This is my annual assessment of the funds that I own and whether it makes sense to hold them with my annual outlook, as described in this month’s companion article. My outlook is “Risk Off” because of economic uncertainty, plus bonds are now paying an attractive yield. The funds assessed in this article exclude bond funds, individual stock, and American Century Advantis All Equity Markets (AVGE). As interest rates rose and stocks and bonds fell, I gradually sold my most volatile funds and bought short-term ladders of certificates of deposit and Treasuries to lock in higher yields. With interest rates higher, I now ask myself, would I rather own my remaining funds in my intermediate buckets or make four or five percent in safer investments? That is the question.

I use the “Bucket Approach” and have Fidelity Wealth Management manage my longer-term portfolios, which collectively resemble a diversified, traditional 60% stock to 40% bond portfolio, including small cap and emerging market exposure. My short-term bucket consists of money markets and short-term CD and Treasury ladders. Intermediate buckets consist of Treasury ladders to match RMD withdrawal needs along with the funds in this article, plus a small position in American Century Advantis All Equity Markets (AVGE). These intermediate buckets tend to be more conservative with large-cap developed market funds and quality bond funds of short to intermediate duration. All of the funds in the intermediate buckets included in the article are actively managed, which I favor for their versatility to adapt to changing environments.

This article is divided into the following sections:

Mutual Fund Observer Tools

The Mutual Fund Observer MultiSearch Screener is powerful in that it allows an investor to find funds based on an extremely wide range of risk and risk-adjusted-performance criteria. In this section, I explore the MFO Analyze and Portfolio Tools with respect to my funds using some of my favorite metrics. I own the following funds except for the Vanguard 500 Index (VFINX) and State Street SPDR S&P 500 (SPY), which I include as baseline funds.

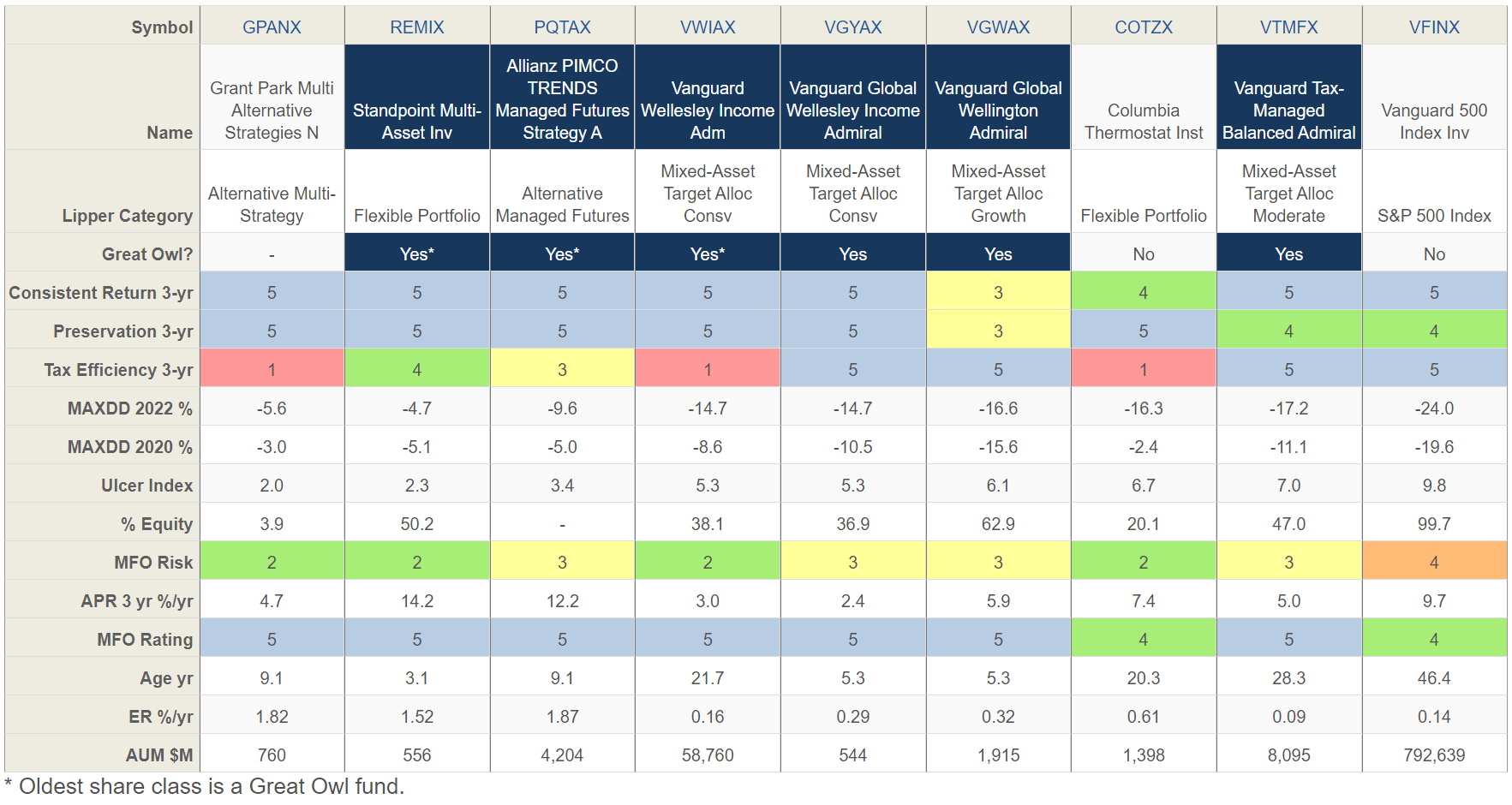

Chart #1 provides a focused summary of the funds. All but Grant Park Multi Alternative Strategies (GPANX) and Columbia Thermostat (COTZX/CTFAX) are classified as MFO Great Owl Funds. The funds are sorted with the lowest risk fund (GPANX) as measured by the Ulcer Index on the left to the highest (VFINX) on the right. All funds are rated as “Best” with an MFO Rating of 5 for Risk Adjusted Performance in their category representing the top quintile except for COTZX, which is rated “4” (Above Average). GPANX and COTZX/CTFAX are the least tax efficient and should be held in tax-advantaged accounts if possible.

