Happy New Year to everyone. May there be peace in your home, on the planet, in the stars, and in all living beings. I am very glad to share that I have recently published a book of children’s stage plays.

Growing up in Mumbai, India, I studied at a school where theatre and drama were an important part of our education. Many of our school plays were then drawn from English literature. A few years ago, I was asked to take on a project to translate nine plays written in Gujarati, my first language, to English. Acclaimed playwright Prakash Lala wanted to make his stories available to young children everywhere. The average 10-12-year-old child in India has a different upbringing than the American kid. Family, grandparents, household help, and even neighbors play a much larger role in raising the kid than we see in society here. I’ve enjoyed translating the plays, working with my own kids on editing, and recently publishing the book on Amazon. Look for the title “Nine Children’s Plays.” I hope you will read it and share it with your friends and family.

Long-dated TIPS bond prices now offer a margin of safety. I am buying.

I have been buying long-term (10-30-year maturity) TIPS bonds this month, and I’d like to share why.

In this article, I write about why Treasury Inflation Protected Securities (TIPS) are finally ready to serve their purpose of protecting against inflation. TIPS now have a high enough Real Yield to make them excellent investments. I have gone from a single-digit percentage allocation in TIPS to more than 25% of the portfolio invested in TIPS in the last few weeks.

Readers who would like to understand the Asset Allocation rationale about holding TIPS in a portfolio, the terminology and bond math of TIPS, or the difference between TIPS and Series I Bonds, might first want to read the three other articles on inflation protection I have written at MFO in the last 12-months:

Feb 2022: Thoughts on Inflation Protection

August 2022: I wish I could give you some good TIPS on beating inflation

October 2022: Series I Bonds: A Ray of Hope

Why am I so focused on TIPS? Haven’t they been a huge disappointment?

