In This Article

How long does it take to establish credit?

For most people, it can take at least six months to establish credit from scratch.

With a strong credit score, you gain access to better interest rates and loan terms for new credit accounts. Strong credit is helpful for many life milestones, from getting approved for your first apartment to purchasing your first car. But if you have no credit, establishing a good credit score can feel daunting.

So, how long does it take to build credit? Well, it depends. If you’re new to building credit, you can generally expect it to take at least six months to establish your first credit score. If you’re wondering how long it takes to rebuild credit and need to improve a damaged score, it could take longer.

Luckily, there are simple steps you can take toward establishing your credit score or improving your credit history. We’ll cover what to expect in terms of timing below.

How are credit scores calculated?

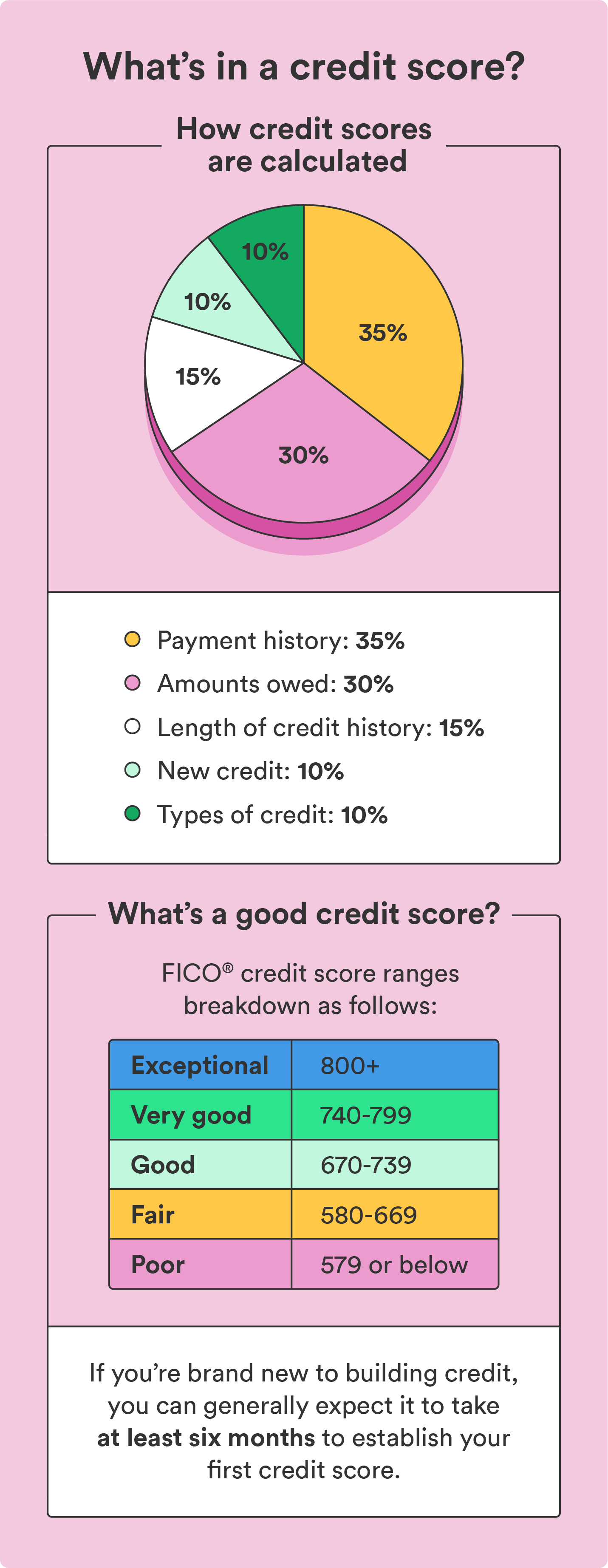

Once you know how credit scores are calculated, it’s easier to grasp why building your first credit score can take around six months (and if you’re rebuilding your credit, it may take longer).

