Whenever you cut a check for an employee, the employee isn’t the only one receiving money. You must withhold payroll taxes from employee wages and remit them to the proper agencies. Depending on the payroll tax, you must match employee contributions. But, not all payroll taxes are created equally. So, who pays payroll taxes? Is it the employer, the employee, or both? Read on for the scoop.

Who pays payroll taxes?

So, who pays payroll taxes? The short answer is employers and employees pay payroll taxes on wages, tips, and income. The long answer is a bit more complicated. It turns out employers and employees share some payroll taxes and not others.

Shared payroll taxes

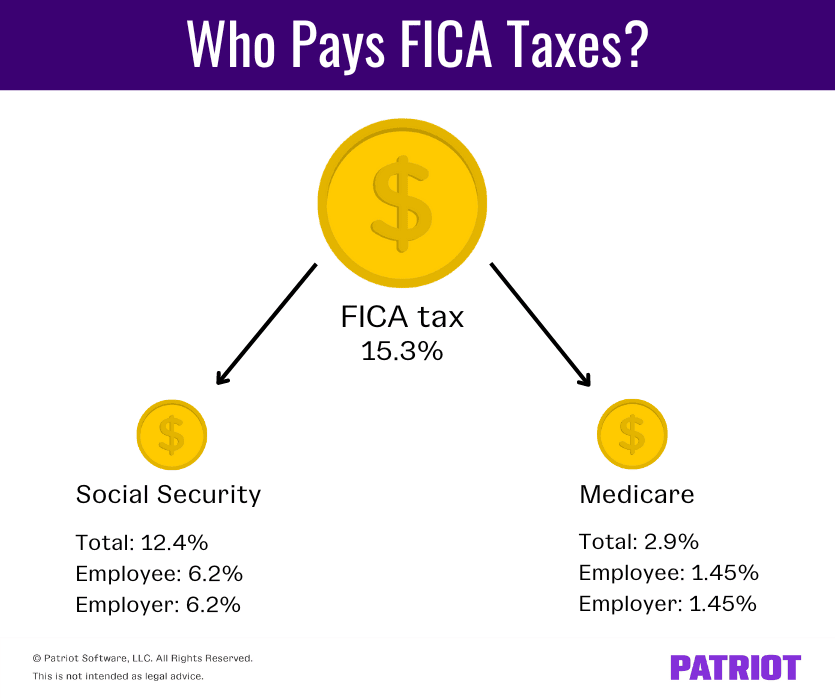

Employers and employees pay equal portions of FICA taxes. FICA taxes are mandatory payroll taxes employers and employees pay paid by employers and employees in the U.S. and include Social Security and Medicare taxes. Social Security and Medicare are “insurance” taxes that help certain groups in the U.S.

For instance, Social Security provides partial income replacement for:

- Retired adults

- Individuals with disabilities

- Qualified spouses, children, and survivors (e.g., widows or widowers)

And, Medicare is a health insurance program for people:

- 65 years or older

- With qualifying disabilities under 65 years old

- With end-stage renal disease

Think of FICA tax as a future safety net you and your employees help create. Now that you know what FICA taxes pay for, let’s look at who pays them.

Social Security

Both employers and employees pay Social Security tax. Employers withhold Social Security taxes from employee wages and match the employee’s contribution.

Social Security tax is a flat rate of 12.4% split between the employer and the employee. In other words, you pay 6.2% and withhold the remaining 6.2% from employee wages.

Because of the Social Security wage base, not all employee wages are subject to tax. You must stop withholding taxes from an employee’s wages once they reach the wage base for the calendar year. For 2023, the Social Security wage base is $160,200. As soon as an employee’s wages reach $160,200 for the year, stop withholding (and matching) Social Security for that employee.

Let’s look at an example of this in action. One of your employees earns $205,000 for the year. Because of the Social Security wage base, you can only withhold Social Security taxes from $160,200 of the employee’s income in 2023. As soon as the employee meets the wage base for the year, stop withholding Social Security for that employee. The remaining $44,800 ($205,000 – $160,200) doesn’t contribute to Social Security.

