HDFC Mutual Fund has announced a New Fund Offer – HDFC MNC Fund – a thematic fund benchmarked to the Nifty MNC Index.

As per the index factsheet available on NSE, the Nifty MNC Index comprises 30 listed companies on National Stock Exchange (NSE) in which the foreign promoter shareholding is over 50%.

HDFC MNC Fund’s Scheme Information Document also suggests that its universe of stocks will have this eligibility criteria based on shareholding. Additionally, the fund can invest 20% of its portfolio in other stocks as well.

Well, what’s different?

What does the Nifty MNC index have?

Let’s first look at the index itself and get an idea of what could be a likely portfolio of the HDFC MNC Fund.

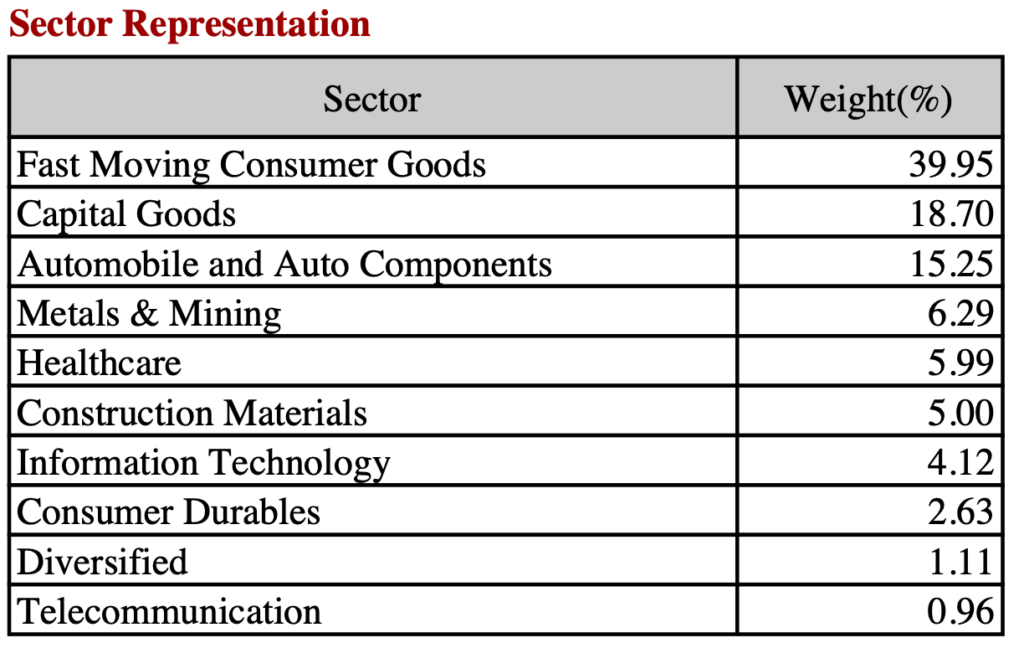

Check out the sectoral spread of the index. What’s amiss?

