Inflation refers to a general increase in the prices of goods and services. When your money doesn’t go as far as it once did, you end up spending more for a smaller number of items.

If you have visited the grocery store recently, you know that prices are exponentially higher than even a year ago. Is it any wonder when you consider that inflation is at its highest rate in 40 years?

But did you know that inflation also influences your credit card rate? The odds are that you are paying a much higher interest rate today than even a year ago. And if the economy doesn’t cool down soon, it could rise even more in the months ahead.

Impact of rate hikes on credit card debt

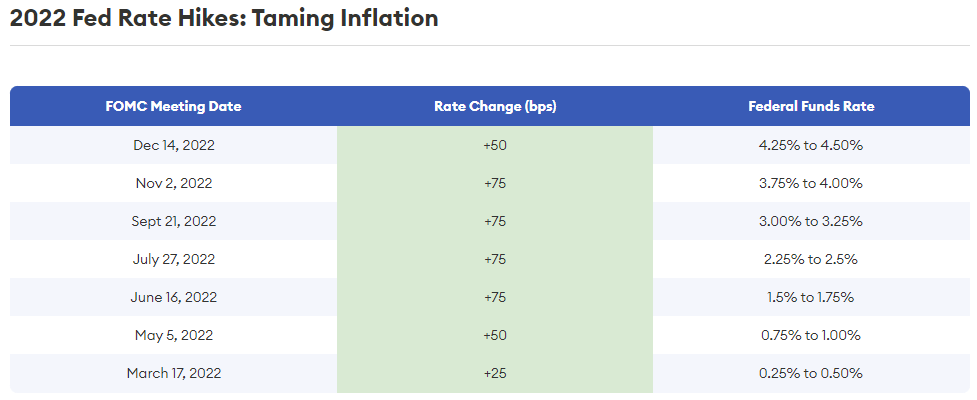

The Fed has increased interest rates six times this year, and there could be one more rise coming down the pike before 2023. So, what does this mean in terms of dollars and cents when it comes to your credit cards balances?

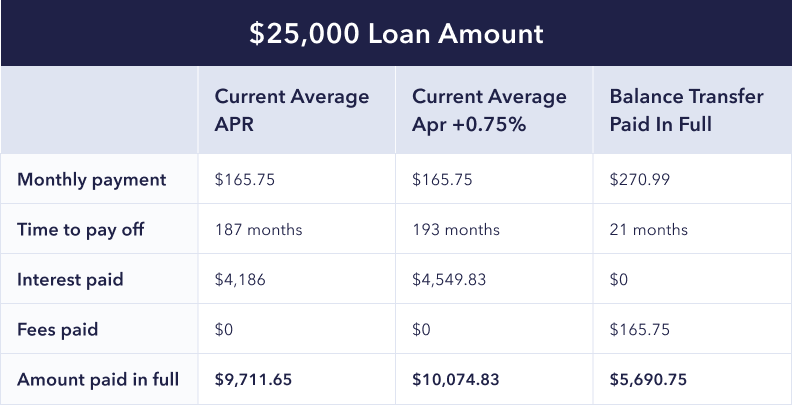

If you are carrying credit card debt, you are going to pay more every time rates climb. In fact, WalletHub recently announced that the Federal Reserve’s latest rate hike will cost Americans with outstanding credit card debt more than $5 billion in interest over the next year. Add that to the higher prices you are paying for everything else, and you can kiss any budget you might have had goodbye.

People Also Read

How interest rates hikes impact APR

You can’t talk about interest rates without mentioning the APR, which stands for Annual Percentage Rate. This is the amount of interest due based on the carried balance from month to month. Interest on credit cards is calculated on a daily basis, so your credit card company charges you by multiplying the ending balance of the APR and then dividing it by 365. That amount is added to your outstanding balance at the end of each day.

When interest rates go up, your APR rises in tandem. Unless you pay your balance in full every month, today’s inflation is going to cost you more money on your credit card debt. And if you only pay the minimum on your credit cards, you are going to pay an even higher price.

How interest rates affect your minimum payment

Tip:

The Credit Card Act of 2009 legally requires credit card companies to provide a 21-day grace period. This means you aren’t responsible for interest charges between the end of the billing cycle and your bill due date.