Physics has been seeking a grand “Unified Field Theory” that can explain everything in the universe. I sometimes wonder if we cannot find a similar overarching theory about all bad decision-making. The closest I have found as that single point of failure is the Dunning Kruger effect.

Recall last week, we were discussing thinking about the impact of retiring Baby Boomers on the equity markets and of rising rates on housing. Rereading that this morning, I realized I buried the most important part of the discussion:

“Both questions are a fascinating reveal of how a common understanding of complex subjects barely scratches the surface of the rich complexities that lay beneath. All too often, the superficial narrative fails to capture the reality beneath.”

The discussion was really about how initial appearances can be misleading due to complexity we may not even be aware of; the housing question about rates — which are obviously important — led us to recognize they are far from the sole driver of the residential real estate market. Indeed, many other things can be even more important.

Our own lack of depth in a specific skillset is why we miss that complex reality. Our tendency as a species towards overconfidence can combine with a little bit of knowledge; ultimately, this leads to fundamental misunderstandings.

Can this one-two punch explain why it is so easy to get so much wrong in the capital markets so often?

Let’s consider another question, this one on U.S. equity valuations:

“Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?”

The demographic question touches on a big issue: $6 trillion dollars in 650,000 (401k) retirement plans held by 10s of millions of Americans. The initial assumption is the retiring boomers matter a great deal, but a deeper dive into the structure of equity ownership suggests that it probably does not.

