What are the Health, Life (Term Life Insurance, ULIPs, and Traditional Life Insurance) insurance policy tax benefits under new and old tax regimes after 1st April 2023? Let us discuss this aspect in detail.

As you may be aware, effective from 1st April 2023, there are certain changes were done to the life insurance premium taxation. This I have discussed in my post is related to budget 2023. You can refer to the same in “Budget 2023 – 12 Key highlights impacting personal finance“.

Considering all these changes, let us see the current insurance policy taxation rules under both new and old tax regimes.

Insurance Policy Taxation – Under New / Old Tax Regime

Let us start with the explanation of Health insurance.

Health Insurance Policy Tax Benefits – Under New / Old Tax Regime

Health Insurance Policy Tax Benefits – Under Old Tax Regime

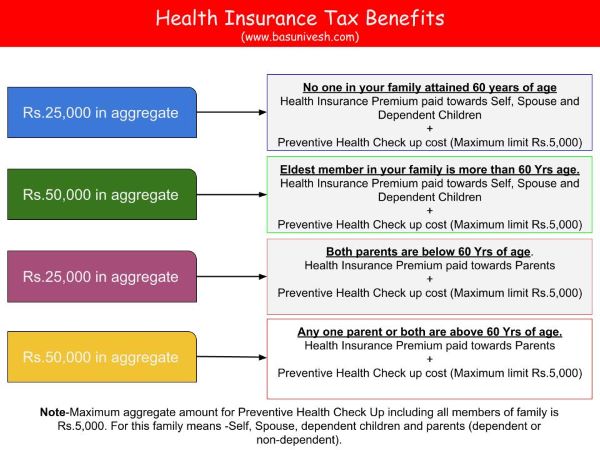

Health insurance premiums paid for Self, Spouse, or dependent children are tax deductible up to Rs.25,000 under Sec.80D. However, if any one of the persons mentioned above (Self, Spouse, or dependent children) is a senior citizen and Mediclaim Insurance premium is paid for such senior citizen then the deduction amount will be Rs.50,000.

Same way, the health insurance premium paid to parents is eligible for deduction up to Rs.25,000 under Sec.80D. However, if any one of your parents is a senior citizen (above 60 years of age), then the limit is Rs.50,000.

For senior citizens above the age of 60 years, who are not eligible to take health insurance, the deduction is allowed for Rs 50,000 towards medical expenditure.

If you are paying the premium against health insurance in the name of the below-mentioned family members, then you can avail of the Health Insurance Tax Benefits under Sec.80D.

- Self

- Spouse

- Your Parents (Dependent or not dependent)

- Dependent children

For senior citizens above the age of 60 years, who are not eligible to take health insurance, the deduction is allowed for Rs 50,000 towards medical expenditure.

Section 80D includes a deduction of Rs.5,000 for any payments made towards preventive health check-ups. This deduction will be within the overall limit of Rs.25,000/Rs.50,000, as the case may be.

The whole summary can be explained as below.

Health Insurance Policy Tax Benefits – Under New Tax Regime

As Section 80D is not available under the new tax regime, obliviously there are no health insurance policy tax benefits.

Note – The claim amount received by health insurance policies whether paid directly to the hospital (in the case of a cashless cover) or reimbursed to the insured, is not taxed as it is not an ‘income’ for you but reimbursement of an expense.

Term Insurance Policy Tax Benefits – Under New / Old Tax Regime

Term Insurance Policy Tax Benefits – Under Old Tax Regime

They are the simplest products and easy to understand also. The premium you pay towards the term life insurance is fully eligible for tax deduction under Sec.80C.

Note that the aggregate amount of deduction eligible under sections 80C, 80CCC, and 80CCD is capped at Rs.1,50,000 as per section 80CCE of the Income Tax Act, 1961.

If the policy is terminated within 2 years from the date of commencement of the policy (in the case of a single premium policy or in regular premiums), then the deductions allowed in earlier years are reversed and added back to the year’s income in which the policy lapsed.

Death payment receivable by the nominee under the term life insurance is completely tax-free as per section 10(10D) of the Income Tax Act.

Term Insurance Policy Tax Benefits – Under New Tax Regime

As Section 80C is not part of the new tax regime, the tax benefits are not available under the new tax regime. Also, as usual, the death benefits are tax-free under the new tax regime too.

ULIP Tax Benefits – Under New / Old Tax Regime

ULIPs are the most dangerous products which claim to combine investment with insurance with high fees.

ULIP Tax Benefits under Old Tax Regime

Premium payments under a ULIP are eligible for deduction under section 80C of the Income Tax Act. This covers the premium paid for individual, spouse, and children without specifying if dependent or not. As with term insurance premiums, ULIP premiums also fall under the Rs.1,50,000 limit.