Chart #1: MFO ANALYZE – COMPARE (Three Years)

Source: Author Using Mutual Fund Observer

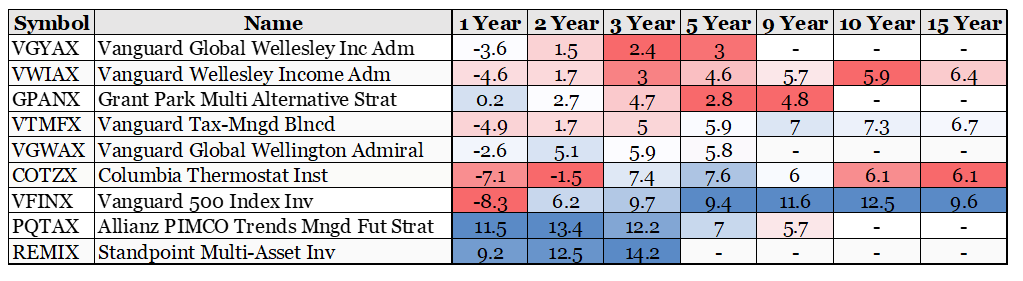

Chart #2 contains the period returns sorted by the lowest three-year return to the highest. During this period, the U.S. economy has experienced the COVID-induced recession, high stimulus, a rapidly rising Fed Funds rate, and last year’s bear market. The next three years will probably be characterized by a recession, falling rates, and quantitative tightening. The next three years favor funds with a high percentage allocated to bonds with longer durations, assuming inflation is contained. This will favor COTZX/CTFAX, VWIAX/VWINX, VGYAX, VTMFX, and VGWAX. Valuations are higher in the U.S., which favors funds with higher international exposure, such as VGYAX, VGWAX, PQTAX, and REMIX. The S&P 500 has benefited from the massive stimulus, low-interest rates, strong dollar, and buybacks over the past decade, which won’t exist in the coming decade. Funds with better long-term performance are VTMFX, COTZX/CTFAX, VWIAX, and PQTAX. Standpoint Multi-Asset (REMIX) is a newer fund with only a three-year history.

Chart #2: MFO ANALYZE – FIXED PERIOD – RETURN

Source: Author Using Mutual Fund Observer

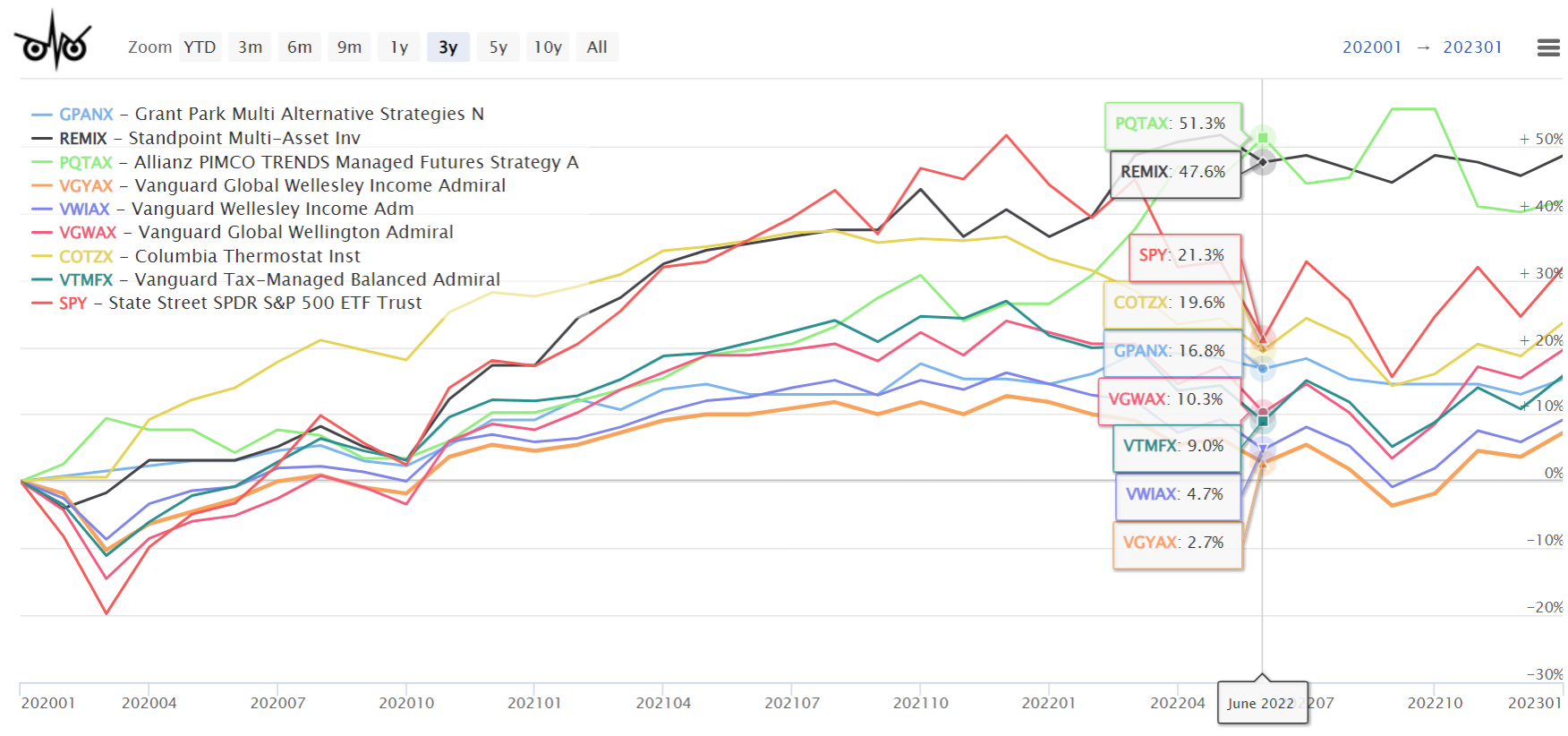

Chart #3 reflects recent performance. Allianz PIMCO Trends Managed Futures (PQTAX), Standpoint Multi-Asset (REMIX), and Grant Park Multi Alternative Strategies (GPANX) had better performance during 2022, followed by Vanguard Funds (VGYAX, VGWAX, VWIAX/VWINX). Vanguard Tax-Managed Balanced (VTNFX) and Columbia Thermostat (COTZX/CTFAX) had the worst 2022 performance losing about 13% compared to 18% for the S&P 500. I reduced allocations to PQTAX in some portfolios as it became more volatile at the end of the year. GPANX (blue line) has remarkably low volatility.

