Disclaimer: This is not investment advice, PLEASE DO YOUR OWN RESEARCH !!!!

For all readers that found my SFS write-up from February as too exciting, I have good news: I have found a stock that looks at least as boring as SFS, maybe even more so: Logistec, a maritime terminal operator from Canada.

Background/Intro:

This is the first investment idea that I initially found on Twitter, a big Hat tip to Sutje who brought this up on my radar and of course to the author of the original write-up “Wintergem Stocks”. The Wintergem Substack has a 3 part write-up that I can only recommend to read first:

Part 1 – Deep Dive Marine Segment

Part 2 – Deep Dive Environmental Segment

Part 3 – Is Logistec a compounder

Wintergem has also a recent update on Logistec’s recently released 2022 report.

In this post, I will just focus on aspects that a found especially interesting on top of the excellent Wintergem write up.

To summarize Logistec’s business in my own words:

Logistec, a Canadian company based in Toronto, operates two divisions. The larger one is called “Maritime services” and mainly comprises a large number of North American maritime terminals, that operate anything from containers to bulk and even “break bulk” cargo. In one of their earlier annual reportss they describe the main cargo types as follows: “Cargoes handled typically consist of forest products, metals, dry bulk, fruit, grain and bagged cargoes, containers, general and project cargoes”

The second division which is smaller and also less proitable is Environmental services, whcih comprises a nuber of businesses that offer different environmental services like cleaning up hazardous waste or fixing water piping systems.

“Factsheet”

Here are some figures that I found interesting:

Maritime services:

To my understanding, their ports mostly cater to the North American economy and are less dependent on international trade (Asia, or Europe) with the exception of the Tremont Joint Venture. Typical cargo types are for instance wood pellets, grain (Bulk) or parts for wind turbines (break Bulk). This is a picture of a typical bulk terminal:

Ports/terminals are considered to be a very attractive asset class especially for long term investors such as pension funds. Ports of America, a large, unlisted Port operator for instance was bought in 2021 by a Canadian Pension fund for ~4 bn uSD. The idea behind this is that ports are very durable assets that have natural moats and are able to provide safe long term “real returns” for investors. The maritime services businesses is the core business of Logistec.

Due to the Northern location of many of the ports, the business is seasonal with actual losses in the Winter season (first quarter) when the big Northern inland rivers and arctic waters are frozen. Here is the map as of 2022 (orange dots are terminals):

One interesting part of the Maritime servic is a minority (49%) JV participation in a larger conatainer terminal in Montreal (“Termont”), more on this later.

Environmental services:

This segement is the younger devision and was build through a series of acquistions. One of theri main products can “upgrade” lead water pipes by coating them from the inside. Lead water pipes are a big problem in certain regions of the US. Another interesting activity is the removal of PFAS or “forever chemicals” from soil. Overall, this segment has been growing nicely in the past but seems to have more of a “large project” character which makes it less predictable.

Long term track record:

One of the things that actually pulled me towards the company was the fact that they issue this 54 year chart of sales and profits on their website (until 2021):

That growth was achieved both, by organic growth but also via acquisitions. Logistec retains most of their profits in order to grow their business. Over the past 10 years, they managed to grow EPS by ~13% p.a.

Looking back, the decline in profit in 2016 was mainly attributed to low commodity prices in the mining sector which seems to be a major factor for their maritime segment.

Share price

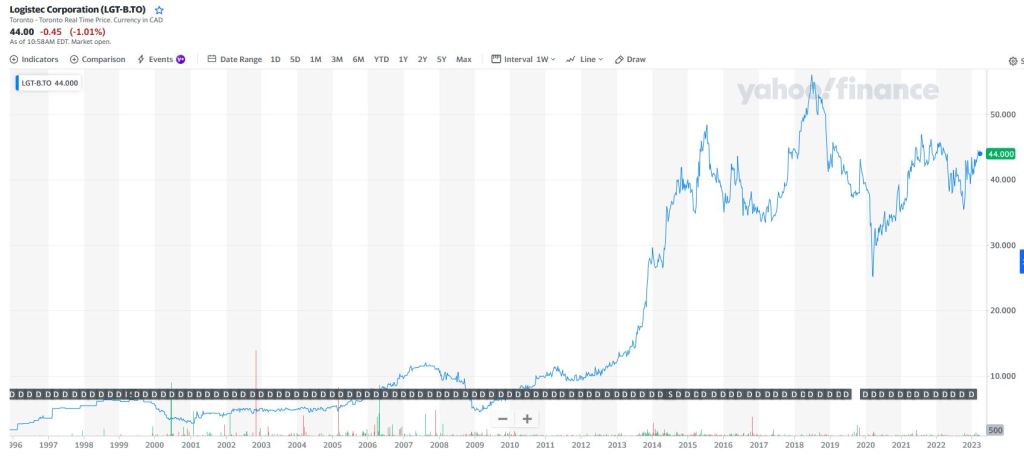

What I find interesting looking at the long term stock chart ist the fact, that for some reason, the share price went up ~4x from 2013 to 2015 and since then went sideways despite the very positive fundametnal developement:

Investors who bought into Logistec in 2014 oder 2015 earned basically nothing since then as the dividend has been quite low.

Management:

Madeleine Paquin, the daughter of the founder joined the company in 1984 took over as CEO in 1996 when she was 33 years old, so she is now 59 years old which means at some point in time, there might be a succession topic. The current management team shows no other family member as managers, her two sisters are part of the Supervisory board but have been active in the company before, but in less senior roles.

Compensation for management has increased significantly in 2022 but is still OK for a North American company

Unfortunately I didn’t find a more detailed split on salaries. I assume, the 9 mn covers the managment team as presented on the web page.

