One word that I can associate with building a portfolio in 2023 is ‘caution’. Lots of caution.

What does it even mean? How should you allocate between equity and bonds? What do you do with gold?

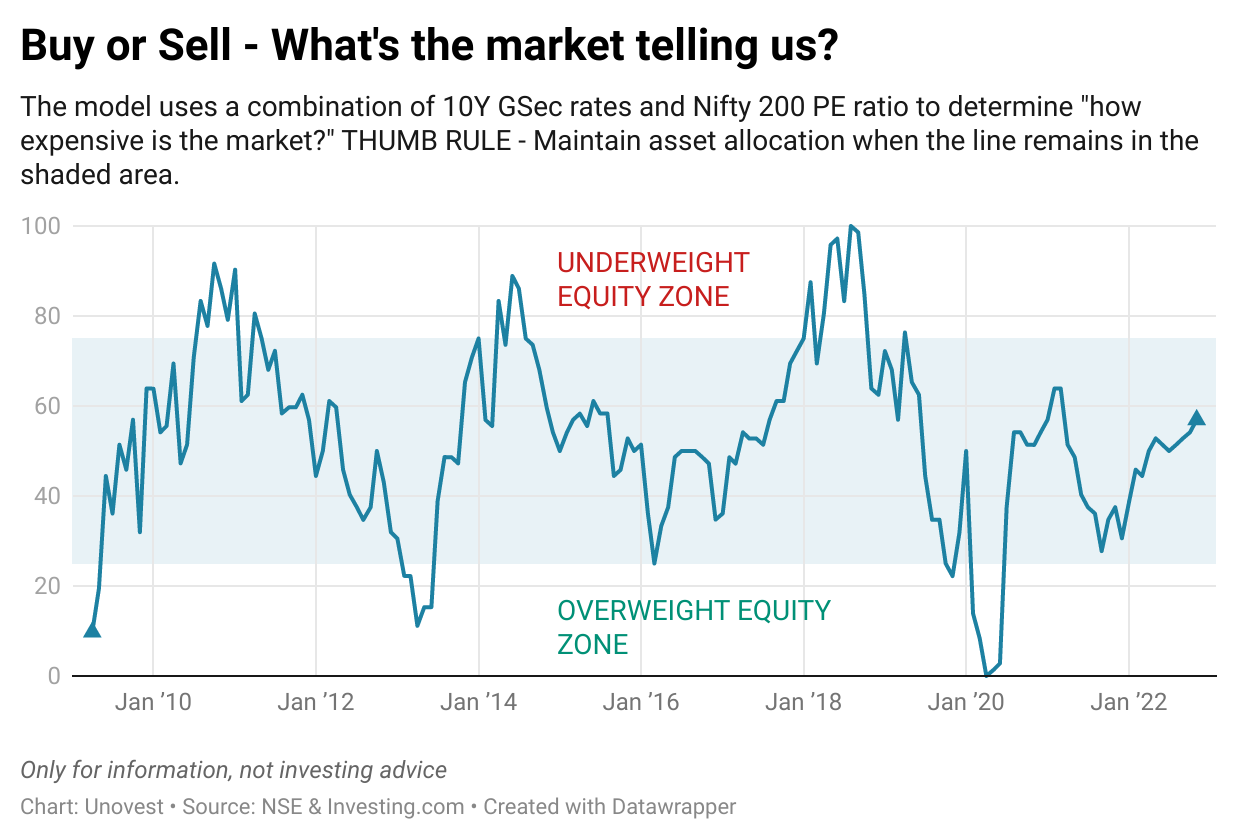

First off, don’t go too aggressive with equity investments. The markets are not sending the right signals. While equity is the way to build wealth in the long term, you need to slow down.

An interesting parameter to look at is the India VIX or the volatility indicator. See chart below.

VIX is at one of its lowest percentile levels. Let’s say it is not a sign of bullishness.

Refer to the VIX levels in Feb 2020 and Aug 2018 as well.

Our in-house asset allocation indicator suggests that equity investments should be strictly in line with your asset allocation and any new investments should be spread over months, if not years.

The only place that can afford an aggression now is the fixed income side, directly through Fixed Deposits / bonds or via debt funds. Even RBI has finally increased the rate on its floating rate bonds to 7.35% from 7.15%.

There are more details in the Jan 2023 issue of the LightHouse.

Interest rates are at near peak and locking into high rates is never a bad idea.

Coming to Gold, I have held a different view on gold as an investment. Gold is an insurance. As an investment, it represents the worst of equity (volatility) and debt (long term returns).

Having said that, the popular view in the market is to have a tactical allocation to gold. In any case, limit yourself to 10% allocation in the portfolio.

The most important thing to do now

As a first time equity investor, starting SIP in hybrid funds or conservatively managed equity funds could make a lot of sense.

If you are an existing investor, it is time to look at your portfolio and reallocate assets to their designed allocation. You are likely overallocated to equity, so pull out money and invest in debt.

If you have substantial lumpsum, it might be good to invest in debt to set the allocations right.

A bias towards fixed income, that is, allocating more to debt, can be a good idea.

—

Between you and me: How are you allocating your investments in 2023?