Chart #3: MFO ANALYZE – CHART

Source: Author Using Mutual Fund Observer

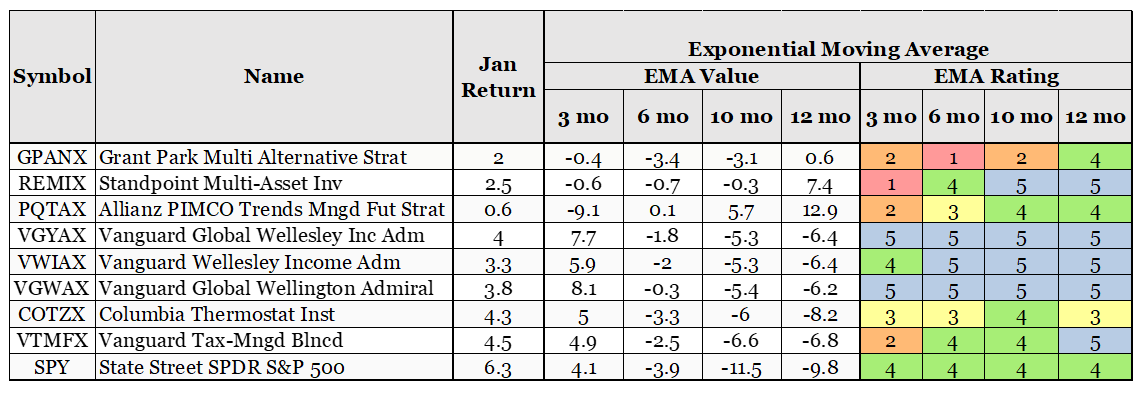

Chart #4 shows the recent trends in the funds, with the Vanguard Global Funds (VGYAX and VGWAX) benefiting the most, followed by the Vanguard Wellesley Income Fund (VWIAX/VWINX). The best performers from 2022 (PQTAX, REMIX, and GPANX) have had the lowest momentum recently, followed by the Vanguard Tax Managed Balanced Fund (VTMFX).

Chart #4: MFO ANALYZE – TREND

Source: Author Using Mutual Fund Observer

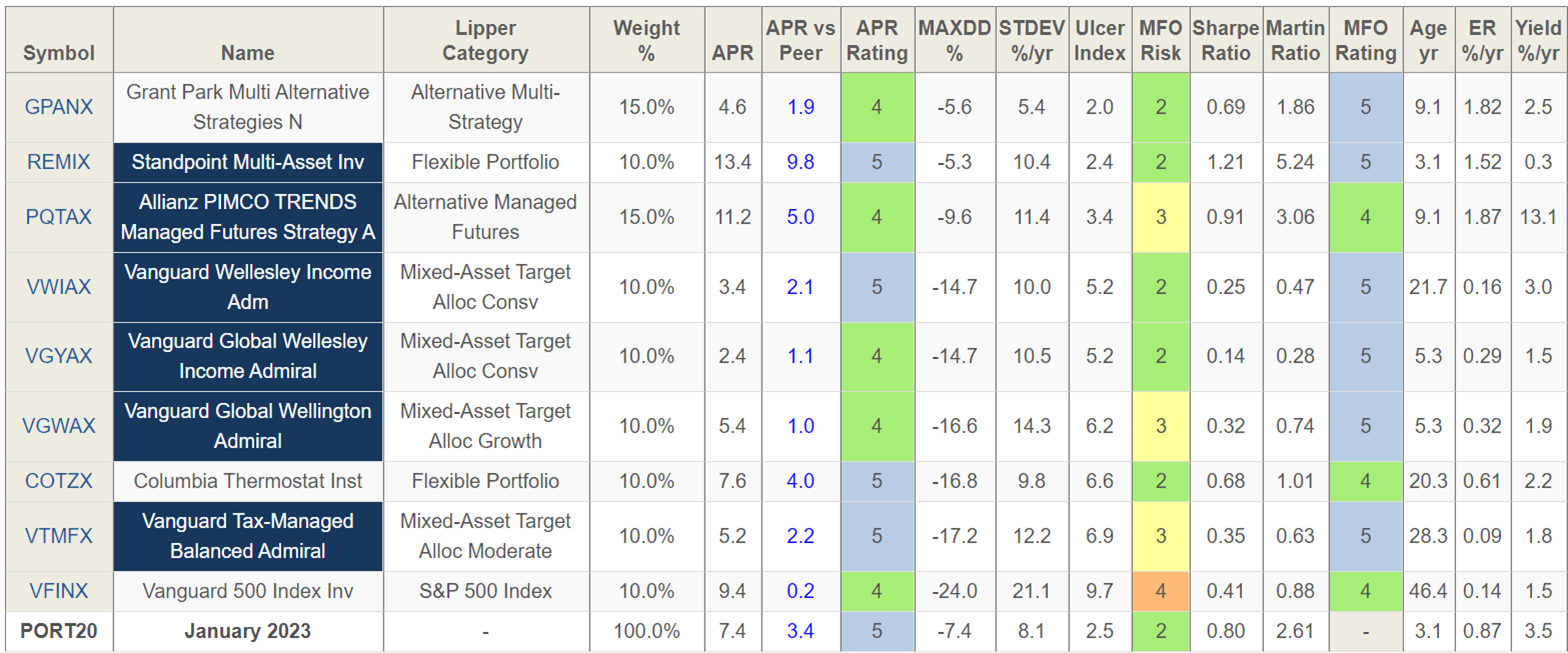

How would a portfolio of these funds have performed over the past three years? Chart #5 shows that with a near equal weighting, including the S&P 500, the portfolio would have made 7.4% with a maximum drawdown of 7.4%. The Ulcer Index of the portfolio is 2.5, which is lower than all but two of the funds reflecting the benefits of the low correlation. Expenses are relatively high at 0.87%.