Overall, I like the combination of family ownership and management. Ms. Paquin seems to be very competent and under her leadership, the company has roughly 10x top line and profits.

Share structure: A/B structure

Below is an overview of Logistec’s share structure which consists of ~7,4 mn Class A shares and 5,7 mn B shares. The A shares, which are held mostly by the three Paquin sisters, have 30 votes, the B-shares however have a right to 1,1x the A shares dividend and a tag-along right in the case of a company sale-

The B shares do have a dividend preference over the A shares. Sumanic is the holding of the three sisters, each sisters holds 1/3 ofthe shares.

Pro’s & Cons

Based on the Wintergem write-up and my own research, as always a quick summary of stuff that I like and stuff that I like less:

I like:

+ family owned, family run

+ long term growth path with two “Platforms” to deploy capital

+ cheap in absolute and relative terms (“Extra asset”).

+ additional mean reversal potential (margins, multiple)

+ Exposure to interesting secotors (wind industry, biomass, forever chemicals)

+ potentially good Portfolio diversification (Canada, logistics)

Not so good

- capital intensive

- debt (not excessive but still)

- cyclical exposure especially in the Environmental division, commodities exposure in the maritime segment

- potentially less attractive E&A segment

- succession topic in 5-10 (?) years

- A/B share structure (however similar to Alimentation Couche-Tard)

Why is the stock cheap ?

As always, it is important to at least try think aboutwhy a stock is cheap. This is what I came up with:

- A/B share structure (Super voting) could be an issue for some investors

- there is a certain result volatility, especially in the Environmental segment

- Capital intensive business

- It is not a pure play (terminals)

- rising Interest rates (infrastructure)

- zero analyst coverage

- little freefloat, stock is quite illiquid

- low dividend yield especially for infrastructure. Typical infrastructure investors want yield, not growth

- no direct catalyst

- P&L not easy to read (JVs, “Extra assets”)

Overall there seem to be quite a few reasons why the stock cheap. But of course, Canada is far away and I might have missed some other reasons.

Valuation:

In the past, with lower interest rates, ports have been valued quite high. This is a slide that shows some M&A transaction in the ports sector in the year 2019 with respective EV/EBITDA mutliples that are commonly used as the valuation measure for infrastructure assets:

Back then, valuation ranges for Terminal/port assets have been somwhere between 13-20x EV/EBITDA, which could be a, little bit lower now ith higher interest rates.

If we look at our “fact sheet” again, we can see that Logistec trades far below this levels but has traded much higher historically:

To be clear: I would not invest into Logstec just as a “mean reversion” play, but it shows that in historic terms, the current valuation looks cheap.

“Extra Asset”: Tremont Terminal

Now we need to finally tackle the “extra Asset”: Logistec owns a 49% stake in a JV called TERMONT which is a container terminal in Montreal and handles business on a long term contract with the world’s largest container shipper MSC. In 2022, dividend income from this JV has been 15 mn USD, the underlying profit slightly lower. They seem to have doubled the capacity over the recent years which explains the increase in profits (from 2,5 mn in 2016 to 13,6 mn in 2022=.

When comparing Logistec’s valuation at an EV/EBIT or EV/EBITDA basis, which we did above, this profit stream is not included as it only enters the P&L in the “I” section.

So when making EV/EBITDA comparisons, this value should be subtracted from the EV. Why ? Because on could simply sell this asset for cash and EBITDA and EBIT would not change, but EV would decrease by the cash received.

What is the JV stake worth ? If we use Logistec’s P/E of ~11, we would come up with something like 140 mn CAD, which I think is a very conservative estimate for a container terminal on a long term contract.

This is how valuation looks if we adjust this asset:

So based on on the adjustment, EV/EBITDA is a full poin lower, EV/EBIT almost 2 points.

I also compiled a list of global listed port operators, although as the results show, this is a very diverse lot and port assets are generally very individual assets:

If I account for the “non pure play status” and assume ” the average 10xEV/EBITDA valuation of these peers, Logistec should be roughly worth 105 CAD per share based on 2022 results, however as I mentioned above, this alone would be not enough.

What kind of growth can be expected ?

Logistec has grown as mentioned by 10-15% p.a. over a very long time, be reinvesting most of its cash into organic and inorganic growth. Just recently, they were able to acquire a substantial competitor called Federal Marine Terminals which was doing around 116 mn CAD in sales in 2022 . This alone will add 11 new Terminals and grow overall sales by more than 10%. I don’t know how many other mid size operators in that area exist but to me it looks like that they have some runway to grow in the maritime sector.

The environmental segment is more difficult to assess, but in theory there should be ample growth opportunities too.

Therefore I think it is fair to assume the historic growth rate of 10-15% as a good estimate for the next 5-10 years as well.

At a current dividend yield of 1%, this would imply a total return of 11-16% p.a. without assuming any multiple expansion, which I think is a really good return/risk proposition and a good fit for my boring portfolio.

Summary:

Logistec ticks many of my check boxes, like having a solid but boring business model, a long term orientation, Family ownership, good growth opportunities and a very moderate valuation . Although there is clearly no short term catalyst, I do think that over a time frame of 3-5+ years there is a good chance of a decent return if they continue to execute like they did in the past.

As this is Canada, which is far away and I am not overly familiar with the industry, I decided to buy “only” a 3% position at this stage at an average price of 44 CAD/share. To be honest, with the exception of Alimentation Couche-Tard, my “far away” investments so far have not been too successful and include a few “hall of shame” investments like Cras.com and Silver Chef.

The financing comes mostly from selling some more Meier & Tobler and dividends (Solar).

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH.