The – Washington Consensus – has been out in full force this week with the US Federal Reserve and the RBA increasing interest rates further despite all the indications that inflation peaked months ago and its downward trajectory has had little if anything to do with the ridiculous interest rate rises since early 2022. Both banks, along with most other central banks, are just thumbing through the New Keynesian textbook to get their direction and pretending to be capable of assessing the situation correctly. Neither the textbooks nor the assessments are remotely accurate and unnecessary pain is just being inflicted on low income mortgage holders. But the public barely know that there is a grand global experiment being conducted by central banks which allow us to reflect on the veracity of competing economic theories and approaches. Most central banks are hiking rates at present as a reflection of the dominance of the New Keynesian prioritisation of monetary policy as a counter-stabilising, anti-inflationary policy tool over fiscal policy. One central bank is not following suit – the Bank of Japan. The BOJ has not shifted rates, is maintaining its yield curve control policy and the government is expanding fiscal policy. The diametric opposite to the New Keynesian approach. We now have enough data to assess the relative merits of the two approaches. Japan has lower inflation, no currency crisis and its citizens are better off as a result of the monetary-fiscal policy initiatives.

The Western Consensus

In Australia, interest rates have gone beyond the level that the RBA itself considers can be absorbed by many mortgage holders.

In Chapter 3 of the RBA’s – Financial Stability Review – April 2023 – which focuses on household and business finances, the RBA indicated that around 15 per cent of Australian households will not have sufficient cash reserves or income to remain solvent after the interest rates rose again yesterday.

The RBA noted that:

This risk is highest for those who also have low incomes. This is because low-income households typically have less ability to draw on wealth or cut back on discretionary consumption to free up cash flow for debt servicing.

Further:

Estimates suggest around 16 per cent of existing loans are unable to meet serviceability assessments conducted at current interest rates … If mortgage rates were to increase by a further 1 percentage point, the share of loans unable to refinance with another lender is estimated to increase to around 20 per cent.

So first the RBA set about destroying what saving buffers people had built up, claiming that would allow them to keep spending as their liquidity was being undermined by the interest-rate rises.

Then the RBA admitted it was deliberately seeking to increase unemployment by around 180 thousand workers who will be forced onto unemployment benefits which are way below the poverty line and the federal government refuses to increase the payments.

And finally, the RBA is fully aware that around 20 per cent of mortgage holders will be driven broke by its interest rate rises if not more.

How did we reach a situation where an unelected body that is largely unaccountable to the public can render such damage?

Further, as I also noted yesterday – RBA loses the plot – Treasurer should use powers under the Act to suspend the RBA Board’s decision making discretion (May 3, 2023) – that the RBA decisions are actually pushing inflation up not down via the impacts on business costs and rental prices.

So we have the absurdity that inflation is falling because the factors that created the pressure (the supply-side factors) are in retreat and the RBA is actually prolonging the inflationary period despite claiming its interest rate increases are intended to bring inflation down more quickly.

The joke is on us people!

And, amidst all the outcry, this morning, the National Australia Bank announced that they have recorded a 17 per cent increase in their half-year profits to a “record $A4.1 billion” as a result of the higher interest rates.

I noted last year several times that the private banks were going to generate massive profits as a result of the RBA’s interest rate mania while their customers were increasingly being screwed.

The crazy part is their share price fell because the greed cohort thought that the profits would be even higher than they were reported.

In the US, the Federal Reserve Bank added more mortgage pain yesterday (May 3, 2023) by raising the policy rate a further 0.25 percentage points, which makes it the higher level for 16 years.

Their interest rate increases have redistribute income from poor to rich and created the beginnings of a series of private bank failures.

So much for their charter that requires them to maintain financial stability.

Meanwhile, the land of the rising sun

The mainstream economics media has hardly commented on the global experiment that is now clearly underway.

The RBA and the Federal Reserve are just part of the gaggle of central banks pushing up interest rates at present, pretending they are ‘winning’ the war against inflation, when the latter has already peaked and is falling for reasons quite apart from what the central banks are doing.

Gaggle by the way can mean a ‘flock of geese’ or ‘a disorderly group of people’.

Either meaning might apply, given that the term ‘goose’ is an informal insult in English!

However, there is one central bank that is not playing along with this agenda – the Bank of Japan – and, in that sense, provides a direct comparison to the New Keynesian consensus approach.

I have commented on this experiment before:

1. Former Bank of Japan governor challenges the current monetary policy consensus (March 22, 2023).

2. Bank of Japan continues to show who has the power (January 26, 2023).

3. Bank of Japan has not shifted direction on monetary policy (December 22, 2022).

4. The monetary institutions are the same – but culture dictates the choices we make (December 8, 2022).

5. Two diametrically-opposed approaches to dealing with inflation – stupidity versus the Japanese way (October 6, 2022).

6. Why has Japan avoided the rising inflation – a more solidaristic approach helps (July 4, 2022).

7. We have an experiment under way as the Bank of Japan holds its cool (March 31, 2022).

Japan has experienced all the global supply shocks that other nations have endured that imparted the inflationary pressures.

Japan imports almost everything!

Yet, the Bank of Japan has not increased its policy interest rate and has held the line on the yield targetting for the 10-year Japanese Government Bond.

The Japanese government also relaxed fiscal policy further to deal with the cost-of-living crisis – provided fiscal transfers to households and subsidies to business as part of a deal to compress profit margins.

