State paid family leave (PFL) programs aren’t slowing down anytime soon. Back in 2020, Colorado voted to implement its own Paid Family and Medical Leave Insurance (FAMLI) program. And beginning in 2023, the Colorado paid family leave program takes effect.

What does this mean for Colorado employers? It means you have a new payroll tax to handle. Read on to learn more about your Colorado paid leave responsibilities.

Colorado paid family leave FAQs for employers

Colorado’s paid family leave aims to provide employees with protected paid time off for qualifying events, like caring for a new child. The state joins the existing—and growing—list of states with paid family leave laws, including Maryland and Washington.

PFL works similarly to the federal Family and Medical Leave Act (FMLA). Like the FMLA, PFL protects employee jobs while employees care for a child, family member, or themselves. But unlike the FMLA, paid family leave programs by state provide employees with paid time off.

Learn the ins and outs of Colorado’s FAMLI program with the following FAQs for employers.

1. When does the program start?

The Colorado paid family leave effective date for contributions is 2023, one year before Colorado employees can receive benefits.

Keep the following important dates related to paid family leave Colorado in mind:

- January 1, 2023: Contributions begin

- January 1, 2024: Qualifying employees can begin taking benefits

2. Who pays?

Colorado employees and qualifying employers pay FAMLI premiums. So, withhold the premium from employee wages. If applicable, you must make a matching employer contribution.

Here’s the breakdown:

- All employees contribute

- Employers with 10 or more employees must also contribute

You may be able to offer a private paid family leave plan to employees. The plan must provide the same (or better) benefits as the state FAMLI plan with no additional costs or restrictions. Before opting for a private plan, you must get approval from Colorado’s Department of Labor and Employment’s FAMLI Division. You must handle FAMLI premiums until the FAMLI Division reviews and approves your plan.

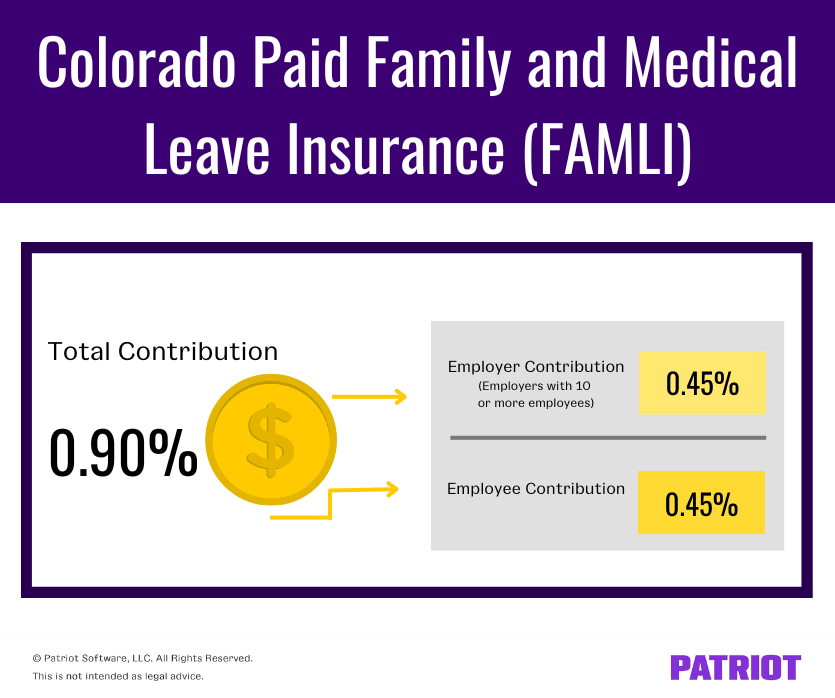

3. What is the contribution rate?

The total Colorado PFL rate is 0.90% of employee wages, up to the Social Security wage base ($160,200 for 2023). Of this 0.90% rate, employees pay 0.45%, and qualifying employers (those with 10 or more employees) pay 0.45%.

Employers with nine or fewer employees are not responsible for the employer share of 0.45%.

The FAMLI premium applies to all types of payments that Colorado considers wages. This includes payments defined as wages under FUTA, tips, and employee contributions to 401(k) plans. For more information on how Colorado defines “wages,” check out the state website.

Let’s say you pay an employee $2,000 per pay period. You must withhold $9 ($2,000 X 0.0045) from their paycheck for the FAMLI program. If you have 10 or more employees, you also need to contribute $9.

Continue withholding (and contributing, if applicable) the FAMLI premium from employee wages until they earn above $160,200. This means the maximum amount you’ll withhold in 2023 is $720.90 ($160,200 X 0.0045) per employee. Likewise, the maximum amount you’ll contribute (if applicable) in 2023 is also $720.90 per employee.

4. Which employees qualify for leave?

Beginning January 1, 2024, employees who earned $2,500 over the previous year for work in Colorado can take leave for qualifying reasons.

Employees receive up to 12 weeks of leave to:

- Care for a new child (birth, adoption, or foster care placement)

- Deal with a serious health condition

- Care for a family member with a serious health condition

- Make arrangements for a family member’s military deployment

- Take safe leave due to domestic violence, stalking, or sexual assault or abuse

Employees who experience pregnancy or childbirth complications may receive an additional four weeks.

Your employees can take continuous or intermittent leave. Or, employees can take leave in the form of a reduced schedule.

The benefit amount employees receive is based on a sliding scale. The FAMLI program pays up to 90% of the employee’s average weekly wage.

5. What are my responsibilities?

As a Colorado employer, you have a few responsibilities relating to the Colorado FAMLI program:

- Notify employees

- Handle contributions

- Submit wage reports

Notify employees

You must must notify your employees about the paid family leave program by January 1, 2023. And, you must post the 2023 FAMLI Program Notice in a prominent location in your workplace by January 1, 2023.

Handle contributions

You must withhold employee contributions of 0.45% from employee wages. If you have 10 or more employees, you must also contribute 0.45%.

Make quarterly premium payments to Colorado’s FAMLI Division via:

- Online payments from your My FAMLI+ Employer account (expected to launch at the end of 2022)

- ACH credit

- Check

- Online bill pay

Submit wage reports

In addition to quarterly premium payments, you must submit reports to the FAMLI Division each quarter. You can submit quarterly wage reports within your My FAMLI+ Employer account.

6. Where can I get more information?

Check out the Colorado Family and Medical Leave Insurance Program (FAMLI) website for more information.

Colorado family leave at a glance

Stay on top of the paid family leave law with the following fast facts:

- Payroll contributions begin January 1, 2023

- Employees must pay a contribution rate of 0.45%

- Employers with 10 or more employees must also pay 0.45%

- Eligible employees receive up to 12 weeks of paid and protected leave, plus an additional four weeks for qualifying reasons

- Employees can use the time to care for themselves, a child, or a family member

- The benefit amount is based on a sliding scale and pays up to 90% of the employee’s average weekly wage

- Employers must provide a written notice to employees about the program

Computing the new Colorado paid family leave premium can be tricky. With Patriot’s payroll software, you don’t need to worry about calculating contribution amounts. And when you sign up for Patriot’s payroll services, we’ll handle filing and deposits for you. Why make payroll more difficult than it needs to be? Get your free trial today!

This is not intended as legal advice; for more information, please click here.