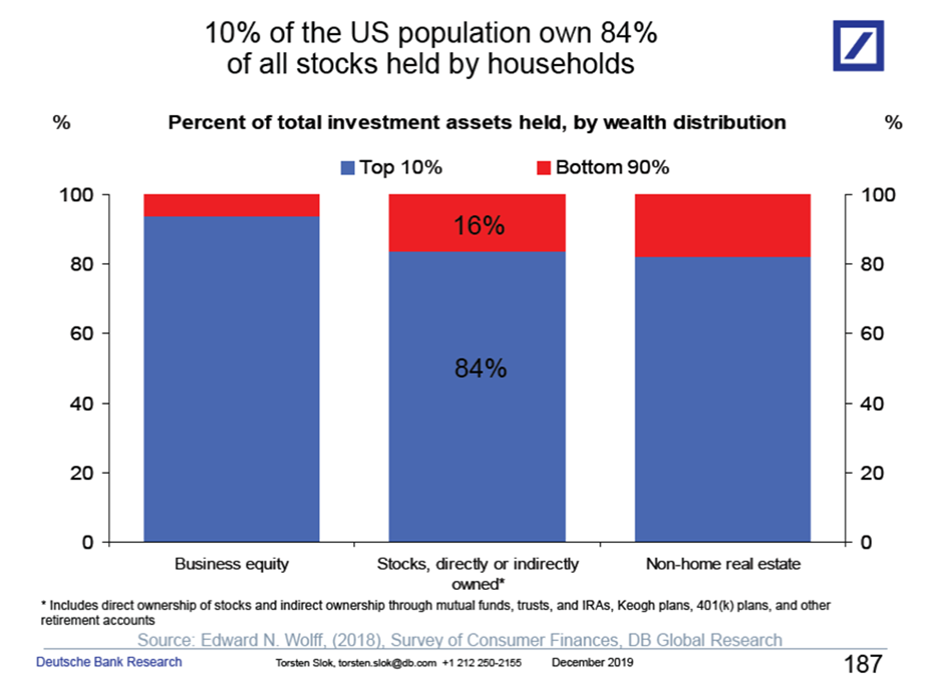

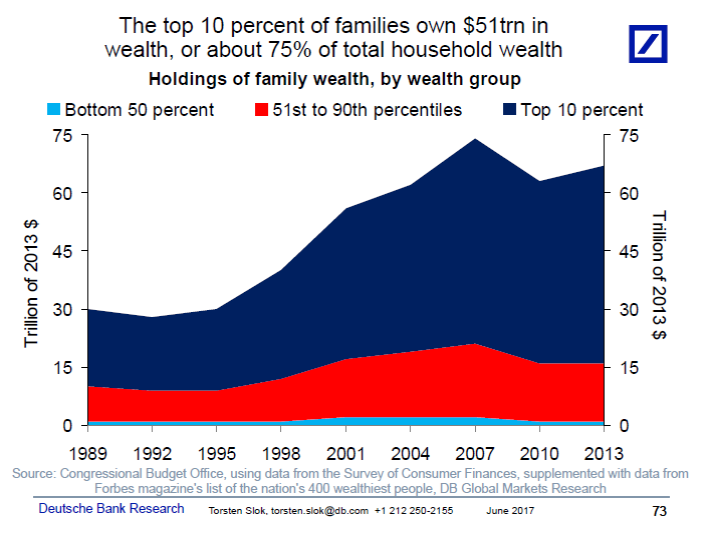

I suspect most of us have a distorted viewpoint of the average investor versus the total capital in the market. As the charts below show, the vast majority of equities are held by the top 1% and 10%. This demographic cohort is simply not a seller due to retirement – the tax expenses would be too great. Instead, a comprehensive approach to managing generational wealth transfer, philanthropy, gifts, trusts, etc. occurs.

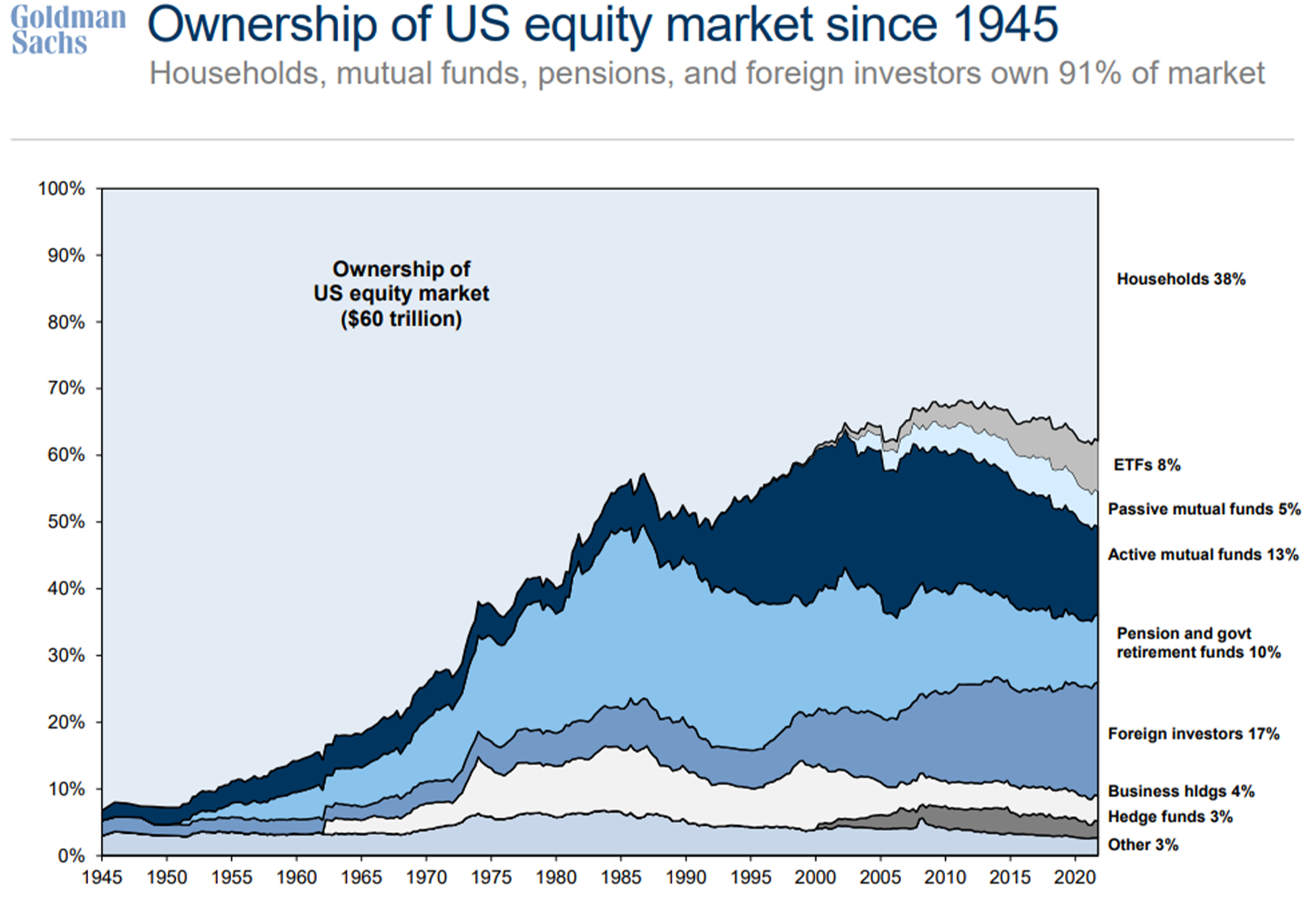

Adding a layer of complexity, at one point in time, all of these stocks were owned directly by individuals as specific company stock. As Ben pointed out via his favorite chart at top, ownership of U.S. equity market since 1945 has shifted dramatically to different investment vehicles. U.S. households once owned 95% of all stocks individually in brokerage accounts; today, ownership is is via ETFs, mutual funds, pensions, hedge funds, foreign investors, etc.

Estate taxes are why appreciated equity is transferred this way. These scenarios do not usually involve a much stock selling. But as we have seen, most people have little idea about exactly how top heavy equity ownership is. The market is much bigger, more professionalized, and institutionalized.

~~~

A few years ago, a friend came out with a fantastic idea for an Index and ETF; even better, he managed to snag an amazing stock symbol. (I am purposefully omitting the specifics and the names of the fund managers, sponsors, banks, etc.) It had an ESG twist, and so was a potential fit for foundations, endowments, family offices, etc. He put together a great board of advisors, a clever idea for adjusting the index, it was all so brilliant. The index even outperformed it’s S&P500 benchmark all 5 years running. But it found little pick up despite the hot sector it was in. Here we are five years later, and while the idea + ticker are still great, the fund shut down due to lack of interest.

I asked my buddy if he had any interest in selling the stub (assets include name, intellectual property, board, ticker symbol, etc.) for pennies on the dollar. I like the idea, and imagine how easy it would be to turn it into a giant success, a $ billion dollar ETF.

Before putting any time or capital at risk, I wanted to discuss it with an expert. In my circles, nobody knows more about the ETF industry than Dave Nadig. We looked at the idea and who the potential ETF/index buyers might be. We kicked around how the target demographic makes these decisions, how they check which box, who they consult with, what other parties advise the decision-makers. Last, we considered why other like-minded funds similarly failed to attract much capital. The key conclusion was this was despite the sexy idea and stock ticker and great performance, it was only a so-so investing vehicle, unlikely to attract much capital.

Hence, I was saved a lot of time and work and headache and capital, all because I had some small awareness of my own astonishing ignorance. I don’t usually think of humility as my strong suit, but I would chalk this one up to a mix of concern, fear and recognition of my lack of competency in this space.

I consider that a giant win…

~~~

Some people have suggested that knowing about cognitive biases does not help in the fight against them. I never want to be on the opposite side of an intellectual argument with Danny Kahneman; however, I am hopeful that if we think about things less in terms of what we do know, and more in terms of what we might not know, perhaps we can make better decisions.

Previously:

What If EVERYTHING Is Narrative? (June 21, 2021)

What If Everything is Survivorship Bias? (aka The Hidden World of Failure) (October 23, 2020)

Stock Ownership:

Distribution of Household Wealth in the U.S. since 1989 (March 10, 2020)

Stock Ownership in the USA (January 14, 2020)

Wealth Distribution Analysis (July 18, 2019)

Composition of Wealth Differs: Middle Class to the Top 1% (June 5, 2019)

Wealth Distribution in America (April 11, 2019)

US Wealth Distribution, Stock Ownership Edition (June 30, 2017)