Chart #5: MFO – PORTFOLIO (Three Years)

Source: Author Using Mutual Fund Observer

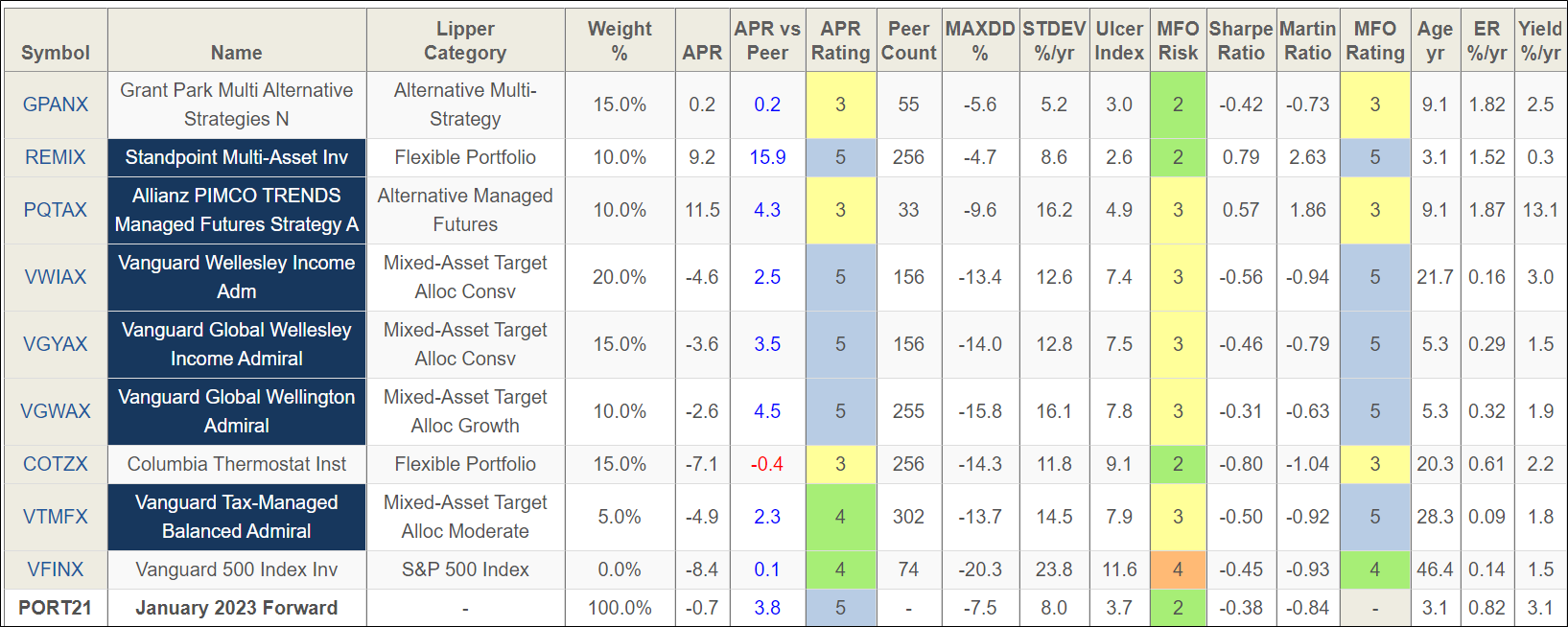

How might a defensive portfolio look if we take into account a recession and falling rates over the next two years? One possibility shows how a slightly more defensive portfolio would have performed over the past twelve months ending January. It would have nearly broken even and had a maximum drawdown of less than eight percent. I increased allocations to GPANX for its stability, VWIAX as a conservative domestic value-oriented fund, and COTZX because it increases allocation to equities as the stock market falls. I held allocations to REMIX at ten percent because it has less history, and to PQTAX, even though it has been a top performer because of its volatility. I show low allocations to VTMFX because of its higher volatility.

Chart #6: MFO – PORTFOLIO (One Year)

Source: Author Using Mutual Fund Observer

After reviewing each of these funds in Mutual Fund Observer, I assess that they are respectable holdings for this year, given the uncertainty of hard or soft landings and inflation.

