Sometimes life would be easier if everyone was more like Keanu Reeves:

But other times you just can’t help yourself:

I’m choosing door #2 today. Sorry, Keanu.

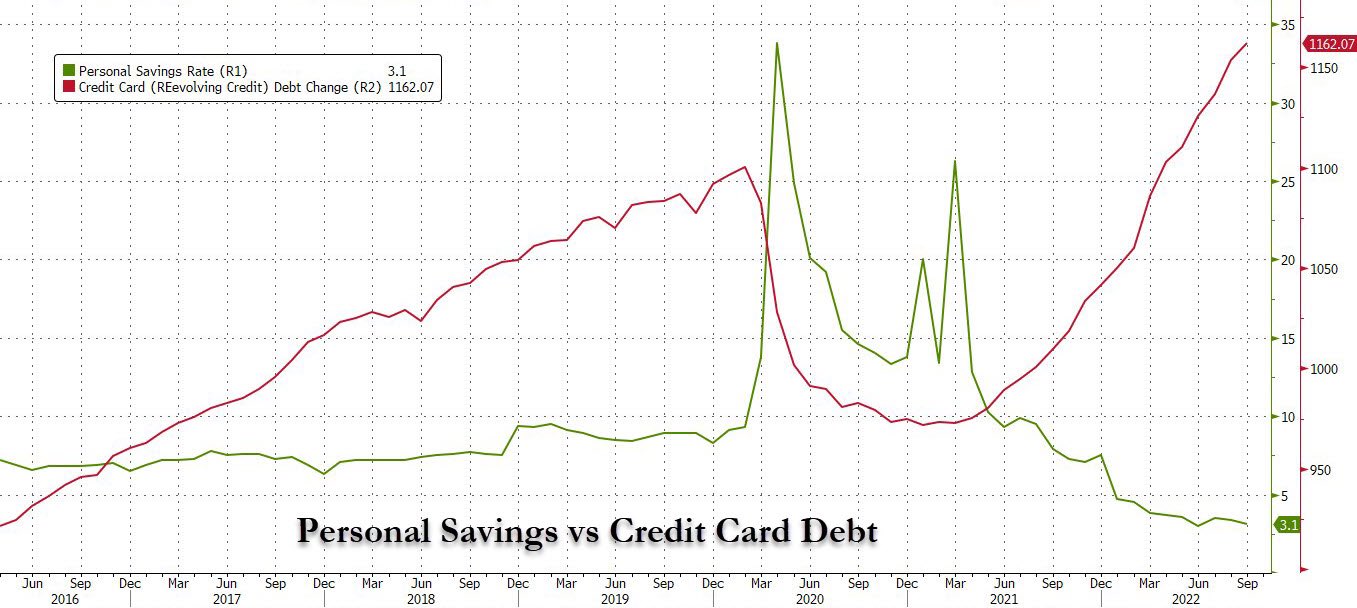

I’ve seen some variation of this chart making the rounds for a few weeks now:

At face value, it looks scary and even obvious.

During the pandemic, the personal savings rate skyrocketed while credit card debt plummeted. Now the opposite is happening as savings rates tumble while credit card debt is back on the rise.

The consumer is screwed. Case closed. Right?

I’m sorry to inform you that this is a misdemeanor chart crime of the first degree.

First things first, we’re comparing a stock versus a flow in this chart. You’ll excuse me for the nerdy terminology but stock refers to a cumulative number at a point in time (in this case credit card debt) while flow refers to a quantity that is measured over time (in this case the personal savings rate).

So we’re measuring apples and oranges here.

And since we’re measuring stock versus flow, these numbers really tell us nothing unless you have a relevant benchmark to compare them to.

Obviously, it’s not a good thing the personal savings rate has fallen so much but there are a number of reasons that can help explain why it’s happening.

Inflation is a logical explanation. People are saving less because costs have risen so much.

