There is nothing better than starting a year with looking at 15 “fresh” and randomly selected Norwegian shares. Three of them made it onto my preliminary watch list. As always, I am more than happy to get my reader’s input in the comments as these are quite rapid analysis and I most likely miss a lot of interesting things. Let’s go:

16. Melhus Sparebank

Melhus is a 43 mn EUR market cap local savings bank. The stock trades at around 10x earnings, pays a 6% dividend but hasn’t moved much for the last 20 years. EPS is oscillating in a range since 20 years, too. “Pass”.

17. Europris ASA

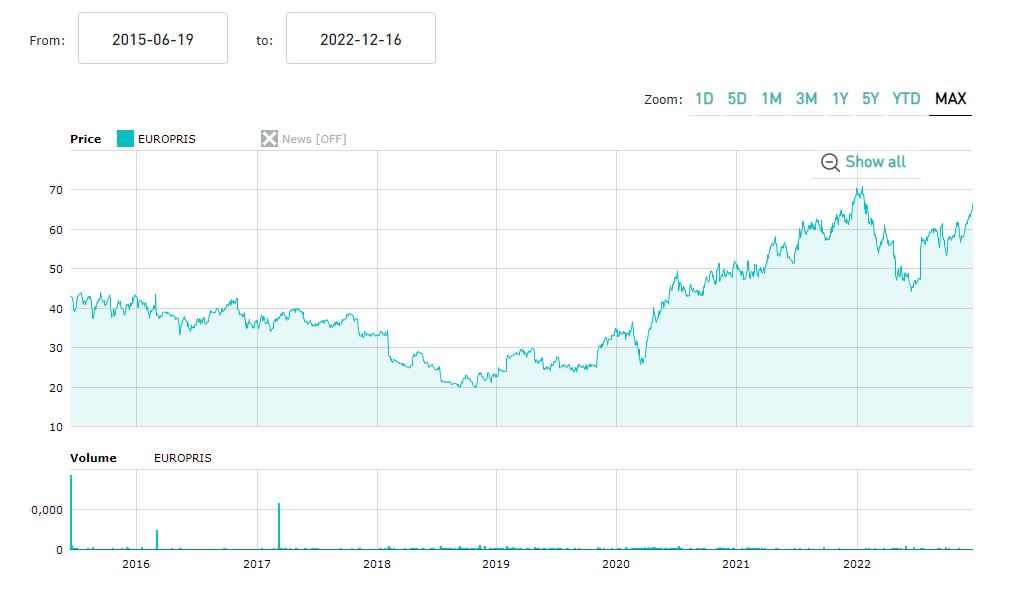

Europris is a 1,1 bn EUR market cap retailer that sells “discount variety” items in Norway, both through a chain of 300 stores but also online.

AT 12x earnings, the stock doesn’t look expensive and according to TIKR, they did 10x their EBIT since 2013. The company IPOed in 2015 and looking at the chart, they seem to have done quite well for a retailer, especially in the last few years despite Covid

They have a very interesting recent capital markets presentation. Among others, they seem to have acquired a Skandinavian toy retailer. Overall I find it quite interesting although the question clearly is how much growth opportunities are left in a small country like Norway, nevertheless it is a “watch”.

18. Sparebank -1 SR Bank

Sparebank is a 2,9 bn regional bank that looks equally cheap than most of its Nordic peers with a P/E of ~9x and 4,5% dividend yield. Their longer term share price chart looks “constructive” and returns on Equity have been mostly in the low double digits which is very good. Nevertheless, for some reasons I am not so keen on regional Nordic banks, therefore I’ll “pass”.

19. EQVA

EQVA is a 21 mn EUR market cap company that until Mid November called itself Havyard ASA. The company is mostly a shipbuilder that services the oil offshore sector as well as renewable and fishing.

The company had negative earnings from 2015-2019 and has been making profits in 2020 and 2021. The share price looks very much like a theme park roller coaster:

The company claims to have shifted its business model towards a more stable service model, hwoever in Q3 they again showed EBITDA losses. Overall, despite the new name, I would “pass”.