ULIP Tax Benefits under New Tax Regime

As usual, as Sec.80C is not part of the new tax regime, the tax benefits of investing in ULIP are not available under the new tax regime.

ULIP Taxation at Maturity

Effective from 1st February 2021, there were certain changes in ULIP Taxation. Hence, let us understand the taxation of the policies which were purchased before 1st Feb 2021 and after 1st Feb 2021.

a) Taxation of ULIP Policies purchased before 1st April 2021

If the policy was issued before 31.3.2012 and the premium is not more than 20% of the sum assured and if the policy was issued after 1.4.2012 and the premium is not more than 10% of the sum assured, then the maturity proceeds are tax-free. Otherwise, it is taxable.

However, the death benefit is tax-free

b) Taxation of ULIP Policies purchased after 1st April 2021

If the policy was issued before 31.3.2012 and the premium is not more than 20% of the sum assured, if the policy was issued after 1.4.2012 and the premium is not more than 10% of the sum assured, AND if the aggregate premium does not exceed Rs.2,50,000 for any of the previous years during the term of any of those policies, then it is tax-free. Otherwise, it is taxable.

ULIP equity funds (Where ULIP invests at least 65% in stocks of domestic companies) are taxed at 15% and 10% in the case of LTCG and STCG respectively (Where STT is paid). ULIP debt funds (of HIGH Premium ULIPs) shall be taxed like any other capital asset. Such funds shall be taxed as debt mutual funds. Short-term gains (holding period <=3 years) shall be taxed at the marginal tax rate. Long-term capital gains (holding period > 3 years) shall be taxed at 20% after indexation.

Death benefit anyhow is tax-free (even though you are not meeting the above conditions).

Do remember that as per section 80C(5)(ii), in case of a ULIP, if the policy is terminated before paying a premium for 5 years, then the benefit of 80C would be lost from that year onwards and also, the past deductions claimed would become deemed income of the year in which such termination takes place.

Life Insurance Policies Tax Benefits (excluding ULIPs) – Under New / Old Tax Regime

Here come the traditional policies like endowment, money back, guaranteed products, or any life insurance products which combine insurance with investment (excluding ULIPs).

Life Insurance Policies Tax Benefits (excluding ULIPs) – Under Old Tax Regime

Whatever the premium you pay towards such policies is eligible for the deduction under Sec.80C. However, the deduction falls under the overall cap of Rs.1,50,000 including all the items under sections 80C, 80CCC, and 80 CCD.

If the policy is terminated within 2 years from the date of commencement of the policy (in the case of a single premium policy or in regular premiums), then the deductions allowed in earlier years are reversed and added back to the year’s income in which the policy lapsed.

Life Insurance Policies Tax Benefits (excluding ULIPs) – Under New Tax Regime

As Sec.80C is not available under the new tax regime to claim, you will not get any tax benefits by investing in such policies.

Life Insurance Policies Maturity Taxation

As per section 10(10D) of the Income Tax Act, your maturity proceeds are tax-free if –

- The premium in any year does not exceed 20% of the sum assured for policies issued between 1.4.2003 to 31.3.2012 and 10% of the sum assured for policies issued after 1.4.2012.

- 15% in case the policy is on the life of a person with disability / severe disabilities or specified disease or ailments for policies issued after 1.4.2013

- The yearly aggregate premium should be less than Rs. 5 lakhs (effective from 1st April 2023). For an old policy that was issued before 1st April 2023, this Rs.5 lakh rule will not be applicable.

These conditions will not apply to the death benefits. Death benefits under traditional policies will be tax-free.

Annuity Plans Tax Benefits Under New / Old Tax Regime

These are pension plans where either they are immediate annuity plans (you invest a lump sum and the pension will start immediately) or deferred annuity plans (you invest regularly and after a certain period, the pension will start).

Annuity Plans (Pension Plans) Tax Benefits under Old Tax Regime

Annuity plans come under the purview of sections 80C and 80CCC of the Income Tax Act 1961. This deduction is clubbed with all the other items eligible for deduction under sections 80C and 80CCD with an aggregate cap of Rs.1,50,000.

The deduction is only available in the year in which the contribution is made.

Annuity Plans (Pension Plans) Tax Benefits under New Tax Regime

As usual, there are no tax benefits under the new tax regime as Sec.80C is not part of the new tax regime.

The pension that you receive from such annuity plans is taxed as per your tax slab.

I hope I have covered all the aspects of Insurance Policy Tax Benefits under new and old tax regimes.