But it’s also true that U.S. households built up excess savings during the pandemic because they were spending less money and lots of people received government support. Now they’re spending more to make up for lost time.

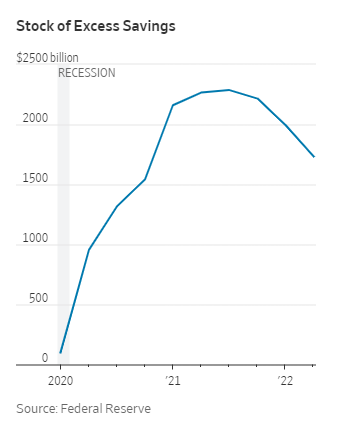

The Wall Street Journal estimates there is still something in the range of $1.2 to $1.8 trillion of excess savings (that is savings over and above what households would have been expected to save had the pandemic never happened):

The best guess from experts is that it will take 9-12 months for people to spend down these excess savings.

It’s not great people are saving less especially if we are going into a recession in the coming year, but there is still a lot of dry powder on household balance sheets.

And if inflation continues to fall, that could potentially help bring the savings rate back up.

Rising credit card debt doesn’t feel all that great either but this one really isn’t out of the ordinary if you zoom out a little.

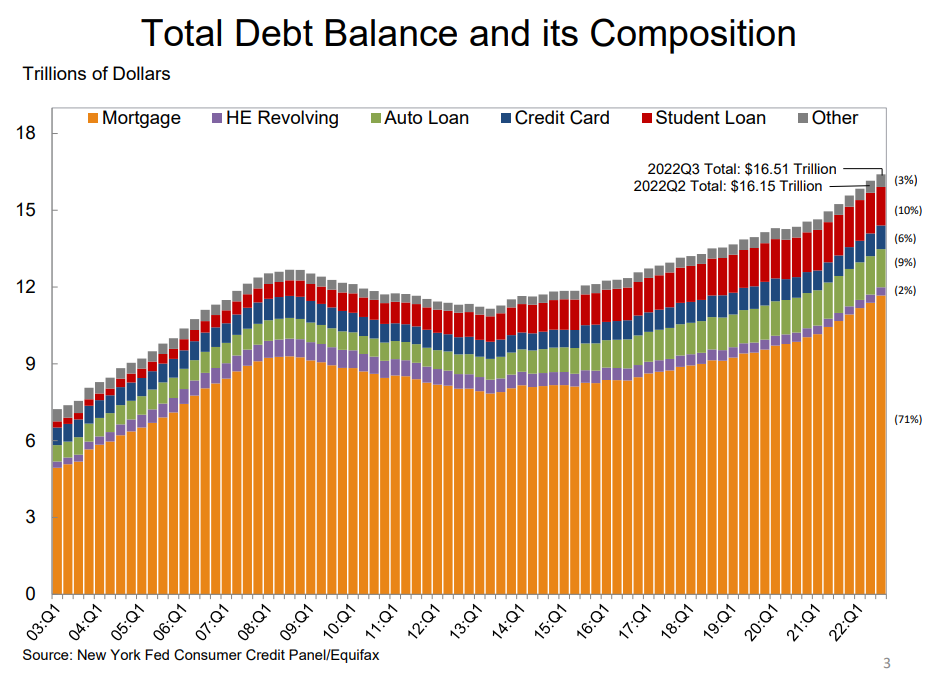

The New York Fed produces a quarterly report on household debt composition over time that shows things aren’t nearly as bad as they seem:

The bulk of consumer debt has always come in the form of mortgages, which make up more than 70% of total debt. Credit card debt as of the end of the third quarter was just 6% of total household debt.

Do you know what the historical average is for credit card debt in relation to total debt?

It’s 6%.

So we’re right on average. In fact, credit card debt has been relatively stable at right around 6% since 2010. It was as high as 10% of total debt in 2003.