Your credit score is what lenders look at to determine how dependable of a borrower you may be, and your payment history is often the first thing they check (it’s the largest factor in your credit score). If you have no credit history to show, lenders can’t anticipate your ability to use credit responsibly and pay your bills on time. That’s why getting approval for new accounts is more challenging as a first-time credit user.

Most lenders use your FICO® Score, which is based on five key factors¹:

- Payment history (35%): your history of paying bills on time or not

- Amounts owed (30%): how much available credit you’re using

- Length of credit history (15%): how long you’ve been building credit

- Credit mix (10%): the mix of different types of credit accounts you have

- New credit (10%), meaning the number of credit accounts you have recently opened

FICO® Scores and another standard scoring model, the VantageScore, have credit score ranges from 300 to 850.

- 579 or below: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800+: Excellent

How fast you can build credit depends on where you’re starting (for example, starting from scratch or working to improve a damaged score) and your ability to maintain smart credit habits consistently.

How to start building credit from scratch

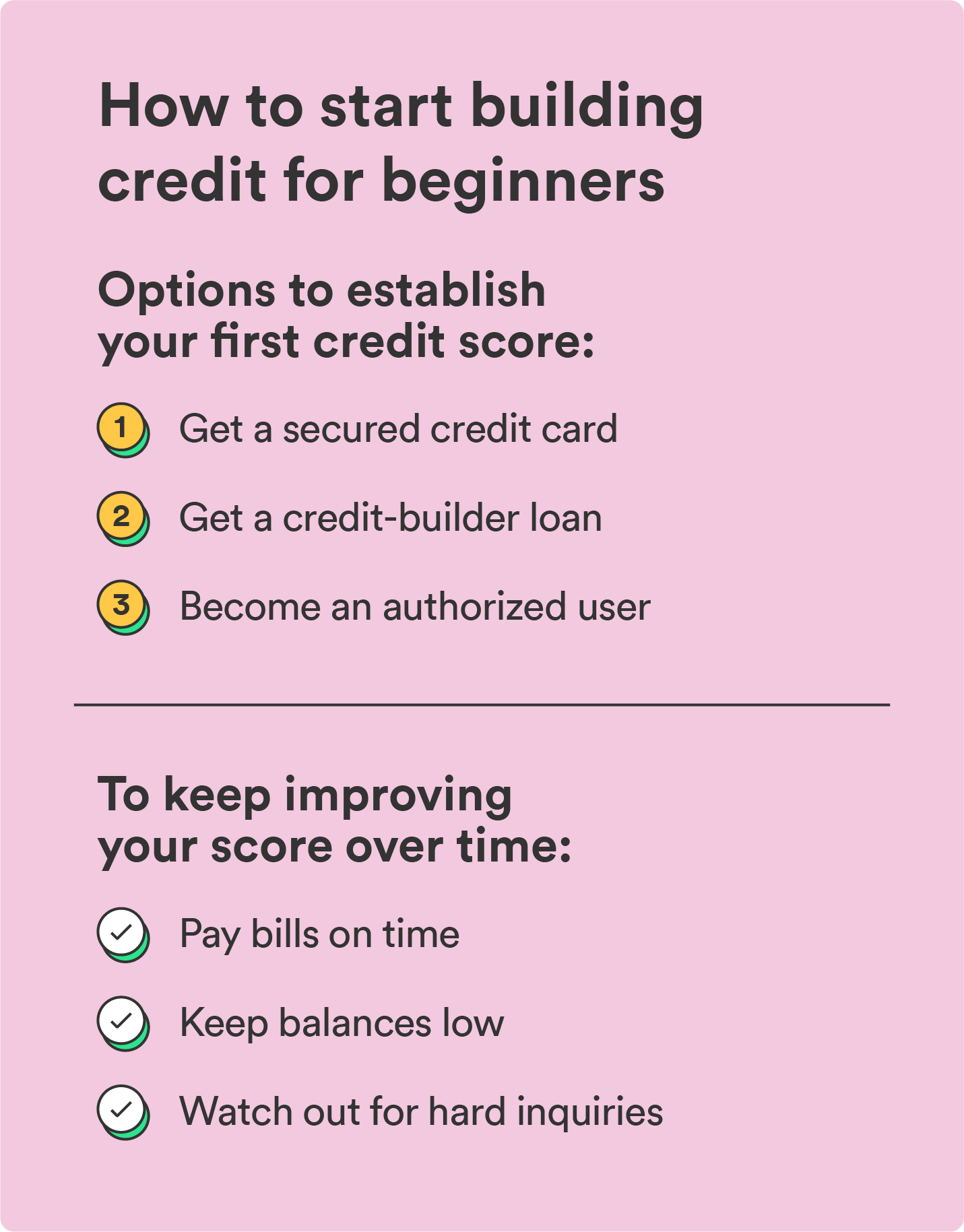

Once you know all the factors that affect your credit score, you can start working toward establishing a good credit score. You’ll need some sort of credit account to get started. If you’re wondering how to build credit without a credit card, you have a few options:

- Get a secured credit card: Secured credit cards are used just like regular credit cards, but you pay a security deposit upfront. This deposit is collateral for your card and denotes your credit limit.

- Get a credit-builder loan: If you want to build credit without a credit card, you can use a credit-builder loan to build a history of on-time payments. They’re different from traditional loans because you’re essentially repaying a loan to build credit, and you don’t get the loan’s proceeds until you repay it in full.

- Become an authorized user: One way to start establishing credit without a credit history is to ask a friend or family member with a strong credit history to add you as an authorized user on their account.

Be sure to speak with a creditor to discuss which options might be best for you.

The options above can move your credit score in around 30 days. Both positive and negative credit information often takes 30 days to hit your credit report.

Don’t expect your credit score to jump 100 points in a single month. Building good credit is a long game – you’ll need to use credit responsibly for three to six months before seeing drastic changes to your score.