Portfolio Visualizer Optimization Tools

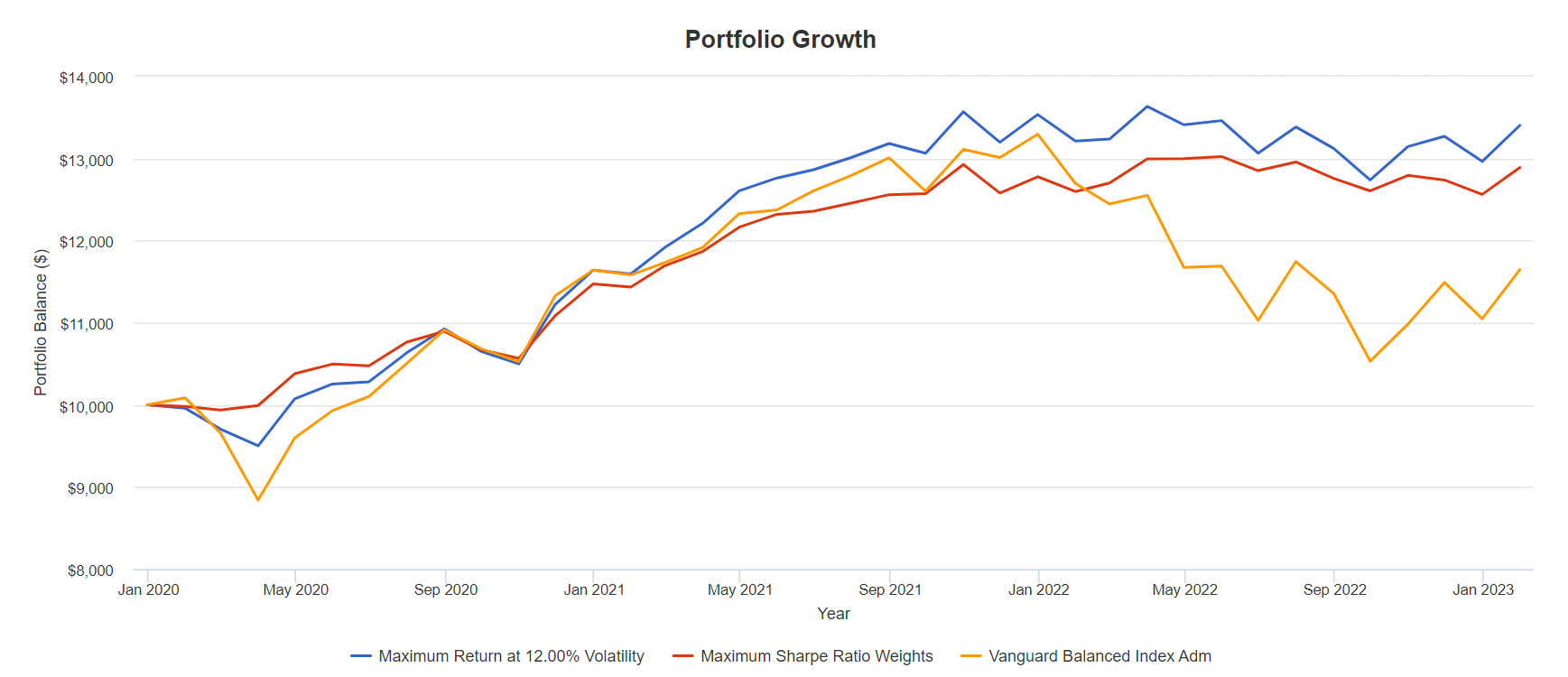

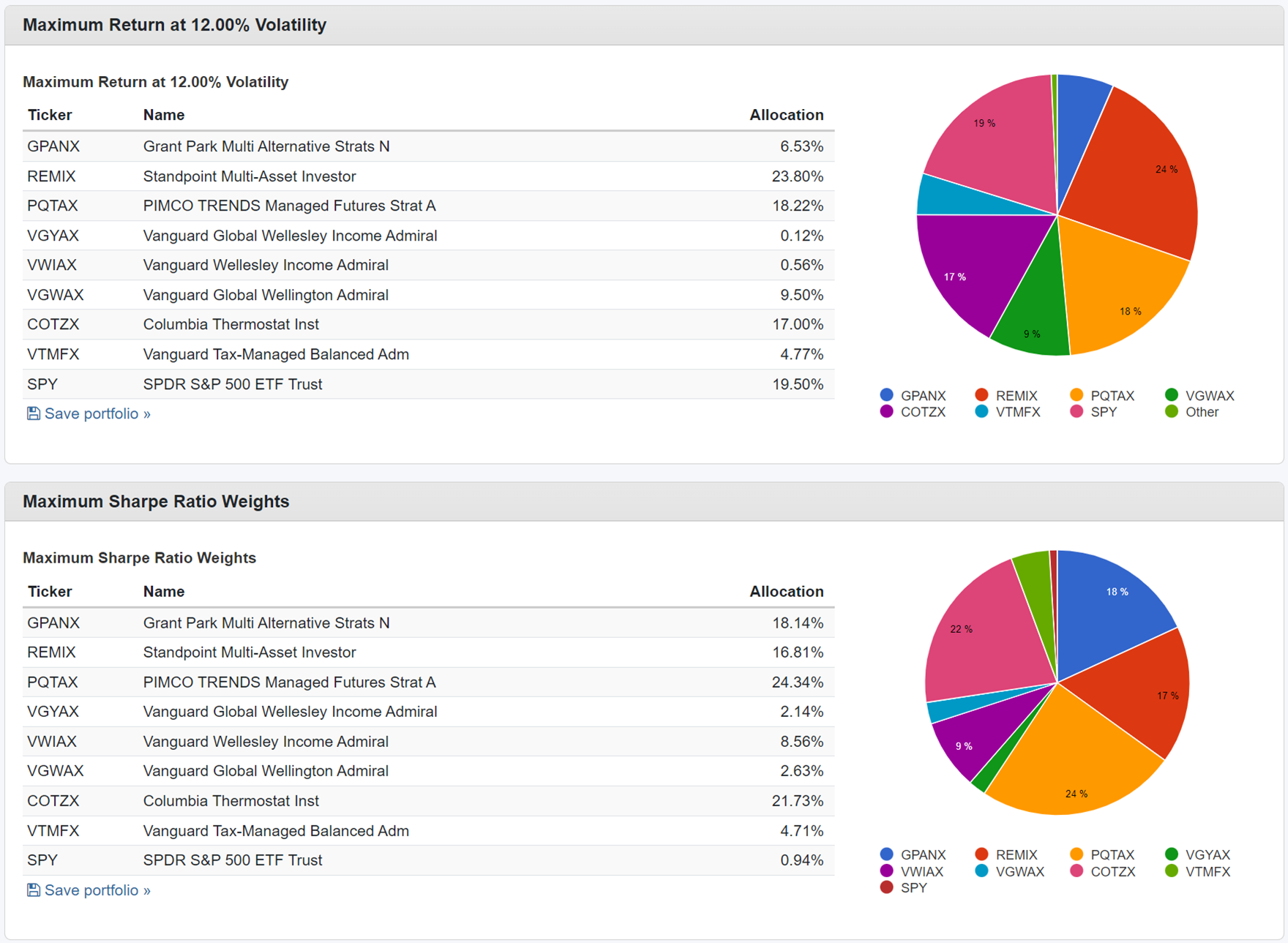

I find the primary strength of Portfolio Visualizer to be optimizing and analyzing allocations for different time periods. The link to Portfolio Visualizer is here. I ran two scenarios to maximize return at 12% volatility (blue line) and to maximize the Sharpe Ratio (red line) using the Vanguard Balance Fund (VBIAX) as a baseline. These two options, along with bonds, are what I am striving for over the next two years – stability with respectable risk-adjusted returns.