Meanwhile the corporations elsewhere are gouging profits to their hearts’ content because our governments refuse to pressure the corporate sector into the same sort of behaviour that the Japanese government has succeeded to extract from its price setters.

As a result of its policy stance, the Japanese currency has been attacked relentlessly by the ‘short-sellers’ in the financial markets who think they can bluff the Bank into changing policy and delivering massive profits to the speculators.

The Bank has refused to be bluffed and, has instead, inflicted large losses on the short-sellers.

I discuss that issue in the 2. blog post cited above.

The progressives in the UK might have taken note of the way the Bank of Japan stares down the financial markets – there has been no yen currency crisis and the government has not had to ask the IMF for money.

Instead the likes of Starmer and his gang (who have conducted a major purge of the Left in the British Labour Party) are now backtracking on policy promises – such as to nationalise the dysfunctional privatised utilities and rail, among other promise reneges, because they have to be fiscally responsible – which is code for appeasing the financial markets.

Why? Because they have a pathological fear of the City, which goes back to the 1970s when Callaghan and Healey used the ‘run out money, currency crisis, IMF bailout’ ruse to purge Tony Benn and his socialist mates within the Party.

The Left has never recovered really.

They should look to the East and see how Japan deals with the financial market speculators.

Anyway, how is Japan going in the inflation ‘fight’ given that it hasn’t shifted its monetary policy stance?

Well, the answer is they are demonstrating that the interest rate hikes that other central banks have inflicted on their citizens were not necessary in bringing the supply-side inflation down.

Here is an update.

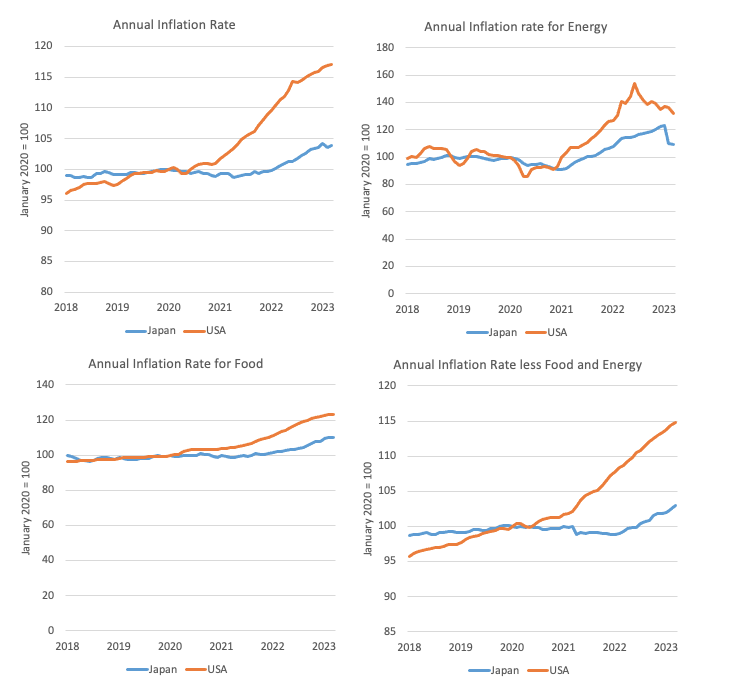

The current annual inflation rate in Japan (All Items) (March 2023) is 3.3 per cent down from the peak of 4.4 per cent in January 2023.

For the US, the peak was 8.3 per cent in August 2022 and the current rate is 4.98 per cent.

The following four-panel graph captures the key aggregates from January 2018 to March 2023.

The indexes are set to 100 in January 2020.

The question that should be asked is why has Japan been able to resist the high inflation while also refusing to hike rates and contract fiscal policy?

We know the answer.

Further, the ‘currency-crisis’ lot always claim that if the financial markets are upset by a national government policy then they will destroy the currency.

Well, the evidence is not supportive of that paranoia, as long as the government and the central bank understand their own capacity to resist the speculators.

Initially, as the interest rate differential between the US and Japan emerged after the US Federal Reserve started hiking rates, the yen depreciated somewhat.

‘Currency-crisis here we come’ said the ignorant.

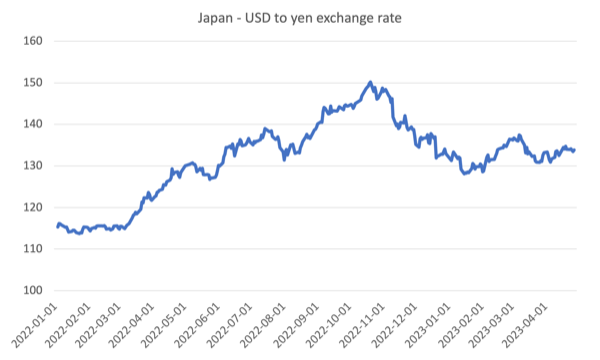

The following graph shows the USD-yen exchange rate from the start of 2022.

A modest depreciation followed by several months of appreciation and a stabilisation at slightly lower rate relative to before all the hiking began.

Conclusion: no currency crisis.

Conclusion

The question I have is why are the mainstream financial media not reporting all this?

We all hear about the US Federal Reserve pushing up rates and the boss is widely quoted in the Australian media.

The RBA governor gets blanket coverage for his asinine commentary trying to justify the interest rate rises.

But I guarantee that the Australian public will have no idea that the Bank of Japan has defied this western consensus and it is actually doing much better than the hikers!

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.