Consumer confidence rose to an eight-month high in December as declining gas prices and easing inflation contributed to more optimistic views of economy. However, spending plans were mixed. Vacation intentions improved, while the intention to buy homes and big-ticket appliances cooled further due to elevated mortgage rates. This shift in consumer preference from goods to services is likely to continue in 2023.

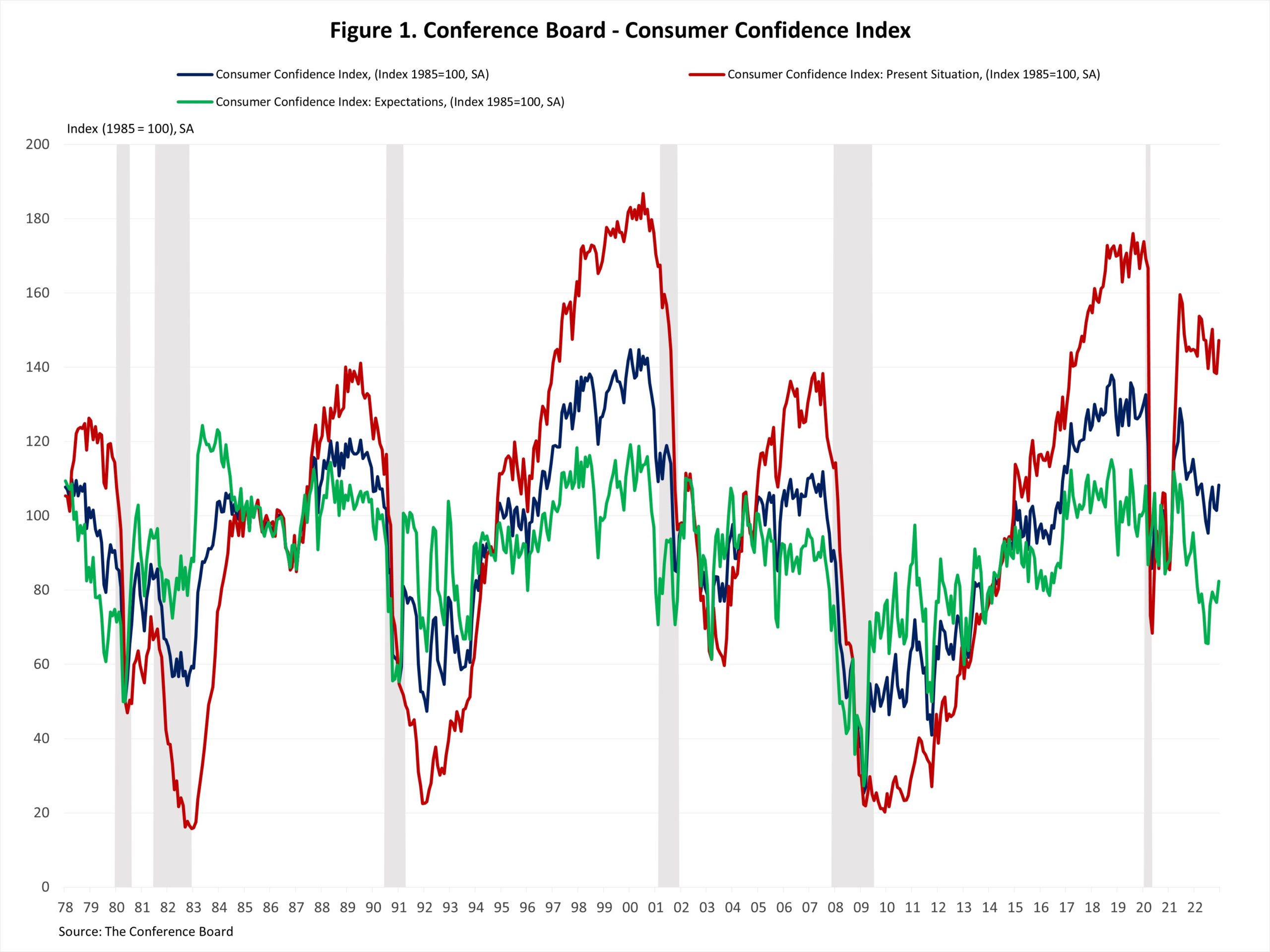

The Consumer Confidence Index, reported by the Conference Board, increased 6.9 points from 101.4 to 108.3 in December, the highest level since April 2022. The Present Situation Index rose 8.9 points from 138.3 to 147.2, and the Expectation Situation Index climbed 5.7 points from 76.7 to 82.43, the highest since February 2022. However, it’s still lingering around 80 – a level associated with a recession.

Consumers’ assessment of current business conditions improved in December. The shares of respondents rating business conditions “good” rose by 1.2 percentage points to 19.0%, while those claiming business conditions “bad” fell by 3.5 percentage points to 20.1%. Meanwhile, consumers’ assessment of the labor market was also more favorable. The share of respondents reporting that jobs were “plentiful” increased by 2.6 percentage points, while those saw jobs as “hard to get” fell by 0.9 percentage points.

Consumers were less pessimistic about the short-term outlook. The share of respondents expecting business conditions to improve rose from 19.8% to 20.4%, while those expecting business conditions to deteriorate fell from 21.0% to 20.3%. Similarly, expectations of employment over the next six months were more positive. The share of respondents expecting “more jobs” increased by 1.0 percentage points to 19.5%, and those anticipating “fewer jobs” decreased by 2.9 percentage points to 18.3%.

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home fell slightly to 6.2% in December. The share of respondents planning to buy a newly constructed home marginally increased to 0.9%, while for those who planning to buy an existing home declined to 2.5%.

Related