Chart #7: PV PORTFOLIO OPTIMIZATION – SUMMARY PORTFOLIO GROWTH (3 Years)

Source: Author Using Portfolio Visualizer

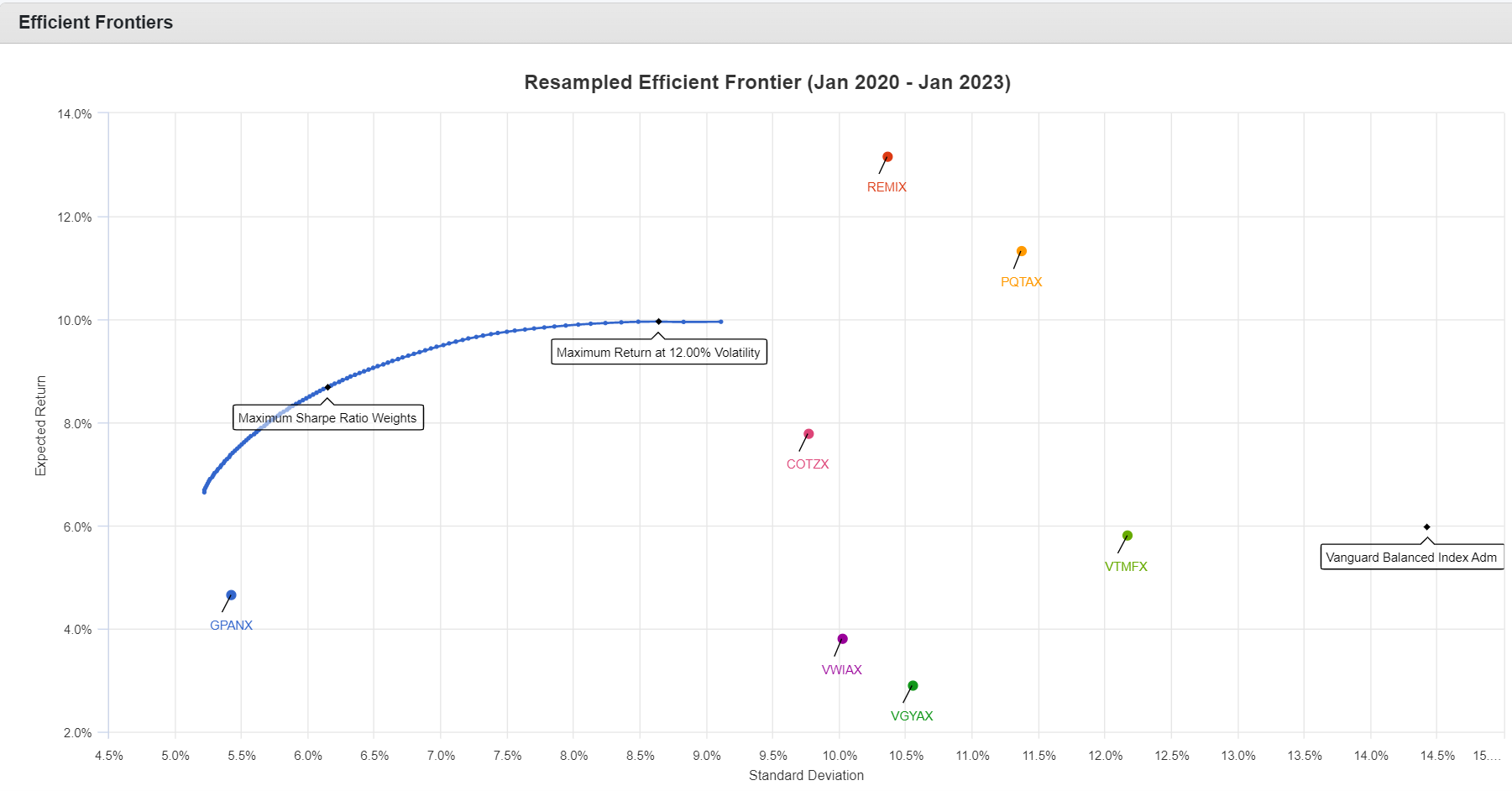

Chart #8 shows the Efficient Frontier (blue line), which is the maximum return for the level of volatility over the past three years. The Expected Return (11.3%) and Standard Deviation (21.1%) of the S&P 500 are outside of the chart scales. GPANX, REMIX, PQTAX, and COTZX are good choices, with VWIAX and VGYAX requiring more understanding of why their poor performance won’t continue. These two will benefit from stabilizing or falling yields. VTMFX is a good long-term holding in a tax-efficient account.