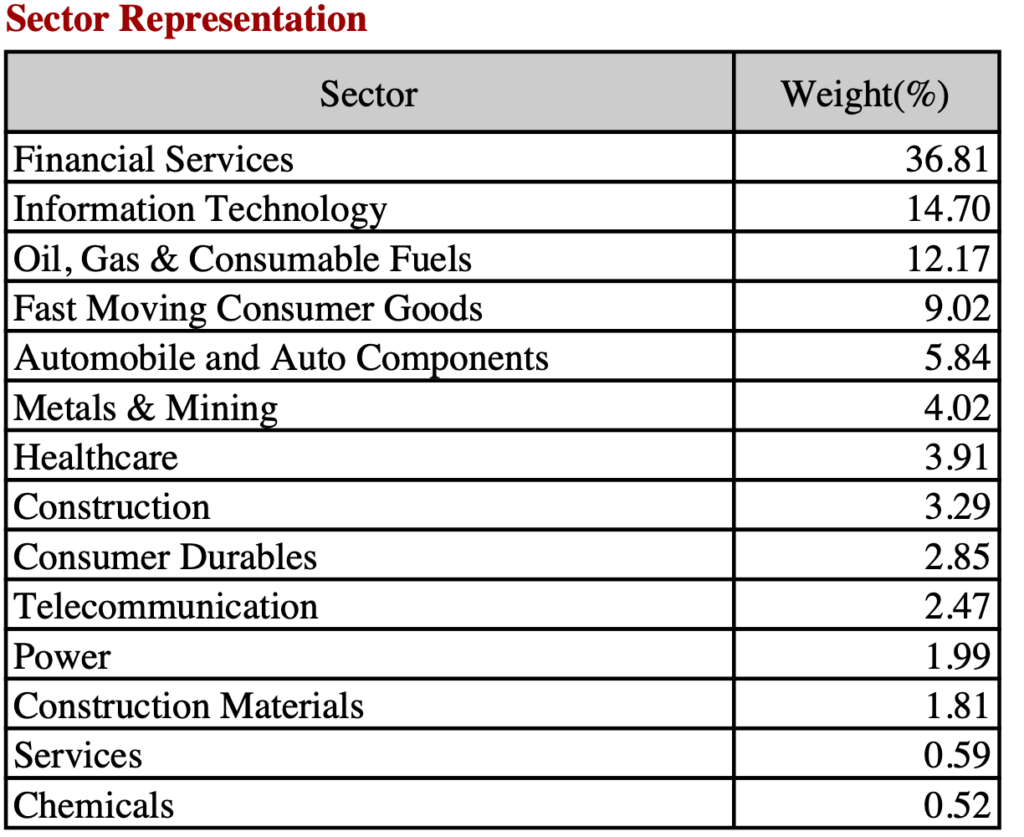

The biggest difference Nifty MNC Index has in contrast with, say, Nifty 50 – a broader market index, is the literal absence of Financial Services, which forms a bulk of the latter.

