is, here’s a brief summary. An audit trail is a set of documents that confirm the transactions you record in your books. When you record transactions in your accounting books, you base the entries on your company’s purchases, sales, and expenses.

If you’re on the hunt to find accounting errors in your books, seek help from your audit trail. Because your audit trail details all of the information about transactions, you can use it to cross-check the information you recorded in your books.

2. Double-check your work

To find accounting errors in your books, you have to be willing to do a little extra legwork. So, what does this mean for you? This means taking extra time to double-check your work.

Go through your transactions and make sure what you inputted matches what you have on your documents (e.g., receipts). If you catch a discrepancy, change it right away.

At some point or another, you may make a mistake while inputting transactions in your books. This could include things like:

- Adding the transaction into the wrong account

- Flip-flopping numbers

- Misentering numbers

- Reversing entries

- Overlooking or forgetting to record a transaction

Mistakes can happen to even the most seasoned business owner or accountant, which is why you should always double (or triple) check your work.

3. Have a consistent process

Whether you record transactions and review your books daily, weekly, monthly, quarterly, or annually, you need to have a consistent process to find accounting errors.

Each time you review your books, be on the lookout for accounting errors. Try to keep your process as consistent as possible. That way, you can find accounting errors before they snowball into bigger problems.

If you don’t currently have a regular accounting process, consider starting one to catch accounting mistakes early on and prevent future issues.

4. Conduct routine reconciliations

This next tip goes hand in hand with having a consistent process. To find accounting errors, you also need to conduct routine reconciliations (e.g., bank statement reconciliation).

When you reconcile your accounts, you compare the numbers in an account with another financial record (e.g., bank statement) to ensure the balances match.

If you find a mistake when reconciling your accounts, adjust the affected journal entries. To do this, create a new journal entry to remove or add money from the account.

You should compare an account to things like your:

The more often you reconcile your accounts, the more likely you are to find accounting errors. Carve some time into the week or month to compare your accounts and ensure accounting errors aren’t going over your head.

5. Get a fresh set of eyes

You’re a business owner, not an accountant. So, you’re probably going to make accounting mistakes (especially when you’re just starting out) at some point. To help find errors in your books, have someone else review your work.

Maybe you’ve looked over your books two, three, or even four times. But sometimes, all it takes is a fresh set of eyes to catch an accounting mistake. Consider asking some of the following people to check over your books:

- Accountant

- Business partner, if applicable

- Manager/supervisor

- Employee or co-worker

You are less likely to let an accounting mistake slip through the cracks if you have someone else reviewing your books.

Keep in mind that although it’s a good idea to have someone else look over your books, you should limit how many individuals have access to them.

Searching for a way to keep track of income and expenses in order to avoid accounting errors? Patriot’s accounting software is easy-to-use and affordable. Try it for free today!

This article is updated from its original publication date of May 26, 2020.

This is not intended as legal advice; for more information, please click here.