Chart #8: PV PORTFOLIO OPTIMIZATION – EFFICIENT FRONTIER

Source: Author Using Portfolio Visualizer

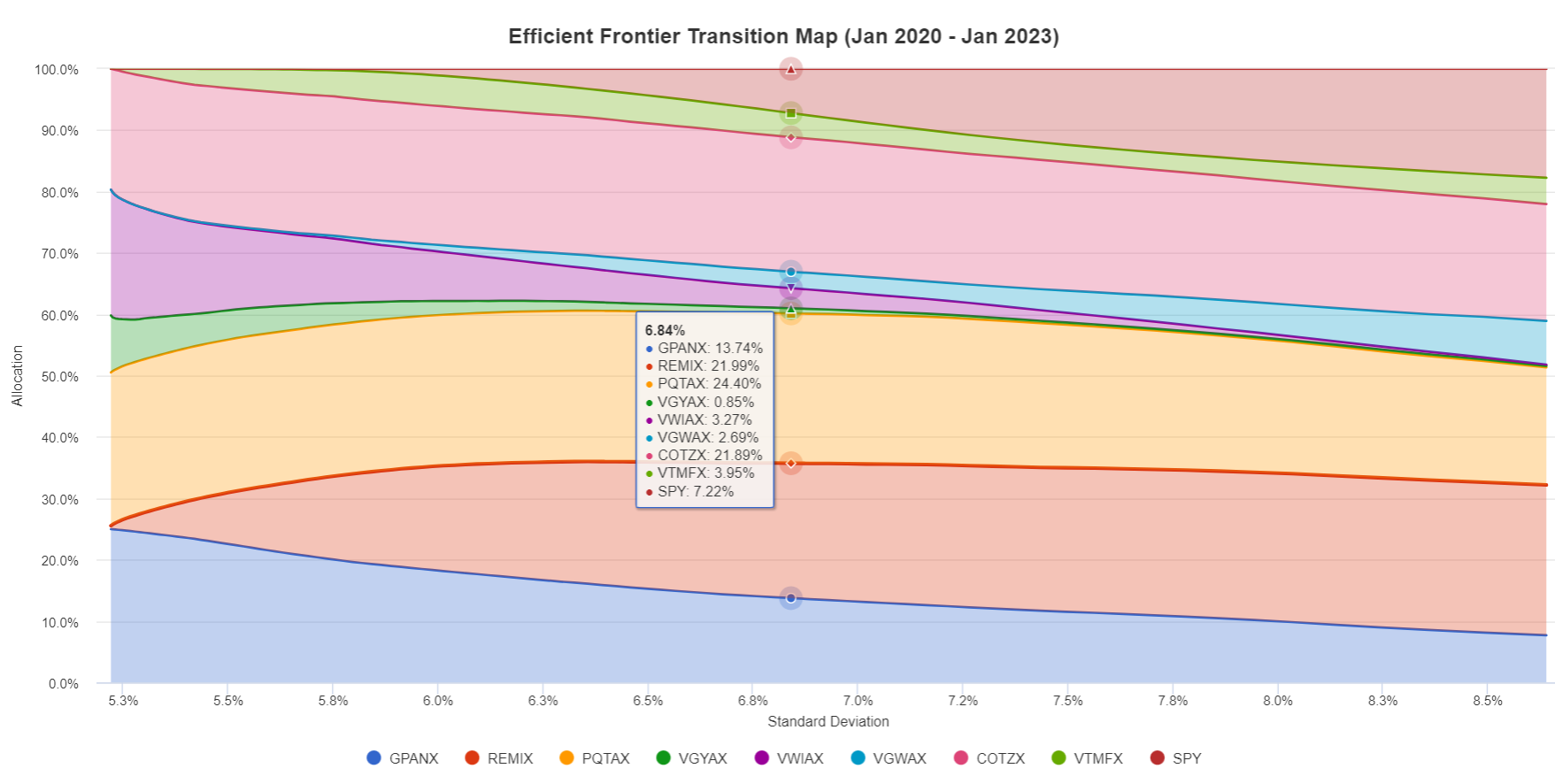

Chart #9 is useful for investors to understand their own risk tolerance and outlooks. If one is more “Risk Off” and wants less volatility then they should increase allocations to GPANX, VGYAX, and VWIAX. If one is more “Risk On” and wants more return then they should increase allocations to the S&P 500, VGWAX, and REMIX. PQTAX and COTZX are good funds to own across all ranges. (Hint: The Legend going from left (GPANX) to right (SPY) matches the funds in the chart from bottom (GPANX) to top (SPY))

Chart #9: PV PORTFOLIO OPTIMIZATION – EFFICIENT FRONTIER TRANSITION MAP

Source: Author Using Portfolio Visualizer

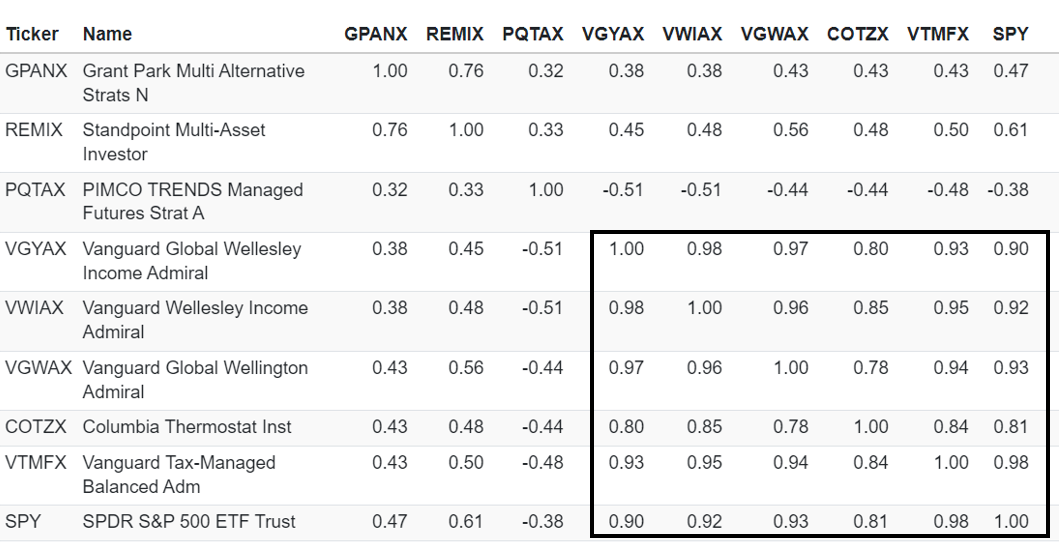

To smooth out volatility, one might seek uncorrelated funds. Chart #10 shows that VGYAX, VWIAX, VGWAX, COTZX, VTMFX, and the S&P 500 (SPY) are the most correlated, with COTZX being slightly less correlated, and one could combine some of these funds if the goal is to keep it simple.

