This was not quite

the Autumn Statement many people were expecting. Public spending on

health and schools was increased a bit in the short term, welfare

payments were indexed to inflation with some icing on top, and cuts

to public spending were postponed to after the next election so may

never happen. If we discount the latter, the fiscal tightening was

all about raising taxes by not indexing allowances. By 2023/4, the

ratio of taxes to GDP (national accounts definition) will be nearly

37’5%, compared to just over 33% in 2019/20.

Of course none of

that means that most public services are not still in crisis, or that

the government’s assumptions about public sector pay are any less

painful (and strike creating), or that higher food and energy prices

are not going to stretch many people’s budgets beyond their limits.

The OBR’s forecast for falling average real disposable income last

March was terrible (the worst since WWII), but their forecast

yesterday (with less energy subsidy from the government) was a lot

worse.

The coming

recession

The OBR has

predictably followed the Bank in forecasting a recession, which we

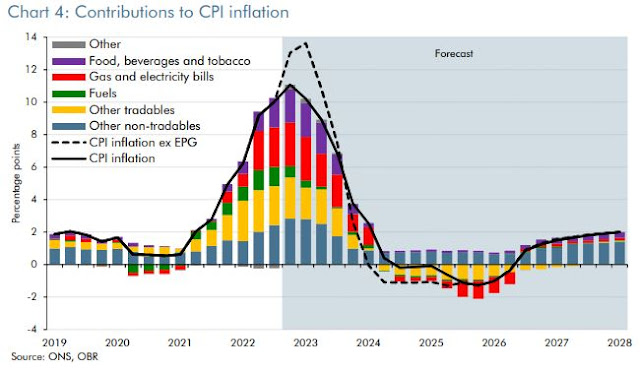

have already started. What is most eye-catching about their short

term forecast is what they expect to happen to inflation. The chart

below looks complicated but focus on the black line, which is their

forecast for inflation.

The OBR expects

inflation is currently near its peak, but it will soon come crashing

down. Indeed during 2024 it will fall to zero, and be negative during

2025/6, helped by modest falls in energy and food prices.

If you think that is

implausible, here is the reason (bottom left quadrant).

The OBR are

following their normal practice of taking their forecast of interest

rates from market expectations. These expectations have Bank rate

rising to 5% early next year, and then falling back to about 3.5% by

2028. There is no way this will happen if inflation follows the path

the OBR are predicting. As the Bank themselves say they don’t

believe these market expectations about what they will do, it is

slightly surprising that the OBR have stayed with them. It makes the

OBR’s forecast a bit weird, but I will try and rescue what I can in

the comments below.

The OBR’s forecast

for GDP is similar to the Bank’s latest forecast until about the

middle of next year (their

Chart 14), with both predicting falling GDP. Thereafter the OBR

is much more optimistic, forecasting a recovery in output of 1.3% GDP

growth in 2024 compared to a predicted further fall of 0.9% by the

Bank. But the OBR are much more pessimistic about the path of GDP

than they were in March (see Chart 1), which in the short term is

because in March they were not forecasting a recession, and in the

medium term because they now think energy prices will be permanently

higher which will reduce potential GDP. This is one of the reasons

for the need for fiscal consolidation in the Autumn Statement.

Another is higher

debt interest payments caused by higher interest rates and higher

debt. But here the implausibility of the path for short term rates

assumed by the OBR matters. These rates will undoubtedly be lower,

which will reduce borrowing costs particularly into the medium term.

So some if not all of the cuts to government spending pencilled in

for later years might not be necessary even if Sunak remains PM by

then (see Table 3 and page 51).

Of course with cuts

to personal income like those forecast, higher interest rates and

rising taxes (excluding energy subsidies), the recession could easily

be deeper than the OBR or Bank are forecasting. Is the OBR’s

forecast for the recovery plausible? Well lower interest rates than

they are assuming would help, but much depends on consumers. The OBR

have the savings ratio falling to just under 5% next year and 2024,

but then only recovering slightly to just over 5% thereafter. That is

below the historic average, but may be reasonable given how much

consumers saved during the pandemic.

The fiscal stance

The Chancellor has

sensibly avoided calls from some of his MPs and others to cut

spending in the short term, as such cuts would not have been

credible. His income tax increases over the next few years will not

help ease the coming recession and subsequent recovery, but their

demand impact will be smaller than spending cuts, and they are

probably necessary in the longer term. His failure to allow more for

public sector pay will cause considerable disruption in the short

term.

The government likes to say it is fiscally responsible. But one

definition of fiscal responsibility is sticking to your own fiscal

rules. It’s worth remembering that in 1998 Labour set out fiscal

rules which guided policy for 10 years until the Global Financial

Crisis. In contrast, since 2010 I have lost count of the number of

times the government has broken and then changed its own fiscal

rules, and today added to that count as we regress from a current

deficit to a total deficit target so public investment could be cut a

little (it falls from 2024 onwards).

So in the short term this Autumn Statement does very little to end

the crisis in most public services, and we will have public sector

strikes to look forward to. It also does nothing to moderate the

forthcoming recession or help the subsequent recovery, although

responsibility for the former has to be shared with the Bank. In the

medium term, more sensible fiscal rules (see

here) plus likely changes in the forecast will reduce

or eliminate the need for public spending cuts after the election.

In political terms this Autumn Statement does nothing to enhance the

Conservatives chances at the next election. Far from setting traps

for Labour, promising spending cuts after the election is not a

winning strategy when public services are already on their knees. If

the OBR is right, and 2024 does bring a recovery in output along with

falling inflation and interest rates, it gives the government

something to talk about, but with real personal disposable income

having fallen by 3% in each of the previous two years then voters’

memories will have to be very short to celebrate this.