Have you received a call or text claiming there’s been an unauthorized transaction on your account? And in order to get your “new card,” you’ll have to verify some account details? Scammers love this one.

Whether over the phone or via text, scammers may pose as a Chime member services agent and request personal information or try to have you download an app that gives them access. Nope! Don’t go there.

If some form of fraud or risk is suspected on a Chime member’s account, here’s what really happens:

- The transaction will be declined or the card will be disabled, and you won’t be able to make purchases.

- Chime will send declined transaction push notifications or banners/messages within the app. You should check the app if their transactions are declined for any reason.

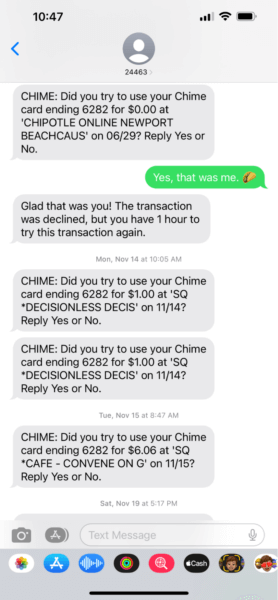

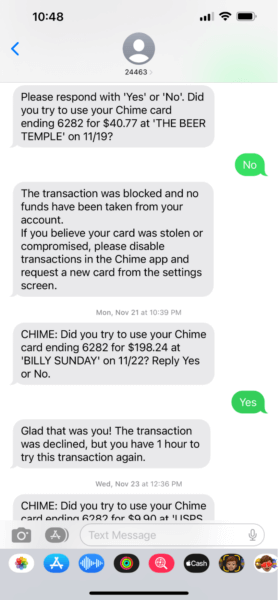

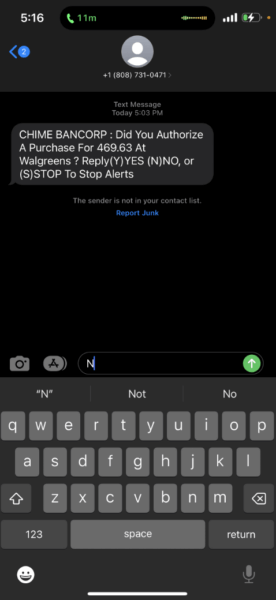

- Chime will send an SMS text to the member to confirm the transaction, but it will read exactly like this: “Did you try to use your Chime card ending [LAST 4] for $[AMOUNT] at [MERCHANT] on [DATE]? Reply Yes or No.”

If you reply “YES”, Chime asks you to retry the transaction and unlocks your card for one hour. If you reply “NO”, Chime continues to decline transactions, and you are told to reach out to Chime to replace your card. Not the other way around.

These texts are actually from Chime.

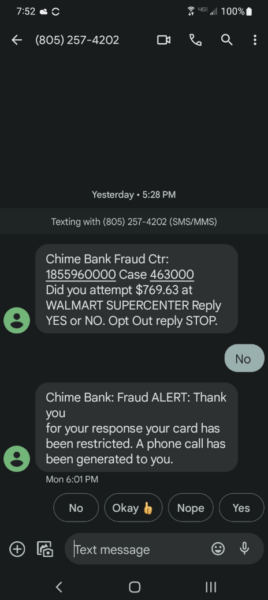

In scam SMS messages, you’ll notice some false names and phrases used, such as “Chime Bank” and “Chime Bancorp”. We’ve also seen texts claiming to be from “Chime Banking,” which is also fake. Often, these scammers will follow up with a call, which is also indicated in one of the examples below. You’ll never receive a call from Chime, and no Chime agent will ask you for login or account information.

These texts are scams! Beware!

How to avoid it:

✓ Check the app to ensure everything is status quo

✓ Look for false phrases or names

✓ Notice odd misspellings and capitalizations

✓ Block the number and delete the messages

✓ Call Chime directly if you have questions

One of the best ways to protect your money is with Chime security features, like two-factor authentication, real-time transaction alerts, and the ability to freeze your debit card if lost or stolen.