Chart #10: PV PORTFOLIO OPTIMIZATION – ASSETS – MONTHLY CORRELATIONS

Source: Author Using Portfolio Visualizer

Chart #11 shows the allocations that were used to create the portfolios in Chart #7. In both portfolios, REMIX, PQTAX, and COTZX have high allocations. Also, in both portfolios, VGYAX has the lowest allocations. I have reduced allocations to Vanguard Global Wellington (VGWAX) and increased allocations to the more conservative Vanguard Global Wellesley (VGYAX) because of being more “risk off.”

Chart #11: PV PORTFOLIO OPTIMIZATION – SUMMARY PORTFOLIO ALLOCATIONS

Source: Author Using Portfolio Visualizer

Answering the Question – To Sell or Not to Sell?

In short, I am pleased with the changes that I made last year, and I don’t plan to sell any of the funds that I own this year and invest the proceeds into cash or bonds. In fact, as short-term ladders mature, I will add to some of these funds toward the middle of the year after matching bond ladders with withdrawal needs. My preference is to own five to ten funds in a portfolio with five to fifteen percent of a bucket in each fund. My “Buy,” “Sell,” and “Hold” comments reflect this.

Vanguard Funds

I view the pairs of Vanguard funds Wellesley/Wellington and Global Wellesley/Global Wellington as “risk off” and “risk off” trades. They are mostly “buy and hold,” but if I have a good sense that risk is increasing, then I shift allocations from Wellington to Wellesley. I sold Vanguard Wellington (VWELX) last year because of its high volatility and allocations to the technology sector. I plan to “Hold” these three funds this year. I am currently tilted toward VWIAX and VGYAX.

- Vanguard Wellesley Income Adm (VWIAX), Mixed-Asset Target Allocation Conservative (38% equities, large-cap value-oriented, effective duration 6.8 years, average credit rating A+)

- Vanguard Global Wellesley Income Admiral (VGYAX), Mixed-Asset Target Allocation Conservative (15% U.S. equities, 21% non-US equity, large-cap value-oriented, effective duration 5.9 years, average credit rating A)

- Vanguard Global Wellington Admiral (VGWAX), Mixed-Asset Target Allocation Growth (36% U.S. equities, 28% non-US equity, large-cap value-oriented, effective duration 5.9 years, average credit rating A)

Conservative Funds

GPANX has been the least volatile of all of the funds and a consistent performer. It is 58% allocated to fixed income and 35% to cash. The majority (66%) is in government securities and cash & cash equivalents (21%). It is available at Fidelity but not at Vanguard. Expenses are a high 1.8%. I have to ask myself, “Why should I own a fund that has earned 4.7% over the past three years when money markets and short-term treasuries are paying 4 to 5%? I have plenty in Treasury ladders, but I believe that GPANX provides some diversification through active management. The yields on short-term bonds will fall over the next two years, but hopefully, GPANX will make money in different environments. I have a large enough allocation to GPANX that I will “Hold.”

- Grant Park Multi Alternative Strategies (GPANX), Alternative Multi-Strategy (4% equities, 58% fixed income, 35% cash, 66% government sector)

Flexible Portfolio and Managed Futures Funds

Flexible Portfolio funds are one of my favorite multi-asset/multi-strategy funds because they allow the managers the ability to adapt. I reduced allocations to COTZX/CTFAX last year because it was losing value as yields rose. I plan to increase allocations (Buy) to COTZX/CTFAX during the first half of the year. I have a large enough allocation to REMIX that I plan to “Hold.”

- Standpoint Multi-Asset Inv (REMIX), Flexible Portfolio (26% U.S. equities, 16% non-US equity, large-cap blend oriented, 39% cash) The link to Standpoint Multi-Asset Inv (REMIX) on the Standpoint website is provided here.

- Columbia Thermostat Inst (COTZX), Flexible Portfolio (Fund of funds, 27% equities, large-cap blend oriented, effective duration 5.9 years, average credit rating A.A.-) The link to Columbia Thermostat Fund (COTZX) on the Columbia Threadneedle website is provided here.

Managed Futures Fund

I am new to managed futures funds which is why I have been cautious with PQTAX. I decreased allocations to PQTAX at the end of last year because it was falling. Given my research in this article, I will probably increase allocations to PQTAX this year, but for now, I will “Hold” what I have. The link to PQTAX on the PIMCO website is provided here.

- Allianz PIMCO TRENDS Managed Futures Strategy (PQTAX),

Vanguard Tax-Managed Balanced (VTMFX)

I don’t own VTMFX personally, but have it in family members’ portfolios that I assist with. It is a good long-term holding on a risk-adjusted basis. I reduced allocations last year based on the risk tolerance of the portfolio owners. The allocation is about half to stocks or bonds, but volatility was high because of high allocations to consumer cyclical and technology sectors. It would fit into some portfolios of those who want long-term tax efficiency and good risk-adjusted performance. Since allocations to VTMFX are low, I give it a “Hold.”

- Vanguard Tax-Managed Balanced Admiral (VTMFX), Mixed-Asset Target Allocation Moderate (47% U.S. equities, large-cap blend oriented, effective duration 4.6 years, average credit rating AA-)

Closing Thoughts

I plan to make no major change to the funds in this article except to increase allocations to COTZX/CTFAX and possibly PQTAX this year. COTZX and CTFAX are different share classes of the same fund. COTZX, with lower expenses, is available at Vanguard, and CTFAX is available at Fidelity. Each month, I need to make small decisions as to where to invest short-term ladders as they mature. These decisions appear to be 1) extend the duration of ladders to meet withdrawal needs as yields stabilize, 2) buy intermediate bond funds after completing bond ladders, 3) increase allocations to AVGE in the second half of the year if conditions warrant, and 4) search for more equity funds to compliment AVGE. In addition, I have more research to do about buying Treasure Inflation Protected notes, and I bought my first one yesterday to test the water.