There are regular interventions from commentators over time who repeat the same thing over and over – usually some prophesy that a currency (for example, the Yen or the USD) will collapse soon, and life goes on until they come out with the same predictions, which never turn out. The mainstream media loves to give these characters a platform because the headlines are sensational and I guess that sells ‘units’ for the companies. The latest I saw was from Mr. Roubini in the Financial Times, who has been predicting the collapse of the USD regularly. Time to give him a miss I think. A related topic of hysteria that ordinary folks seem to get agitated about but clearly don’t understand even the first principles involved is the old canard – central bank losses. This gets a little more abstract for most relative to the Roubini-type currency collapse headlines but the mainstream press still manage to whip up a doom scenario that somehow the central bank is about to go broke and governments will have to bail them out and taxes and debt will rise, and, somehow, ultimately, our grandchildren will find themselves in penury trying to pay back the debts our current governments ran up. A recent Bank of International Settlements Bulletin article (No. 68)- Why are central banks reporting losses? Does it matter? (released February 7, 2023) – bears on this issue. Conclusion: nothing to see here.

Why are central banks reporting losses?

These are just manifestations of accounting conventions.

The sequence of events leading up to this situation has been as follows:

1. Quantitative easing programs, yield curve control, and all the rest of the names that simply refer to the central bank entering the secondary bond markets, where government bonds are freely traded by speculators and purchasing large quantities of bonds at various maturities (5-year, 10-year, etc).

2. So the central banks credited bank reserve accounts with funds they created through digital keystrokes and recorded the bond purchases on the assets side of their balance sheet (which just measure the assets and liabilities/capital of the bank) at the value of the bonds at the time of purchase.

3. As a result, over time, the assets rose rather significantly as the bond purchasing programs expanded.

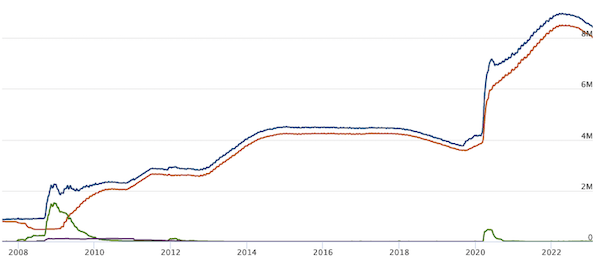

For example, here is the US Federal Reserve Banks assets from July 30, 2007 to January 31, 2023 (Source).

The top line (blue) is the total assets while the line just below it are Securities Held Outright, which are the bond purchases.

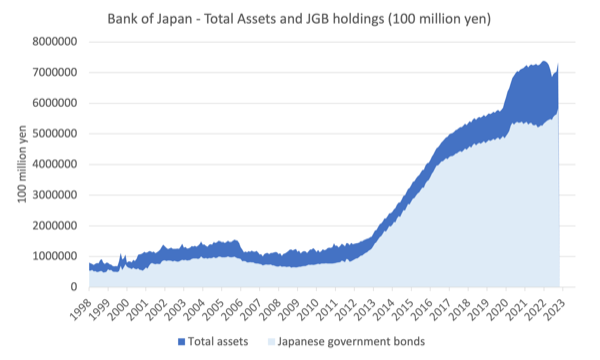

And for the Bank of Japan a similar story emerges (data from 1998 to January 2023), as it does for many central banks who engaged in bond-buying programs.

4. The BIS notes that the bond purchases were facilitated (as noted above) by the central banks providing “interest-bearing commercial bank reserves”, which meant two things:

– they paid the commercial banks a return close to the market return on short-term cash, which effectively meant that the procedure just shifted numbers from an account at the central bank (outstanding interest-bearing government debt) to another account (interest-bearing reserves) – which meant the banks were indifferent to holding bonds or reserves.

– the proportion of interest-free liabilities on the central banks’ balance sheets to total liabilities also fell.

For example, the US Federal Reserve before the GFC did not provide a support rate on excess commercial bank reserves.

5. These macroeconomic policy decisions taken by central banks “influence their profits and losses as a by-product”. How?

6. By increasing interest rates in their mad attempt to reduce inflationary pressures which are abating anyway without the influence of interest rates, the central banks have:

– driven up bond yields and forced down bond prices (remember bond prices and yields are inversely related) so that the asset value of their current bond holdings has fallen.

– driven down their net interest income because “a large proportion of their liabilities is linked to policy rates” – via the payments of interest on the excess reserves in the system.

7. The upshot is that using accounting treatments that recognise “changes in market value in calculating net profits” has led to the situation where:

some central banks have recently reported losses, and more are expected to follow … In some cases and depending on accounting approaches, losses are sizeable and can result in negative equity.

The banks already reporting losses include: RBA, National Bank of Belgium, Bank of England, Bank of Japan, Netherlands Bank, RBNZ, Sveriges Riksbank and the US Federal Reserve.

The accounting losses (numbers) are written off against the existing capital of the central banks and so if the numbers get big enough, the bank would enter a period of ‘negative equity’ – that is, the current capital it holds is not sufficient to match the accounting loss numbers.

Sounds horrific.

It isn’t.