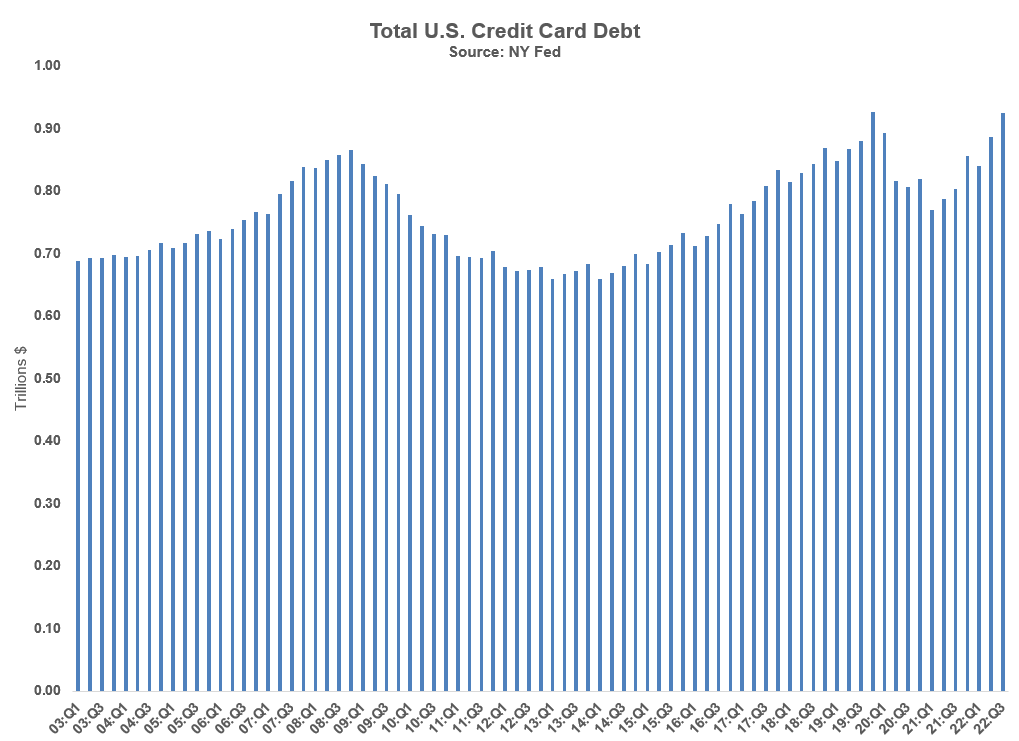

And if you look at credit card levels going all the way back you can see we’re just now breaking through pre-pandemic levels:

Credit card debt is by far the worst kind of debt there is. But people aren’t gorging themselves on high interest rate debt just yet.