Remember that the wage base may increase annually to account for the cost of living.

Medicare

Employers and employees also share Medicare tax. Like Social Security, you must withhold Medicare from employee wages and match the employee’s contribution.

The Medicare tax rate is 2.9% split between employee and employer. The employer must withhold 1.45% from employee wages and contribute a matching 1.45%.

While there isn’t a wage base for Medicare taxes, there is an additional Medicare tax of 0.9% you should know about. The additional Medicare tax isn’t a shared tax; only the employee pays it.

Employees must pay the additional tax when they reach one of the following thresholds:

| Filing Status | Threshold Amount |

|---|---|

| Married filing jointly | $250,000 |

| Married filing separate | $125,000 |

| Single | $200,000 |

| Head of household (with qualifying person) | $200,000 |

| Qualifying widow(er) with dependent child | $200,000 |

Let’s take another look at the employee from earlier. Your employee makes $205,000 per year. Because they file as single and make more than $200,000, you must withhold the regular Medicare rate (1.45%) plus the additional Medicare tax (0.9%) on wages beyond $200,000 for a total Medicare contribution of 2.35%. However, you continue paying only 1.45%.

Employer payroll taxes

Employers and employees don’t share all payroll taxes. There are some payroll taxes paid solely by employers.

Employers must pay the following payroll taxes:

- Self-employment taxes

- Federal unemployment tax

- State unemployment tax

Self-employment taxes

Employers pay self-employment tax when they are … (drum roll, please) self-employed. Because no one withholds FICA taxes from their wages, self-employed workers need a way to remit their Social Security and Medicare taxes. This is where self-employment taxes come into play.

The self-employment tax rate is the same as the FICA rate, 15.3% of annual earnings.

Here’s how the self-employment tax breaks down. The self-employment tax rate is 15.3%. Social Security taxes make up 12.4%, and Medicare covers the remaining 2.9%.

Self-employed workers must keep track of the Social Security wages base ($160,200) and the additional Medicare tax (0.9% once wages exceed $200,000). Both are the same for self-employed workers as they are for other employees.

Federal unemployment tax

The Federal Unemployment Tax Act (FUTA) is an unemployment tax on employers. The federal government depends on FUTA taxes to provide unemployment compensation to workers who have lost their jobs.

Some employers don’t have to pay FUTA tax. The IRS has three tests to help you determine if you have to pay FUTA taxes:

- General test

- Household employees test

- Farmworkers test

Each test is for a specific type of employee. If the answers to a particular test apply to your situation, you must pay FUTA tax on employee wages. For more information about the tests, see IRS Publication 15.

The FUTA rate is 6% and applies to the first $7,000 paid to an employee for the year. This $7,000 is the FUTA wage base.

Because of the wage base, the largest FUTA amount you’ll pay per employee is $420 ($7,000 X 0.06). If you pay more than $420, you’ve paid too much.

When paying FUTA tax, there are two more things you should know:

- You may be eligible for a FUTA tax credit (most employers are)

- Depending on where you live, you may be in a credit reduction state

Check out our chart for FUTA tax credit and credit reduction states.

| FUTA Tax Credit | Credit Reduction State | |

|---|---|---|

| When does this apply to me? | You may be eligible for this credit if you pay wages subject to state unemployment tax. | If your state doesn’t have enough money to cover its unemployment benefits, it will borrow money from the federal government. Your state will have two years to pay back the loan. The state becomes a credit reduction state if the balance is outstanding by November 10 of the second year. Your state will remain a credit reduction state until the debt is paid. |

| How does this affect me? | The FUTA tax credit can cover up to 5.4% of FUTA taxable wages. For example, a FUTA tax credit of 5.4% will reduce your FUTA tax liability to 0.6% (6% – 5.4%). |