20. Horsiont Energi

Horisont is a 81 mn EUR market cap company that was IPOed in 2021. The company is a developer of “blue Hydrogen” projects, i.e. producing Hydrogen from Natural Gas with an integrated Carbon Capture and Storage. The company has no revenues and Blue Hydrogen has lost most of its appeal due to high Natural Gas prices. “Pass”.

21. Tomra Systems

Tomra is a 5,4 bn market cap company, whose products many of us might have encountered in a supermarket: Tomra is the undisputed leader in “reverse vending machines” that automate the collection of used bottles, cans etc. in coutnries where customers need to pay a deposit.

Looking at the share price, it is pretty clear that Tomra is not an “undiscovered” stock:

Despite the -1/3 pullback, Tomra is still expensive and is value at 44x P/E and 32 EV/EBIT. On the positive side, Tomra is growing nicely over many years. Even in 2020, growth was 6,5% and in a normal year they grow by 10% or more. EBIT margins are between 12-15%, returns on Capital are oK, with an ROE of ~17%. The company has only tillte debt

In the recent years, Tomra has diversified also into recycling. Interestingly, in 2022, they seem to struge with cost pressures and for the first 9M have reported declining profits despite increasing top line.

Overall, Tomra looks ilke a super interesting company, however it is clearly much too expensive for my taste. Nevertheless I would put them on “watch”. Maybe the they will be available at a better valuation at some point in the future.

22. Voss Veksel Ogland

Voss is a 45 mn EUR market cap small bank that is located in the town with the same name. As most other regional Skandinavian banks, the stock ist cheap at 8x P/E and a 5,8% dividend yield. On the other hand, ROE’s are only 8% and growth is low. “Pass”.

23. Canopy Holdings

Canopy is a 2021 IPO that has lost -95% of its share price over a year with a remaining market cap of 4 mn EUR. they are doing something with technology and are loss making. “Pass”.

24. Axactor

Axactor is a 169 mn EUR market cap company that specializes in “debt collection”. Looking at the chart, the company seems to encounter some issues:

The company has quite volatile results with losses in 2020 and 2021. Currently, the company seems to be quite profitable, with a 2022 P/E in the middle single digits. However, the company carries significant leverage.

I think it would be really interesting to look at this closer although it might be a very difficult business model, therefore I’ll put them on “watch”.

25. Webstep ASA

Webstep is a 61 mn EUR market cap IT service/consulting company active mostly in Norway and Sweden. The company has been able to grow their top line, but the bottom line is quite volatile. Gross margins are in the range of 15-20%, so they seem to be rather an outsourcing company than a “value add” consultant.

Q3 2022 looks good from the top line but dreadful for profits. Nothing to see here, “pass”.

26. Bergenbio ASA

Bergenbio is a 6 mn EUR market cap Biopharmaceutical company that develops based on “small molecule” technology medication against some sorts of cancer. The company has only phase II projects and is loss making, “pass”.

27. Havila Shipping

Havila Shipping is a 26 mn EUR market cap company that operates several offshore vessels. The company has been making operational losses for some time and carries significant debt. Net income is either a big loss or a big profit based on special items. “Pass”.

28. Olav Thon Eiendoms

Olav Thon is a 1.7 bn EUR market cap real estate company that manages shopping centers (and has nothing to do with former German football player Olaf Thon).

Looking at the share price, they have done a lot better than their shopping center peers. The company looks reasonably cheap (7% FCF yield, 5% dividend yield), but shopping centers are not my strength. They also run valuation changes directly through the P&L. “Pass”.

29. NRC Group

NRC Group is a 101 mn EUR market cap “infrastructure construction” group active in Scandinavia. According to TIKR, they have been loss making for 6 out of the last 10 years and the srock price has lost -75% since 2018. “Pass”.

30. Gram Car Carriers

Gram Car Carriers is a 444 mn EUR market cap company that was IPOed in March 2022 and ” invests in and operates assets in the pure car and truck carrier shipping segment. It provides a fleet of vessels for various aspects of the seaborne vehicle transportation trade”.

For some reason, the stock tripled since then, making them most likely one of the most successful recnt IPOs;

According to their Q3 report, for some reasons, transport rates have quintupled in 2022. Not sure if this is sustainable. Shipping is a sector, where I am extremely cautious, therefore I’ll “pass”.