Credit habits to help build credit faster

While there’s not much you can do to shorten the time it takes to establish your first credit score, practicing a few smart credit habits can help expedite the process:

- Pay bills on time each month: Since your payment history is the most significant factor in your credit score, prioritize making all payments on time and in full each month.

- Keep credit utilization low: Aim to keep your credit utilization (the amount of credit you spend) under 30% of your total limit.

- Keep old accounts open: Canceling old accounts can lower your credit age, which can lower your credit score. Unless you’re paying a high APR or annual fee, keep old credit cards open even if you don’t use them.

- Watch out for hard inquiries: Any application you submit for a new credit account can result in a hard inquiry, which can cause a slight dip in your score. Wait six months between new credit applications to avoid too many hard inquiries at once.

Remember, your credit score is based on your credit activity over long periods – there’s no secret shortcut to establishing or boosting your score. The best approach is to maintain smart credit habits and stay the course as your credit file grows.

Build credit in 3 to 6 months with smart habits

The process of addressing and starting your credit journey takes time. Pay your bills on time, maintain low balances, and keep a pulse on how many credit accounts you have open and when you use them.

You can boost your credit score with continued effort and sound money habits. Then, you can borrow money when needed and secure great rates. You may not see the results immediately, but remember, slow and steady wins the race.

Start building credit today – get started with the Chime Credit Builder Secured Visa® Credit Card without a credit check.

FAQs

Find more answers about how to start building credit below.

How long does it take to build credit?

You can generally expect it to take at least six months to establish your first credit score. Rebuilding a damaged score can take longer.

How fast can you build your credit in three months?

You could potentially raise your credit score in 1-2 months. However, it depends on your current score, financial situation, and how much you want to raise it. For those rebuilding damaged credit, it could take much longer.

To raise credit quickly, pay your bills on time, limit new credit account applications to avoid hard inquiries, and keep your balances low.

What does your credit score start at?

There’s no starting credit score – you either have open credit accounts, or you don’t. Your score will be generated based on your credit and payment activity once you open an account.

The post How Long Does It Take To Build Credit? What To Expect When Building Credit From Scratch appeared first on Chime.