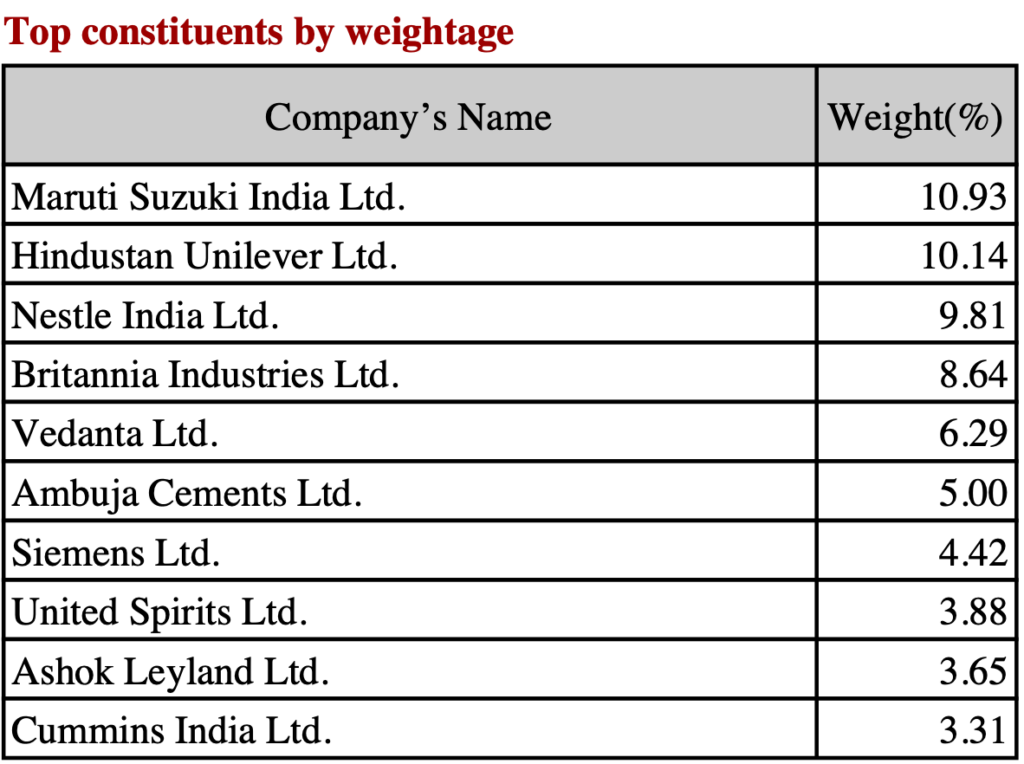

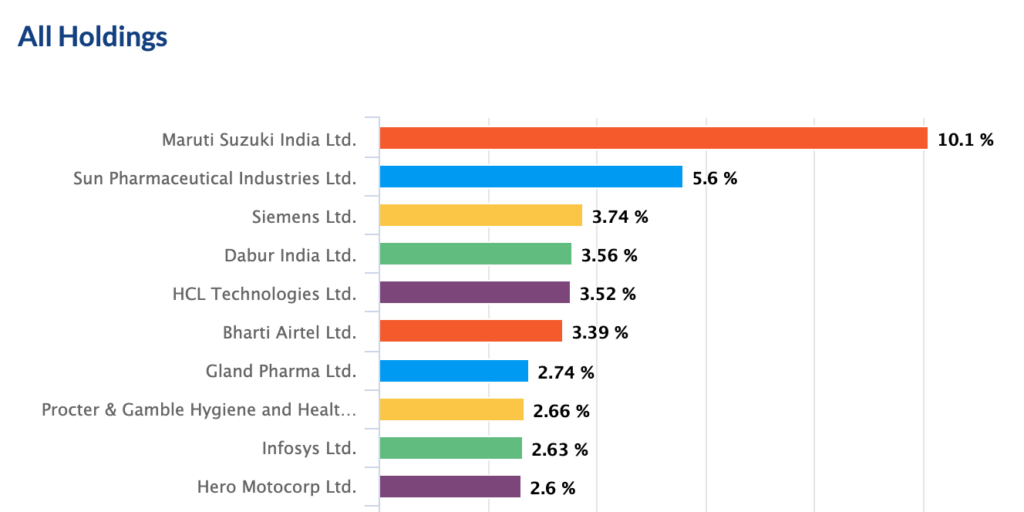

Here are the MNC index top holdings.

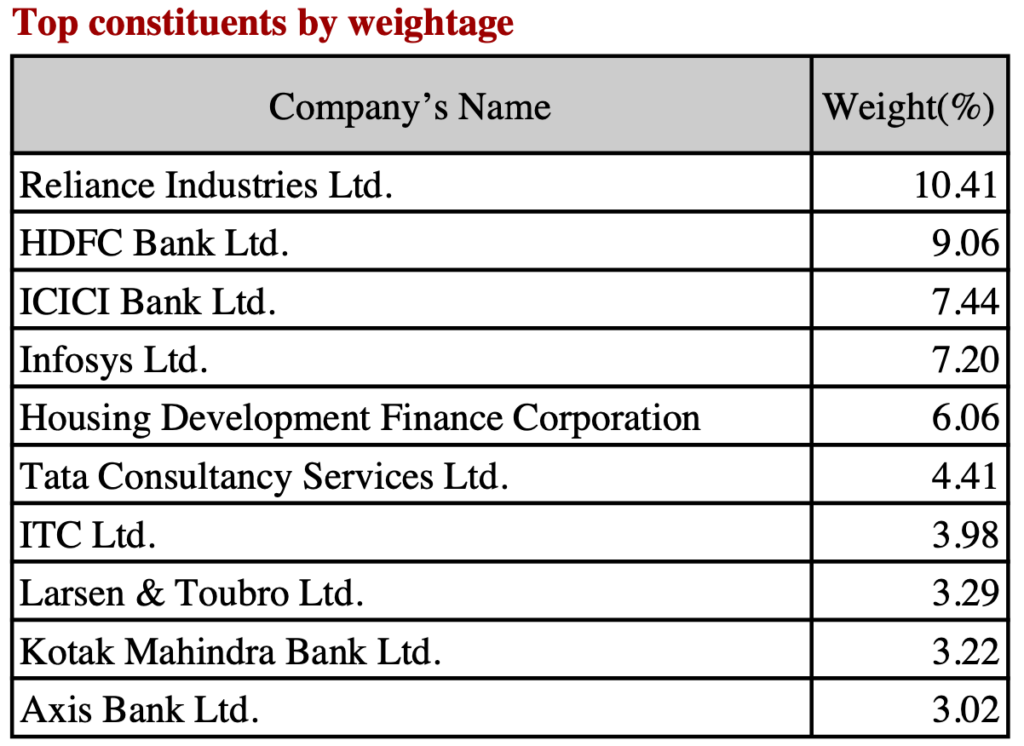

Here’s the same for Nifty 50

What do other MNC funds have in their portfolio?

Why just the index, let’s also look at the other similar existing funds.

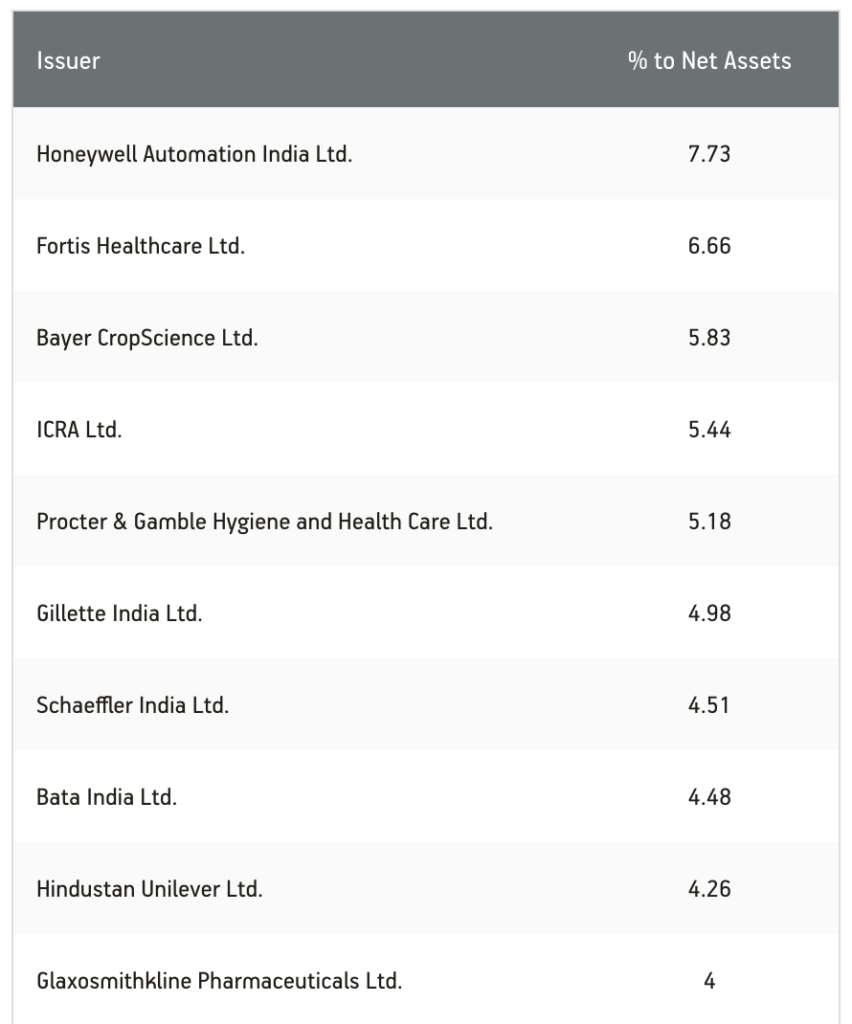

This is ICICI Pru MNC Fund’s top 10 holdings.

Below is Aditya Birla SL MNC Fund’s Top 10 holdings

Here’s UTI MNC Fund’s Top 10 holdings

Thematic funds, as per SEBI, have to adhere to minimum 80% of the holdings as per the defined theme. 20% leeway is provided for other stocks.

Why? They say the reason is diversification. We all know the real reason is to find ways to beat the benchmark and/or other funds.

Should you invest in HDFC MNC Fund?

With a large fund universe with HDFC MF, I am not sure we need another actively managed fund from it.

On that note, why even have an actively managed MNC fund. HDFC MF already has dozens of funds doing the same.

If at all, this was a good chance to have a passive option based on the Nifty MNC index.

The index already has rules. The stock universe is limited. A low cost option would have made great sense.

Not that anyone needs ‘one more fund’, but that, at least in my view, would be the right thing to do.

So for this New Fooling Offer, you can give a total miss.

If you are someone who thinks that MNC funds offer better quality as well as decent performance and thus prefer the theme, then you have other funds with a track record.

—

Further Read: John Bogle’s 8 rules to build your mutual fund portfolio