New NAHB 2023 Priced-Out Estimates show that 96.5 million households are not able to afford a median priced new home, and that additional 140,436 households would be priced out of the new home market if the price goes up by $1,000. This post presents details regarding how interest rates affect the number of households that could be priced out of the new home market.

For a new home with an estimated median price of $425,786 in 2023 and a modeled 30-year fixed-rate mortgage rate of 6.25%, a quarter percentage point increase in the interest rate would price out approximately 1.3 million households. The monthly mortgage payments will increase as a result of rising mortgage interest rates, and therefore higher household income thresholds would be needed to qualify for a mortgage.

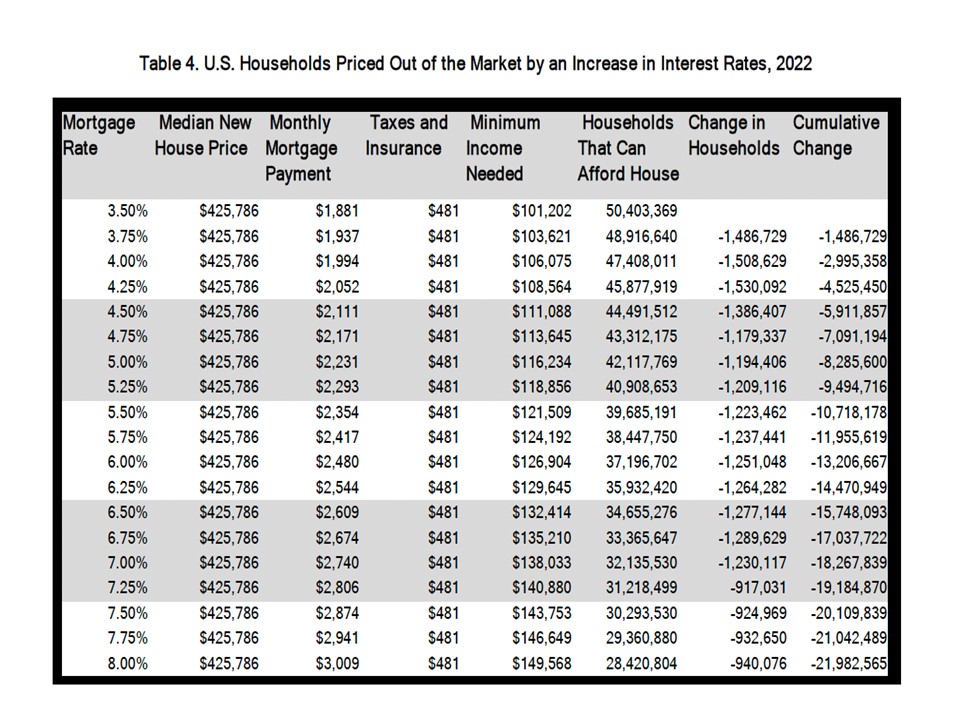

The table below shows the number of households priced out of the market for a new median priced home at $ 425,786 for each 25 basis-point increase in interest rates from 3.5% to 8%. When interest rates increase from 6.25% to 6.5%, approximately 1.28 million households can no longer afford buying median-priced new home. An increase from 6.5% to 7% prices approximately 1.29 million more households out of the market. And, about 917,000 households would further be squeezed out of the market if interest rates increase to 7.25% from 7%. This diminishing effect happens because only fewer households at the smaller end of (upper) household income distribution will be affected. In contrast, when interest rates are relatively low, a 25 basis-point increase affects a larger number of households at the more substantial section of the income distribution.

Related