I have written about his previously:

1. Central banks can operate with negative equity forever (September 22, 2022).

2. The ECB cannot go broke – get over it (May 11, 2012).

3. The sham of ECB independence (October 24, 2017).

4. Repeat after me: Central banks can make large losses and who would care (February 16, 2022).

5. Central banks should just write off all their government debt holdings (February 15, 2021).

6. Banque de France should write off its holdings of State debt (April 24, 2019).

7. The US Federal Reserve is on the brink of insolvency (not!) (November 18, 2010).

8. Better off studying the mating habits of frogs (September 14, 2011).

You can see from the date trail of these past blogs, how regularly this topic arises in the mainstream media – same old!

Does it matter?

The BIS understand that:

1. “Central banks are public institutions with policy mandates; they typically transfer their excess profits to the fiscal authority” – so, ultimately they are part of government and inherit the currency-issuing status.

The Economic and Monetary Union is a little different because none of the Member State governments are sovereign in the euro. Only the ECB has the currency-issuing capacity and France, for example, cannot order it to use that capacity.

For nations such as Australia, etc, the central banks are creatures of the state.

2. For central banks “the usual concept of solvency does not apply” – they are not commercial entities that are accountable to their shareholders.

3. For whatever reason, many central banks had arrangements with treasury or finance departments in government to indemnify them against losses. What does that mean? Simply that the government will always ‘cover’ the losses in an accounting sense – numbers flowing from the left pocket of government to the right pocket.

4. Other central banks did not follow that path and “note that they are irrelevant from the perspective of the overall public sector balance sheet”. That is, explicitly recognise that the central banks are part of government despite all the claims about ‘independence’.

The BIS write in this regard that:

As central banks generally remit some or all of their profits to the fiscal authority, they are part of the “consolidated” public sector finance picture … Recent losses for a number of central banks have led to smaller transfers to the fiscal authority or none at all, in some cases probably for years to come.

Right to Left pocket or vice versa.

5. Further:

… central banks do not seek profits, cannot be insolvent in the conventional sense as they can, in principle, issue more currency to meet domestic currency obligations, and face no regulatory capital minima precisely because of their unique purpose.

In other words, a currency-issuing government, unlike a non-government corporation, can never run out of money. There are no financial constraints.

The BIS, however, sneak this fiction into the story:

… central banks are protected from court-ordered bankruptcy and are backed (indirectly) by taxpayers.

The taxpayers are not part of this story.

Taxes reduce non-government spending capacity (among other functions – like stopping people smoking).

They do not fund anything or back anything.

Principally, from the macroeconomic perspective, taxes serve to create the real resource space that the government can spend into without causing demand-pull inflation.

The central banks are backed by government because they are part of government – that is the reality.

6. “These provisions allow central banks to successfully operate without capital and withstand extended periods of losses and negative equity.”

The BIS provide several examples from history.

But, then things fall apart

The BIS then start qualifying their conclusions:

There can be, however, exceptional situations where misperceptions and political economy dynamics can interact with losses to compromise the central bank’s standing. If there is macroeconomic mismanagement and the state lacks credibility, losses may erode the central bank’s standing, which may jeopardise its independence and could even lead to the currency’s collapse.

No examples are given. Why?

Because this is hot air.

Yes, politicians might beat up the story to bring harm to other politicians.

Financial markets might talk big about abandoning the currency but if the central bank holds its position then as Japan shows, the ‘market players’ lose.

The Roubini-types have been forecasting hell for Japan and claim that the Bank of Japan will back down soon and accede to the market demands for interest rate rises and the abandonment of yield curve control.

My most recent post on that topic was – Bank of Japan continues to show who has the power (January 26, 2023).

The financial commentators and gambling were also hoping that when the current governor (Haruhiko Kuroda) retired soon, the policy approach of the Bank would shift in favour of the markets.

Wrong again.

It looks like the government will appoint the Bank of Japan Deputy Governor Masayoshi Amamiy when Mr Kuroda goes and the former will not change policy direction at all given his stated public views.

The yen has depreciated since the US Federal Reserve started hiking rates and the gap between the yen interest rates diverged.

That was entirely predictable.

But the depreciation has been finite and the yen strengthened recently – again entirely predictable – when it became obvious that the bank was not going to give the financial market gamblers the profits they were betting on.

So, ultimately, central bank losses will, in their own right, precipitate some currency crisis.

They might if the government is weak in resolve and confused in its policy direction. But that says nothing other than financial markets will prey on a government that they think will back down and ratify the speculative bets.

The BIS also carry on about the need for “central bank independence” which necessitates “well-designed distribution rules governing transfers from the central bank to the government, processes for dealing with episodes of losses or reduced profitability, and clarity on risk-sharing arrangements if present.”

In other words, smokescreens to cloak what is really the case.

And that is, that the central bank is part of government and currency-issuing capacity always likes in the government, which can move currency numbers around internal accounting structures at will without any significant consequence.

Conclusion

There will be more on this in the mainstream media for sure.

Central banks are racking up losses due to their own policies.

But those losses are meaningless.

What is more important is the massive income transfers that the central banks are now making to commercial banks (and indirectly their shareholders) through the returns they are paying on excess reserves.

And further, the massive income losses the central banks are inflicting on low-income mortgage holders as a consequence of the rate hikes.

They should immediately go back to a state of zero support rates on excess reserves and stop hike rates.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.