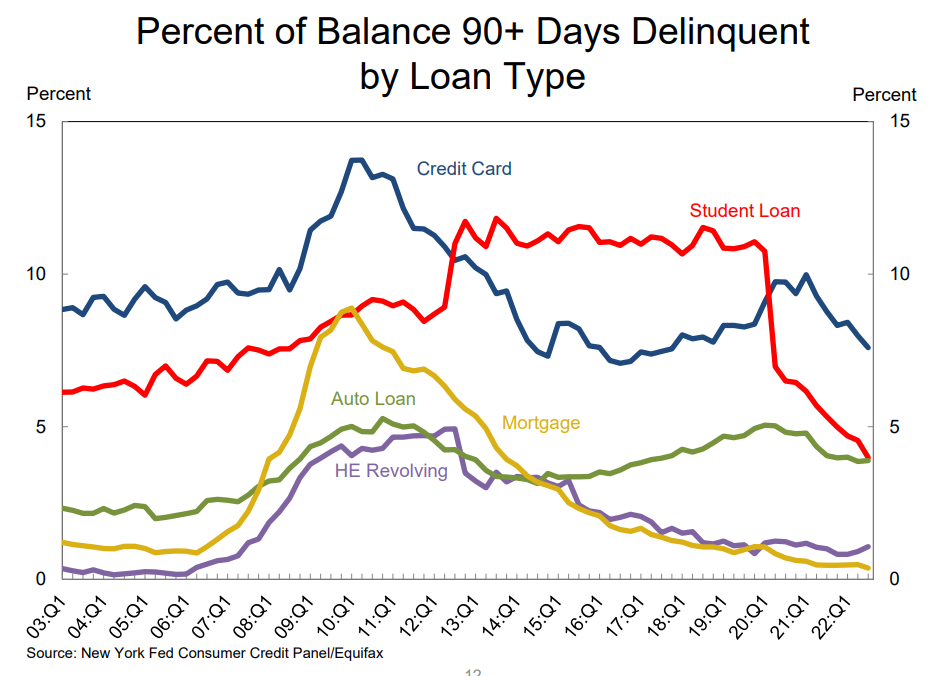

Just look at the delinquency rates on credit cards:

They’re falling.

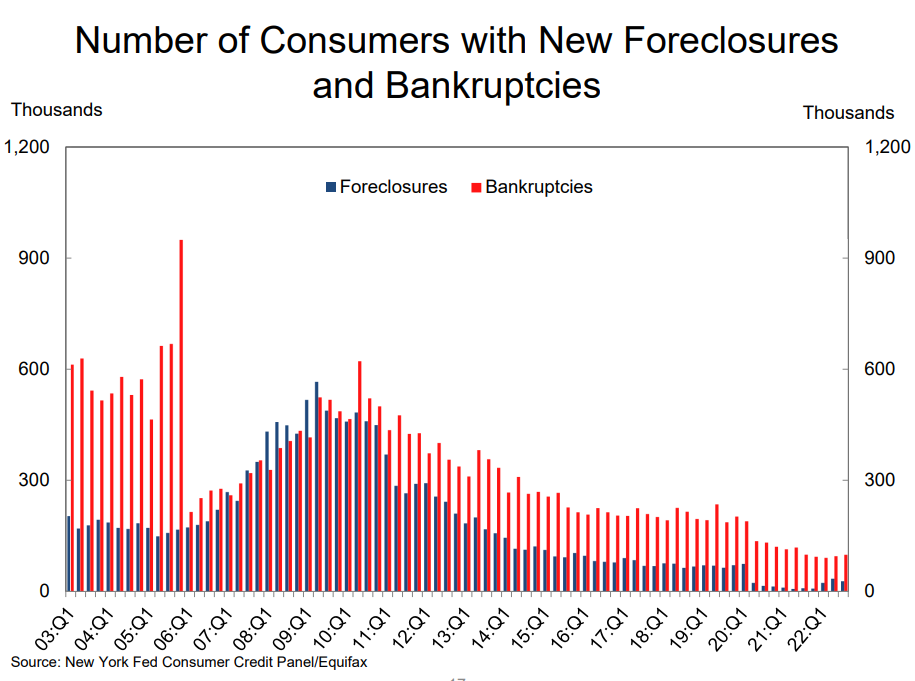

Or how about the foreclosure and bankruptcy data — still well below historical norms:

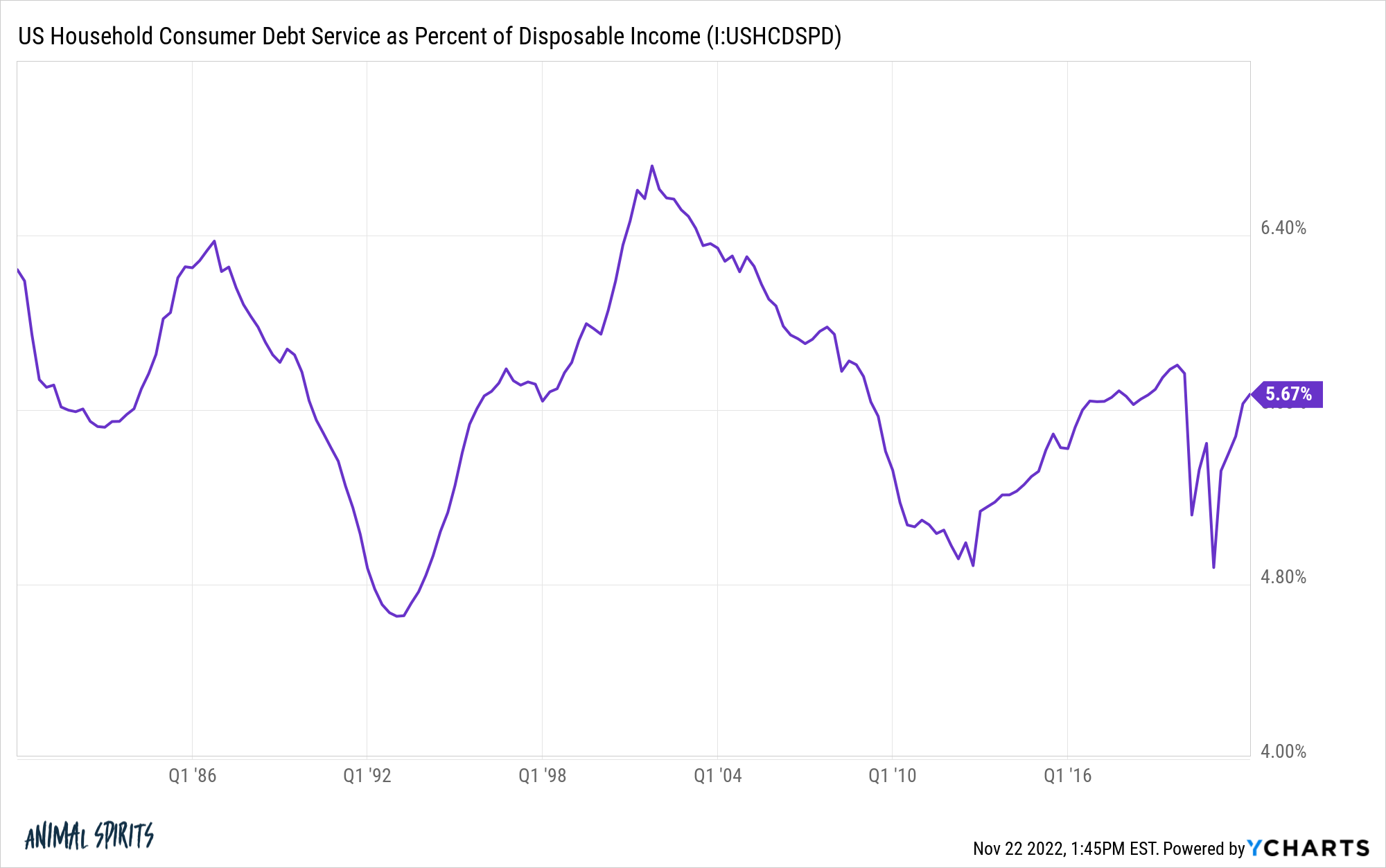

Consumer debt as a percentage of disposable income is rising but remains relatively low by historical standards:

The good times for consumer spending won’t last forever.

Eventually people will spend down their excess savings from the pandemic. Many probably already have.

But we love to spend money in this country. I can’t see people simply spending down their savings and then sitting on their hands.

