Disclaimer: This is not Investment advice. PLEASE DO YOUR OWN RESEARCH !!

Summary:

If you would ask me about the most boring stock of my generally very boring portfolio, I would possibly name Schaffner Group. I had bought a first position back in 2021 during my “All Swiss Stocks” series.

However, I have never written a more detailed write-up despit my annual summaries (2021/2022 , 2022/2023), maybe becasue I always got bored when I started writing about it ? Over time I added to the position and after the most recent 6 months numbers, I decided to increase into a full position. Time to explain the investment case a little bit better.

- The Company – Transformation

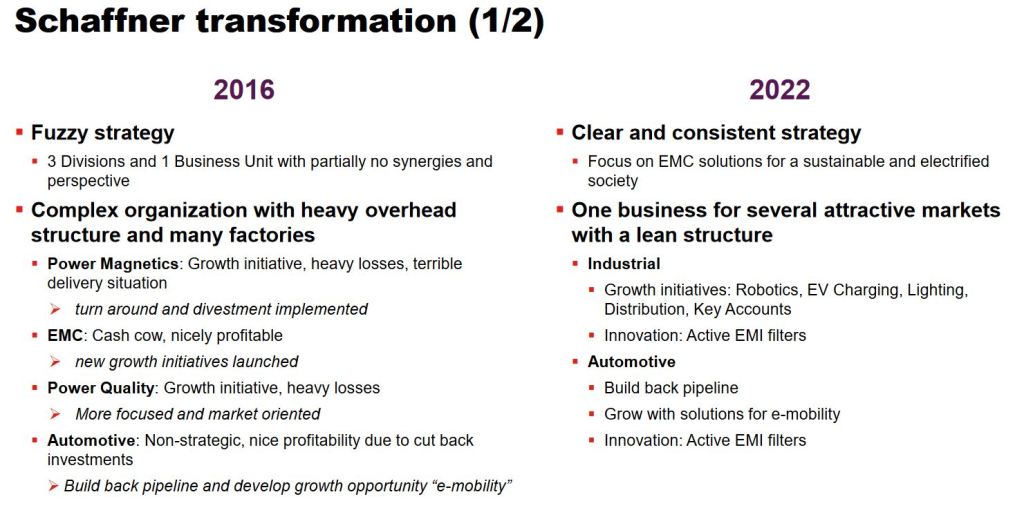

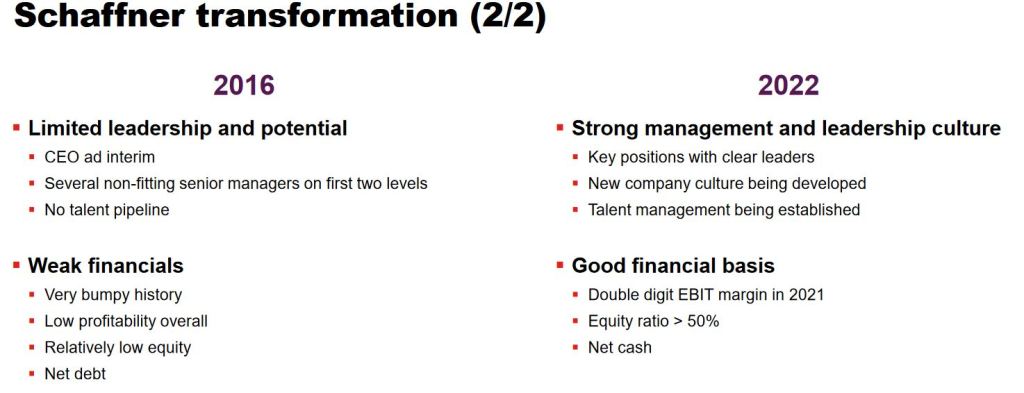

Schaffner Group is a Swiss company that underwent a significant tranformation over the past few years. Most importantly, they managed to dispose their second largest division “Power Magnetics” which was loss making in 2021 and focus on 2 divisions: EMI Filters and Automotive. This is how Schaffner describes their tranformation in a 2022 investor presentation:

For some reasons, the last 2 years still have been “noisy”. In 2020/2021 (Financial year goes from 01.04 to 31.3.), they had to book a (non cash) loss for the power magenitics disposal, in 2021/2022, the Automotive division suffered from the supply chain issues in the automobile industry.