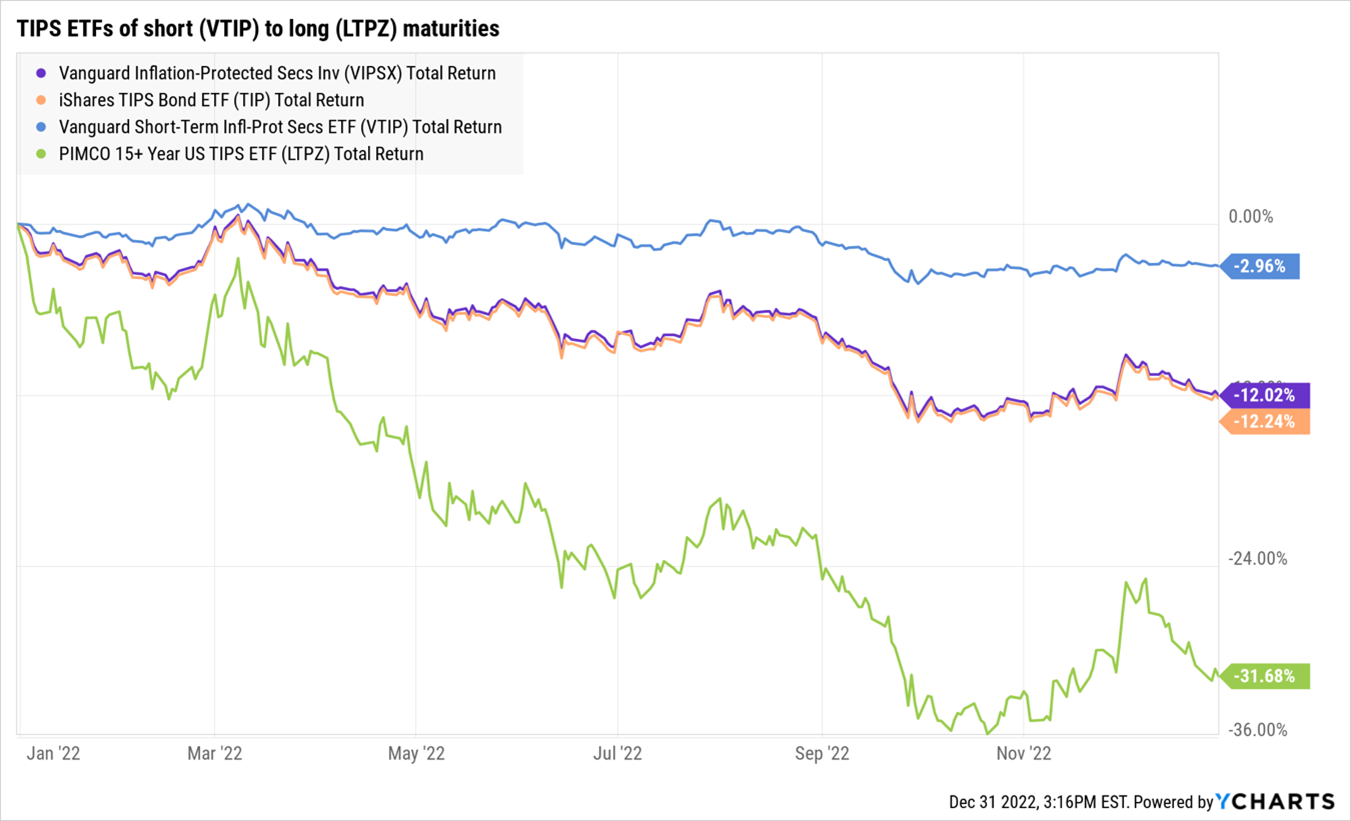

- Viscerally, I feel the inflation monster everywhere. There is not a single service, item, or experience I am purchasing where the price is the same or lower than a few years ago. It’s a natural instinct to protect your purchasing power. TIPS are the only direct investment product linked directly to inflation. They are US Government Credit risk and priced in US Dollars. The year 2022 should have been the year of TIPS. It was not. My earlier articles talked about why TIPS would disappoint, and they indeed did. Total Returns of TIPS ETFs were down 3% for the shortest maturities to negative 32% for the longest ones.

- Although inflation was burning in 2022, the entry price for TIPS was wrong. TIPS were too expensive coming into the year. Now, the bonds are priced much better.

- I’ve wanted to significantly increase my exposure to TIPS because I worry that controlling inflation may be easier said than done. When the going gets tough – huge US Government interest bills, Corporate Debt servicing, financial accidents, economic downturns – Federal Reserve’s determination might waver.

- There is also a growing din that a 2% inflation target is unnecessary. In the future, might we live in a world more corresponding to 3-4% CPI and not the 2% we are used to? If so, TIPS coupons, which reflect CPI changes, would pay higher amounts.

- If inflation became an endemic feature, Fixed coupon bonds would suffer losses. On the other hand, TIPS bonds would hold up better, especially given their current pricing.

What’s changed about TIPS from the beginning to the end of 2022?

- TIPS trade based on Real Yields. To understand Real Yield, please read the August MFO article. A Buyer of TIPS gets Real Yield at the time of purchase + Future CPI.

- At this time last year, investors were paying the US Treasury to hold TIPS. Real Yields were negative. But now investors are getting paid handsomely positive Real Yields to hold TIPS.

| TIPS Bond Maturity | Dec 31, 2021 | Dec 31, 2022 | Change |

| 5-year | -1.61% | 1.66% | 3.27% |

| 10-year | -1.04% | 1.58% | 2.62% |

| 30-year | -0.44% | 1.67% | 2.11% |

- TIPS Real Yields have adjusted upwards, and TIPS Bonds prices have sufficiently adjusted down this year to NOW make them interesting investments. TIPS are finally ready to deliver the policy objective of protecting investors against inflation. The chart below shows the upward adjustment in Real Yields from the 2021 lows compared to almost two decades of history. The yields today are competitive.

Isn’t it also true that Fixed Coupon Treasury Bond Yields have also gone up in Yields? Why not invest in US Treasuries? Why bother investing in TIPS?

- Yields (or Interest Rates) are much higher everywhere. Let’s look at the Fixed coupon Treasury Yields over the last year:

| Fixed Bonds | Dec 31, 2021 | Dec 31, 2022 |

| 5-year | 1.37% | 3.99% |

| 10-year | 1.63% | 3.88% |

| 30-year | 2.01% | 3.97% |

- Yields for fixed coupon Treasuries are also much better than a year ago. And so are yields for municipal bonds. However, only US Government TIPS offer exposure to increasing inflation.