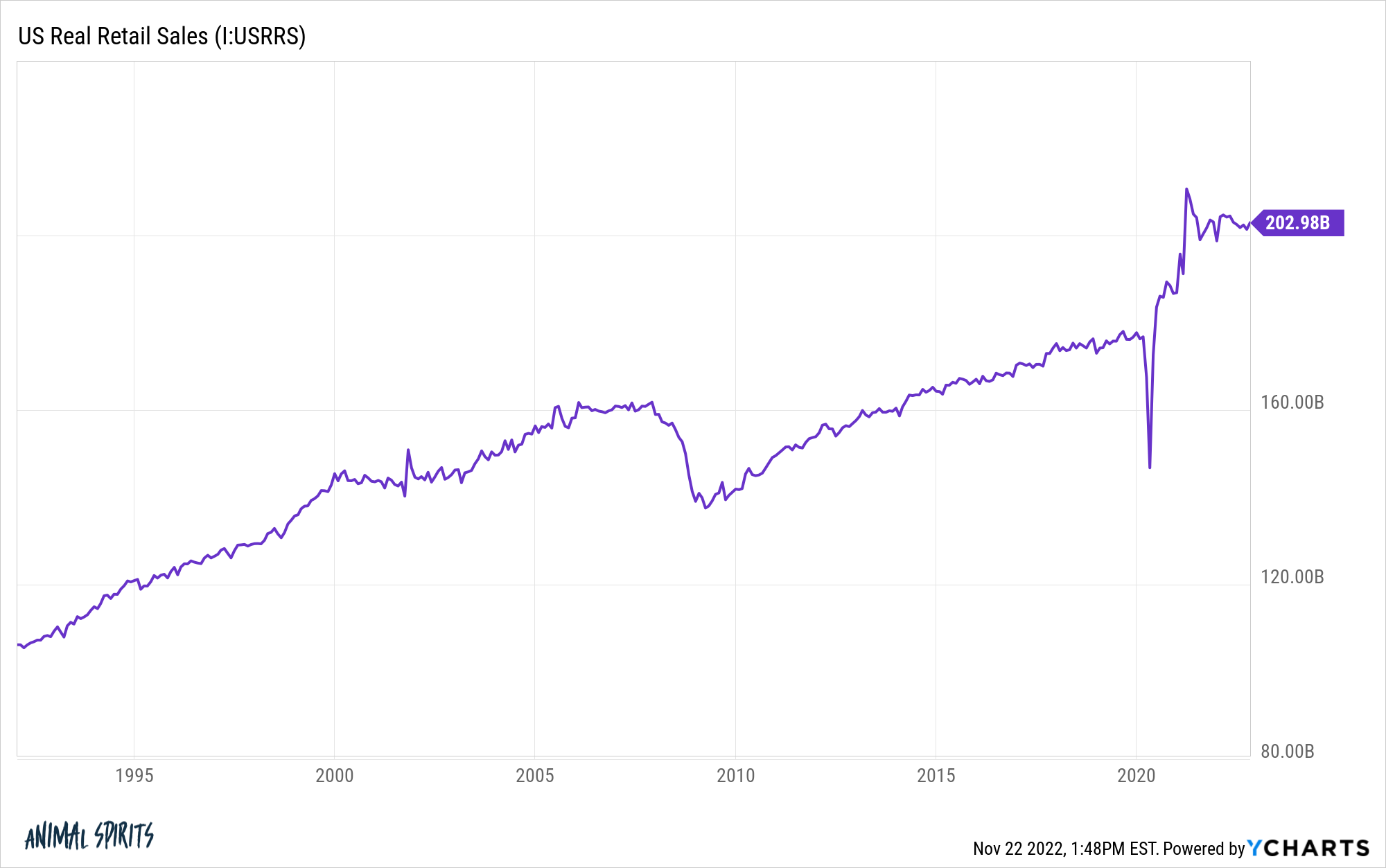

Things have flatlined a bit in recent months, but even if you adjust for inflation, retail sales data remains far above the pre-pandemic trendline:

My guess would be credit card debt will continue to charge higher once all of the excess savings have been spent.

As long as the labor market remains strong, most households will be fine going to restaurants, taking a trip to Disney and filling up the airports.

It might take a recession to slow down the consumer.

Further Reading:

Has the Consumer Ever Been More Prepared For a Recession?