However, under this noise, the core division, EMI filters grew steadily. Now, in FY 2022/2023, with a certain recovery of the Automotive segment, the true quality of the business starts to emerge. But more on this laters.

2. The business & Products

Schaffner has a nice graph in one of theri presentation how their products look like:

These products at first sight are clearly not “sexy consumer” products that you find in the supermarket but rather small, but important parts for other manufacturers (B2B).

The main product line of Schaffner are EMI Filters. You can find a detailed description of these Filters and why they are needed for instance here. In a nutshell, most electrical equipement requires these filters in order to prevent electro magnetic interference (EMI) between different electronic circuits. Although these components are normally relatively low value items, they usually need to be custom made to directly fit the specific purpose and there are often industry norms that require the use of these filters.

It seems to be that this is a small but growing industry with only a few players and Schaffner seems to have a global market share of around 20-30%. So in this small pond, it is a rather big fish.

Schaffner’s business model is to mostly desgin the components in Switzerland but manufacture them in China and Thailand, so they seem to be very competitve on price.

What I find most interesting is the fact, that there is structural growth in this industry as the increased electrification means structurally higher demands for their components. EV charging, semi-conductor manufacturing and heatpumps are a few areas that Schaffner mentios that currently drive growth and will so for the foreseeable future.

3. How have things progressed ?

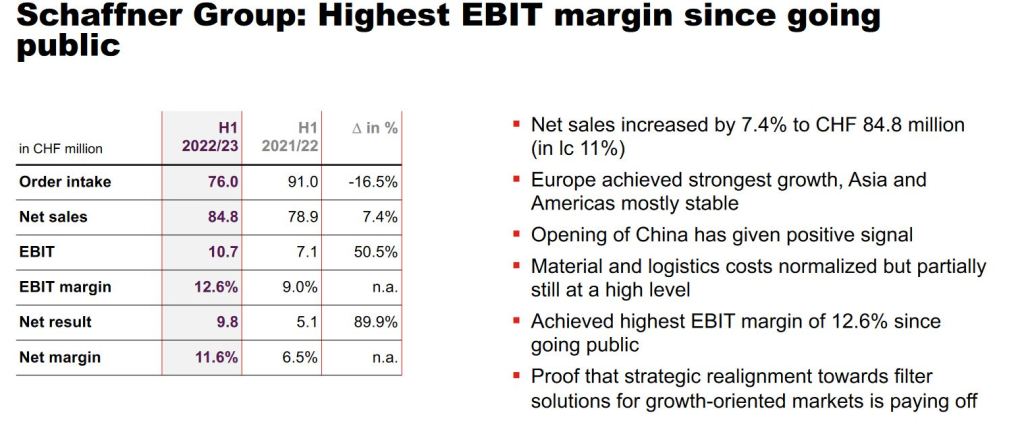

Since I have bought the first shares, the Industrial division has grown steadily, but as mentioned, the Automotive division had some problems. In the curren financial year however things look good and Schaffner, which communicates normally quite undertsated got almost euphoric:

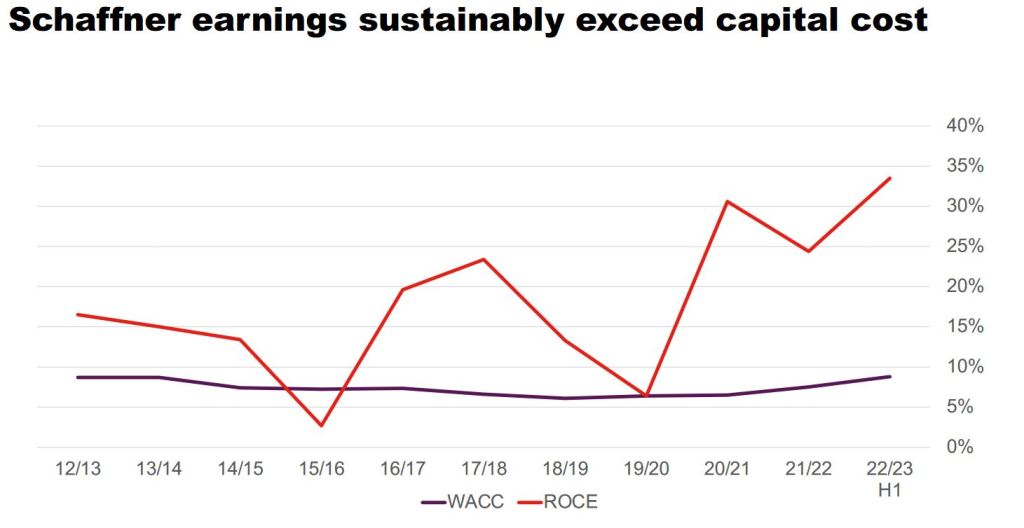

Schaffner had intitially guided mid term target of an EBIT-Margin of 10-12% and an organic growth rate of 5% p.a., both targets have been surpassed and they seem to be quite optimistic for the full year. This is supported by a very capital efficient bsuiness model with reaching 33% ROCE in the first 6M:

4. Valuation

With 631‚069 outstanding shares and a share price of 285 mn CHF, the company is valued at ~180 mn CHF. Schaffner has around 8 mn in net cash at 31.03 so this translates, if we just double 6M numbers. into an expected P/E of 9,2x and EV/EBIT of 8,0 for the current year. Not bad for a double digit EBIT margin business with a high ROCE and a good chance of decent growth and a rock solid balance sheet. Especially when considerung that a normal Siwss business with this KPIs would easily trade 50% or more expensive.

5. Why is the stock cheap ?

I think there are a few obvious reasons, the main being a very weak long term track record which is reflected in an extremly unispiring long term share price:

Schaffner today is trading below its IPO price of 1998 and has oscillated between 100 and 300 CHF for the last 15 years or so. So clearly, investors don’t seem to be convinced yet, that Schaffner will be on a long term success path.

In addition, the last 2 years have been noisy and only one analyst seems to cover Schaffner. Liquidity is only modest, it is not easy for a fund or larger investor to get in and out quickly. Schaffner also reports only twice a year and does not provide quarterly updates. Not everyone likes this, i do.

Schaffner also has some China exposure and seems to employ around 300 people in China. The larger manufacturing hub however seems to be Thailand with 1000 employees.

Last but not least, the business model at first sight is not very sexy and also not easy to understand.

6. Management, shareholder structure, other stuff

The largest investor is a financial investor called BURU Holding who also owns a 20% stake in Kardex, another high quality Swiss manufacturer. BURU Holing is run by Philipp Buhofer, a Swiss Investor who seems to play the long game and seems to be quite active. Marc Buhofer, obviously a relative, owns another 3% of Schaffner.

CEO Aeschliman was appointed in 2017. He owns around 2100 shares which is a little bit less than his annual salary, but number is increasing due to incentive programs. The incentives are based on EBIT margins, free cashflow and individual targets, Overall I would rate the combination of shareholder & Managment as good.

As mentioned above, balance sheet quality is high, with 8 mn net cash and no goodwill.

Capital allocation is relatively transparent: They pay out around 40-50% of the profit in dividends and the rest will go towards selective M&A.

Maybe one remark with regard to a potential catalyst: I think there is none or only a very small one. The only potential “soft catalyst” could be a potetnial dividend increase. If they stick to their 40-50% pay out rule, 40% of a potential 20 mn net profit in 2022/2023 would be around 12,50 CHF per share, a significant increase compared to the 9 CHF paid in for the previous year.

Summary:

The overall case for Schaffner can be summarized quite easily: One can get a good company with a very good business at an excellent price.

The combination of a double digit EBIT margin (12%) , double digit organic growth, ROCE in the 20-30% and a valuation of ~9x 2023 P/,E for me is a decent bet on the expectation, that the future of Schaffner looks better than the past.

For me, Schaffner is one of the most interesting cases of a traditional business that can potentially benefit from a long growth trend towards electrification. Yes, it is a trunaround, but compared for instance to Meier & Tobler at the time of the investment, the turn around has already happened and they now “only” need to proof that this was not a one-off.

Even if this journey is bumpy, I think over the next 3-4 years, the shares could offer a decent return. On top of an expected dividend yield of up to 5% p.a. I could easily imagine another 10% pa. as a combination of growth and a slight multiple expansion form the current low levels. In the best case, this could even become a “Meier & Tobler 2.0” if the stock trades at “Swiss Quality multiples”.

I have therefore increased the position further to a 6% weight and financed this mostly through a further decrease in Meier & tobler which is now not so cheap anymore.

One should mention that the share is not overly liquid, on average, 300-400 shares are traded daily on the Swiss exchange.