- Second, taxes matter: As an individual investor residing in NY, it is better for me to hold New York municipal bonds over US Government fixed-coupon Treasuries when investing through a taxable account.

- I like TIPS above both fixed US Treasuries and Munis because if the Federal Reserve loses control over inflation, TIPS will be the only bond of the three that will assert my purchasing power. You know where my head is at. I hope they don’t screw up, but if they do, I don’t want to go down with them.

What could go wrong with buying TIPS now?

- I could be early. If the Federal Reserve continues to hike rates, if US fixed Treasury yields continue rising, so will TIPS Real Yields. TIPS Bonds will then decline. The question is, “Am I prepared to then increase my allocation to Bonds and TIPS?” I believe I am.

- Inflation could collapse. In that case, my expenses would also rise at a slower rate. Also, chances are the Federal Reserve would cut interest rates, and that might actually help all kinds of longer-dated bonds due to their Duration Risk.

- US Government Credit could become riskier. I assign that as a low-probability scenario for now.

What assets am I selling to buy TIPS now? What am I rebalancing out of?

- This is a really good question. Every asset was down in 2022. You have to starve Peter to feed Paul. I have been lightening up on Equities across the board and using that cash to buy TIPS.

- I feel a lot more convinced about the margin of safety in TIPS bonds today than I do for the margin of safety in any kind of Equities, including US Value stocks. I have thus been reducing exposure to US Value stocks to buy TIPS.

What are the different scenarios in buying 30-year TIPS now?

- Base case: The Bond market currently believes CPI runs at 2.3% over 30 years, and the Real Yield is 1.65%, which means the yield to Maturity would be in the 3.95% zone. I assign this to be a 50% probability.

- Bear case: Real Yields on the long dates TIPS goes from 1.65% to 2.5% if inflation is sticky and the Federal Reserve continues hiking. While TIPS bonds would decline by 18-20% mark-to-market, the eventual yield over the long term would be almost 5%. Current Real Yields (1.65%) + CPI (3-4%). I assign this to be a 15% scenario. Initially would hurt, but eventually, it would help.

- Bullish case: Real yields decline back to 1% from the current 1.65%, and CPI averages at 2%. This yield decline could lead to an 18% price increase plus the CPI. I assign this a 35% probability. I will see a mark-to-market gain in TIPS prices. I would have to evaluate my view on inflation at that point.

I am sure there are more sinister bearish scenarios and more rewarding bullish scenarios, but none of these are for investors unwilling to take substantial volatility.

Why not just buy and hold the Total Bond Portfolio?

- For a majority – maybe 97% of the investors – that Total Bond portfolio is just fine. There is no need to do anything beyond that. Intellectually honesty is important here. If I cannot stand losing money in an asset, or I am unwilling to increase my allocation when the investment goes against me, then I should not be taking a proactive risk. In such a case, benchmarking the portfolio to a simple formula is all I will ever do.

- However, I believe that diving deep into the markets and all of the accompanying analysis is more than just about intellectual curiosity. I lead with analysis, but then I want intuition and judgment to take over the decision-making. This last bit tells me that TIPS are ok to buy now. Every morning I have walked in to find TIPS bonds lower in price, and I have been adding to the portfolio.

In Conclusion

Whether one needs to own TIPS or just the Total Bond Portfolio is up to each investor. Anytime one goes on a limb, an element of proactive risk is always introduced. I am investing in TIPS because I am willing to lock in the Real Yields of 1.65% and am interested in receiving the CPI. Furthermore, I am worried that the CPI might not decline as smoothly as the Bond market expects. For those who are willing to study TIPS and are concerned about high inflation, it would be remiss to let this opportunity slip by with inaction.

For investors interested in investing in long-dated TIPS, the best option is likely the PIMCO 15+ Year US TIPS ETF (LTPZ), with expenses of 0.20% and an effective duration of just over 20 years, compared to its peers’ six-year duration.