If you’re in a credit reduction state, the FUTA credit rate of 5.4% is reduced by 0.3% the first year and an additional 0.3% each year the loan goes unpaid. If you qualified for the full FUTA tax credit rate of 5.4%, subtract 0.3% to find your reduced FUTA tax credit rate of 5.1% (5.4% – 0.3%). Next, subtract your reduced FUTA tax credit rate from the FUTA tax rate of 6% to find your FUTA tax rate for the year of 0.9% (5.1% – 6%). Remember to add 0.3% to your state’s credit reduction each year until the state repays the loan. |

| What do I have to do? | To qualify for the full credit, you cannot be in a credit reduction state. File Form 940, Employer’s Annual Federal Unemployment Tax Return. |

Subtract your state credit reduction rate from your FUTA credit rate. File Form 940, Employer’s Annual Federal Unemployment Tax Return. |

State unemployment tax

State unemployment tax (SUTA) helps fund unemployment programs and benefits to employees who lost their jobs through no fault of their own. While unemployment taxes are usually employer-only taxes, there are a few exceptions to the rule. Alaska, New Jersey, and Pennsylvania require you to withhold money from employee wage as well.

SUTA tax is a percentage of employee wages. State unemployment tax rates differ from state to state. SUTA tax goes by other names. For instance, California has state unemployment insurance (SUI), and Florida has a reemployment tax. Regardless of the name, all states have an unemployment tax.

Make sure to pay the SUTA tax to the state where the work takes place. If you have employees working in different states, you’ll pay SUTA tax to each state where the work is performed.

To find a state’s SUTA rate, simply sign up for a SUTA tax account with the appropriate state and the state will send all the information you need.

Employee payroll taxes

There are some payroll taxes that only the employee has to worry about, like federal, state, and local income taxes. Again, employees who live in Alaska, Pennsylvania, or New Jersey must pay state unemployment insurance (SUI).

Federal income tax

Federal income tax is an employee-only tax you must withhold from employee wages. There isn’t a single rate for federal income tax. Withholding for federal income tax depends on the employee’s:

- Pay frequency

- Filing status

- Annual income

- Form W-4

Again, federal income tax doesn’t have a flat rate. If you want to calculate federal income tax by hand, IRS Publication 15 has withholding tables that can help. But, withholding federal income tax from employee wages doesn’t have to be complicated. Online payroll software can calculate payroll taxes so you don’t have to.

State income tax

Forty-one states (and Washington D.C.) have a state income tax. So, there’s a good chance that you’ll have to withhold state income tax from employee wages.

Some states use a flat rate for their income tax, while others use tax brackets to decide what rate employees pay. Visit your state’s department of revenue for more information.

The following states don’t have a state income tax on employee income:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

While New Hampshire doesn’t have a state income tax on wages, they do levy an income tax on dividend and interest income.

Local income tax

Local income taxes help pay for community improvement projects and education. Local income taxes occur only in states that have a state income tax. But not all states with state income tax will have local income taxes.

Local income taxes vary between municipalities. There are some common tax rates you should know about:

- Flat tax rate: A single rate across all income levels

- Progressive tax rate: The tax rate increases with employee income

- Flat dollar amount: All employees pay the same dollar amount, regardless of their annual income

Check local laws to make sure you’re withholding the right amount of local income tax from employee wages.

Who pays payroll taxes employee or employer cheatsheet

| Types of Payroll Taxes | Shared Payroll Taxes | Employer-only Payroll Taxes | Employee-only Payroll Taxes |

|---|---|---|---|

| Social Security | ✓ | ||

| Medicare | ✓ | ||

| Additional Medicare | ✓ | ||

| Federal unemployment | ✓ | ||

| State unemployment | ✓ | ✓ * | |

| Federal income | ✓ | ||

| State income | ✓ | ||

| Local income | ✓ | ||

| Self-employment | ✓** |

* Only for employees working in Alaska, Pennsylvania, and New Jersey.

** Only for self-employed individuals.

State-specific payroll taxes

Depending on your state, there may be additional state-specific taxes you need to know about. Be on the lookout for things like:

Contact your state to learn who contributes to these payroll taxes and the tax rates.

With Patriot’s Full Service payroll, your payroll taxes can be easier than ever. Simply enter your payroll information, and we’ll handle calculations, deposits, and the necessary forms. Try it for free today!

This is not intended as legal advice; for more information, please click here.